UK Salary Guide: Understand Salary Distribution and Market Trends

Share

Average salary UK – a comprehensive overview

The median UK salary is £31,461 and the mean UK salary is £36,834 per year. These numbers change significantly when you look at differences between industries, educational backgrounds, age, gender or regional differences.

Along with job satisfaction, working conditions and career prospects, pay is one of the most important aspects of a job. For many people, their salary is the single most important factor in their professional lives. But do you know how your salary compares? Do you know where you stand compared to the average UK salary? Compared to the average salary in your industry? Of people with your education level? This article is shining a bright spotlight on these very questions and demystifying pay in the UK.

We’ll cover the following topics – do feel free to jump to whatever is most interesting to you:

- Average salary in the UK – overview

- Industry and occupation breakdown

- Influence of education level

- Average salary by age group

- Regional differences in the UK

- Gender pay gap

- What it all means for you

We’ll dive right in but let’s just get our definitions straight before we do. Whenever we refer to salary or average UK salary, we mean total compensation. That is, base salary plus overtime pay, bonuses and any other components of work-related income (we’re not looking at non-work income such as rent income). Also, throughout the article, we are talking about gross salaries – so don’t compare these numbers with what hits your account but with the gross number on your pay slip. You can use an online tool to convert between the two.

All numbers refer to 2020 unless otherwise specified and are based on official ONS data. Self-employed people are not taken into account. And we’re only looking at salaries of full-time employees so if you only work 2 days a week, make sure to adjust for that.

Finally a word on the average metric that we use in this article. There are two principal ways to measure an average – the mean and the median. Most people are familiar with the mean – it’s basically the sum of all observations divided by the number of observations. The median, on the other hand, is the mid-point, i.e. the observation which is both smaller and larger than 50% of observations. In this article, we will take the median as our principal measure so whenever you read about the average salary in the UK, read mid-point, not mean.

Overall salary stats – average UK salary and much, much more

The average (read median) salary in the UK is £31,461 per year (£585.5 per week). The mean salary, on the other hand, amounts to £36,834 per year (£706.4 per week).

So where does this sizable difference come from? Put simply, the mean is higher than the median because there are quite a few people who earn A LOT of money, but nobody who works full-time earns nothing. In other words, the outliers are much more extreme on the rich end than on the poor end. Look at it this way – Daniel Radcliffe made about £20 million in 2011 when he shot the last of the Harry Potter movies. That’s WAY more than you or I make and so it pulls the mean up by quite a lot. That doesn’t happen to the median, though, because for the median, Daniel Radcliffe is just one more person above the cut-off and it doesn’t matter by how much he is above. This insensitivity to extreme values is the reason why from now on, we will only be looking at the median as our measure of the average salary in the UK.

