What Is Journal Entry For Deferred Revenue Expenditure . deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. the following deferred revenue journal entry outlines the most common journal entries in accounting. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. This journal entry recognizes the liability.

from www.youtube.com

deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. This journal entry recognizes the liability. deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. the following deferred revenue journal entry outlines the most common journal entries in accounting. deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered.

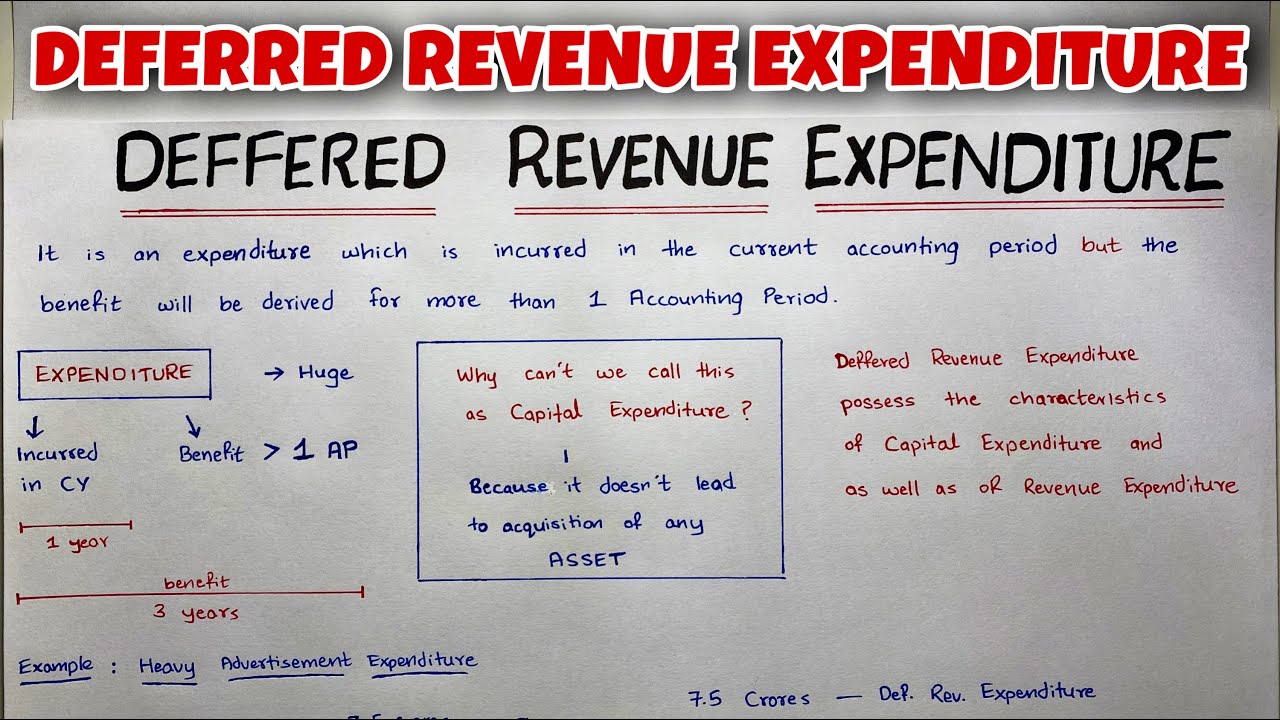

Deferred Revenue Expenditure EXPLAINED By Saheb Academy YouTube

What Is Journal Entry For Deferred Revenue Expenditure when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. This journal entry recognizes the liability. deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. the following deferred revenue journal entry outlines the most common journal entries in accounting.

From www.slideserve.com

PPT CHAPTER 6 Refining the accounting database PowerPoint What Is Journal Entry For Deferred Revenue Expenditure deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. when a customer pays. What Is Journal Entry For Deferred Revenue Expenditure.

From www.youtube.com

Deferred Revenue Expenditure EXPLAINED By Saheb Academy YouTube What Is Journal Entry For Deferred Revenue Expenditure deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. a deferred revenue journal. What Is Journal Entry For Deferred Revenue Expenditure.

From financialfalconet.com

Deferred Revenue Journal Entry with Examples Financial What Is Journal Entry For Deferred Revenue Expenditure when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. deferred revenue is a liability on a company's balance sheet that represents a prepayment. What Is Journal Entry For Deferred Revenue Expenditure.

