Canara

- 2. CANARA BANK TOGETHER WE CAN

- 3. FOUNDER OF CANARA BANK Sri Ammembai subba Rao Pai (1852-1909) "A good bank is not only the financial heart of the community, but also one with an obligation of helping in every possible manner to improve the economic conditions of the common people" - A. Subba Rao Pai. .

- 4. HISTORY OF CANARA BANK A Subba Rao Pai, established the Canara Hindu Permanent Fund in Mangalore, in 1906. The bank changed its name to Canara Bank Limited in 1910 In 1958,RBI ordered Canara Bank to acquire G.Raghumathumul Bank in Hyderabad which has five branches . Canara Bank inaugurated its 1000th branch in year 1976 Canara Bank acquired Lakshmi Commercial Bank in 1985 bringing 230 branches in northern India. In 1996, canara bank became the first Indian Bank to get ISO certificate for ‘Total Branch Banking’ for its Seshadripuram branch in Bangalure.

- 5. VISION AND MISSION Vision: To emerge as a ‘Best Practices Bank’ by pursuing global benchmarks in profitability, operational efficiency, asset quality, risk management and expanding the global reach. Mission: To provide quality banking services with enhanced customer orientation, higher value creation for stakeholders and to continue as a responsive corporate social citizen by effectively blending commercial pursuits with social banking.

- 6. Directors of CANARA BANK 1. Chairman and Managing Director ……………… Shri. R.K. DUBEY 2. Executive Director ……………… Shri. ASHOK KUMAR GUPTA 3. Executive Director ………….. Shri. V. S. KRISHNA KUMAR 4. Director representing Government of India …………… Dr. RAJAT BHARGAVA 5. Director representing Reserve Bank of India ………….. Smt. MEENA HEMCHANDRA 6. Workmen Employee Director ………….. Shri. G.V. SAMBASIVA RAO 7. Officer Employee Director …………… Shri. MANIMARAN 8. Part Time Non Official Director ……………. Shri. SUTANU SINHA 9. Shareholder Director …………… Shri. BRIJ MOHAN SHARMA 10. Shareholder Director ………….. Shri. RAJINDER KUMAR GOEL 11. Shareholder Director …………… Shri. SANJAY JAIN

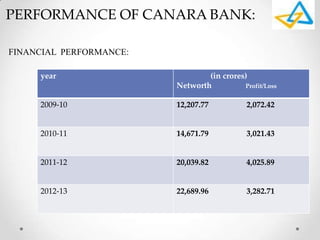

- 7. PERFORMANCE OF CANARA BANK: FINANCIAL PERFORMANCE: year (in crores) Networth Profit/Loss 2009-10 12,207.77 2,072.42 2010-11 14,671.79 3,021.43 2011-12 20,039.82 4,025.89 2012-13 22,689.96 3,282.71

- 8. MAR'09 MAR'10 MAR'11 MAR'12 MAR'13 7.8 9.67 11.96 13.74 14.20 FINANCIAL PERFORMANCE (COMPARISION):

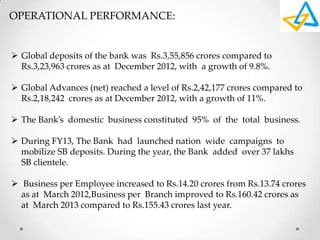

- 9. OPERATIONAL PERFORMANCE: Global deposits of the bank was Rs.3,55,856 crores compared to Rs.3,23,963 crores as at December 2012, with a growth of 9.8%. Global Advances (net) reached a level of Rs.2,42,177 crores compared to Rs.2,18,242 crores as at December 2012, with a growth of 11%. The Bank’s domestic business constituted 95% of the total business. During FY13, The Bank had launched nation wide campaigns to mobilize SB deposits. During the year, the Bank added over 37 lakhs SB clientele. Business per Employee increased to Rs.14.20 crores from Rs.13.74 crores as at March 2012,Business per Branch improved to Rs.160.42 crores as at March 2013 compared to Rs.155.43 crores last year.

