Ethereum (ETH -11.75%) is the decentralized, open-source technology that powers much of the crypto world. Everything from decentralized finance (DeFi) applications and non-fungible tokens (NFTs) to enterprise blockchain solutions relies on Ethereum's technology.

Ethereum's native token, Ether, is the second-largest cryptocurrency after Bitcoin (BTC 0.2%). While it hasn't been as successful as the market leader, it has had its fair share of bull runs.

If you want to profit from the growing use of Ethereum, there are several ways you can invest. The most direct option is buying Ethereum itself. Because it's extremely volatile, this carries the greatest risk but also the greatest potential profits. Another option is buying Ethereum stocks, including managed funds that invest in Ethereum for you and companies with large exposure to Ethereum technology.

What is it?

What is Ethereum?

Ethereum is an open-source blockchain technology in the form of software. Software developer Vitalik Buterin originally proposed the idea in 2013, and Ethereum launched in 2015.

Any developer making an application that would benefit from blockchain technology can build it on the Ethereum network. While Ethereum is most associated with its native Ether token and other cryptocurrencies, its technology is also enabling widespread innovation in industries as diverse as insurance, logistics, and healthcare.

Developers write programs on Ethereum using self-executing, self-enforcing protocols called smart contracts, which are deployed to Ethereum-powered blockchains. The blockchain's network of computers executes the smart contract by performing specified actions when the conditions of the contract are met. Blockchain data can't be modified after it's created, and that gives users confidence in the technology.

Although early cryptocurrencies, most notably Bitcoin, are merely stores of value that can be transferred, Ethereum has more uses. If Bitcoin is a smartphone app, Ethereum is more like the device maker. Ethereum's cryptocurrency benefits from its technology because transaction fees for decentralized applications on its blockchain are paid in Ether.

What is the Ethereum Merge?

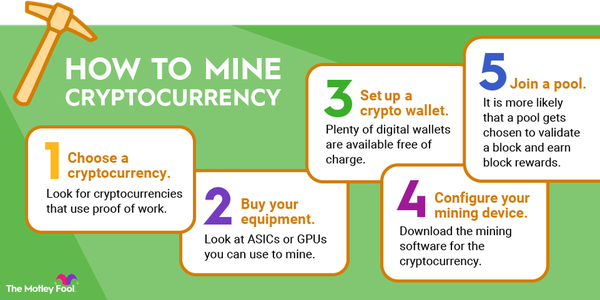

The Ethereum Merge is the term for the network's switch from its original proof-of-work system to a proof-of-stake system, which was completed in September 2022.

When Ethereum launched, it used proof of work, the same system used by Bitcoin, to validate and record transactions. A notable drawback of this system is extremely high energy usage, which has led to Bitcoin using more power per year than some entire countries.

In 2020, Ethereum introduced the Beacon Chain, a proof-of-stake network. It continued using its original proof-of-work mainnet for processing transactions until The Merge when Ethereum combined the Beacon Chain with the mainnet and made the transition to proof of stake.

The primary benefit of The Merge is energy efficiency. By switching to proof of stake, Ethereum has cut its energy consumption by 99.95%. Transaction speeds changed a small amount, but not enough for most users to notice.

Top Ethereum stocks

Top Ethereum stocks

Here are the best stocks and ETFs to buy if you want to add Ethereum to your portfolio:

1. Grayscale Ethereum Mini Trust

The Grayscale Ethereum Mini Trust (ETH -18.21%) is a fund that invests exclusively in Ether. It was spun off from the Grayscale Ethereum Trust (ETHE -18.21%) and designed to be a low-cost version of that fund, which charges an expensive annual management fee of 2.50%.

In comparison, the Grayscale Ethereum Mini Trust is a bargain with just a 0.15% annual fee. That also makes it one of the most affordable Ethereum ETFs.

2. Bitwise Ethereum Fund

Bitwise is the world's biggest crypto index fund manager. It offers managed funds for multiple types of cryptocurrency, and one option is the Bitwise Ethereum Fund (ETHW -18.2%).

This fund also invests solely in Ether, which is held offline in cold crypto storage for maximum security. It has a 0.20% annual fee, and Bitwise donates 10% of the fund's profits to Ethereum open-source development.

