Process Costing Chapter 7 Learning Objectives 1 Explain

Process Costing Chapter 7

Learning Objectives 1. Explain the concept and purpose of equivalent units. 2. Assign costs to products using a five-step process. 3. Assign costs to products using weighted-average costing. 4. Prepare and analyze a production cost report. 5. Assign costs to products using first-in, first-out (FIFO) costing. 6. Analyze the accounting choice between FIFO and weighted-average costing. 7. Know when to use process or job costing. 8. Compare and contrast operation costing with job costing and process costing.

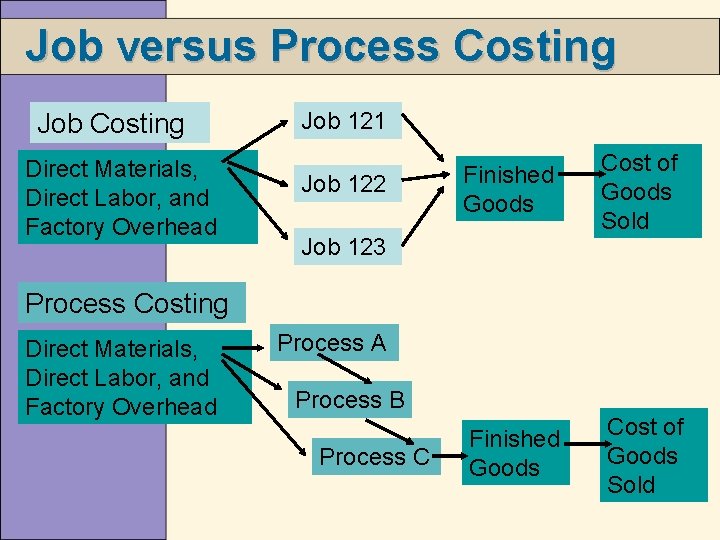

Job versus Process Costing Job Costing Direct Materials, Direct Labor, and Factory Overhead Job 121 Job 122 Finished Goods Cost of Goods Sold Job 123 Process Costing Direct Materials, Direct Labor, and Factory Overhead Process A Process B Process C

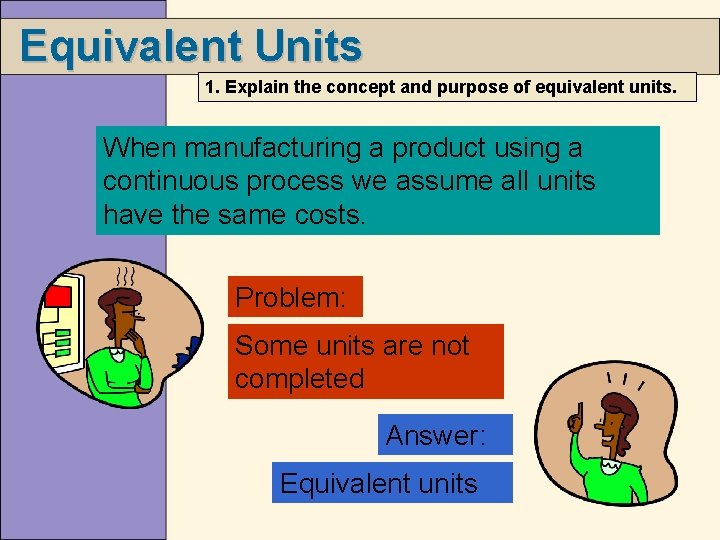

Equivalent Units 1. Explain the concept and purpose of equivalent units. When manufacturing a product using a continuous process we assume all units have the same costs. Problem: Some units are not completed Answer: Equivalent units

Equivalent Units Continued Equivalent Units (Eq. U) Number of units that could have been completed with the given costs. Number of units in process 2 . 5 + x Percentage of completion = Eq. U x = 1 . 5 = 1

Equivalent Units Continued Jerilee has a big weekend planned. She works Friday night, plans to go to the football game Saturday, and wants to go to the fair on Sunday. She determines she will have ten hours to study. Problem: Jerilee has 10 hours of Accounting and 10 hours of Spanish. Answer: She can do all of her Accounting, all of her Spanish, or some Accounting and some Spanish.

Equivalent Units Continued She can do her Accounting Spanish 10 x 100% = 0 x 0 = 10 0 10 One class finished She can do her Spanish Accounting Spanish 0 x 0 = 0 10 x 100% = 10 10 One class finished

Equivalent Units Continued She can do half of each Accounting 10 x 50% = 5 Spanish 10 x 50% = 5 10 Equivalent to one class finished Or a combination Accounting 10 x 60% = 6 Spanish 10 x 40% = 4 10 Equivalent to one class finished

Product Costing in a Process Industry 2. Assign costs to products using a five-step process. Five steps to Costing a Product 1. Measure the physical flow of resources. 2. Compute the equivalent units of production. 3. Identify the product costs for which to account. 4. Compute the costs per equivalent unit. 5. Assign product cost to batches of work.

