ALBAWABA – Oil prices rose slightly Tuesday, to recuperate some of the losses from the previous session, driven by supply cuts from the world’s biggest oil exporters and a weaker dollar, news agencies reported.

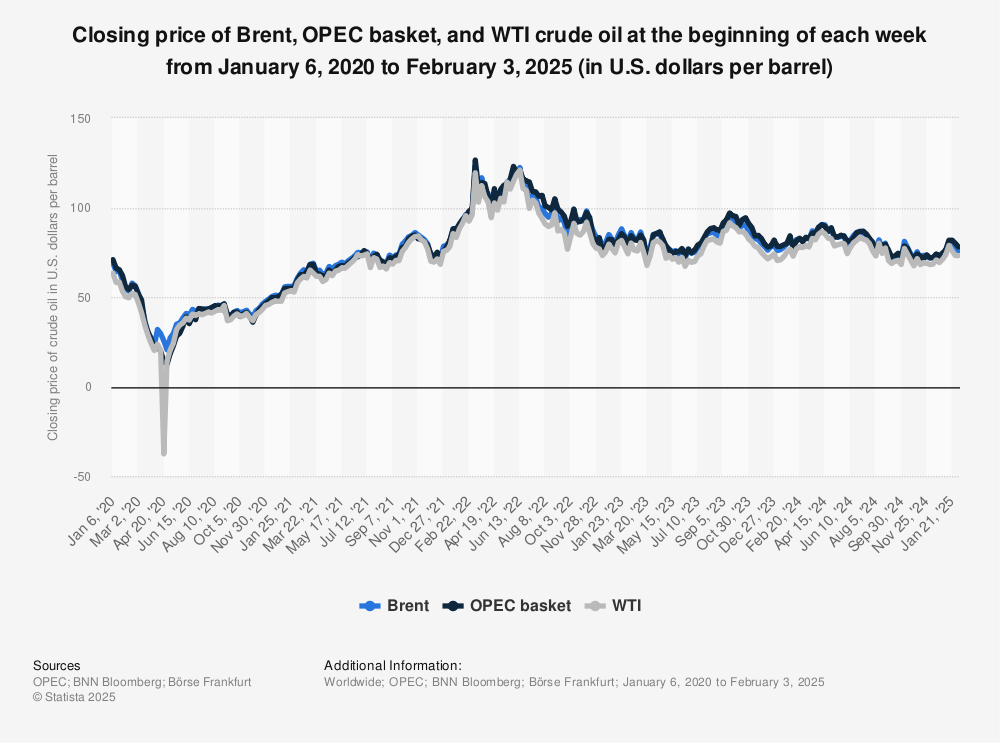

Brent and West Texas Intermediate (WTI) crudes edged 0.4 percent and 0.5 percent, to $78 and $73.34 on the barrel, respectively, according to Reuters.

The Organization of Petroleum Exporting Countries and their allies (OPEC+) enacted a number of cuts over the past year, the latest being Russia’s and Saudi Arabia, which will extend through August.

Oil prices slipped slightly Monday, as reported by Bloomberg, but has made some advances since, back to selling at over $78 and $73 per barrel of Brent and WTI.

Overall, both oil crudes have been range-bound since April, with marginal slides and surges in June, all above the $70 and $67 thresholds, as reported by the German data platform, Statista.

Supply cuts by the world's biggest oil exporters Saudi Arabia and Russia set for August bolstered benchmark prices. While Russia will not cut production, it will lower its exports to replenish domestic fuel supplies for its ongoing war effort in Ukraine.

Meanwhile, the United States (US) dollar fell to a two-month low, Reuters reported.

A weaker US dollar lowers oil prices for importing countries and consumers conducting oil transactions in other currencies, and it usually boosts oil demand.

Traders are also looking ahead to US crude inventory data due later on Tuesday from industry group American Petroleum Institute. Reuters’ analysts expect a build-up of 200,000 barrels.

"Oil has found a floor and the only thing ... that could break that is if US inflation is scorching hot and the Fed is forced to tighten this economy into a recession," OANDA analyst Edward Moya told Reuters.

Central bank officials and economists repeatedly warned that the US Federal Reserve will likely raise US interest rates to further curb inflation. But incoming economic data indicate the rate hikes will pause for now, and perhaps for the foreseeable future.