FMCG Giant Hindustan Unilever Limited (HUL) Case Study

📖 Learning

Hindustan Unilever Limited (HUL) is a British-Dutch assembling organization headquartered in Mumbai, India. The items of Hindustan Unilever Ltd incorporate nourishments, drinks, cleaning specialists, individual consideration items, water purifiers, and purchaser merchandise. HUL was set up in 1933 as Lever Brothers and following the merger of its constituent gatherings in 1956, HUL was renamed Hindustan Lever Limited. The organization was then renamed in June 2007 as "Hindustan Unilever Limited".

At the start of 2019, the Hindustan Unilever Limited portfolio had 35 items marked in 20 classifications and utilized 18,000 representatives with offers of Rs. 34,619 crores in 2017-18. In December 2018, HUL reported its procurement of Glaxo Smithkline's India business for $3.8 billion out of an all value merger manage ratio of 1:4.39.

However, the joining of 3800 representatives of GSK stayed questionable as HUL expressed there was no provision for maintenance of workers in the deal. In January 2019, HUL said that it hopes to finish the merger with Glaxo Smith Kline Consumer Healthcare (GSKCH India) this year.

History And Journey Of Hindustan Unilever

Brands And Products Of Hindustan Unilever

Business Model of HUL

Business Growth In India

Expected Future Growth

History And Journey Of Hindustan Unilever

Hindustan Unilever Limited (HUL) is India's biggest quick-moving customer merchandise organization. HUL works in seven business sections.

The cleanser segment incorporates cleansers, cleanser bars, cleanser powders, and scourers. Individual items incorporate items in the classifications of oral consideration, healthy skin (barring cleansers), hair care bath powder, and shading beautifiers. Refreshments incorporate tea and espresso.

Nourishments incorporate staples (atta salt and bread) and culinary items (tomato-based items natural product-based items and soups). Frozen yogurts incorporate frozen yogurts and solidified treats. Others incorporate synthetic substances and water business.

HUL's item portfolio incorporates family unit brands—for example, Lux, Lifebuoy, Surf Excel, Rin, Wheel, Fair and Lovely, Pond's, Vaseline, Lakme, Dove, Clinic Plus, Sunsilk, Pepsodent, Closeup, Axe, Brooke Bond, and Bru, Knorr, Kissan, and Kwality Wall's. HUL is a backup of Unilever, one of the world's driving providers of food products, home care, personal care, and refreshment items with deals in more than 190 nations and a yearly turnover of $6.08 billion in 2020.

Hindustan Unilever Limited traces its origins to Unilever, a British-Dutch multinational company, which is the parent of HUL. William Hesketh Lever was a popular social reformer and is regarded as one of the main propagators of several significant employee benefits options like benefits of health, savings, and more. Thus, his ideologies largely seeped into Unilver and resulted in developing its strong sense of corporate responsibility and leadership. This culture was invariably passed on to the Hindustan Unilever Limited (HUL).

The British-Dutch company Unilever, which emerged as a result of the merger of the operations of Dutch Margarine Unie and British soapmaker Lever Brothers, when it first came to India, discovered the rich and largely unexplored potential of the Indian market. Soon after, the establishment of Hindustan Vanaspati Mfg. Co. Ltd. followed in 1931, which was succeeded by the foundation of Lever Brothers India Limited (1933) and United Traders Limited (1935). The Indian subcontinent had only been importing FMCG products, branded under Lever Brothers since then, the first of which were spotted as early as 1888. Following this, brands like Lifebuoy stepped in 1895, along with other famous companies like Pears, Lux, and Vim. Vanaspati was launched in 1918 and the famous Dalda brand came to the market in 1937.

The 3 Unilever companies - Hindustan Vanaspati Manufacturing Company, Lever Brothers India Limited, and United Traders Limited eventually merged together to form HUL in November 1956. HUL offered 10% of its equity to the Indians and soon swooped into the news, being the first foreign subsidiary to do so.