Assumptions about Costs in WIP How do we account for beginning balance and current period activities and costs? One possibility: weighted average We combine beginning balance and current period activities and costs. Beginning Balance Prior Period Unit costs are a Current Period weighted average

Assumptions about Costs in WIP Continued Another possibility: FIFO We separate prior period and current period activities and trace the beginning balance and current period costs to the respective units. Prior Period Current Period We assume units from last period are completed and transferred out first. Prior Period then Current Period First-in, First-out

Process Costing: an Example Bart’s Beverages Blending Department Units Materials Costs Conversion Costs WIP October 1 1, 000 a $1, 113 $194 October activity 5, 000 22, 487 14, 056 Total 6, 000 $23, 600 $14, 250 Transferred out 5, 500 WIP October 31 500 b Total 6, 000 a 25% complete with respect to materials and 10% with respect to conversion costs. b 80% complete with respect to materials and 40% with respect to conversion costs.

Process Costing: Weighted Average L. O. 3 Assign costs to products using weighted-average costing. Weighted Average Use the five step process. 1. Measure the physical flow of resources. 2. Compute the equivalent units of production. 3. Identify the product costs for which to account. 4. Compute the costs per equivalent unit. 5. Assign product cost to batches of work.

Step 1: Measure the physical flow of resources. BB + Units Started 1, 000 a + 5, 000 6, 000 Total gallons to account for = = Units Transferred Out 5, 500 + + 6, 000 Total gallons accounted for a 25% complete with respect to materials and 10% with respect to conversion costs. b 80% complete with respect to materials and 40% with respect to conversion costs. EB 500 b

Step 2: Compute the equivalent units of production. Physical Units Transferred out Work in process, October 31 Equivalent units a 500 units x 80% b 500 units x 40% Equivalent Units Materials Conversion 5, 500 400 a 200 b 5, 900 5, 700

Step 3: Identify costs for which to account. Total Costs Materials Costs Conversion Costs WIP October 1 $1, 307 $1, 113 $194 October costs 36, 543 22, 487 14, 056 $37, 850 $23, 600 $14, 250 Total

Step 4: Compute the costs per equivalent unit. Total Materials WIP, October 1 $1, 307 $1, 113 $194 October costs 36, 543 22, 487 14, 056 $37, 850 $23, 600 $14, 250 Total Eq. U (Step 2) 5, 900 5, 700 Cost per Eq. U $4. 00 $2. 50 Total costs (Step 3) Conversion

Step 5: Assign product cost to batches of work. Total Materials Conversion Eq. U (Step 2) 5, 500 Cost per Eq. U (Step 4) $4. 00 $2. 50 $22, 000 $13, 750 400 200 $4. 00 $2. 50 2, 100 $1, 600 $500 $37, 850 $23, 600 $14, 250 Transferred out Costs transferred out $35, 750 WIP, October 31 Eq. U (Step 2) Cost per Eq. U (Step 4) Costs WIP, October 31 Total cost assigned

The Production Cost Report L. O. 4 Prepare and analyze a production cost report. Production cost report A report that summarizes production and costs for a period Why? Used by managers to monitor production and cost flows

The Production Cost Report Weighted Average Blending Department Month Ending October 31 Units to be accounted for Physical WIP beginning inventory 1, 000 Units started in this period 5, 000 Total units to account for 6, 000 Equivalent Units Materials Conversion Units accounted for Completed and transferred out WIP ending inventory Total units to account for a 500 units x 80% b 500 units x 40% 5, 500 400 a 200 b 6, 000 5, 900 5, 700

The Production Cost Report Continued Costs to be accounted for Total Materials Conversion WIP beginning inventory $1, 307 1, 113 194 Current period costs 36, 543 22, 487 14, 056 $37, 850 $23, 600 $14, 250 $4. 00 c $2. 50 d 35, 750 22, 000 e 13, 750 f 2, 100 1, 600 g 500 h $37, 850 $23, 600 $14, 250 Total costs to be accounted for Costs per equivalent unit Costs to be accounted for Costs assigned to units transferred out Costs assigned to WIP ending inventory Total costs accounted for c $23, 600/5, 900 units d $14, 250/5, 700 units e $4. 00 x 5, 500 units f $2. 50 x 5, 500 units g $4. 00 x 400 units h $2. 50 x 200 units

Assigning Costs using FIFO L. O. 5 Assign costs to products using first-in, first-out (FIFO) costing. FIFO Use the same five step process. 1. Measure the physical flow of resources. 2. Compute the equivalent units of production. 3. Identify the product costs for which to account. 4. Compute the costs per equivalent unit. 5. Assign product cost to batches of work.

