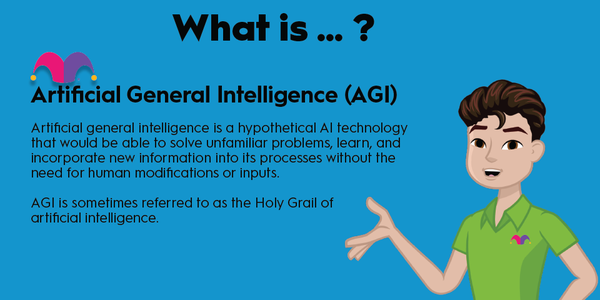

Proclaiming itself the "pioneer" in generative artificial intelligence (AI), Cerebras and its stock have drawn increasing attention from AI investors, engineers, and aficionados. In March 2024, Cerebras introduced the Third Generation 5nm Wafer Scale Engine, or WSE-3, which the company claims is the fastest AI chip. It's no wonder Cerebras is garnering considerable interest from the AI community.

With Open AI's launch of ChatGPT in late 2022, generative AI exploded onto the scene. Now, it and other generative AI models are becoming increasingly present in our daily lives. It's hardly expected to slow down. According to Bloomberg Intelligence, the generative AI market is projected to grow from about $40 billion in 2022 to more than $1.3 trillion in 2032 -- a compound annual growth rate (CAGR) of almost 42%.

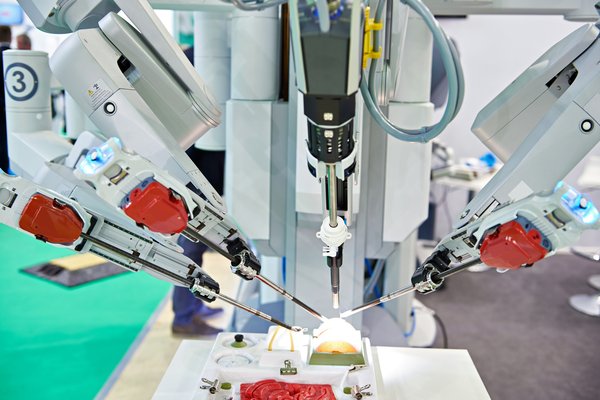

In addition to several government laboratories, Cerebras has a variety of customers operating in the private sector. The Mayo Clinic, for example, has turned to Cerebras for assistance in developing AI models for healthcare.

Financial details of the relationship are scarce, but Cerebras CEO Andrew Feldman identified the deal as a "multimillion-dollar" arrangement. Oil supermajor TotalEnergies (TTE -1.34%) has also enlisted Cerebras to help with seismic modeling.

While investors may be motivated to add Cerebras to their portfolios, there are important things to consider. Besides looking at how to buy shares of Cerebras stock, investors will want to consider when the company plans to hold its initial public offering (IPO) and whether alternative investment opportunities exist.

Artificial Intelligence

Is it publicly traded?

Is Cerebras publicly traded?

As of November 2024, Cerebras was not a publicly traded company; however, earlier in the year, the company had submitted SEC Form S-1 indicating its plan to IPO in the near future.

Cerebras has held several funding rounds that have helped it to raise capital from investors like the Abu Dhabi Growth Fund and venture firm Benchmark Capital. After completing a Series F round in 2021, Cerebras had raised about $715 million in funding, according to Crunchbase.

IPO

When will it IPO?

When will Cerebras IPO?

Although 2023 saw a slowdown in the number of companies holding IPOs compared to previous years, there has been an increase in IPO activity during 2024. While Cerebras is not officially on the calendar to hold an IPO, there is speculation that the company is looking to debut soon on the public markets, possibly as early as late 2024.

In its Form S-1, Cerebras stated that it had chosen Citigroup (C -1.32%) and Barclays (BCS 0.45%) to act as joint book-running managers for the IPO. There is no indication as to the listing date for Cerebras stock, but the company plans to trade on the Nasdaq exchange under the stock ticker CBRS. So, investors may soon have the opportunity to click the buy button on this IPO stock. Consistent with its latest funding round in 2021, Cerebras may seek a valuation in excess of $4 billion.

How to buy

How to buy Cerebras stock

For most investors, picking up shares of Cerebras before the IPO is not possible. People who qualify as accredited investors, on the other hand, may be able to buy Cerebras stock before its IPO. Some platforms, like Forge Global (FRGE 3.57%), allow accredited investors to buy shares of pre-IPO companies like Cerebras.

