RBI Project

- 1. 1 The Reserve Bank: Tradition and Change The origin of the Reserve Bank can be traced to 1926, when the Royal Commission on Indian Currency and Finance—also known as the Hilton-Young Commission— recommended the creation of a central bank to separate the control of currency and credit from the government and to augment banking facilities throughout the country. The Reserve Bank of India was established on April 1, 1935 in accordance with the provisions of the Reserve Bank of India Act 1934. Since then, the Reserve Bank‘s role and functions have undergone numerous changes—as the nature of the Indian economy has changed. The Central Office of the Reserve Bank was initially established in Calcutta but was permanently moved to Mumbai in 1937. The Central Office is where the Governor sits and where policies are formulated. Though originally privately owned, since nationalisation in 1949, the Reserve Bank is fully owned by the Government of India. Today‘s RBI bears some resemblance to the original institution, although our mission has expanded along with our deepened, broadened and increasingly globalised economy.

- 2. 2 Preamble The Preamble of the Reserve Bank of India describes the basic functions of the Reserve Bank as: "...to regulate the issue of Bank Notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage."

- 3. 3 The RBI Logo The selection of the Bank‘s common seal to be used as the emblem of the Bank on currency notes, cheques and publications, was an issue that had to be taken up at an early stage of the Bank‘s formation. The Goverment‘s general ideas on the seal were as follows: 1. The seal should emphasize the Governmental status of the Bank, but not too closely; 2. It should have something Indian in the design; 3. It should be simple, artistic and heraldically correct; and 4. The design should be such that it could be used without substantial alteration for letter heading, etc. For this purpose, various seals, medals and coins were examined. The East India Company Double Mohur, with the sketch of the Lion and Palm Tree, was found most suitable; however, it was decided to replace the lion by the tiger, the latter being regarded as the more characteristic animal of India! To meet the immediate requirements in connection with the stamping of the Bank‘s share certificates, the work was entrusted to a Madras firm. The Board, at its meeting on

- 4. 4 February 23, 1935, approved the design of the seal but desired improvement of the animal‘s appearance. Unfortunately it was not possible to make any major changes at that stage. But the Deputy Governor, Sir James Taylor, did not rest content with this. He took keen interest in getting fresh sketches prepared by the Government of India Mint and the Security Printing Press, Nasik. As a basis for good design, he arranged for a photograph to be taken of the statue of the tiger on the entrance gate at Belvedere, Calcutta. Something or the other went wrong with the sketches so that Sir James, writing in September I938, was led to remark: ......‘s tree is all right but his tiger looks too like some species of dog, and I am afraid that a design of a dog and a tree would arouse derision among the irreverent. .....‘s tiger is distinctly good but the tree has spoiled it. The stem is too long and the branches too spidery, but I should have thought that by putting a firm line under the feet of his tiger and making his tree stronger and lower we could get quite a good result from his design. Later, with further efforts, it was possible to have better proofs prepared by the Security Printing Press, Nasik. However, it was eventually decided not to make any change in the existing seal of the Bank, and the new sketches came to be used as an emblem for the Bank‘s currency notes, letter-heads, cheques and publications issued by the Bank. Source: „History of the Reserve Bank of India‟

- 5. 5 Objectives and Reasons for the Establishment of R.B.I. The main objectives for establishment of RBI as the central Bank of India were as follows:- To manage the monetary and credit system of the country. To stabilizes internal and external value of rupee. For balanced and systematic development of banking in the country. For the development of organized money market in the country. For proper arrangement of agriculture finance. For proper arrangement of industrial finance. For proper management of public debts.

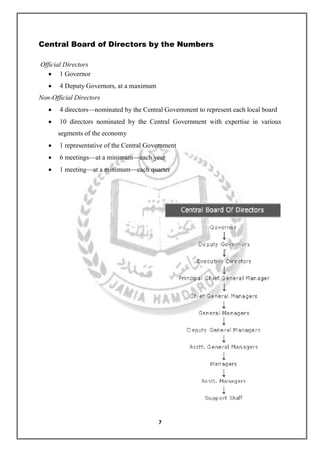

- 6. 6 Structure, Organization and Governance: How We Function The Reserve Bank is wholly owned by the Government of India. The Central Board of Directors oversees the Reserve Bank‘s business. About the Central Board The Central Board has primary authority for the oversight of the Reserve Bank. It delegates specific functions to its committees and sub-committees. Central Board: Includes the Governor, Deputy Governors and the nominated Directors and a government nominee-Director Committee of Central Board: Oversees the current business of the central bank and typically meets every week, on Wednesdays. The agenda focusses on current business, including approval of the weekly statement of accounts related to the Issue and Banking Departments. Board for Financial Supervision: Regulates and supervises commercial banks, Non-Banking Finance Companies (NBFCs), development finance institutions, urban co-operative banks and primary dealers. Board for Payment and Settlement Systems: Regulates and supervises the payment and settlement systems. Sub-committees of the Central Board: Includes those on Inspection and Audit; Staff; and Building. Focus of each subcommittee is on specific areas of operations. Local Boards: In Chennai, Kolkata, Mumbai and New Delhi, representing the country‘s four regions. Local board members, appointed by the Central Government for four-year terms, represent regional and economic interests and the interests of co-operative and indigenous banks.