Step 1: Measure the physical flow of resources. Exactly the same as weighted average. BB + Units Started 1, 000 a + 5, 000 6, 000 Total gallons to account for = = Units Transferred Out 5, 500 + + 6, 000 Total gallons accounted for a 25% complete with respect to materials and 10% with respect to conversion costs. b 80% complete with respect to materials and 40% with respect to conversion costs. EB 500 b

Step 2: Compute the equivalent units of production. Physical Units Equivalent Units Transferred out 5, 500 From WIP October 1 1, 000 750 a 900 b Units started and completed in October 4, 500 400 c 200 d 5, 650 5, 600 WIP October 31 Equivalent units a 1, 000 units x 75% b 1, 000 units x 90% c 500 units x 80% d 500 units x 40% Materials Conversion

Step 3: Identify costs for which to account. Exactly the same as weighted average. Total Costs Materials Costs Conversion Costs WIP October 1 $1, 307 $1, 113 $194 October costs 36, 543 22, 487 14, 056 $37, 850 $23, 600 $14, 250 Total

Step 4: Compute the costs per equivalent unit. October costs Equivalent units (Step 2) Cost per equivalent unit Total Materials Conversion $36, 543 $22, 487 $14, 056 5, 650 5, 600 $3. 98 $2. 51 Note: Include only current period costs and activities.

Step 5: Assign product cost to batches of work. Transferred out Total Materials Conversion Units in WIP October 1 Prior period costs $1, 307 $1, 113 $194 Complete beginning WIP EU (Step 2) [A] 750 900 $3. 98 $2. 51 5, 244 2, 985 2, 259 4, 500 $3. 98 $2. 51 29, 205 17, 910 11, 295 $35, 756 $22, 008 $13, 748 Cost per EU (Step 4) [B] Cost to complete beginning WIP [A x B] Units started and completed in October Number of units [C] Cost per EU [B] Cost of units started, completed and transferred out [B x C] Total cost of units transferred out

Step 5: Assign product cost to batches of work continued Transferred out* Total Materials $35, 756* $22, 008* Conversion $13, 748* WIP, October 31 EU (Step 2) 400 200 $3. 98 $2. 51 2, 094 $1, 592 $502 $37, 850 $23, 600 $14, 250 Cost per EU (Step 4) Costs WIP, October 31 Total cost assigned * From previous page

Comparison of FIFO and Weighted Average L. O. 6 Analyze the accounting choice between FIFO and weighted-average costing. FIFO Separates prior period and current period activities and traces the prior period and current period costs to the respective units. Weighted Average Does not separate prior period and current period activities and costs.

Comparison of FIFO and Weighted Average Continued Bart’s Beverages Blending Department Costs to account for $37, 850 FIFO Weighted Average Cost per EU Materials $3. 98 $4. 00 Conversion $2. 51 $2. 50 $35, 756 $35, 750 2, 094 2, 100 $37, 850 Cost of goods transferred out Costs WIP, October 31 Costs accounted for

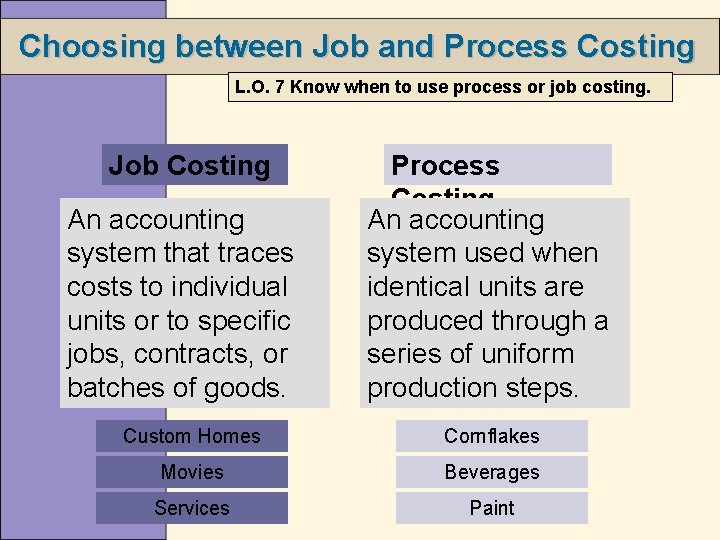

Choosing between Job and Process Costing L. O. 7 Know when to use process or job costing. Job Costing An accounting system that traces costs to individual units or to specific jobs, contracts, or batches of goods. Process Costing An accounting system used when identical units are produced through a series of uniform production steps. Custom Homes Cornflakes Movies Beverages Services Paint

Operation Costing L. O. 8 Compare and contrast operation costing with job costing and process costing. Job Costing Operation Costing Process Costing An accounting system that traces costs to individual units or to specific jobs, contracts, or batches of goods. A hybrid costing system often used in manufacturing goods that have some common characteristics plus some individual characteristics. An accounting system used when identical units are produced through a series of uniform production steps. Automobiles Computers Clothing

Chapter 7 Finally! Finalmente!

- Slides: 33