UK Job Market Report

29 January 2024

Adzuna has the most complete index of UK job vacancies covering all regions in the UK, based on every job vacancy advertised online in the UK from over 1,000 sources. This data is then normalised, de-duplicated, mix-adjusted and outliers are removed in real time to give an accurate, complete, up to the minute view of the job market. Our UK Job Market Report tracks advertised vacancies, average advertised salaries, competition for jobs, trending roles, time to fill positions, and more.

We also supply real-time data to the Number 10 Dashboard, the Cabinet Office and the Office for National Statistics’ labour market indices. For more granular data breakdowns at a local authority level, job title, or skill level, please contact our labour market intelligence division, Adzuna Intelligence.

Vacancies

The UK jobs market experienced its biggest monthly fall in vacancies in over three years in December, as business confidence in the UK continues to contract.

Total advertised job vacancies dropped -6.95% in December to 929,138, the second month in a row that total vacancies are lower than 1 million. The last time job vacancies fell this dramatically was in June 2020, when monthly vacancies dropped -18.14% as businesses struggled to get to grips with the effects of the Covid-19 pandemic.

Salaries

Average advertised salaries are on the rise, up +0.96% monthly to £37,577, and up +2.28% on an annual basis. This may point to a lack of entry-level or junior positions available, with companies hiring only for more senior roles.

However, more job adverts are neglecting to include salary data (50.2%) compared to those that do. This makes it hard for potential candidates to understand the seniority of a role and if it is relevant for them to apply for.

Time to fill

The average time to fill vacancies has dipped slightly, at 35.6 days on average in September 2023 (the latest data), down from 35.8 in August.

Competition

Competition for jobs is now the highest it’s been since September 2021, at 1.68 jobseekers per vacancy. This is compared to May and June when it was at its 2023 lowest, at 1.45.

Hottest cities

Cambridge has remained on top as the best city to find a job, with low competition rates: there are 0.3 jobseekers for 7,383 vacancies, a status it has maintained throughout 2023. This is followed by Oxford (0.63) and Reading (0.73).

On the other side of the scale, Bradford has maintained its position as the most competitive city for jobseekers with 6.53 jobseekers competing for 2,831 vacancies. This has continued to increase as overall vacancy numbers have fallen. This is followed by Birmingham (3.54) and Sunderland (3.04).