- 7. 7 Central Board of Directors by the Numbers Official Directors 1 Governor 4 Deputy Governors, at a maximum Non-Official Directors 4 directors—nominated by the Central Government to represent each local board 10 directors nominated by the Central Government with expertise in various segments of the economy 1 representative of the Central Government 6 meetings—at a minimum—each year 1 meeting—at a minimum—each quarter

- 8. 8 SECRETARY'S DEPARTMENT Names and addresses of the Directors of the Central Board of the Reserve Bank of India 1. Dr. D Subbarao Governor Reserve Bank of India Central Office Mumbai 400 001. 2. Smt. Shyamala Gopinath Deputy Governor Reserve Bank of India Central Office Mumbai 400 001. 3. Dr.K.C.Chakrabarty Deputy Governor Reserve Bank of India Central Office Mumbai 400 001. 4. Dr. Subir Gokarn Deputy Governor Reserve Bank of India Central Office Mumbai 400 001. 5. Shri Anand Sinha Deputy Governor Reserve Bank of India Central Office Mumbai 400 001 6. Shri Y.H. Malegam Chartered Accountant C/o S. B. Billimoria & Company Meher Chambers (2nd floor) R. Kamani Road, Ballard Estate Mumbai 400 001 * 7. Prof. Suresh D. Tendulkar Economist, AD-86-C, Shalimar Bagh, New Delhi – 110 088 * 8. Prof. U. R. Rao Chairman, Physical Research Laboratory Department of Space, Government of India Antariksh Bhavan, New BEL Road Bangalore – 560 094 * 9. Shri Lakshmi Chand IAS (Retd.), C-12, Sector 14 NOIDA, Gautham Budh Nagar Uttar Pradesh * 10. Shri H. P. Ranina Advocate, Supreme Court of India, 506, Raheja Centre, 214 Backbay Reclamation, Free Press Journal Road, Mumbai - 400 023 @

- 9. 9 11. Shri Azim Premji Chairman, WIPRO Limited Doddakannelli, Sarjapur Road, Bangalore – 560033 @ 12. Shri Kumar Mangalam Birla Chairman, Aditya Birla Group of Companies Aditya Birla Centre, S. K. Ahire Marg, Worli Mumbai – 400 030 @ 13. Smt. Shashi Rajagopalan Plot No. 10, Saket Phase 2 Kapra, ECIL Post Hyderabad – 500 062 @ 14. Shri Suresh Neotia B-32, Greater Kailash Part - I New Delhi – 110 048 @ 15. Dr. A. Vaidyanathan B-1, Sonali Apartment, Old No. 11 Beach Road, Kalakshetra Colony Chennai – 600 090 @ 16. Prof. Man Mohan Sharma 2/3 Jaswant Baug (Runwal Park), Behind Akbarallys, Chembur Naka Mumbai – 400 071 @ 17. Shri Sanjay Labroo Managing Director & CEO Asahi India Glass Ltd. Global Business Park Tower - B, 5th Floor' Mehrauli - Gurgaon Road Gurgaon - 122002 (Haryana) @ 18. Shri Ashok Chawla Finance Secretary Government of India Ministry of Finance New Delhi 110001 # * Directors nominated under Sect 8 (1) (b) of the RBI Act, 1934. @ Directors nominated under Sect 8 (1) (c) of the RBI Act, 1934. # Director nominated under Sect 8 (1) (d) of the RBI Act, 1934

- 10. 10 Names and Addresses of the Members of The Local Boards of The Reserve Bank of India WESTERN AREA EASTERN AREA 1. Shri Y.H. Malegam Chartered Accountant c/o S.B.Billimoria & Company Meher Chambers (2nd floor) R. Kamani Road, Ballard Estate Mumbai 400 001 1. Shri Suresh D. Tendulkar Economist, AD-86-C, Shalimar Bagh, New Delhi – 110 088 2. Shri K. Venkatesan 113, F-Block Anna Nagar East Chennai 600 040 2. Shri A. K. Saikia, Retd. IAS H-8, Sector - 27 Noida - 201 301 3. Shri Dattaraj V. Salgaocar Managing Director V. M. Salgaocar & Bro. Ltd. Hira Bihar, Airport Road, Chicalim Vasco Da Gama, Goa - 403 711 3. Shri Sovan Kanungo, Retd. IAS 17/404, East End Apartments Mayur Vihar I ( Extension ) New Delhi -110096 4. Shri Jayantilal B. Patel Chairman Sahakari Khand Udyog Mandal Ltd. At & Post, Gandevi Sugar Factory Taluka Gandevi, District Navsari, Via Billimora Gujarat PIN-396 360 As on Dated November 3, 2010, Mumbai