From www.studyequation.com

Deferred revenue expenditure Study Equation What Is Journal Entry For Deferred Revenue Expenditure the following deferred revenue journal entry outlines the most common journal entries in accounting. deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services. What Is Journal Entry For Deferred Revenue Expenditure.

From fabalabse.com

What is deferred revenue journal entry? Leia aqui What is an example What Is Journal Entry For Deferred Revenue Expenditure a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. deferred revenue (also called unearned revenue) is generated. What Is Journal Entry For Deferred Revenue Expenditure.

From fundsnetservices.com

Deferred Revenue Journal Entry What Is Journal Entry For Deferred Revenue Expenditure when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. deferred revenue expenditure is an expenditure that is revenue in nature and incurred during. What Is Journal Entry For Deferred Revenue Expenditure.

From fabalabse.com

What is journal entry for deferred revenue? Leia aqui How do you What Is Journal Entry For Deferred Revenue Expenditure the following deferred revenue journal entry outlines the most common journal entries in accounting. deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or. What Is Journal Entry For Deferred Revenue Expenditure.

From dxoviepya.blob.core.windows.net

What Is Journal Entry For Deferred Revenue at Kathy Gibbs blog What Is Journal Entry For Deferred Revenue Expenditure the following deferred revenue journal entry outlines the most common journal entries in accounting. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have. What Is Journal Entry For Deferred Revenue Expenditure.

From www.slideserve.com

PPT Deferred Revenue Journal Entry Is Crucial to Revenue Recognition What Is Journal Entry For Deferred Revenue Expenditure deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. the following deferred revenue journal entry outlines. What Is Journal Entry For Deferred Revenue Expenditure.

From quickbooks.intuit.com

What is Unearned Revenue? QuickBooks Canada Blog What Is Journal Entry For Deferred Revenue Expenditure when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. deferred revenue is a liability on a company's balance sheet that represents a prepayment. What Is Journal Entry For Deferred Revenue Expenditure.

From fabalabse.com

What is the journal entry for deferred revenue? Leia aqui How do you What Is Journal Entry For Deferred Revenue Expenditure deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. deferred revenue (also called unearned revenue) is generated when a. What Is Journal Entry For Deferred Revenue Expenditure.

From www.investopedia.com

What Deferred Revenue Is in Accounting, and Why It's a Liability What Is Journal Entry For Deferred Revenue Expenditure when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. This journal entry recognizes the liability. deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. the following deferred revenue journal. What Is Journal Entry For Deferred Revenue Expenditure.

From www.slideshare.net

Chapter04 What Is Journal Entry For Deferred Revenue Expenditure deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. the following deferred revenue journal entry outlines the most common journal entries in accounting. deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers. What Is Journal Entry For Deferred Revenue Expenditure.

From www.youtube.com

Deferred Revenue Examples Journal Entry in Accounting YouTube What Is Journal Entry For Deferred Revenue Expenditure deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. a deferred revenue journal entry is needed when a business supplies. What Is Journal Entry For Deferred Revenue Expenditure.

From fabalabse.com

What is the entry for deferred revenue? Leia aqui What is the journal What Is Journal Entry For Deferred Revenue Expenditure deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance.. What Is Journal Entry For Deferred Revenue Expenditure.

From vibrantfinserv.com

What is a deferred revenue expenditure / Article / VibrantFinserv What Is Journal Entry For Deferred Revenue Expenditure deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are. What Is Journal Entry For Deferred Revenue Expenditure.

From efinancemanagement.com

Deferred Revenue Meaning, Importance And More What Is Journal Entry For Deferred Revenue Expenditure deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. when a customer pays in advance for. What Is Journal Entry For Deferred Revenue Expenditure.

From www.youtube.com

Deferred Revenue Expenditure YouTube What Is Journal Entry For Deferred Revenue Expenditure deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. when a customer pays in advance for goods or services, the company debits the cash account. What Is Journal Entry For Deferred Revenue Expenditure.

From www.youtube.com

What is Deferred Revenue Expenditure YouTube What Is Journal Entry For Deferred Revenue Expenditure a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000.. What Is Journal Entry For Deferred Revenue Expenditure.

From dxoviepya.blob.core.windows.net

What Is Journal Entry For Deferred Revenue at Kathy Gibbs blog What Is Journal Entry For Deferred Revenue Expenditure the following deferred revenue journal entry outlines the most common journal entries in accounting. deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. a deferred revenue journal entry is needed when a business supplies its services to a customer and. What Is Journal Entry For Deferred Revenue Expenditure.