The organization obtained Lipton in 1972, and Lipton Tea (India) Ltd was consolidated in 1977. Brooke Bond joined the Unilever overlap in 1984 through a global obtaining. Lake's (India) Ltd joined the Unilever overlap through a worldwide securing of Chesebrough Pond's USA in 1986.

The progression of the Indian economy, which began in 1991, denoted an enunciation in the organization's development bend. The expulsion of the administrative structure enabled the organization to investigate every item and open-door section with no imperatives on the creation limit. At the same time, deregulation allowed acquisitions and mergers.

The Tata Oil Mills Company (TOMCO) converged with the organization with effect from April 1, 1993. In 1996, Unilever and Lakme Ltd framed a 50:50 joint endeavor, Lakme Unilever Ltd, to advertise Lakme's market-driven beautifiers and other suitable results. In 1998, Lakme Ltd offered its brands to Unilever and stripped its half stake in the joint venture.

In 1994, the organization and US-based Kimberly Clark Corporation framed a 50:50 joint endeavor—Kimberly-Clark Lever Ltd—which markets Huggies Diapers and Kotex Sanitary Pads. The organization likewise set up a backup in Nepal called Unilever Nepal Limited (UNL). UNL's production line speaks to the biggest assembling interest in the Himalayan kingdom. In the1992, Brooke Bond gained Kothari General Foods with critical interests in instant coffee.

In 1993, HUL acquired Kissan from the UB Group and the Dollops ice-cream business from Cadbury India. Tea Estates and Doom Dooma, two major organizations of Unilever, were converged with Brooke Bond. At that point, in 1994, Brooke Bond India and Lipton India converged to shape Brooke Bond Lipton India Ltd (BBLIL) to empower more noteworthy concentration and guarantee collaboration in the customary beverages business. BBL converged with Unilever with effect from January 1, 1996.

The internal rebuilding finished with the merger of Pond's (India) Limited (PIL) with HUL in 1998. The two organizations had huge covers in personal products, specialty chemicals, and export organizations; other than a typical appropriation framework since 1993 for personal products. The two additionally had a typical administration pool and an innovation base.

In January 2000, the administration chose to grant 74% value in Modern Foods to Unilever. This started the divestment of government value in open division endeavors (PSU) to private area accomplices. The organization's entrance into bread production is a key augmentation of the organization's wheat business. In 2002, the organization procured the administration's residual stake in Modern Foods.

In 2002, the organization made its entry into Ayurvedic well-being with its Ayush item range and Ayush therapy centers. In 2003, the organization procured the Cooked Shrimp and Pasteurized Crabmeat business of the Amalgam Group of Companies, an innovator in marine products trades. Additionally, the organization propelled Hindustan Unilever Network Direct to home business. In 2004, the organization launched the 'Pureit' water purifier.

In 2005, Lever India Exports, Lipton India Exports Ltd, Merry climate Food Products, Toc Disinfectants Ltd, and International Fisheries Ltd were amalgamated within Unilever. In February 2006, Vasishti Detergents Ltd (VDL) converged with Unilever. In September 2006, Modern Foods Industries (India) Ltd & Modern Foods and Nutrition Industries Ltd were included. In October 2006, Unilever stripped its 51% controlling stake in Unilever India Shared Services Ltd, currently known as Capgemini Business Services Pvt. Ltd., to Cap Gemini SA.

In March 2007, Sangam Direct, a non-store home conveyance retail business managed by Unilever India Exports Ltd (UIEL) and a completely possessed auxiliary, was moved to Wadhavan Foods Retail Pvt Ltd (WFRPL) in a droop deal business. Likewise, Unilever completed the demerger of its operational offices in Shamnagar, Jamnagar, and Janmam and shaped three autonomous organizations —Shamnagar Estates Ltd., Jamnagar Properties Ltd, and Hindustan Kwality Walls Foods Ltd. In June 2007, the organization changed its name from Hindustan Lever Ltd to Hindustan Unilever Limited.