- 11. 11 NORTHERN AREA SOUTHERN AREA 1. Prof. U. R. Rao Chairman, Physical Research Laboratory, Department of Space, Antariksh Bhawan, New BEL Road Bangalore – 560094 1. Shri Lakshmi Chand Retd. IAS, C-12, Sector – 14, Noida, U. P. 201301 2. Dr. Ram Nath Ex-Professor & Vice Chancellor CSA University of Agri. & Tech. Plot No. 710, 'A' Block, Avas Vikas Colony, Hanspur, Naubasta, Kanpur - 208 001 2. Shri C. P. Nair Retd. Chief Secretaray to Government of Kerala Narayaneeyam, Jawahar Nagar Thiruvananthapuram - 695 041 3. Dr. Pritam Singh Director, Management Development Institute Mehrauli Road, Sukhrali Gurgaon - 122 001 3. Dr. M. Govinda Rao Director National Institute of Public Finance and Policy 18/2, Satsang Vihar Marg Special Institutional Area (Near JNU) New Delhi 110 067 4. Shri Kamal Kishore Gupta Chartered Accountant Kamal & Co. 1372, Kashmere Gate Delhi 110006 4. Smt. Devaki Jain, Tharangavana, D-5, 12th Cross, RMV Extension, Bangalore 560080 5. Shri Mihir Kumar Moitra H-205, Wembley Estate Rosewood City Sector-49-50 Gurgaon-122001 As on Dated November 3, 2010, Mumbai

- 12. 12 Management and Structure The Governor is the Reserve Bank‘s chief executive. The Governor supervises and directs the affairs and business of the Reserve Bank. The management team also includes Deputy Governors and Executive Directors. Departments 1. Markets Monetary Policy Department Financial Markets Department Internal Debt Management Department Department of External Investments and Operations 2. Regulation and Supervision Department of Non-Banking Supervision Urban Banks Department Department of Banking Supervision Foreign Exchange Department Rural Planning and Credit Department 3. Research Department of Economic Analysis and Policy Department of Statistics and Information Management 4. Services Department of Government Bank Accounts Department of Currency Management Department of Payment and Settlement System Customer Service Department

- 13. 13 5. Support Premises Department Secretary‘s Department Rajbhasha Department Inspection Department Legal Department Department of Administration and Personnel Management Human Resources Development Department Department of Communication Department of Information Technology Department of Expenditure and Budgetary Control Department of Banking Operations and Development The RBI is composed of: 26 Departments: These focus on policy issues in the Reserve Bank‘s functional areas and internal operations. 26 Regional Offices and Branches: These are the Reserve Bank‘s operational arms and customer interfaces, headed by Regional Directors. Smaller branches / sub-offices are headed by a General Manager / Deputy General Manager. Training centers: The Reserve Bank Staff College at Chennai addresses the training needs of RBI officers; the College of Agricultural Banking at Pune trains staff of co-operative and commercial banks, including regional rural banks. The Zonal Training Centers, located at regional offices, train non-executive staff. Research institutes: RBI-funded institutions to advance training and research on banking issues, economic growth and banking technology, such as, National Institute of Bank Management (NIBM) at Pune, Indira Gandhi Institute of Development Research (IGIDR) at Mumbai, and Institute for Development and Research in Banking Technology (IDRBT) at Hyderabad.

- 14. 14 Subsidiaries: Fully-owned subsidiaries include National Housing Bank (NHB), Deposit Insurance and Credit Guarantee Corporation (DICGC), Bhartiya Reserve Bank Note Mudran Private Limited (BRBNMPL). The Reserve Bank also has a majority stake in the National Bank for Agriculture and Rural Development (NABARD).