Although people who don't qualify as accredited investors may be unable to buy Cerebras stock, that doesn't mean they're completely out of luck. There are a variety of other AI stocks for them to consider. Here's a four-step guide on how to buy stocks.

Step 1: Open a brokerage account

Buying stocks is a great step toward building personal wealth. To get started, investors must open a brokerage account. Many options are available, but inexperienced investors may want to consider Fidelity, which offers zero-commission online trades.

Step 2: Figure out your budget

People with substantial experience know that creating a budget is integral to successful investing. Maybe you have an ample pile of cash to begin investing. Maybe you plan to start with just a few bucks. Whatever the case, it's critical to assess your financial situation and determine an appropriate budget.

Step 3: Research related companies

While the average investor waits for Cerebras to hold its IPO and become an option for them, there are several other stocks they may find worthy of buying now.

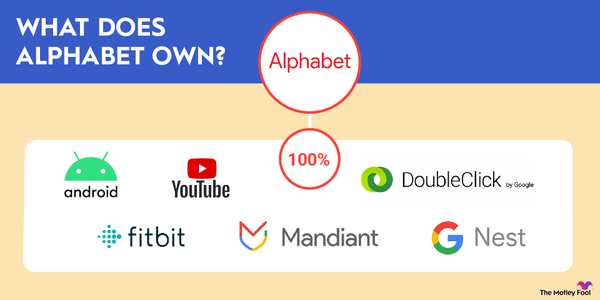

1. Nvidia

One of the most obvious alternatives for prospective Cerebras investors is AI stalwart Nvidia (NVDA 6.86%), arguably Cerebras' most formidable competitor. With its Hopper Tensor Core GPU (graphic processing units), Nvidia was already an industry leader in supporting AI computing.

However, Nvidia upped its AI game in March 2024 with its X800 series network switches. The company characterizes the X800 switches as "end-to-end networking platforms that enable us to achieve trillion-parameter-scale generative AI essential for new AI infrastructures."

Despite its commanding position -- the company's market capitalization exceeded $2.9 trillion in October 2024 -- there's still a general consensus among investors that Nvidia has plenty of opportunities for growth ahead of it. That's something that likely appeals to investors who are also interested in Cerebras.

Market Capitalization

And since it generates massive amounts of cash, it represents an AI investment opportunity at the lower end of the risk spectrum. In fiscal year 2024, for instance, Nvidia reported a free cash flow of $26.9 billion.

2. Qualcomm

Instead of a competitor, investors may feel more compelled to pick up shares of a collaborator. Qualcomm (QCOM 0.11%), for example, has partnered with Cerebras, making a way for investors to indirectly gain exposure to the privately held company.

In March 2024, Cerebras announced it had selected Qualcomm's Cloud AI 100 Ultra, an AI inference card designed specifically for generative AI and large language models, to be used with its CS-3 AI accelerators for training to provide a superior AI solution.

Simply branding Qualcomm as an AI company would be giving it short shrift. As a leading semiconductor company, Qualcomm provides wireless solutions found in numerous applications, including smartphones, vehicles, and devices operating on the Internet of Things.

The company has a variety of available growth opportunities. While investors wait for these to play out, they can reap the rewards of the company's dividend, which had a forward yield of 1.9% as of April 2024.

3. Astera Labs

Instead of waiting for Cerebras to hold its IPO, investors can opt for an AI-oriented semiconductor stock that recently held its IPO -- a stock like Astera Labs. Making its way to publicly traded markets in March 2024, Astera Labs offers its Intelligent Connectivity Platform to meet the connectivity demands of AI and cloud infrastructures. Already, the company has secured some industry leaders as customers.

Raghu Nambiar, Advanced Micro Devices' (AMD -0.51%) vice president for data center ecosystems and solutions, said: "Close collaboration with Astera Labs on PCIe technologies [connections for high-bandwidth communication] ensures our customers' platforms continue to meet the higher bandwidth connectivity requirements of next-generation AI and HPC [high-performance computing] workloads." Intel (INTC -1.63%) and Nvidia also use solutions from Astera Labs.

The company posted revenue of $115.8 million and a net loss of $26.3 million in 2023.

Step 4: Place an order

You're almost at the finish line -- just some final decisions to make. For one, you'll have to decide how many shares you'd like to buy. Next, you'll have to choose the type of order you want to make: a market order or a limit order. Finally, click the buy button and celebrate the step you've just taken toward building your personal wealth.

Profitability

Is Cerebras profitable?