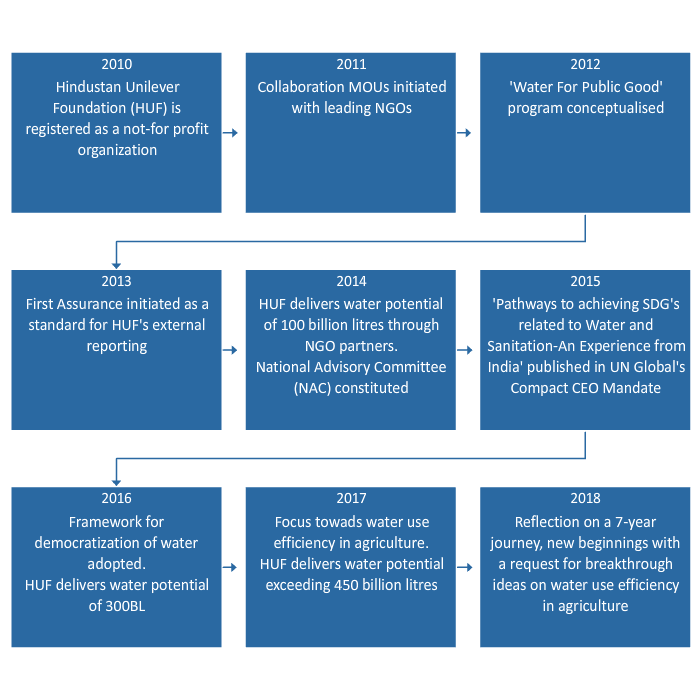

In 2008, the organization reported its coordinated efforts with the Indian Dental Association (IDA) related to World Dental Federation (FDI) through the Pepsodent brand to help improve the oral well-being and cleanliness benchmarks in India. In April 2008, the organization demerged and moved certain immovable properties to Brooke Bond Real Estates Pvt Ltd. In January 2010, the organization introduced its new corporate office.

In April 2010, Unilever affirmed the plan of amalgamation of Bon Ltd, an entirely possessed backup of Hindustan Unilever Limited, with it. The selected date for the previously mentioned plan was 1 April 2009 and the plan was made viable from April 28, 2010. Ensuing to the amalgamation, Bon Ltd stopped being an auxiliary of the company.

During 2010-11, Kissan forayed into a new market fragment in three major classifications. It propelled Kissan Fruit and Soya, a delightful mix of organic product juice and soya milk, which appreciated a separated suggestion in this market. The brand likewise went into the Indian (non-sweet) spreads showcase with the dispatch of Kissan Creamy Spread over key towns. In the bakery division, the organization propelled two new items—Chapi and Cream Rolls. The organization stripped 43.31% stake in Hindustan Field Services Pvt Ltd for Smollan Group (the JV accomplice).

Along these lines, Hindustan Field Services Pvt. Ltd. stopped being a backup organization. Lakme Lever Pvt Ltd, a completely claimed auxiliary of HUL, extended the system of Lakme Beauty Salons in that year with the opening of 11 franchises and oversaw salons alongside 18 franchisees' salons.

In December 2011, the organization demerged the FMCG sends-out business, including explicit fares related to assembling units of the organization, into its entirely claimed backup Unilever India Exports Ltd (UIEL). The plan wound up successful on January 1, 2012.

In 2012, the organization went into a concurrence with Unilever to showcase Brylcreem in India. During the year under audit, Unilever and elements of Piramal Realty (Ajay Piramal Group) consented to an arrangement for the task of HUL's leasehold privileges of the land and building named Gulita arranged at Worli Sea Face Mumbai for an exchange estimation of Rs. 452.5 Crore.

On 22 January 2013, the Board of Directors of HUL affirmed a proposition to consent to another arrangement with its parent organization Unilever for the arrangement of innovation exchange imprint permit, trademark registration, and other services on 1 February 2013. This new understanding underlined that the loyalty cost of 1.4% of turnover payable by HUL to Unilever will increment in a staged way to an eminence cost of 3.15% of turnover, no later than the money-related year finishing 31 March 2018.