- 15. 15 Main Activities of the RBI: What We Do The Reserve Bank is the umbrella network for numerous activities, all related to the nation‘s financial sector, encompassing an extending beyond the functions of a typical central bank. This section provides an overview of our primary activities: Monetary Authority Issuer of Currency Banker and Debt Manager to Government Banker to Banks Regulator of the Banking System Manager of Foreign Exchange Regulator and Supervisor of the Payment and Settlement Systems Developmental Role

- 16. 16 “The basic functions of the Reserve Bank of India are to regulate the issue of Bank notes and the keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage.” - From the Preamble of the Reserve Bank of India Act, 1934 Monetary Authority Monetary policy refers to the use of instruments under the control of the central bank to regulate the availability, cost and use of money and credit. The goal: achieving specific economic objectives, such as low and stable inflation and promoting growth. The main objectives of monetary policy in India are: Maintaining price stability Ensuring adequate flow of credit to the productive sectors of the economy to support economic growth Financial stability The relative emphasis among the objectives varies from time to time, depending on evolving macroeconomic developments. Our Approach Our operating framework is based on a multiple indicator approach. This means that we monitor and analyse the movement of a number of indicators including interest rates, inflation rate, money supply, credit, exchange rate, trade, capital flows and fiscal position, along with trends in output as we develop our policy perspectives.

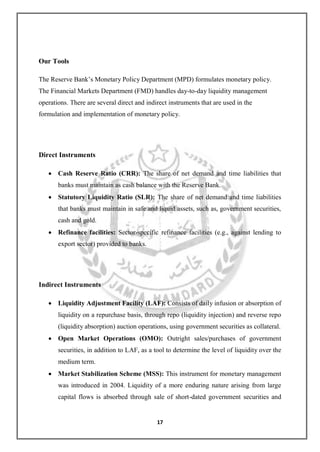

- 17. 17 Our Tools The Reserve Bank‘s Monetary Policy Department (MPD) formulates monetary policy. The Financial Markets Department (FMD) handles day-to-day liquidity management operations. There are several direct and indirect instruments that are used in the formulation and implementation of monetary policy. Direct Instruments Cash Reserve Ratio (CRR): The share of net demand and time liabilities that banks must maintain as cash balance with the Reserve Bank. Statutory Liquidity Ratio (SLR): The share of net demand and time liabilities that banks must maintain in safe and liquid assets, such as, government securities, cash and gold. Refinance facilities: Sector-specific refinance facilities (e.g., against lending to export sector) provided to banks. Indirect Instruments Liquidity Adjustment Facility (LAF): Consists of daily infusion or absorption of liquidity on a repurchase basis, through repo (liquidity injection) and reverse repo (liquidity absorption) auction operations, using government securities as collateral. Open Market Operations (OMO): Outright sales/purchases of government securities, in addition to LAF, as a tool to determine the level of liquidity over the medium term. Market Stabilization Scheme (MSS): This instrument for monetary management was introduced in 2004. Liquidity of a more enduring nature arising from large capital flows is absorbed through sale of short-dated government securities and

- 18. 18 treasury bills. The mobilized cash is held in a separate government account with the Reserve Bank. Repo/reverse repo rate: These rates under the Liquidity Adjustment Facility (LAF) determine the corridor for short-term money market interest rates. In turn, this is expected to trigger movement in other segments of the financial market and the real economy. Bank rate: It is the rate at which the Reserve Bank is ready to buy or rediscount bills of exchange or other commercial papers. It also signals the medium-term stance of monetary policy.

- 19. 19 Issuer of Currency The Reserve Bank is the nation‘s sole note issuing authority. Along with the Government of India, we are responsible for the design and production and overall management of the nation‘s currency, with the goal of ensuring an adequate supply of clean and genuine notes. The Reserve Bank also makes sure there is an adequate supply of coins, produced by the government. In consultation with the government, we routinely address security issues and target ways to enhance security features to reduce the risk of counterfeiting or forgery. Approach The Department of Currency Management in Mumbai, in cooperation with the Issue Departments in the Reserve Bank‘s regional offices, oversees the production and manages the distribution of currency. Currency chests at more than 4,000 bank branches— typically commercial banks—contain adequate quantity of notes and coins so that currency is accessible to the public in all parts of the country. The Reserve Bank has the authority to issue notes up to value of Rupees Ten Thousand. Our Tools Four printing presses actively print notes: Dewas in Madhya Pradesh, Nasik in Maharashtra, Mysore in Karnataka, and Salboni in West Bengal. The presses in Madhya Pradesh and Maharashtra are owned by the Security Printing and Minting Corporation of India (SPMCIL), a wholly owned company of the Government of India. The presses in Karnataka and West Bengal are set up by BRBNMPL, a wholly owned subsidiary of the Reserve Bank. Coins are minted by the Government of India. RBI is the agent of the Government for distribution, issue and handling of coins. Four mints are in operation: Mumbai, Noida in Uttar Pradesh, Kolkata, and Hyderabad.