- 10. Awards Best Bank Award among large banks by IDRBT for "Use of Technology for Financial Inclusion" handed over by Governor, RBI, Dr. D Subbarao. Skoch Award for Financial Inclusion, handed over by Chairman, PMEAC, Dr. C Rangarajan. 1st Rank for Self Help Groups Linkage for the year 2011-12 in the State of Bihar Award for 'Best Online Bank' among Public Sector Banks- IBA Banking Technology Awards 2011 Award for 'Best Customer Relationship Initiative' among Public Sector Banks - IBA Banking Technology Awards 2011.

- 11. ACHEIVEMENTS Achieved the mandated targets in respect of Agriculture (18.22% against 18% norm) Direct agriculture (16.97% against 13.5% norm) Credit to specified minority communities (18.19% against 15% norm) Weaker Section (11.73% against 10% norm) Women Beneficiaries (13.96% against 5% norm) Mandated Targets under Priority Sector

- 12. CORPORATE SOCIAL RESPONSIBILITY OF THE BANK : CANARA BANK CENTENARY RURAL DEVELOPMENT TRUST (CBCRD Trust) RURAL DEVELOPMENT & SELF‐EMPLOYMENT TRAINING INSTITUTES (RUDSETIs) RURAL CLINIC SERVICE CENTRE FOR ENTREPRENEURSHIP DEVELOPMENT FOR WOMEN

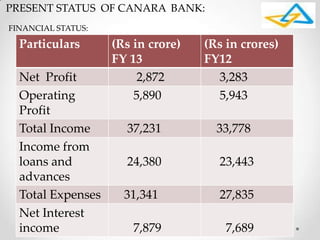

- 13. PRESENT STATUS OF CANARA BANK: FINANCIAL STATUS: Particulars (Rs in crore) FY 13 (Rs in crores) FY12 Net Profit 2,872 3,283 Operating Profit 5,890 5,943 Total Income 37,231 33,778 Income from loans and advances 24,380 23,443 Total Expenses 31,341 27,835 Net Interest income 7,879 7,689

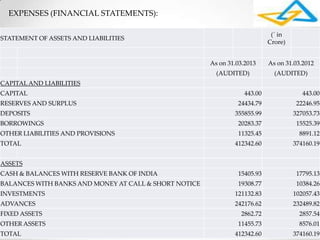

- 14. EXPENSES (FINANCIAL STATEMENTS): STATEMENT OF ASSETS AND LIABILITIES (` in Crore) As on 31.03.2013 As on 31.03.2012 (AUDITED) (AUDITED) CAPITALAND LIABILITIES CAPITAL 443.00 443.00 RESERVES AND SURPLUS 24434.79 22246.95 DEPOSITS 355855.99 327053.73 BORROWINGS 20283.37 15525.39 OTHER LIABILITIES AND PROVISIONS 11325.45 8891.12 TOTAL 412342.60 374160.19 ASSETS CASH & BALANCES WITH RESERVE BANK OF INDIA 15405.93 17795.13 BALANCES WITH BANKS AND MONEY AT CALL & SHORT NOTICE 19308.77 10384.26 INVESTMENTS 121132.83 102057.43 ADVANCES 242176.62 232489.82 FIXED ASSETS 2862.72 2857.54 OTHER ASSETS 11455.73 8576.01 TOTAL 412342.60 374160.19

- 15. PROFIT/LOSS: YEAR PROFIT (in crores) 2008-09 1,565.01 2009-10 2,072.42 2010-11 3,021.43 2011-12 4,025.89 2012-13 3,282.71

- 16. Major Competition Public Banks • State Bank of India • Bank of India • Bank of Baroda • Central Bank of India • Union Bank of India • Andhra Bank • Dena Bank • Allahabad Bank • And many others Private & Foreign banks • HDFC • Axis Bank • Standard Chartered • HSBC • Yes bank • Barclays bank • Deutsche Bank • And many more

- 17. FOREIGN BRANCHES OF CANARA BANK UNITED KINGDOM CHINA HONGKONG BAHRAIN UNITED ARAB EMIRATES RUSSIA

- 18. MARKET STRUCTURE: 67.7 12.2 7.2 5.0 1.0 6.9 Govt of India FIIs InsuranceCompanies Resident Individuals Banks Others Govt. 67.7 FIIs 12.2 Insurance Companies 7.2 Residents Individuals 5.0 Banks 1.0 Others 6.9 As on March 31, 2013

- 19. Marketing using four p’s:

- 20. PRODUCTS: Investment Banking Commercial Banking Retail Banking Private Banking Asset Management Mortgages Credit Cards

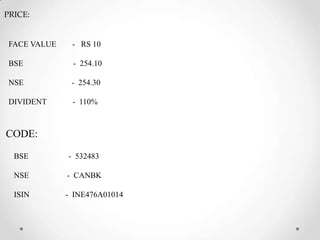

- 22. PRICE: FACE VALUE - RS 10 BSE - 254.10 NSE - 254.30 DIVIDENT - 110% CODE: BSE - 532483 NSE - CANBK ISIN - INE476A01014

- 23. HUMAN RESOURCES Number of employees – 44,090 IN 2012 Recruitment process: Education Qualification(Any Degree) Age 21 years(Base on recruitment year Based on Written Exam(Conducted by IBPS)

- 24. PESTLE ANALYSIS:

- 25. POLITICAL FACTORS: • Focus on regulation of government • Budget and budget measures • Foreign Direct Investments limits ECONOMIC FACTORS: • Monetary policy for example: Repo rates, C.R.R, Reverse repo rate • GDP • Interest rates • Inflation rate • Saving and Investment

- 26. SOCIO-CULTURAL FACTORS: • Traditional Mahajan Pratha • Change in life style • Population • Literacy rate TECHNOLOGICAL FACTORS: • Auto Teller Machine • Credit card facility • Automatic Voice recorder • It services and Mobile banking

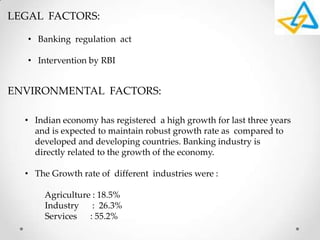

- 27. LEGAL FACTORS: • Banking regulation act • Intervention by RBI ENVIRONMENTAL FACTORS: • Indian economy has registered a high growth for last three years and is expected to maintain robust growth rate as compared to developed and developing countries. Banking industry is directly related to the growth of the economy. • The Growth rate of different industries were : Agriculture : 18.5% Industry : 26.3% Services : 55.2%

- 28. SWOT Analysis:

- 29. Strength: Weakness: 1. Innovative schemes 2. Technologically advance 3. Articulation of good banking 4. Canara bank has employed over 44,000 people 5. Canara bank made a partnership with UNEP to initiate a successful solar loan programme 1. Inadequate Publicity 2. Low International presence 3. Customer service is lesser as compared to other banks

- 30. Opportunity: 1. Rural and social banking 2. Agriculture based consultancy Threats: 1. Economic crisis 2. Highly competitive environment 3. Changing government and RBI policies

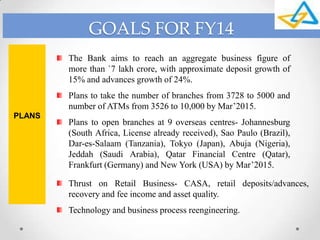

- 31. GOALS FOR FY14 PLANS Thrust on Retail Business- CASA, retail deposits/advances, recovery and fee income and asset quality. Technology and business process reengineering. The Bank aims to reach an aggregate business figure of more than `7 lakh crore, with approximate deposit growth of 15% and advances growth of 24%. Plans to take the number of branches from 3728 to 5000 and number of ATMs from 3526 to 10,000 by Mar’2015. Plans to open branches at 9 overseas centres- Johannesburg (South Africa, License already received), Sao Paulo (Brazil), Dar-es-Salaam (Tanzania), Tokyo (Japan), Abuja (Nigeria), Jeddah (Saudi Arabia), Qatar Financial Centre (Qatar), Frankfurt (Germany) and New York (USA) by Mar’2015.