The expansion in eminence cost in the period from 1 February 2013 to 31 March 2014 is assessed to be 0.5% of turnover and from there on in the scope of 0.3% to 0.7% of turnover in each money related year, paving the way to a complete evaluated sovereignty cost increment of 1.75% of turnover contrasted with existing courses of action no later than the monetary year finishing 31 March 2018.

In 2014, Unilever reported an organization with Internet.org, a Facebook-directed coalition of accomplices to see how web access can be expanded to contact millions of individuals crosswise over India. The organization additionally dispatched Prabhat activity for network improvement in towns around its industrial facilities during the year under survey. Furthermore, the organization also went into association with MTV to embrace its brands during the year under review. In 2015, the organization propelled The Unilever Foundry.

During the year under audit, the organization was perceived as the most inventive advertiser at the Mobile Marketing Association (MMA). The organization additionally resuscitated Ayush with e-dispatch during the year. Besides, it also propelled the 'Swachh Aadat Swachh Bharat' program in India during the year under review. On 8 September 2015, HUL reported that it has further consented to bring forth an arrangement for the deal and the transfer of its bread and pastry shop business under the brand Modern to Nimman Foods Private Limited, an investee organization of the Everstone Group, for an undisclosed amount.

Brands And Products Of Hindustan Unilever

HUL is the market chief in Indian buyer items with products in more than 20 purchaser classes (for example, cleansers, tea, cleansers, and shampoos among others). Sixteen of HUL's brands were included in the ACNielsen Brand Equity rundown of 100 Most Trusted Brands Annual Survey (2014) which was completed by Brand Equity, an enhancement of The Economic Times. There are many brands and products owned by Hindustan Uniliver:

Food Products

- Annapurna salt and Atta (once known as Kissan Annapurna)

- Bru gold

- Brooke Bond 3 Roses, Taj Mahal, Taaza and Red Label tea

- Kissan squashes, kinds of ketchup, squeezes and sticks

- Lipton ice tea

- Knorr soups and supper creators and soupy noodles

- Kwality Wall's solidified treat

- Modern Bread, prepared to eat chapattis and other pastry shop things (presently offered to Everstone Capital)

- Magnum (ice cream)

Homecare Brands

- Wheel cleaner

- Cif Cream Cleaner

- comfort cleansing agents

- Domex disinfectant/toilet and bathroom cleaner

- Rin detergent products

- sunlight cleanser and shading care

- Surf Excel cleanser and delicate wash

- Vim dishwash

- magic – Water Saver

Personal Care Brands

- Aviance Beauty Solutions and products

- Axe deodorant and aftershave lotion and soap and accessories

- Lever Ayush Therapy ayurvedic health care and personal care products and items

- International breeze

- Brylcreem hair cream, hair gel and hair products

- Clear anti-dandruff hair products

- Clinic Plus shampoo and oil

- Close Up toothpaste

- Dove skin cleansing & hair care range: bar, lotions, creams, and antiperspirant deodorants

- Denim shaving products

- Fair and Lovely, skin lightening cream

- Hamam

- Indulekha ayurvedic hair oil

- Lakmé beauty products and salons

- Lifebuoy soaps and handwash range

- Liril 2000 soap

- Lux soap, body wash, and deodorant

- Pears soap, body wash

- Pepsodent toothpaste

- Pond's talcs and creams

- Rexona

- Sunsilk shampoo

- Sure antiperspirant

- Vaseline petroleum jelly, skincare lotions

- TRESemmé

- TIGI

- Vaseline and relevant products

Water Purifier Products

- Pureit water purifier

Business Model of HUL

Hindustan Unilever is an FMCG company that leverages its Direct to Consumer (D2C) business model and has made over 50 billion in revenue, as discovered in 2017. The company has crossed INR 50,000 cr ($6.55 bn) in turnover during FY21, as per the reports on April 2022. HUL is the first pure FMCG brand to hit such a milestone.

