Tuesday, August 11, 2020

Can Barclays Share Price Rely on Strong Trading Profits?

By Century Financial in 'Brainy Bull'

Barclays’ [BARC] share price has put it among the biggest losers of banking so far in 2020. The stock had opened the year at 180.08p but as of 7 August trades at just 104.60p.

As coronavirus fears began to take hold in March, Barclays’ share price fell to a low of 80.24p on 3 April before recovering to 131.80p on 8 June. However, the recovery was short-lived as it fell to 100.56p on 31 July.

Barclay’s share price then climbed 4% over the first seven days of August but has struggled to navigate record low-interest rates blasting margins as well as economic fears over Brexit and the COVID-19 pandemic.

Amid these headwinds, Barclays Corporate and Investment Bank has been a bright spot with income up 31% year-over-year at £6.9bn for the first half of 2020.

Why then has Edward Bramson, founder of Sherborne, revived his activist campaign against the division?

Investment bank woes, despite increased trading

The UK bank’s earnings results for the first half of 2020 laid bare some of those headwinds when it posted a 66% drop in profits to £695m.

Barclays also set aside £3.7bn to cover anticipated bad loans from the pandemic, as businesses and individuals struggle to keep up debt repayments.

It wasn’t all bad news though. Barclays’ trading division posted a 63% hike in trading revenues to £4.56bn, as an increased number of traders looked to make money in the pandemic driven volatility.

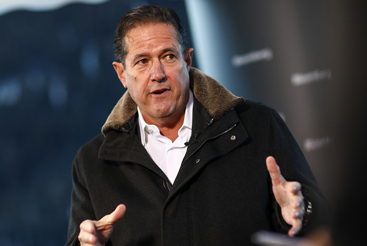

Despite the strong performance, Bramson wrote a letter to shareholders on 6 August requesting the bank slim down its investment arm by 24% to boost profits, according to the Financial Times.

Bramson’s Sherborne Investors Management, which holds a 5.9% stake in Barclays, has long seen the investment bank as being dilutive to Barclays’ shareholder returns.

Bramson argues that the trading surge in the first half of the year will not continue. “In the real world, investors do not care very much about the trading business,” Bramson wrote.

Jes Staley, Barclays chief executive, has paid little attention to critics like Bramson instead deciding to expand rather than reduce the size of the investment unit over recent years.

Richard Buxton, a fund manager at Merian Global Investors, believes that Staley’s hybrid model of having investment banking as well as commercial and retail on the cards has proved itself effective at “offsetting tougher times elsewhere”.

However, Staley could still buckle. Despite return on equity in the investment division reaching 9.6% in the second quarter that compares badly to the likes of Goldman Sachs or Credit Suisse that generated returns of 17% and more, according to analysis by eFinancial.

Increased resilience, but for how long?

Judging by MarketScreener’s analysis of Barclays’ share price, the revived investment bank debacle will have very little impact on the stock. Analysts have a consensus outperform rating on the Barclays stock with an average target price of 141.28p.

Defaults from the pandemic could weigh on the profits of lenders such as Barclays for years to come. Rupert Hargreaves wrote in The Motley Fool. However, its trading division has helped it sidestep the worse of these losses.

“If the pandemic lasts into 2021, it may be forced to take even more loss provisions impacting the share price,” Hargreaves wrote.

“Still, it should be able to cope. Its capital position is strong, and income from its investment bank is helping it stay in the black. As such, the bank seems well-placed to profit from the UK economic recovery when it begins. This suggests investors may profit from buying into the lender’s share price while it trades at a low level.”

Robert Noble, an analyst at Deutsche Bank, is targeting a price more towards the lower end at 135p.

“At first glance UK banks screen as value, but on a relative basis not materially so — and significant risks remain,” he said, according to Interactive Investor.

The group is likely to face more headwinds in the second half of the year, as government support measures for the economy such as furloughing come to an end and the economic reality begins to bite.

Its investment arm will provide its share price with some resilience but for how much longer is unclear.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.