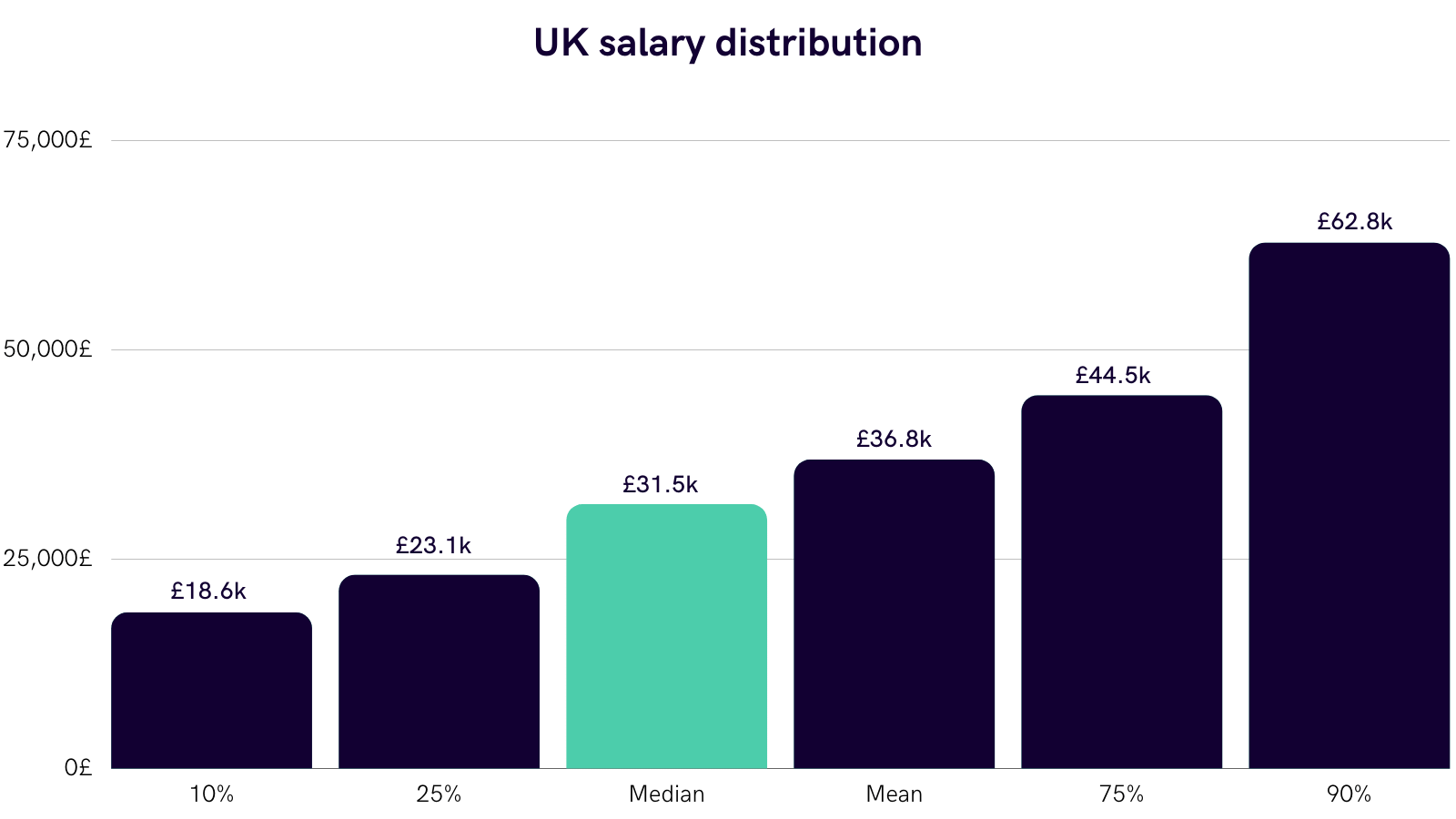

Just like the median tells us the amount which 50% of people exceed and 50% of people fall short of, we can look at other interesting percentiles:

The table says that 10% of people in the UK make less than £18,586 – and vice versa 90% make more than that. That’s about £1’500 per month which is roughly equivalent to what you pay in rent for a studio in South Kensington. Conversely, 90% of people make less than £62,750 whereas the top-10% of earners make more than that. The chart also tells us that 50% of the full-time working UK population have an annual salary between £23,068 and £44,513.

{{cta}}

Now if you have recently graduated from uni and still “only” make £20,000 that doesn’t necessarily mean that your employer is ripping you off. Remember, this chart shows the salary distribution and the average salary across all people in the UK, meaning people who are much older or more experienced than you; people who live in more expensive areas of the country; or people who work in industries that generally pay higher salaries (but often also have more intense working hours). So let’s look at how all these factors influence pay and how the average salary in the UK looks on a more granular level.

Average UK salary by industry and occupation

The industry or profession you work in is one of the key determinants of how well you’re paid – the average salary in the UK varies a lot between industries.

Let’s look at the data:

Just like in many countries, financial and insurance activities lead the pack in the UK, with an average salary of £43,821. That’s pretty close to the overall 75th percentile which is at £44,513. That means that even if you’re “only” in the middle within financial services, you still make more than 75% of people overall.

Conversely, accommodation & food services – an industry group that includes historically low-paid professions such as waiters and housekeepers – pays an average salary of £22,779, which is pretty close to the overall 25th percentile of £23,068. This, in turn, means that if your salary is just mediocre in this industry, 75% of all people in the UK will still make more than you. Another way to look at it is this – if you go into financial services, you will on average have twice as big a salary as if you go into accommodation and food services.

What this tells us is that if you have a job that you can do in any industry – say, if you’re an accountant – you should definitely think twice about where you want to put your skills to use. But beware of assigning too much weight to this industry comparison – after all, you’re in ‘accommodation and food services’ both if you’re a waiter and if you’re the CEO of the Hilton group.

So let’s take a brief look at actual occupations then. It’s common knowledge that Investment Bankers and Consultants make a lot (in relative terms), while facility managers and beauticians don’t. There are too many jobs out there for a really comprehensive data-based overview but just to give you a feeling, here are the top and the bottom three when it comes to the average salary in the UK:

- Chief executives and senior officials (£80,232)

- Marketing and sales directors (£74,950)

- Legal professionals (£74,580)

- Waiters and waitresses (£15,351)

- Textile workers (£14,939)

- Hairdressers and barbers (£14,767)

Let’s look at some more breakdowns of the average UK salary.

