Funeral Contract Template Form

What makes the funeral contract template legally valid?

Because the society takes a step away from in-office working conditions, the completion of documents more and more happens electronically. The funeral contract pdf isn’t an exception. Dealing with it utilizing digital means differs from doing so in the physical world.

An eDocument can be considered legally binding provided that specific requirements are fulfilled. They are especially crucial when it comes to stipulations and signatures related to them. Typing in your initials or full name alone will not guarantee that the institution requesting the form or a court would consider it accomplished. You need a reliable tool, like airSlate SignNow that provides a signer with a digital certificate. In addition to that, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - main legal frameworks for eSignatures.

How to protect your funeral contract sample when filling out it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make document execution legitimate and safe. It also offers a lot of possibilities for smooth completion security wise. Let's quickly run through them so that you can be assured that your funeral service contract sample philippines remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: key privacy standards in the USA and Europe.

- Two-factor authentication: adds an extra layer of security and validates other parties identities through additional means, like a Text message or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the data safely to the servers.

Completing the funeral home invoice sample with airSlate SignNow will give greater confidence that the output form will be legally binding and safeguarded.

Quick guide on how to complete funeral home invoice sample

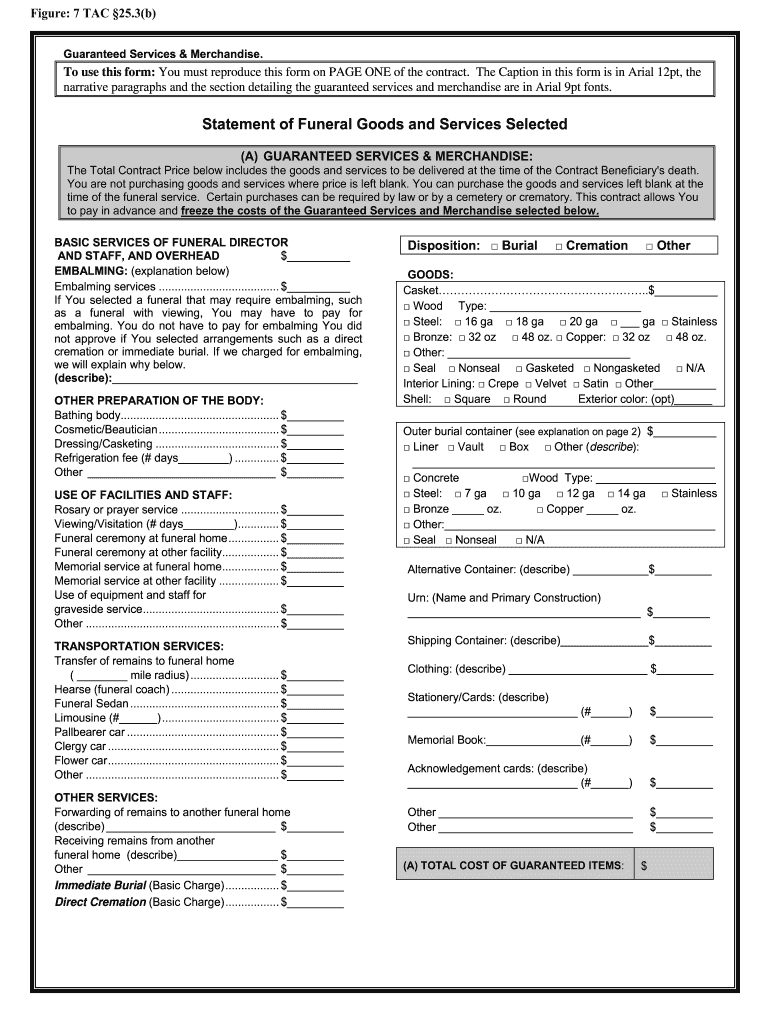

airSlate SignNow's web-based application is specially made to simplify the arrangement of workflow and enhance the entire process of competent document management. Use this step-by-step guideline to complete the STANDARD PRINTED STATEMENT OF FUNERAL GOODS AND ... — Mexico library UNT form quickly and with excellent accuracy.

Tips on how to complete the STANDARD PRINTED STATEMENT OF FUNERAL GOODS AND ... — Mexico library UNT form online:

- To begin the document, utilize the Fill camp; Sign Online button or tick the preview image of the form.

- The advanced tools of the editor will direct you through the editable PDF template.

- Enter your official identification and contact details.

- Utilize a check mark to indicate the answer where necessary.

- Double check all the fillable fields to ensure full accuracy.

- Use the Sign Tool to add and create your electronic signature to airSlate SignNow the STANDARD PRINTED STATEMENT OF FUNERAL GOODS AND ... — Mexico library UNT form.

- Press Done after you complete the blank.

- Now it is possible to print, download, or share the document.

- Follow the Support section or contact our Support staff in case you have any questions.

By utilizing airSlate SignNow's comprehensive service, you're able to complete any needed edits to STANDARD PRINTED STATEMENT OF FUNERAL GOODS AND ... — Mexico library UNT form, generate your personalized digital signature within a few quick steps, and streamline your workflow without the need of leaving your browser.

Create this form in 5 minutes or less

Video instructions and help with filling out and completing Funeral Contract Template Form

FAQs necrological service program pdf

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Related searches to funeral home invoice

Create this form in 5 minutes!

How to create an eSignature for the funeral home invoice template

How to generate an signature for your Standard Preened Statement Of Funeral Goods And Tex info Library UNT in the online mode

How to create an electronic signature for your Standard Preened Statement Of Funeral Goods And Tex info Library UNT in Google Chrome

How to generate an signature for putting it on the Standard Preened Statement Of Funeral Goods And Tex info Library UNT in Gmail

How to generate an signature for the Standard Preened Statement Of Funeral Goods And Tex info Library UNT from your smartphone

How to create an electronic signature for the Standard Preened Statement Of Funeral Goods And Tex info Library UNT on iOS

How to generate an electronic signature for the Standard Preened Statement Of Funeral Goods And Tex info Library UNT on Android

People also ask funeral invoice

-

What is a PRE need burial contract?

One way to plan in advance for the end of one's life is to sign a formal contract called a “preened funeral plan.” With this plan, money to pay for a funeral and/or burial is held in a trust, in an escrow account or paid through an insurance policy on the life of the person desiring the plan.

-

What is an irrevocable burial contract?

A prepaid funeral contract is a legal agreement which says you will pay now (with money or securities) for funeral services that will be needed sometime in the future. ... A prepaid funeral contract may be revocable or irrevocable. Revocable means you may cancel the contract and get most of your money back.

-

Does Medicaid allow for funeral expenses?

Unfortunately, Medicare/Medicaid does not pay for cremation or funerals and burial expenses. There is good news, however. The Social Security program can make a payment funerals and burials, and Medicaid has qualifying rules which allow you to put aside your own money for funeral and burial insurance.

-

How do burial accounts work?

A burial fund is money set aside to pay for burial expenses. For example, this money can be in a bank account, other financial instrument, or a prepaid burial arrangement. Some States allow an individual to prepay for their burial by contracting with a funeral home and paying in advance for their funeral.

-

What is a burial contract?

A prepaid (or preened) burial contract is an agreement whereby the buyer pays in advance for a burial that the seller agrees to furnish upon the death of the buyer or other designated individual.

Get more for funeral home funeral contract sample

Find out other funeral purchase agreement form

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF