Main Menu

- Regions

- Banking

-

Hong Kong Banks Face Mounting Losses

January 27, 2025 -

Bank Closures Leave Gorleston Without a Branch

January 27, 2025 -

SEC Revokes Key Rule, spurs Wall St. Crypto Expansion

January 27, 2025 -

Deutsche Bank Partners with Yonyou for Digital Finance Expansion

January 23, 2025 -

HSBC Expands Operations at India’s GIFT City

January 23, 2025

- Investment

-

Saudi Arabia Opens Makkah to Foreign Investors

January 27, 2025 -

Meta Commits $60 Billion to AI Expansion

January 27, 2025 -

Trump’s Pro-Crypto Agenda Sparks Debate

January 27, 2025 -

New Zealand Targets Reforms to Boost Competition

January 23, 2025 -

Saudi Arabia Pledges $600 Billion Investment in US

January 23, 2025

- Infrastructure

-

$5 Billion Infrastructure Boost Rolls Out Across US

January 14, 2025 -

BMW Drives Circular Economy Forward

January 13, 2025 -

EIB Drives Ukraine’s Recovery Efforts

January 13, 2025 -

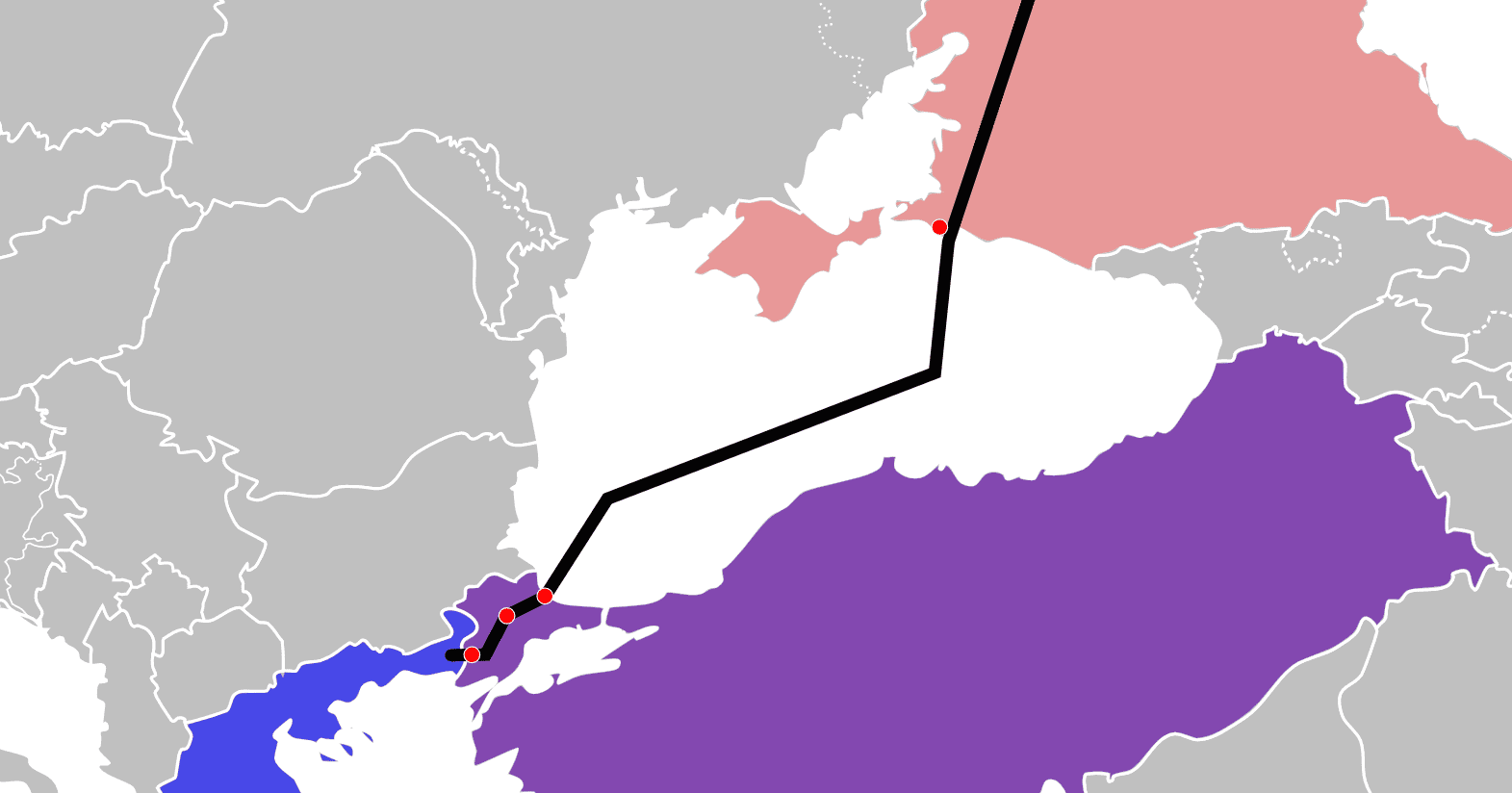

Drone Attack Targets Russian Gas Pipeline

January 13, 2025 -

Munich Launches New Tender for Charging Infrastructure

January 10, 2025

- Tech

-

Visa Invests in Moniepoint to Boost Africa’s Digital Payments

January 27, 2025 -

HSBC Closes Zing Payments App

January 27, 2025 -

Musk and Altman Clash Over $500bn AI Project

January 23, 2025 -

Russia to Launch Unified Facial Payment System

January 23, 2025 -

Paytm Seeks Revival Amid Regulatory Setbacks

January 22, 2025

- Featured

-

Creating value in healthcare projects using PPP models

January 6, 2025 -

Innovation in Capital Management: SG Consulting Group LLC and its Digital Vision for the Future

January 6, 2025 -

The Evolving Role of CFOs: How Numarqe is Reshaping Financial Management in 2024

January 6, 2025 -

Revolutionizing Digital Risk Management: Resecurity’s Competitive Edge in Cybersecurity

January 6, 2025 -

The Importance of CSR Activities in the Corporate Environment

January 6, 2025

- Videos

- Subscribe

- Magazine

- Awards

-