From www.asimplemodel.com

Deferred Revenue A Simple Model What Is Journal Entry For Deferred Revenue Expenditure deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. deferred revenue is a liability on a company's balance sheet that represents a prepayment. What Is Journal Entry For Deferred Revenue Expenditure.

From fabalabse.com

How do I pass deferred revenue entry? Leia aqui How do you pass entry What Is Journal Entry For Deferred Revenue Expenditure deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or. What Is Journal Entry For Deferred Revenue Expenditure.

From www.youtube.com

Deferred Revenue Expenditure Class 11th Journal Entries AGH What Is Journal Entry For Deferred Revenue Expenditure This journal entry recognizes the liability. deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. a deferred revenue journal entry is needed when a business supplies. What Is Journal Entry For Deferred Revenue Expenditure.

From www.thevistaacademy.com

Journal Entry Deferred Revenue Expenditure in Accounting What Is Journal Entry For Deferred Revenue Expenditure the following deferred revenue journal entry outlines the most common journal entries in accounting. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance.. What Is Journal Entry For Deferred Revenue Expenditure.

From fabalabse.com

What is the journal entry for deferred revenue? Leia aqui How do you What Is Journal Entry For Deferred Revenue Expenditure This journal entry recognizes the liability. deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers. What Is Journal Entry For Deferred Revenue Expenditure.

From docs.erpnext.com

Deferred Revenue What Is Journal Entry For Deferred Revenue Expenditure deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. deferred revenue is a liability on a company's. What Is Journal Entry For Deferred Revenue Expenditure.

From shoereaction11.gitlab.io

Deferred Revenue Expenditure In Balance Sheet Recons What Is Journal Entry For Deferred Revenue Expenditure This journal entry recognizes the liability. the following deferred revenue journal entry outlines the most common journal entries in accounting. deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. a deferred revenue journal entry is needed when a business supplies. What Is Journal Entry For Deferred Revenue Expenditure.

From www.youtube.com

Deferred RevenueMeaning, Examples with Accounting Entry, Liability or What Is Journal Entry For Deferred Revenue Expenditure when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. the following deferred revenue journal entry outlines the most common journal entries in accounting. This journal entry recognizes the liability. a deferred revenue journal entry is needed when a business supplies its services to a customer and. What Is Journal Entry For Deferred Revenue Expenditure.

From www.googlesir.com

Deferred Revenue Expenditures With Examples (Explained) Googlesir What Is Journal Entry For Deferred Revenue Expenditure deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. deferred revenue journal entry example (debit or credit) suppose a manufacturing. What Is Journal Entry For Deferred Revenue Expenditure.

From www.slideserve.com

PPT Capital and Revenue (Receipts and Expenditure) PowerPoint What Is Journal Entry For Deferred Revenue Expenditure a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. This journal entry recognizes the liability. deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. the following deferred revenue journal. What Is Journal Entry For Deferred Revenue Expenditure.

From www.youtube.com

CONFUSIONUNBILLED REVENUE vs DEFERRED REVENUE UNDERSTAND WITH CASE What Is Journal Entry For Deferred Revenue Expenditure deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers. What Is Journal Entry For Deferred Revenue Expenditure.

From www.slideserve.com

PPT Accounting Basics PowerPoint Presentation, free download ID2855641 What Is Journal Entry For Deferred Revenue Expenditure deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue. This journal entry recognizes the liability. the following deferred revenue journal entry outlines the most common journal entries in accounting. a deferred. What Is Journal Entry For Deferred Revenue Expenditure.

From medium.com

What Is the Journal Entry for Deferred Expenses? by Jackpit Medium What Is Journal Entry For Deferred Revenue Expenditure deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. deferred revenue expenditure is an expenditure that is revenue in nature and incurred during an accounting period, however, related benefits are to be derived in multiple. This journal entry recognizes the. What Is Journal Entry For Deferred Revenue Expenditure.

From www.slideserve.com

PPT Deferred Revenue Journal Entry PowerPoint Presentation, free What Is Journal Entry For Deferred Revenue Expenditure deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. when a customer pays in advance for goods or services, the company debits the cash account and credits deferred revenue.. What Is Journal Entry For Deferred Revenue Expenditure.

From www.youtube.com

Deferred Revenue Expenditure Class 11Capital and Revenue Receipts What Is Journal Entry For Deferred Revenue Expenditure deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000. deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. when a customer pays in advance for goods or services, the company debits the cash account. What Is Journal Entry For Deferred Revenue Expenditure.