4 Basic Small Business Accounting Tips

Accounting

I Hope I Don't Get Audited

One of the most intimidating aspects of operating a small business or being self employed is the bookkeeping that is involved. But small business accounting doesn't need to be complicated. Most of the skills that you need for day to day bookkeeping are the same basic math skills you learned back in grade school.

We are going to consider some basic small business accounting tips which will greatly simplify the bookkeeping process. These 4 tips are even helpful if you hire an accountant to do the bulk of your bookkeeping.

Pay With Cash Whenever Possible

Paying with cash is one key way of simplifying the bookkeeping process. The following two advantages in particular result from using cash to make purchases:

- The elimination of unnecessary expenses when you receive your monthly bill. This will also speed up the process of determining your profit margin.

- Paying cash upfront also makes it easier to negotiate discount with your suppliers. Some suppliers are willing offer cheaper prices for customers that pay upfront.

It needs to be noted that paying cash does not eliminate the need to keep all necessary receipts. It does not involve shady small business accounting practices like paying under the table, or other forms of tax evasion. The sole purpose of this method is to make your bookkeeping easier.

Not A Good Bookkeeping System

Avoid Shoebox Accounting

You will want to come up with a well organized filing system. This means that you wouldn’t just stuff all of your receipts in a shoebox. A simple and well organized system of bookkeeping will save time and reduce your headaches. It will also serve as a protection if you are ever audited.

One wise practice for small business accounting involves only handling receipts once. Immediately file the receipt away in the appropriate location. It is also a good practice to deposit all cash receipts into the bank as soon as possible. This greatly simplifies the bank reconciliation process.

Another wise small business accounting practice involves using accounting software. To the extent possible it is good to go paperless. Small business accounting software does not have to be expensive. There are a number of inexpensive (and even free) options out there. Of course you would want to do your homework to find the best accounting software that suits your small business needs.

Regardless of the record keeping system that you use, it is important that you stick with it. Procrastination can cause a lot of bookkeeping headaches. It is better to do a few minutes of bookkeeping everyday than endless hours later on.

Perform Internal Audits

If you do not have any employees and you do your own bookkeeping, internal controls are not quite as important. But you still will want to regularly self audit your records to make sure that you haven't made any costly mistakes.

If you hire out your bookkeeping, or if you have any employees then you need to have internal controls put into place. A lot of this comes down to simple record keeping and regularly consulting those records.

This would include keeping an audit trail. This would involve the keeping of all receipts and making sure that all expenses all accounted for. To make this easier it would be advisable to keep your business account separate from your personal.

Make Sure You Meet Government Requirements On Record Retention

As a small business owner you want to be aware of all regional and national tax laws. These will vary by locality so you would want to do our homework to make sure you we can keep the tax police off your back.

You will also need to consult with local tax authorities on how long you would need to keep certain records.

Here are some examples of the type of records that you would want to keep:

- ledgers and journals - computerized or manual

- all financial statements

- log and appointment books

- tax reports and records

- your business journal

Government Agencies may also require that you keep support documentation as well. Here is a sample of the type of documentation that you would want to keep:

- sales invoices and receipts, cash register tapes, purchase orders

- bank statements, cancelled cheques and deposit slips

- any government or legal correspondence

- credit card statements, along with any business purchase receipts

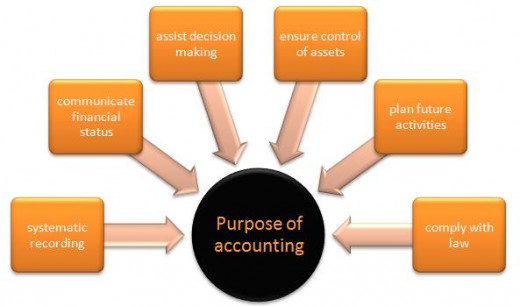

Purposes of Accounting

Small Business Accounting Poll

Do you do your own bookkeeping or do you hire it out?

The KISS Principle of Small Business Accounting (Keep It Simple Stupid)

The following four small business accounting tips can be summed up by the KISS principle. Keep It Simple Stupid.

For the sake of repetition for emphasis we want to put the following four small business accounting tips into practice.

- Pay with cash whenever possible

- Keep well organized records (avoid shoebox accounting)

- Perform internal audits

- Observe legal requirements on record retention

Observing the following four small business accounting tips will save you a lot of anxiety and contribute greatly to the success of your business.