- 20. 20 RBI’s Anti-counterfeiting Measures Continual upgrades of bank note security features Public awareness campaigns to educate citizens to help prevent circulation of forged or counterfeit notes Installation of note sorting machines

- 21. 21 Banker and Debt Manager to Government Managing the government‘s banking transactions is a key RBI role. Like individuals, businesses and banks, governments need a banker to carry out their financial transactions in an efficient and effective manner, including the raising of resources from the public. As a banker to the central government, the Reserve Bank maintains its accounts, receives money into and makes payments out of these accounts and facilitates the transfer of government funds. We also act as the banker to those state governments that have entered into an agreement with us. The role as banker and debt manager to government includes several distinct functions: Undertaking banking transactions for the central and state governments to facilitate receipts and payments and maintaining their accounts. Managing the governments‘ domestic debt with the objective of raising the required amount of public debt in a cost-effective and timely manner. Developing the market for government securities to enable the government to raise debt at a reasonable cost, provide benchmarks for raising resources by other entities and facilitate transmission of monetary policy actions. Our Tools At the end of each day, our electronic system automatically consolidates all of the government‘s transactions to determine the net final position. If the balance in the government‘s account shows a negative position, we extend a short-term, interest-bearing advance, called a Ways and Means Advance—WMA—the limit or amount for which is set at the beginning of each financial year in April.

- 22. 22 The RBI’s Government Finance Operating Structure The Reserve Bank‘s Department of Government and Bank Accounts oversees governments‘ banking related activities. This department encompasses: Public accounts departments: manage the day-to-day aspects of our Government‘s banking operations. The Reserve Bank also appoints commercial banks as its agents and uses their branches for greater access to the government‘s customers. Public debt offices: provide depository services for government securities for institutions and service government loans. Central Accounts Section at Nagpur: consolidates the government‘s banking transactions. The Internal Debt Management Department based in Mumbai raises the government‘s domestic debt and regulates and develops the government securities market.

- 23. 23 Banker to Banks Like individual consumers, businesses and organisations of all kinds, banks need their own mechanism to transfer funds and settle inter-bank transactions—such as borrowing from and lending to other banks—and customer transactions. As the banker to banks, the Reserve Bank fulfills this role. In effect, all banks operating in the country have accounts with the Reserve Bank, just as individuals and businesses have accounts with their banks. As the banker to banks, we focus on: Enabling smooth, swift and seamless clearing and settlement of inter-bank obligations. Providing an efficient means of funds transfer for banks. Enabling banks to maintain their accounts with us for purpose of statutory reserve requirements and maintain transaction balances. Acting as lender of the last resort. Our Tools The Reserve Bank provides similar products and services for the nation‘s banks to what banks offer their own customers. Here‘s a look at how we help: Non-interest earning current accounts: Banks hold accounts with the Reserve Bank based on certain terms and conditions, such as maintenance of minimum balances. They can hold accounts at each of our regional offices. Banks draw on these accounts to settle their obligations arising from inter-bank settlement systems. Banks can electronically transfer payments to other banks from this account, using the Real Time Gross Settlement System (RTGS). Deposit Account Department: This department‘s computerized central monitoring system helps banks manage their funds position in real time to maintain the optimum balance between surplus and deficit centres. Remittance facilities: Banks and government departments can use these facilities to transfer funds.

- 24. 24 Lender of the last resort: The Reserve Bank provides liquidity to banks unable to raise short term liquid resources from the inter-bank market. Like other central banks, the Reserve Bank considers this a critical function because it protects the interests of depositors, which in turn, has a stabilizing impact on the financial system and on the economy as a whole. Loans and advances: The Reserve Bank provides short-term loans and advances to banks / financial institutions, when necessary, to facilitate lending for specified purposes.

- 25. 25 Regulator of the Banking System Banks are fundamental to the nation‘s financial system. The central bank has a critical role to play in ensuring the safety and soundness of the banking system—and in maintaining financial stability and public confidence in this system. As the regulator and supervisor of the banking system, the Reserve Bank protects the interests of depositors, ensures a framework for orderly development and conduct of banking operations conducive to customer interests and maintains overall financial stability through preventive and corrective measures. The Reserve Bank regulates and supervises the nation‘s financial system. Different departments of the Reserve Bank oversee the various entities that comprise India‘s financial infrastructure. We oversee: Commercial banks and all-India development financial institutions: Regulated by the Department of Banking Operations and Development, supervised by the Department of Banking Supervision Urban co-operative banks: Regulated and supervised by the Urban Banks Department Regional Rural Banks (RRB), District Central Cooperative Banks and State Co-operative Bank: Regulated by the Rural Planning and Credit Department and supervised by NABARD Non-Banking Financial Companies (NBFC): Regulated and supervised by the Department of Non-Banking Supervision Our Tools The Reserve Bank makes use of several supervisory tools: On-site inspections Off-site surveillance, making use of required reporting by the regulated entities Thematic inspections, scrutiny and periodic meetings

