Bank’s products and services

- 2. The different products in a bank can be broadly classified into: Retail Banking Trade Finance Treasury Operations

- 4. Deposits Loans, Cash Credit and Overdraft Negotiating for Loans Remittances Book-Keeping

- 5. Issuing and confirming of letter of credit. Drawing, accepting, discounting, buying, selling, collecting of bills of exchange, promissory notes, drafts, bill of lading and other securities.

- 6. Buying and selling of bullion. Acquiring, holding, underwriting and dealing in shares & debentures

- 7. The banks can also act as an agent of the Government or local authority. They insure, guarantee, underwrite, participate in managing and carrying out issue of shares, debentures, etc.

- 9. Credit Card: Credit Card is “post paid” or “pay later” card that draws from a credit line-money made available by the card issuer (bank) and gives one a grace period to pay. If the amount is not paid full by the end of the period, one is charged interest

- 10. Debit Cards: Debit Card is a “prepaid” or “pay now” card with some stored value. Debit Cards quickly debit or subtract money from one’s savings account, or if one were taking out cash.

- 12. Automatic Teller Machine: The ATM’s are used by banks for making the customers dealing easier It allows the customers: • To transfer money to and from accounts. • To view account information. • To order cash. • To receive cash.

- 13. Electronic Funds Transfer (EFT):. It automatically transfers money from one account to another. Telebanking: Telebanking refers to banking on phone services.

- 14. Mobile Banking: A new revolution in the realm of e- banking is the emergence of mobile banking. On-line banking is now moving to the mobile world, giving everybody with a mobile phone access to real-time banking services, regardless of their location.

- 15. Internet Banking: Internet banking involves use of internet for delivery of banking products and services.

- 16. Reduce the transaction costs of offering several banking services and diminishes the need for longer numbers of expensive brick and mortar branches and staff. Increase convenience for customers, since they can conduct many banking transaction 24 hours a day.

- 17. Increase customer loyalty. Improve customer access. Attract new customers. Easy online application for all accounts, including personal loans and mortgages.

- 18. Banking covers many services, these basic services have always been recognized as the hallmark of the genuine banker. These are… The receipt of the customer’s deposits The collection of cheques drawn on other banks The payment of the customer’s cheques drawn on himself

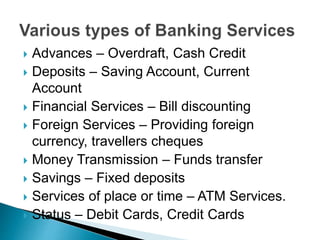

- 19. Advances – Overdraft, Cash Credit Deposits – Saving Account, Current Account Financial Services – Bill discounting Foreign Services – Providing foreign currency, travellers cheques Money Transmission – Funds transfer Savings – Fixed deposits Services of place or time – ATM Services. Status – Debit Cards, Credit Cards

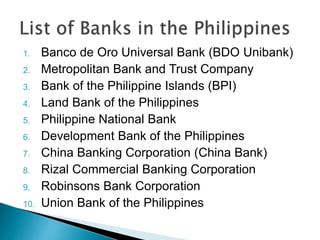

- 20. 1. Banco de Oro Universal Bank (BDO Unibank) 2. Metropolitan Bank and Trust Company 3. Bank of the Philippine Islands (BPI) 4. Land Bank of the Philippines 5. Philippine National Bank 6. Development Bank of the Philippines 7. China Banking Corporation (China Bank) 8. Rizal Commercial Banking Corporation 9. Robinsons Bank Corporation 10. Union Bank of the Philippines

- 21. 11. Security Bank Corporation 12. Citibank, N.A. 13. United Coconut Planters Bank 14. Hongkong and Shanghai Banking Corporation 15. East West Bank 16. Philtrust Bank (Philippine Trust Company) 17. Bank of Commerce 18. Standard Chartered Bank 19. Asia United Bank 20. Deutsche Bank AG

- 22. 21. Maybank 22. Philippine Bank of Communications 23. Philippine Veterans Bank 24. Australia and New Zealand Banking Group 25. The Bank of Tokyo-Mitsubishi UFJ, Ltd. 26. JPMorgan Chase 27. ING Group 28. Mizuho Corporate Bank 29. CTBC Bank 30. Bank of America, N.A