Pay in instalments using Apple Pay

Pay for your purchase in instalments when you check out with Apple Pay, online and in apps on your iPhone or iPad.

To be eligible to pay in instalments using Apple Pay online and in apps, you’ll need:

An iPhone or iPad with iOS 18 or iPadOS 18 or later.

To set up Apple Pay.

An instalment offer from a debit or credit card issuer or instalment provider.

How it works

Buy now, pay later (BNPL) and monthly instalment loans allow you to make purchases without the need to make the full payment up front. These instalment loans allow you to finance a purchase and pay it back in fixed instalments over time. You can now make purchases in instalments when you check out with Apple Pay online and in apps on your iPhone or iPad and select the pay later option that works for you.* Instalment offers are available on supported debit and credit cards from banks and instalment providers.

If your card supports instalments, you’ll see a Pay Later hint below your card when you check out with Apple Pay online and in apps. Some banks and instalment providers may require you to complete an application, which is subject to eligibility and approval.

Make a purchase using instalments

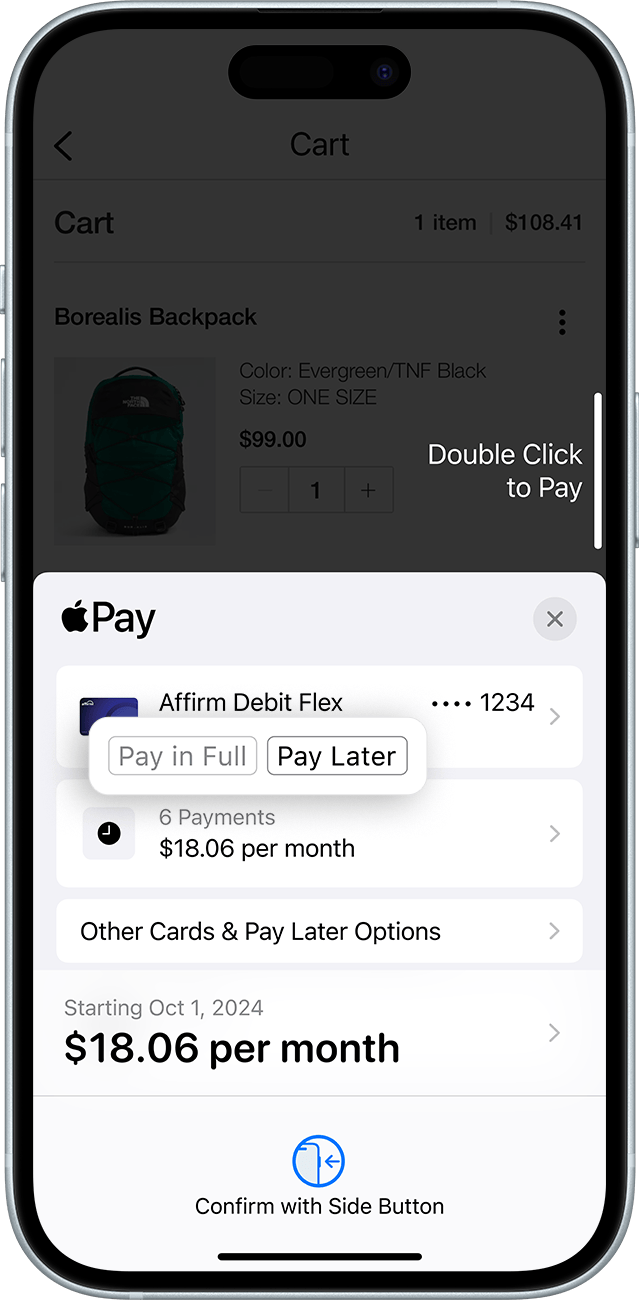

Tap the Apple Pay button or choose Apple Pay as your payment method.

Tap a card that supports pay later. To see if your default card supports pay later, look for the Pay Later hint under the card. To use a different card, tap Change Payment Method or Other Cards & Pay Later Options.

Tap Pay Later on the Payment Options screen.

If approved, you’ll see the instalment payment plans available for your purchase from your card issuer.

Select the payment plan you want to use. Review the details of the plan, including any terms and conditions.

Tap Agree & Continue.

Confirm the payment using Face ID, Touch ID or your passcode.

Purchases made using instalments will be labelled Pay Later in your transaction history in Wallet. You can tap a transaction to see more details about your purchase and to visit the card provider’s app or website to manage your instalment plan or loan.

Apply for and use additional pay later options

When available, you can apply for an instalment loan for your Apple Pay purchase from a supported instalment provider at checkout.

Tap the Apple Pay button or choose Apple Pay as your payment method.