Average UK salary by level of education

Chances are you weren’t too excited about doing your homework as a kid and got annoyed with your parents whenever they got too insistent on how important your education is. Turns out they actually had a point.

The average salary in the UK for people with no higher education above A level standard is about £25,000. This increases by a whopping 36% to £34,000 for graduates and then another 24% to £42,000 for everyone with a postgrad degree (e.g. Masters or PhD). The conclusion in short – going to school pays off.

{{cta}}

Let’s look at it in some more detail. We’ll keep it simple and assume you’ve entered the working world at 18 and not done a degree, making the UK average salary (for this group) of £25,000 a year throughout your life. If you start working at age 18, you have a solid 49 years of work ahead of you. Your earnings in that period will amount to £1,225,000 – a bit over a million pounds. Now say you had chosen to stay at school for another 10 years and get a PhD. You’ll only enter the workforce at 28 and will only have 39 years time to work and make money (what a shame…). Still, your lifetime earnings will amount to £1,638,000. That means you got 10 additional years of being a student and £400,000 more in your pocket.

Average UK salary for different age groups

When it comes to age, there is an interesting development taking place. As you would expect, the youngest people tend to earn the lowest amount of money – they have less education than their elders and are happy to take jobs that don’t pay a lot (including apprenticeships). Over time, people who enter the workforce young gain more experience and become more productive, thereby increasing their earnings. And people who enter the workforce at a later stage in life usually come with a higher level of education which means, as we have just seen, they also make more money. That explains why the average UK salary goes from £10,910 for 16-17 year olds all the way up to £35,904 for 40-49 year olds.

Yet then the trend reverses: the average salary goes down to £33,231 for people between 50-59 and drops further to £28,854 for people over 60. All of these are still full-time salaries so it’s not just that people work less as they get older. So it’s not just the total salary that decreases but also the hourly salary.

Interesting…

UK regional differences in average salary

You can make more money in London than in Newcastle…shocker!

The average salary in London is £41,017, compared to £27,856 in the North East or £28,125 in Wales. As a matter of fact, the average salary in London is still 25% higher than in the region with the second highest average salary in the UK (South East). But before you pack your bags and move to the capital, consider that there are huge differences in terms of cost of living. It’s common to pay £20,000 of rent a year in London and you sure as hell won’t get a pint for a pound…

One interesting consideration in the face of the Covid pandemic and remote working is whether it could pay off to take a job “in London” but actually live in the North or in Wales. After all, scoring a London salary and paying rent in Newcastle is sort of the best of two worlds (if you’re only optimising the amount on your bank account).

Similarly, in a remote situation, hiring managers in London may consider hiring candidates in parts of the UK with a lower average salary and thereby potentially reduce costs for their organisation. Who knows, maybe these dynamics will even the scale over the next 10 years.

Gender pay gap

The average salary in the UK for men is £33,923, compared to £27,981 for women. The overall average of £31,461 lies squarely between those numbers which means that men earn more than average while women earn less than average. In fact the difference is a whopping 21%. Now, some of this can be explained by working hours. Even though we only look at full-time workers, some people work 35 hours and some work 55 hours per week and overall, it’s more often men doing 55 and women 35 than the other way around (talk about outdated gender norms). Even when we leave differences in working hours out of the picture, though, and only look at the average UK salary per hour, the Office for National Statistics estimates a 15% gap – called the gender-pay-gap.

A lot of research has gone into the gender-pay-gap and there are lots of interesting articles about the topic out there (e.g. a short one here or a long one here). For the purpose of this article, we’ll leave it at this – on average, men still have a higher salary than women in the UK.

If you’re interested in more info about the gender pay gap and how to close it – have a look at this article.

What it all means for you

So where does that all leave us? Well, with a somewhat refined understanding of how much or little we make. You should now have a better idea of how your salary compares within your industry, region, age and education group. What you still don’t know, however, is how your salary compares to people who are in a similar situation as you across all of these factors.

Let’s say you’re 30 years old, have a Bachelor’s degree, work at a London bank in London and make £70,000 a year. You know you make more than the average UK salary overall; you know you make more than the average person in your industry; you know you make more than the average person your age; and you know you make more than the average person with a degree. What you don’t know is whether you make more than people who are your peers not just in one but all of these categories. Wouldn’t it be good to know how much you make compared to other 30 year olds with a Bachelor’s degree who work in banking in London (or even more specifically, front-office investment banking, for instance)? Also, wouldn’t it be good to bring satisfaction and working conditions into the equation? After all, your annual salary may be twice as big as the average salary in the UK, but that doesn’t mean much if you’re working twice as many hours as everyone else.