Milwaukee Property Bills Bring Sticker Shock

But it's worth understanding what is causing bills to spike, and one opportunity to save.

Break out the gripes.

Milwaukee property owners began receiving their property tax bills in recent weeks. And for many, there has been sticker shock.

Turning to neighborhood Facebook groups, Next Door and other social media services shows plenty of people surprised to see a big increase.

“Do not open those envelopes before Christmas, it could be a nightmare, am not joking, am telling you in good faith,” wrote one member of Bay View Town Hall.

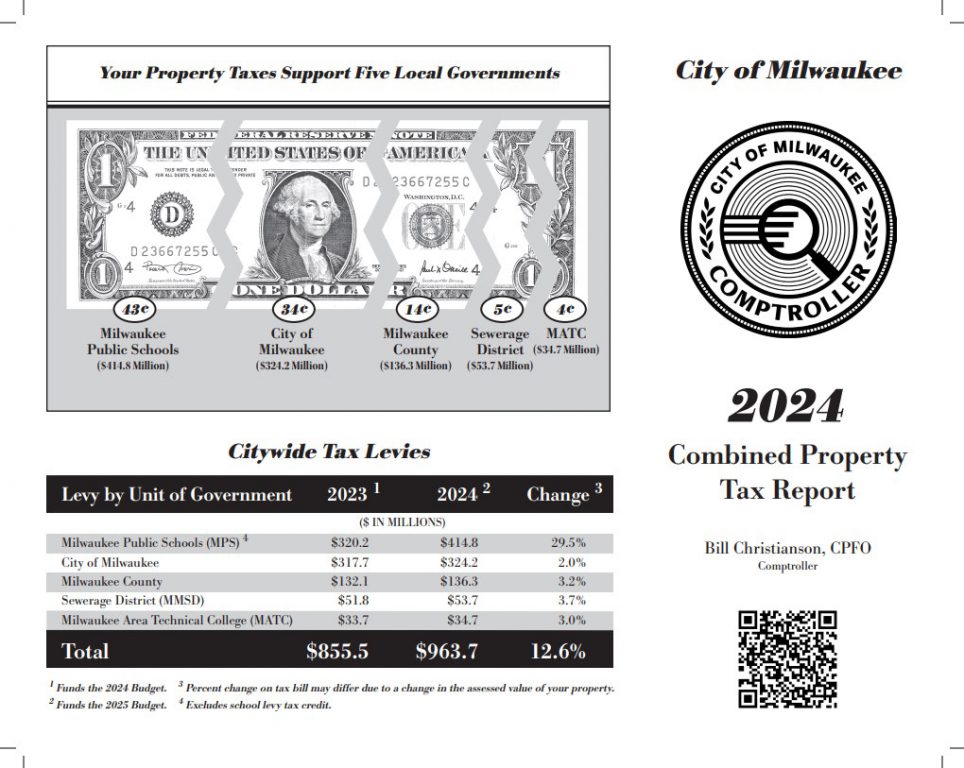

Despite the bill coming from the City of Milwaukee, it represents five bills in one: property tax levies from the city, Milwaukee Public Schools, Milwaukee County, Milwaukee Metropolitan Sewerage District and Milwaukee Area Technical College.

And only one of those entities had a referendum in 2024 that allowed its levy to exceed earlier levy limits: MPS.

The school district, after narrowly securing passage of a referendum in April and then seeing major financial reporting issues exposed in May, now sees its total property tax levy climbing 29.5%.

According to a report from the Comptroller’s Office, of every dollar collected from city property tax payments, MPS now accounts for 43 cents. The city receives 34 cents, Milwaukee County 14 cents, MMSD five cents and MATC four cents. In 2023, the city and MPS each netted 37 cents of every dollar.

State laws cap the amount of revenue a property taxing entity can collect, effectively restricting increases to small inflationary growth and the value of new construction. As a result, the other four entities saw their total levies rise between 2% (the city) to 3.7% (MMSD).

Factoring in the MPS referendum, the total amount levied grew 12.6%. A percentage that, all else being equal, would be passed onto every property tax owner.

But all else is never equal in a city with more than 150,000 properties. The separate assessment process, carried out in the spring, also influences bills.

Best described by Ald. Scott Spiker as a way to split a dinner bill fairly, the process aims to determine the fair market value of every property. It is later applied to the total tax levy, set by the annual budget process, to calculate how much of the total levy an individual property owner is liable for. Raising or lowering an assessment does not change how much money is collected in property tax revenue, but can change individual bills.

But a rising assessment doesn’t necessarily mean a rising property tax bill. If an individual property’s assessment increases less than the average, it often triggers a lower property tax bill. But, unless that gap was very large for your property, the MPS referendum likely rendered that possibility moot in 2024.

The MPS referendum passed 51%-49% in the April spring election, with approximately 81,500 votes cast. More than 4,000 voters, a figure more than twice the size of the final margin, cast a ballot in the April election but left the MPS referendum question blank. Far more voters showed up in November, with 249,007 votes cast in the presidential election.

The referendum allows MPS to have additional operating funds without an explicit requirement on what they are spent on. MPS and board members said the referendum was necessary due to the state underfunding of schools, with per-pupil aid not keeping pace with inflation.

But in May, just over a month after the referendum passed, Superintendent Keith P. Posley became the subject of intense scrutiny over long-delayed district financial reports to the state. He resigned in early June.

As reported in the lead-up to the referendum vote, the owner of a hypothetical $100,000 home was estimated to pay an additional $216 in the first year under the proposal. However, the median Milwaukee home is now assessed at approximately $166,000, rendering the increase even larger.

Make Sure To Claim This Credit

There is one surefire way to reduce the bill for your home: claim the Lottery and Gaming Credit.

If the property is your primary residence, you are likely eligible for the credit. But, in many cases, it is not automatically applied to your bill.

The state credit provides direct tax relief. According to the Wisconsin Department of Revenue, the average 2024 credit is $213. The agency provided guidance on claiming the credit in a press release.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

Political Contributions Tracker

Displaying political contributions between people mentioned in this story. Learn more.