- 26. 26 The Board for Financial Supervision oversees the Reserve Bank‘s regulatory and supervisory responsibilities. The RBI’s Regulatory Role As the nation‘s financial regulator, the Reserve Bank handles a range of activities, including: Licensing Prescribing capital requirements Monitoring governance Setting prudential regulations to ensure solvency and liquidity of the banks Prescribing lending to certain priority sectors of the economy Regulating interest rates in specific areas Setting appropriate regulatory norms related to income recognition, asset classification, provisioning, investment valuation, exposure limits and the like Initiating new regulation

- 27. 27 Manager of Foreign Exchange With the transition to a market-based system for determining the external value of the Indian rupee, the foreign exchange market in India gained importance in the early reform period. In recent years, with increasing integration of the Indian economy with the global economy arising from greater trade and capital flows, the foreign exchange market has evolved as a key segment of the Indian financial market. The Reserve Bank plays a key role in the regulation and development of the foreign exchange market and assumes three broad roles relating to foreign exchange: Regulating transactions related to the external sector and facilitating the development of the foreign exchange market Ensuring smooth conduct and orderly conditions in the domestic foreign exchange market Managing the foreign currency assets and gold reserves of the country Our Tools The Reserve Bank is responsible for administration of the Foreign Exchange Management Act,1999 and regulates the market by issuing licences to banks and other select institutions to act as Authorised Dealers in foreign exchange. The Foreign Exchange Department (FED) is responsible for the regulation and development of the market. On a given day, the foreign exchange rate reflects the demand for and supply of foreign exchange arising from trade and capital transactions. The RBI‘s Financial Markets Department (FMD) participates in the foreign exchange market by undertaking sales / purchases of foreign currency to ease volatility in periods of excess demand for/supply of foreign currency. The Department of External Investments and Operations (DEIO) invests the country‘s foreign exchange reserves built up by purchase of foreign currency from the market. In investing its foreign assets, the Reserve Bank is guided by three principles: safety, liquidity and return.

- 28. 28 Regulator and Supervisor of Payment and Settlement Systems Payment and settlement systems play an important role in improving overall economic efficiency. They consist of all the diverse arrangements that we use to systematically transfer money—currency, paper instruments such as cheques, and various electronic channels. Our Approach The Payment and Settlement Systems Act of 2007 (PSS Act) gives the Reserve Bank oversight authority, including regulation and supervision, for the payment and settlement systems in the country. In this role, we focus on the development and functioning of safe, secure and efficient payment and settlement mechanisms. Our Tools The Reserve Bank has a two-tiered structure. The first tier provides the basic framework for our payment systems. The second tier focuses on supervision of this framework. As part of the basic framework, the Reserve Bank‘s network of secure systems handles various types of payment and settlement activities. Most operate on the security platform of the Indian Financial NETwork (INFINET), using digital signatures for further security of transactions. Here is an overview of the various systems used: Retail payment systems: Facilitating cheque clearing, electronic funds transfer, through National Electronic Funds Transfer (NEFT), settlement of card payments and bulk payments, such as electronic clearing services. Operated through local clearing houses throughout the country. Large value systems: Facilitating settlement of inter-bank transactions from financial markets. These include: - Real Time Gross Settlement System (RTGS): for funds transfers - Securities Settlement System: for the government securities market - Foreign Exchange Clearing: for transactions involving foreign currency Department of Payment and Settlement Systems: The Reserve Bank‘s payment and settlement systems regulatory arm.

- 29. 29 Developmental Role This role is, perhaps, the most unheralded aspect of our activities, yet it remains among the most critical. This includes ensuring that credit is available to the productive sectors of the economy, establishing institutions designed to build the country‘s financial infrastructure, expanding access to affordable financial services and promoting financial education and literacy. Over the years, the Reserve Bank has added new institutions as the economy has evolved. Some of the institutions established by the RBI include: Deposit Insurance and Credit Guarantee Corporation (1962), to provide protection to bank depositors and guarantee cover to credit facilities extended to certain categories of small borrowers Unit Trust of India (1964), the first mutual fund of the country Industrial Development Bank of India (1964), a development finance institution for industry National Bank of Agriculture and Rural Development (1982), for promoting rural and agricultural credit Discount and Finance House of India (1988), a money market intermediary and a primary dealer in government securities National Housing Bank (1989), an apex financial institution for promoting and regulating housing finance Securities and Trading Corporation of India (1994), a primary dealer

- 30. 30 Our Tools The Reserve Bank continues its developmental role, while specifically focussing on financial inclusion. Key tools in this on-going effort include: Directed credit for lending to priority sector and weaker sections: The goal here is to facilitate/ enhance credit flow to employment intensive sectors such as agriculture, micro and small enterprises (MSE), as well as for affordable housing and education loans. Lead Bank Scheme: A commercial bank is designated as a lead bank in each district in the country and this bank is responsible for ensuring banking development in the district through coordinated efforts between banks and government officials. The Reserve Bank has assigned a Lead District Manager for each district who acts as a catalytic force for promoting financial inclusion and smooth working between government and banks. Sector specific refinance: The Reserve Bank makes available refinance to banks against their credit to the export sector. In exceptional circumstances, it can provide refinance against lending to other sectors.. Strengthening and supporting small local banks: This includes regional rural banks and cooperative banks Financial inclusion: Expanding access to finance and promoting financial literacy are a part of our outreach efforts.