The business model of Hindustan Unilever is propelled with the idea of making living sustainable feasible for the masses. With sustainable living, HUL wants to bring about:

- Bettering the future of the children

- A future full of confidence

- A future full of health

- A future that is better for the planet

- A future that is better for the farming and farmers of India

The beauty and personal care segment of Hindustan Unilever helps the company see the most profit, while the food and refreshments segment is declared as the fastest-growing segment of the company. Home care is another segment of the company among its 3 primary segments.

The Hindustan Unilever company gets its competitive advantage from the global footprint it has and the track record of the company for enhancing value for its consumers around the globe.

Some of the prominent patterns that are noticeable in the business model of HUL are:

Reverse Innovation

Reverse innovation refers to the process of building products for industrial countries and then adapting them to the emerging markets. The technique of reverse innovation is what is truly wielded by HUL, which has been a prominent inspiration for many other big brands. The 'Knorr Stock Pot’ that the brand came up with is an excellent example of leveraging reverse innovation. This technique was mastered by HUL by taking references from the famous ‘Dense Soup treasure,’ which was the first major example of reverse innovation, launched in China in 2007.

Focussing on the financially weak

In contrast to the other foreign subsidiaries, HUL ideated to focus on the financially weaker sections of the country, which led them to focus on the majority of the Indian people. Citing the discovery of Wheel detergent powder is one of the examples where Hindustan Unilever created products for the majority of the Indian consumers. Wheel had lower oil-to-water ratio, which enabled Indian to wash textiles even in rivers with hands. Wheel was then made available cleverly by the brand in the local corner shops as well as via door-to-door representatives.

Staying keen on the Triple Bottom Line

While most of the companies solely focus on the profit part of the follow the Triple Bottom Line with only a little focus on the other segments, HUL has a new approach where the brand decided aimed for the other segments, thereby caring for people and the planet.

HUL largely focuses on the people, including its consumers and others. For instance, the company changed the name of one of its popular products "Fair and Lovely" to "Glow and Lovely", following the All Black Lives Matter movement that raged globally. This instantly made HUL a favourite!

Significant Distribution Strategy

The distribution strategy that Hindustan Unilever follows is exemplary! It focuses on hyperlocal markets, retail stores, wholesalers, hypermarkets convenience stores, ecommerce, and more. This hugely helps in the promotion of the HUL products and moving them fast to the consumers!

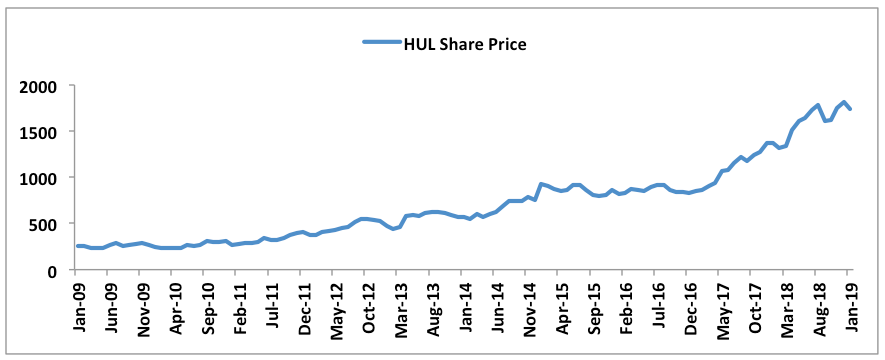

Business Growth In India

FMCG giant Hindustan Unilever Limited (HUL) announced a 15.98% development in solidified net benefit at Rs 6,060 crore for the monetary year finished March 31, 2019, when contrasted with Rs 5,225 crore in 2018. The net profit that HUL witnessed in FY21 rose by 18% YoY at Rs 7,954 crore.

Remarking on the profit, HUL Chairman and Managing Director Sanjiv Mehta stated, "We have conveyed a solid execution for the quarter regardless of some balance in rustic market development. Our attention to fortifying the center and driving business sector advancement has been reliably conveying great outcomes. We have now developed top line and primary concern for the eighth continuous year and our 2019 outcomes were a demonstration of both our technique and execution."