3. Coinbase

Coinbase (COIN -2.72%) is the largest cryptocurrency exchange in the U.S. The company charges transaction fees to buyers and sellers of a wide range of cryptocurrencies, including Ethereum. In addition to Ethereum, many other cryptocurrencies traded on Coinbase use the Ethereum blockchain.

The exchange rolled out Ethereum staking in 2021, allowing investors to lock up their Ether and earn rewards on it during the upgrade to a proof-of-stake system. Coinbase's staking program has since become a significant revenue driver. In the third quarter of 2024, it made $154.8 million from blockchain rewards, 13.7% of its total net revenue.

4. iShares Ethereum Trust ETF

The iShares Ethereum Trust ETF (ETHA -18.19%) is another of the several Ethereum ETFs that launched in 2024. Ether is its only holding, and it has an affordable expense ratio of 0.25%.

5. Robinhood Markets

Robinhood Markets (HOOD -0.73%) may be best known as the discount broker that ushered in the age of commission-free trading. That's not the only way it has been ahead of the game. In 2018, it began offering crypto trading of Bitcoin and Ethereum.

The broker has since expanded its selection to include more than 40 cryptocurrencies, including Solana (SOL 0.3%) and Cardano (ADA). Although Robinhood isn't a pure cryptocurrency play, it does offer some exposure to Ethereum.

How to invest

How to invest in Ethereum

If you want to invest directly in Ethereum, you can buy it through a crypto exchange, a stockbroker, or even a payment app that carries it. Since Ethereum is one of the largest cryptocurrencies by market cap, it's available on almost all platforms that sell crypto.

Here are the different types of platforms you can use to buy Ethereum:

- Cryptocurrency exchanges: The exchanges let users buy, sell, and trade cryptocurrencies. Examples of popular crypto exchanges include Coinbase and Gemini.

- Stock brokers: Some stockbrokers have started selling select cryptocurrencies, with Robinhood being the most prominent example.

- Payment apps: You can buy and sell crypto, including Ethereum, on PayPal (PYPL -0.09%) and Venmo, which is owned by PayPal.

Serious crypto investors have traditionally preferred crypto exchanges. These offer the widest selection of cryptocurrencies and have the most features.

However, crypto exchanges don't have as much of an advantage as they did in the past. Some stockbrokers now provide access to a large number of cryptos and let you transfer your holdings to your own blockchain wallet, making them just as good as exchanges for investing in Ethereum.

Related investing topics:

Should you invest in Ethereum?

Ethereum technology is at the core of most blockchain applications. Many believe blockchain will play a significant role in the future of finance and other industries, making exposure to Ethereum technology a potentially profitable addition to your investment portfolio.

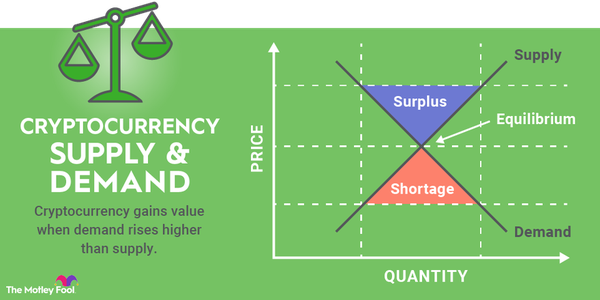

The value of Ether as a digital currency is much more volatile and unpredictable than the growth of Ethereum technology. You can mitigate some of that risk and should take steps to guard against hacking, but ultimately, the value of any investment directly linked to Ether is likely to fluctuate.

FAQ

Ethereum FAQ

What is Ethereum?

Ethereum is a blockchain technology in the form of software. As an open-source technology, it is available to any developer building an application that can benefit from the blockchain method of validation. While Ethereum is mostly associated with Ether and other cryptocurrencies, the Ethereum technology is enabling widespread innovation in industries as diverse as insurance, logistics, and healthcare.

What are the best Ethereum stocks?

The following is a list of the best stocks to buy if you want to add Ether or Ethereum exposure to your portfolio:

- Grayscale Ethereum Mini Trust.

- Bitwise Ethereum Fund.

- Coinbase.

- iShares Ethereum Trust ETF.

- Robinhood.

How do I invest in cryptocurrency?

You can invest in cryptocurrency through a crypto exchange, such as Coinbase or Gemini. These generally have the largest crypto selection and the most features. Some stockbrokers also allow clients to buy and sell cryptocurrency, and investing in companies that are involved with the crypto market is another option.