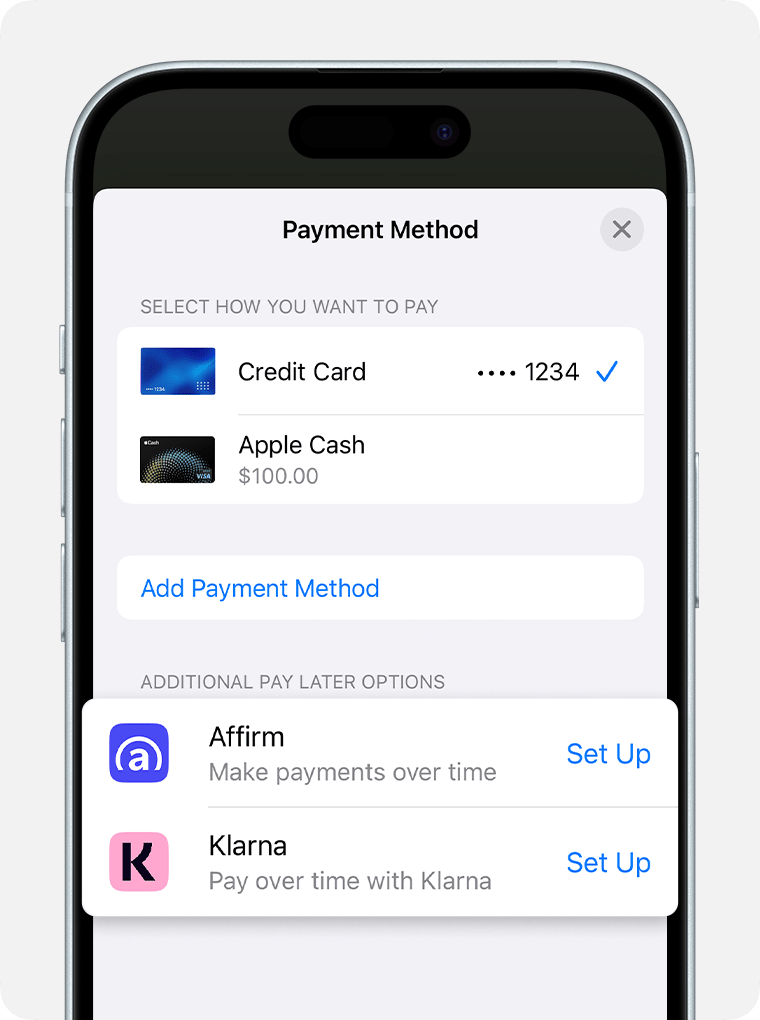

Tap Other Cards & Pay Later Options. If options are available, they’ll be listed under Additional Pay Later options.

Tap Set Up next to the pay later option you want to use.

Information about the instalment provider will be shown. Tap Continue to [Provider Name] to be transferred to the instalment provider and follow the instructions to complete your instalment loan application.

If your application has been approved and you’ve selected an instalment offer for your purchase, a card will be added to the Wallet app to complete the purchase using Apple Pay.

After the card has been set up for Apple Pay, confirm the payment using Face ID, Touch ID or your passcode.

You’ll have a card from the instalment provider in the Wallet app for you to use for future eligible Apple Pay purchases.

If you can’t see pay later options

Your card doesn’t support pay later.

The transaction amount may be below the minimum purchase amount or above the maximum purchase amount that is allowed under the card program.

The currency for your purchase isn’t supported by the card issuer.

Some purchase types may not be supported, such as subscriptions.

To check eligibility and to find out if your card is compatible to pay using instalments, please contact your card issuer.

How to handle order adjustments, returns or refunds

When you pay in instalments using Apple Pay, you can make changes to your order in the same way that you can do for other card purchases you make using Apple Pay.

All instalment offers, plans and loans are provided by the card issuer and are subject to the card issuer’s eligibility requirements and approval. For issues or questions about instalments, making payments and managing your instalment plan, contact the card issuer.

* All loans are offered by your lending provider and are subject to the lending provider’s eligibility requirements and approval, as well as other lending provider terms. Not available in all markets and may not be available for all types of purchases, such as subscriptions and recurring transactions. May need an eligible card. This feature is only available with Apple Pay online and in apps, on iPhone or iPad. Not available in-store. Software requirements apply. To ensure you have all of the features of this product, update your device to the latest software version. Depending on your card, to avoid paying off your loan early, you may need to adjust how you pay your card’s bill. For example, your entire loan may be reflected in the statement balance of your card, and thus paying your statement balance (instead of, for example, the minimum payment due or an adjusted balance) would pay off your entire loan early. Contact your card issuer for more details.

Apple Pay is a service provided by certain Apple affiliates, as designated by the Apple Pay privacy notice. Neither Apple Inc. nor its affiliates are a bank. Any card used in Apple Pay is offered by the card issuer.