Learning & Development Strategy in Banking Industry

- 1. Learning & Development Strategy for Banking Industry

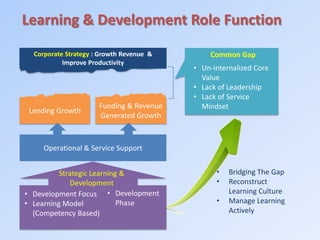

- 2. Corporate Strategy : Growth Revenue & Improve Productivity Lending Growth Funding & Revenue Generated Growth Operational & Service Support Strategic Learning & Development • Development Focus • Learning Model (Competency Based) Common Gap • Un-internalized Core Value • Lack of Leadership • Lack of Service Mindset Learning & Development Role Function • Development Phase • Bridging The Gap • Reconstruct Learning Culture • Manage Learning Actively

- 3. Skill Knowledge Motivation Training & Development Program Human Resouce Capability Enhanced Business Growth Motivation Knowledge, Skills, Confidence

- 4. Learning & Development Focus Learning & Development Focus Professional Lending Skill & Knowledge Service Mindset & Skill Technology & Operation Personal & Team Development Professional Funding Skill & Knowledge Learning Culture Development

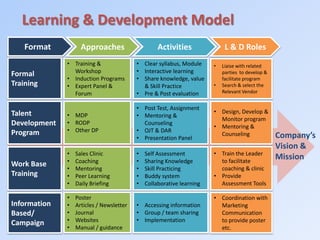

- 5. Learning & Development Model Work Base Training Formal Training Talent Development Program Information Based/ Campaign • Sales Clinic • Coaching • Mentoring • Peer Learning • Daily Briefing • Training & Workshop • Induction Programs • Expert Panel & Forum • MDP • RODP • Other DP • Poster • Articles / Newsletter • Journal • Websites • Manual / guidance • Self Assessment • Sharing Knowledge • Skill Practicing • Buddy system • Collaborative learning • Clear syllabus, Module • Interactive learning • Share knowledge, value & Skill Practice • Pre & Post evaluation • Post Test, Assignment • Mentoring & Counseling • OJT & DAR • Presentation Panel • Accessing information • Group / team sharing • Implementation Format Approaches Activities L & D Roles • Liaise with related parties to develop & facilitate program • Search & select the Relevant Vendor • Design, Develop & Monitor program • Mentoring & Counseling • Train the Leader to facilitate coaching & clinic • Provide Assessment Tools • Coordination with Marketing Communication to provide poster etc. Company’s Vision & Mission

- 6. Learning & Development Phase Define •Company Objectives •Gap Analysis •Training Need Analysis Design • Syllabus & Module • Training Road Map • Evaluation & Tracking Tools Implement & Reinforce • Management Commitment • Leader Involvement • Manage Actively Evaluate •Program effectiveness •Impact to Performance Adjust •Approach • Activity • Follow Up

- 7. Stakeholders’ Business Plan Process Person Involved Training Needs Analysis Program Designing Previous Training Evaluation Stakeholders’ Meeting: Recruitment Plan, Material Needs, Freq and Place Creating Annually Training Plan Material Reinforcement and Finalization Program Implementation Training Execution Training Evaluation Post Program Monitoring Refreshment and Revitalization Training Review Training Impact to Business Training Team Business Head Support & Product Head Training Team Training Team L & D Division/Department Leader Staff Training Team Division/Department Leader Staff Training Development Flow

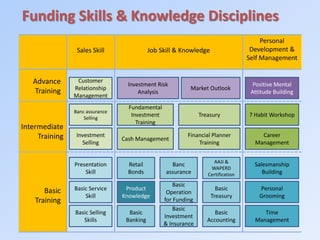

- 8. Funding Skills & Knowledge Disciplines Basic Training Intermediate Training Advance Training Sales Skill Job Skill & Knowledge Personal Development & Self Management Basic Banking Basic Accounting Basic Investment & Insurance AAJI & WAPERD Certification Basic Treasury Banc assurance Basic Operation for Funding Cash Management Basic Selling Skills Investment Selling Banc assurance Selling Product Knowledge Financial Planner Training Investment Risk Analysis Market Outlook Career Management Basic Service Skill 7 Habit Workshop Fundamental Investment Training Time Management Personal Grooming Customer Relationship Management Positive Mental Attitude Building Presentation Skill Salesmanship Building Retail Bonds Treasury

- 9. Lending Skills & Knowledge Disciplines Basic Training Intermediate Training Advance Training Sales Skill Job Skill & Knowledge Personal Development & Self Management Basic Banking Basic Accounting Credit Analysis Asset Conversion Lending Basic Legal for Lending Credit Proposal Workshop Credit Admin & Control Intermediate Financial Analysis (Brown) Basic Selling Skills Pipeline Management Negotiation Skill Product Knowledge Special Asset Management Basic Financial Analysis Loan Structuring Risk Analysis & Mitigation Career Management Basic Service Skill 7 Habit WorkshopCash Flow Analysis Credit Risk Management Customer Relationship Management Positive Mental Attitude Building Presentation Skill Time Management Personal Grooming Salesmanship Building

- 10. Service Skills Disciplines Basic Training Intermediate Training Advance Training Service Skill Job Skill & Knowledge Personal Development & Self Management General Customer Service Training Providing Service Excellence Improving Quality of Service for Call Center Telephone Courtesy Negotiation Skills Handling Objection & Complain Workshop Service Training for Back Office Managing Service Excellence Managing Customer Loyalty Workforce Excellence Effective Communication Service Mindset Personal Grooming Service Leadership Service Culture Development Service Boot Camp Basic Training for Call Center

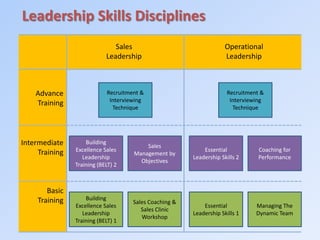

- 11. Leadership Skills Disciplines Basic Training Intermediate Training Advance Training Sales Leadership Operational Leadership Building Excellence Sales Leadership Training (BELT) 1 Sales Coaching & Sales Clinic Workshop Sales Management by Objectives Recruitment & Interviewing Technique Building Excellence Sales Leadership Training (BELT) 2 Essential Leadership Skills 1 Managing The Dynamic Team Essential Leadership Skills 2 Coaching for Performance Recruitment & Interviewing Technique

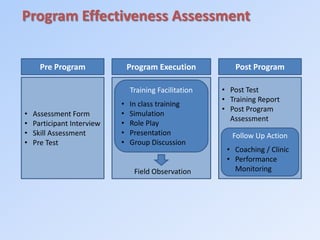

- 12. Program Effectiveness Assessment Pre Program Program Execution Post Program • Assessment Form • Participant Interview • Skill Assessment • Pre Test Training Facilitation • In class training • Simulation • Role Play • Presentation • Group Discussion Field Observation • Post Test • Training Report • Post Program Assessment Follow Up Action • Coaching / Clinic • Performance Monitoring