- 31. 31 Other Functions of RBI Developmental / Promotional Functions of RBI Along with the routine traditional functions, central banks especially in the developing country like India have to perform numerous functions. These functions are country specific functions and can change according to the requirements of that country. The RBI has been performing as a promoter of the financial system since its inception. Some of the major development functions of the RBI are maintained below. 1. Development of the Financial System : The financial system comprises the financial institutions, financial markets and financial instruments. The sound and efficient financial system is a precondition of the rapid economic development of the nation. The RBI has encouraged establishment of main banking and non-banking institutions to cater to the credit requirements of diverse sectors of the economy. 2. Development of Agriculture: In an agrarian economy like ours, the RBI has to provide special attention for the credit need of agriculture and allied activities. It has successfully rendered service in this direction by increasing the flow of credit to this sector. It has earlier the Agriculture Refinance and Development Corporation (ARDC) to look after the credit, National Bank for Agriculture and Rural Development (NABARD) and Regional Rural Banks (RRBs). 3. Provision of Industrial Finance: Rapid industrial growth is the key to faster economic development. In this regard, the adequate and timely availability of credit to small, medium and large industry is very significant. In this regard the RBI has always been instrumental in setting up special financial institutions such as ICICI Ltd. IDBI, SIDBI and EXIM BANK etc. 4. Provisions of Training: The RBI has always tried to provide essential training to the staff of the banking industry. The RBI has set up the bankers' training colleges at several places. National Institute of Bank Management i.e. NIBM, Bankers Staff College i.e. BSC and College of Agriculture Banking i.e. CAB are few to mention.

- 32. 32 5. Collection of Data: Being the apex monetary authority of the country, the RBI collects process and disseminates statistical data on several topics. It includes interest rate, inflation, savings and investments etc. This data proves to be quite useful for researchers and policy makers. 6. Publication of the Reports: The Reserve Bank has its separate publication division. This division collects and publishes data on several sectors of the economy. The reports and bulletins are regularly published by the RBI. It includes RBI weekly reports, RBI Annual Report, Report on Trend and Progress of Commercial Banks India., etc. This information is made available to the public also at cheaper rates. 7. Promotion of Banking Habits: As an apex organization, the RBI always tries to promote the banking habits in the country. It institutionalizes savings and takes measures for an expansion of the banking network. It has set up many institutions such as the Deposit Insurance Corporation-1962, UTI-1964, IDBI-1964, NABARD-1982, NHB-1988, etc. These organizations develop and promote banking habits among the people. During economic reforms it has taken many initiatives for encouraging and promoting banking in India. 8. Promotion of Export through Refinance: The RBI always tries to encourage the facilities for providing finance for foreign trade especially exports from India. The Export-Import Bank of India (EXIM Bank India) and the Export Credit Guarantee Corporation of India (ECGC) are supported by refinancing their lending for export purpose.

- 33. 33 Supervisory Functions of RBI The reserve bank also performs many supervisory functions. It has authority to regulate and administer the entire banking and financial system. Some of its supervisory functions are given below. 1. Granting license to banks: The RBI grants license to banks for carrying its business. License is also given for opening extension counters, new branches, even to close down existing branches. 2. Bank Inspection: The RBI grants license to banks working as per the directives and in a prudent manner without undue risk. In addition to this it can ask for periodical information from banks on various components of assets and liabilities. 3. Control over NBFIs: The Non-Bank Financial Institutions are not influenced by the working of a monitory policy. However RBI has a right to issue directives to the NBFIs from time to time regarding their functioning. Through periodic inspection, it can control the NBFIs. 4. Implementation of the Deposit Insurance Scheme: The RBI has set up the Deposit Insurance Guarantee Corporation in order to protect the deposits of small depositors. All bank deposits below Rs. One lakh are insured with this corporation. The RBI work to implement the Deposit Insurance Scheme in case of a bank failure. Reserve Bank of India's Credit Policy The Reserve Bank of India has a credit policy which aims at pursuing higher growth with price stability. Higher economic growth means to produce more quantity of goods and services in different sectors of an economy; Price stability however does not mean no change in the general price level but to control the inflation. The credit policy aims at increasing finance for the agriculture and industrial activities. When credit policy is implemented, the role of other commercial banks is very important. Commercial banks flow of credit to different sectors of the economy depends on the actual cost of credit and arability of funds in the economy.