Based on the company's S-1 filing, Cerebras has not achieved profitability. Although the company is profitable on a gross profit basis -- it posted gross profits of $2.9 million and $26.4 million in 2022 and 2023, respectively -- Cerebras reported net losses in each of the previous two years.

While it's not reporting positive earnings, Cerebras deserves recognition for narrowing its losses. Through the first six months of 2024, Cerebras has a net loss of $66.6 million, representing an improvement over the net loss of $77.8 million that it reported during the same period in 2023.

Should I invest?

Should I invest in Cerebras?

Cerebras is a privately held company, so it is not an investing option for most people. Since the company's submission of Form S-1, however, it appears that retail investors may not have to wait much longer before they can add this AI stock to their portfolio. Even when Cerebras stock does become available, investors must recognize the inherent risks, including the fact that the company is still unprofitable.

Accredited investors may be able to gain exposure to Cerebras currently. But even for them, a position in Cerebras carries a fair degree of risk, so they must be comfortable with a more speculative investment.

ETF options

ETFs with exposure to Cerebras

Cerebras isn't publicly traded, so investors can't gain exposure to the company through an exchange-traded fund (ETF). But other options exist. There are several artificial intelligence (AI) ETFs that may interest investors.

- Vanguard Information Technology ETF (VGT 2.58%): Don't let the name fool you. Though AI isn't specified in the ETF's name, the fund has plenty of AI exposure. Nvidia is the ETF's third-largest holding; Broadcom (AVGO 0.73%) and Advanced Micro Devices are the second- and third-largest holdings, respectively. The ETF has a low expense ratio of 0.1% and makes quarterly distributions.

- Roundhill Generative AI & Technology ETF (CHAT 1.42%): Branding itself the "world's first Generative AI ETF," this ETF may be an ideal option for investors frustrated that they can't buy Cerebras stock. After Nvidia, the ETF's largest holding, OpenAI partner Microsoft (MSFT 2.55%) represents the ETF's next-largest position. Combined, Nvidia and Microsoft account for more than 15% of the ETF's portfolio, which has 43 holdings and a 0.75% expense ratio.

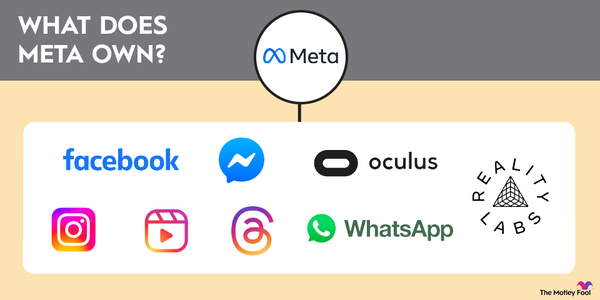

- Global X Artificial Intelligence & Technology ETF (AIQ 1.31%): With 84 holdings in its portfolio, this ETF provides a broader approach to AI. In addition to holding companies that produce hardware catering to AI, the ETF aims to invest in "companies that potentially stand to benefit from the further development and utilization of artificial intelligence (AI) technology in their products and services." Besides top holdings Nvidia, Broadcom, and Qualcomm, the ETF includes Meta Platforms (META 2.94%), Netflix (NFLX 0.06%), and Amazon (AMZN 1.57%) in its top holdings, with a 0.68% total expense ratio.

Related investing topics

The bottom line on Cerebras

In light of the massive growth that the generative AI market is expected to experience over the next decade, it's unsurprising that investors have Cerebras on their radar. While the company has achieved noteworthy success, it's unclear how this success has translated to the company's financial health -- something investors will have a better sense of if the company proceeds with its plans to hold an IPO. In the meantime, investors have a variety of other AI stocks and ETFs they can consider.

FAQ

Investing in Cerebras FAQ

Can you invest in Cerebras?

Because Cerebras has not held an IPO as of April 2024, the stock is unavailable to retail investors. Accredited investors, however, may be able to invest in Cerebras through platforms such as Forge Global.

Is Cerebras on the stock market?

As of April 2024, Cerebras is not a publicly traded company listed on either the New York Stock Exchange or the Nasdaq.

Is Cerebras a listed company?

While Cerebras has completed several funding rounds and has several investors, the company has not held an IPO and is not listed on U.S. exchanges.

What is the stock symbol for Cerebras?

Because Cerebras has not held an IPO as of early 2024, it doesn't have a stock ticker. If the company proceeds with an IPO in late 2024 -- or later -- investors will then discover the stock's symbol.