"Given the large-scale monetary pointers, close term advertise development has directed. Notwithstanding, the medium-term viewpoint remains positive. As an association, we are well-situated to react with speed and nimbleness to address the issues of our shoppers. We stay concentrated on our vital plan of conveying predictable, focused, beneficial, and dependable development," he included.

"Together with the between time profit of Rs 9 for each offer, the all-out profit for the money-related year closure March 31, 2019, adds up to Rs. 22 for every offer," the organization said. "Combined income for 2018-19 remained at Rs 39,860 crore, up from Rs 36,622 crore a year sooner," HUL said in a document to the Bombay Stock Exchange.

HUL's business in India developed by 12%, driven by 10% volume development in the household advertise. In the January-March quarter, the organization posted 13.84% development in its independent net benefit at Rs 1,538 crore when contrasted with Rs 1,351 crore in a similar quarter a year ago. The offers of the organization remained at Rs 9,809 crore in Q4FY19 from Rs 9,003 crore in Q4FY18, enrolling a development of 8.95%. The working benefit (EBITDA) for the March quarter was up 13% year-on-year at Rs 2,321 crore and the EBITDA edge was up 90 bps.

The organization said that the edge improved because of judicious administration of instability in costs (unrefined and money driven) alongside improved blend and working influence.

HUL reported that its Earnings before interest, tax, depreciation and amortisation (EBITDA) stood at Rs 11,324 crore, while the EBITDA margin was reported to be 25% during FY21.

Also read : Unknown Facts About Famous Brands | A Case Study

Expected Future Growth

Hindustan Unilever NSE 0.01 % (HUL) may clock 9-10% development in June quarter benefit despite a slight balance in volumes because of value climbs crosswise over classes. IIFL Institutional Equities expects the FMCG major to report a 6% volume development, a slight control from the 7% volume development recorded in the past quarter.

"Our channel checks give us a feeling that the organization has started value climbs crosswise over classes, (for example, cleansers, espresso), among others. We along these lines gauge a business development of 9%, like the past quarter level. We expect the slight withdrawal in gross edge to be counterbalanced by influence in promotion spending and different costs. In general, EBITDA and PAT are relied upon to develop at 13% and 12%, individually," IIFL said. IDFC Securities expects HUL to report 10.3% to ascend in benefit at Rs 1,728 crore. It sees deals developing at 8% to Rs 10,250 crore.

"We expect 6% volume development and factor in deals development of 11% in home consideration and 7% in close to home consideration portions. Lower advertisement spends (down 80 bps YoY) and commands over different overheads will help EBITDA edges," it stated while proposing edge at 24.3% against 23.7% the previous year. Edelweiss sees income, Ebitda, and benefit development at 7.3%, 8.6%, and 7.7% YoY.

"We anticipate that HUL's volume should grow 5% YoY on a high base of 12% YoY development. Q1FY18 was affected by GST dispatch thus the best approach to take a gander at volume development is three years' normal, which will be 5.6%. Delicate quality in the second 50% of Q4FY19 proceeded for the full quarter in Q1FY20. Provincial development is presently at a similar level as urban development. A mixed value climb of 2.5% has been taken. On EBITDA edge front, we expect 20-30 bps YoY development," the business said.

FAQs

What is Hindustan Unilever origin?

Hindustan Unilever or Hindustan Unilever Limited (HUL) is an Indian subsidiary of Unilever, which sprung from its Dutch-British roots. HUL is headquartered in Mumbai.

Who is the owner of Hindustan Unilever Limited?

HUL is owned by Unilever, its British multinational parent, headquartered in London.

What is HUL?

HUL is the acronym for Hindustan Unilever Limited.

Who are Hindustan Unilever founders?

Hindustan Unilever founders can be cited as 3 parent companies - Hindustan Vanaspati Mfg. Co. Ltd., Lever Brothers India Limited, and United Traders Limited, which were merged to form HUL.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Manage your business smoothly- Google Workspace

- International Money transfer- XE Money Transfer