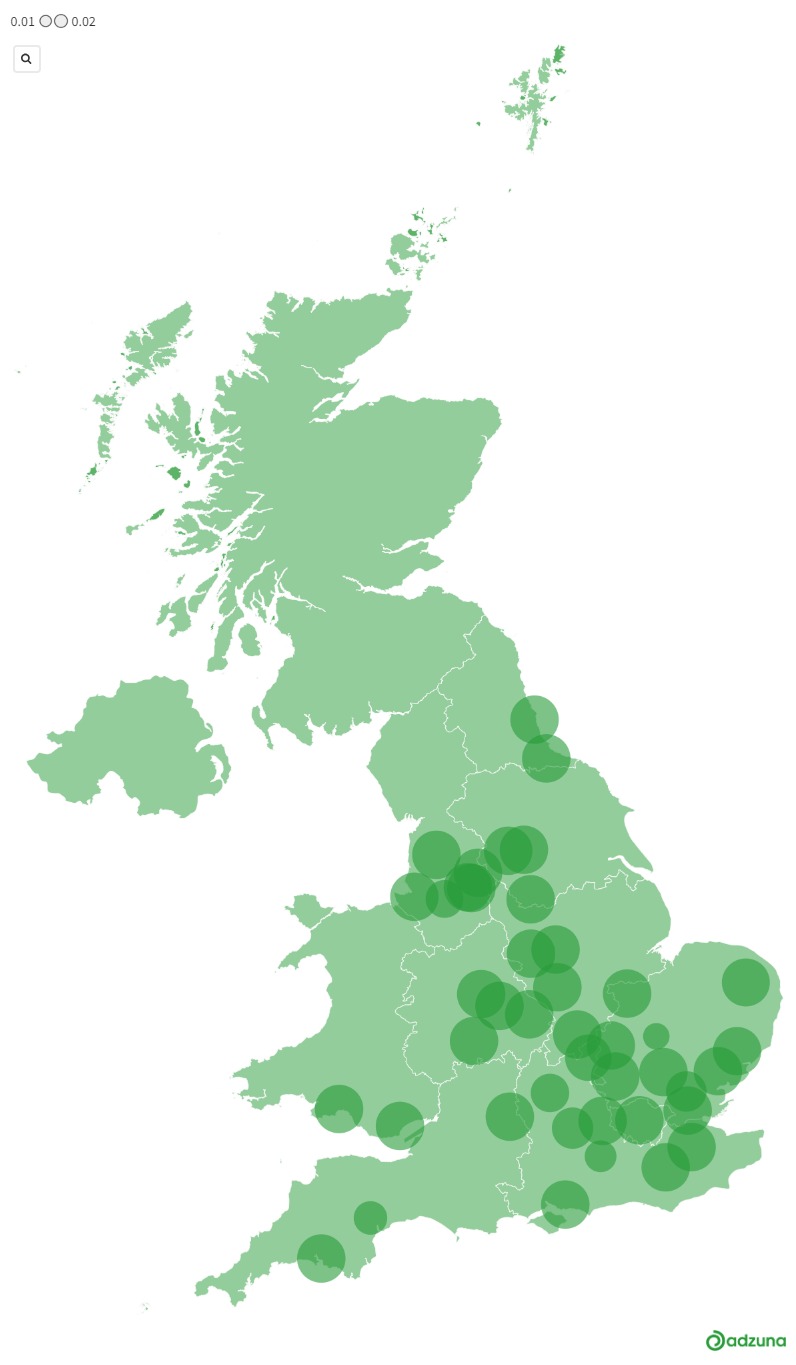

UK regions

Every region saw advertised vacancies fall month-on-month, with Scotland seeing the largest decline, down -9.75% from November. The East Midlands saw the smallest monthly decline, down -5.67%.

East Midlands has experienced the highest annual increase in salaries compared to December 2022, up +7.14% to £34,423, followed by Eastern England, up +4.5% to £36,141. It’s interesting to see Northern Ireland fall so far down the table, with only a modest +2.81% increase in annual salaries. Usually, the region has been one of the top three for salary growth throughout 2023, often driven by high average salaries in Belfast. However annual advertised salaries have fallen -5.3% in the city compared to last year.

London’s salary decrease is slowing further, down to -0.04%, compared to -2.02% in November, pointing to improved salary performance in the capital.

UK sectors

Teaching was the only sector to experience a rise in monthly job vacancies in December, up +4.39% compared to November and an increase of +38.32% compared to 2022’s figures.

Every other sector saw a monthly fall in advertised job vacancies throughout December, with the biggest falls in Retail (-17.94%), Manufacturing (-17.05%), Hospitality & Catering (-14.13%) and Trade & Construction (-13.56%). The availability of Graduate roles has also continued to suffer with live job ads down -8.4% from November.

When compared to last year’s figures, HR & Recruitment vacancies have fallen the most, down -43.38% to 10,127 roles, followed by IT jobs which are down -35.34% to 90,507. The smallest fall was in Engineering, which has seen vacancies drop only -3.48% compared to the same time last year. Despite the fall in advertised vacancies, it’s still one of the biggest hiring sectors with 83,339 available jobs.

Due to positive growth in average advertised salaries in the UK, there was almost widespread growth in sector salaries.

The biggest increases were in Creative & Design jobs, up +2.15% to £39,112 and Retail jobs, up +2.19% to £28,097. IT and Maintenance were the only two sectors to see average advertised salaries fall -1% and -1.65% respectively. IT advertised salaries were also down -8.66% on an annual basis. Whilst this may seem like more bad news for the IT sector, this was one of the smallest decreases in salaries the sector has experienced in the past year, demonstrating that fortunes may be turning.

Social Work jobs saw the biggest increase in advertised salaries compared to the same time last year, up +11.54% to £34,446, followed by Travel, up +10.77% to £32,276, and Energy, Oil & Gas, up +10.69% to £44,949.

Teaching was the sector with the shortest time to fill for roles, at 30.9 days on average, up from 37.8 the previous month, whilst the average for all sectors was 35.6 days. The graduate sector is taking the longest to fill roles, on average 47.2 days, which points to high competition in the sector for a smaller number of available opportunities.

Trending jobs

The data also tracks the most popular occupations among UK jobseekers. Continuing a trend experienced throughout 2023, warehouse work is the top trending job. Lorry driving roles came second, followed by Social Care Worker roles.

Methodology

About Adzuna

Adzuna is a smarter, more transparent job search engine used by tens of millions of visitors per month. We love using the awesome power of technology to bring together every job in one place, help match people to better, more fulfilling jobs and keep Britain working.

Adzuna supplies real-time data to the Number 10 Dashboard, the Cabinet Office and Office for National Statistics labour market indices. In 2018, Adzuna won the contract to run Find a job, one of the British government’s most used online services.

Adzuna.co.uk was founded in 2011 by Andrew Hunter and Doug Monro, formerly of eBay, Gumtree, Qype and Zoopla and is backed by leading Venture Capital firms LocalGlobe, Index Ventures and Smedvig Capital.

We’ve spent a decade developing smarter, more transparent job search so jobseekers worldwide (we’re in 19 countries) can zero in on the right role faster.

About the Job Market Report

Adzuna has the most complete index of UK job vacancies covering all regions in the UK. The technology collects every job vacancy advertised online in the UK from over 1,000 sources. This data is then normalised, de-duplicated, mix-adjusted and outliers are removed in real time to give users an accurate, complete, up to the minute view of the job market.

Claimant count data is based on the latest Labour Market Statistics released by the ONS. The city areas referred to in this study are the top 50 cities in the UK, ranked by comparing the job vacancies in Adzuna’s comprehensive search index of over 1,000,000 live jobs to the number of claimants in each city from the latest ONS data. The full Jobseeker’s Allowance claimant count statistics are available for download here: www.nomisweb.co.uk.

The interest quotient for key roles is calculated by comparing how many views job postings for different occupations on Adzuna receive over a given month and comparing this to the overall job posting views over the same period. It provides a proxy for talent supply in the jobs market.

For more granular data breakdowns at a local authority level, job title, or skill level, please contact our labour market intelligence division, Adzuna Intelligence.