- 34. 34 MONETARY POLICY OF THE RBI With the introduction of the Five year plans, the need for appropriate adjustment in monetary and fiscal policies to suit the pace and pattern of planned development became imperative. The monetary policy since 1952 emphasized the twin aims of the economic policy of the government: a) spread up economic development in the country to raise national income and standard of living, and b) To control and reduce inflationary pressure in the economy. This policy of RBI since the First plan period was termed broadly as one of controlled expansion, i.e; a policy of ―adequate financing of economic growth and at the same time the time ensuring reasonable price stability‖. Expansion of currency and credit was essential to meet the increased demand for investment funds in an economy like India which had embarked on rapid economic development. Accordingly, RBI helped the economy to expand via expansion of money and credit and attempted to check in rise in prices by the use of selective controls. RBI’s Anti-inflationary Monetary Policy since 1972.. Since 1972, the Indian economy has been working with considerable inflationary potential------ rapid increase in money with the public and with the banking system. There was also expansion of bank credit to finance trade and industry. RBI was forced to abandon ‗controlled expansion‘ and adopt the policy of credit restraint or tight monetary policy. RBI has generally followed this kind of monetary policy with varying degrees of success till today.

- 35. 35 AN EVALUATION OF THE MONETARY POLICY The objective of monetary policy was at one time characterized by RBI itself as ‗controlled expansion.‘ On the one hand, RBI was thinking steps such as the bill market scheme to expand bank credit to industry and trade and thus help in economic development. On the either hand, RBI was using both quantitative (general credit restraint) and selective credit controls so that the deployment of loans and advances by the commercial banks for speculative purposes was under control. There was necessary to keep the rising prices under check. Thus, the monetary policy had twin aims- expansion of the economy and control of inflationary pressure. Monetary policy RBI has certain inherent constraints and obviously limited in its usefulness. Finally, the weapons and the powers available to RBI are such that they cover only organized banking sector viz. commercial banks and cooperative banks. To the extent inflationary pressure is the result of bank finance, Reserve Banks general and selective controls will have positive effect. But if inflationary pressure is really brought about by deficit financing and shortage of goods, RBI‘s control may not have effect at all. This is what is probably happening in Indian in recent years. Besides, it should always be kept in mind that RBI has no power over non-banking financial institutions as well as indigenous bankers who play such major role in financing trade and industry.

- 36. 36 OBJECTIVES OF MONETARY POLICY:- 1. Price stability: The chakravarty committee argued that, in the context of planned economic development, monetary authorities should aim at ―price stability‖ in the broadest sense. Price stability here does not mean constant price level but it is consistent with an annual rise of 4% in the wholesale price index. To achieve this objective, the government should aim at raising output levels, while RBI should control the expansion in reserve money and the money supply. 2. Monetary targeting: Emphasizing the inter-relation between money, output and prices, the chakravarty committee has recommended the formation of a monetary policy based on monetary targeting. According to the committee, target for growth in money supply in a broad sense during a given year should be in terms of a range. a) based on anticipated growth in output, and b) in the light of the price situation. The target range should be announced in advance, the target for money supply should be reviewed in the course of the year to accommodate revisions, if any, in the anticipated growth in output and any change in the price situation 3. Change in the definition of budgetary deficit: Till now the budgetary deficit of the central government essentially took from increase in treasury bills outstanding. Not all the treasury bills were held by RBI but part of treasury bills were absorbed by the public. Since the present concept of budget deficit did not distinguish between the amounts held by RBI, it overstated the extent of monetary impact of fiscal operation. Accordingly, the chakravarty committee suggested a change in the definition of budgetary deficit, so that there could be clear distinction between revenue deficit, fiscal deficit and overall budgetary deficit.

- 37. 37 4. Interest rate policy: At present the interest rate structure is completely administered by the monetary authorities under the general direction of the government. According to the chakravarty committee, the present system of administered interest rates has become unduly complex and needs to be modified the committee has mentioned some of the important aspects of interest rate policy which need to be taken into account, while modifying the administered interest rate structure as for example increasing the pool of financial savings, providing a reasonable return on saving of small savers, reinforcing anti-inflationary policies the need to provide credit at concessional rate of interest to the priority sector and the profitability of banks , etc. Thus, the chakravarty committee envisaged a strong supportive role for interest rate policy in monetary regulating based on monetary targeting. 5. Restructuring of the money market in India: The committee envisage (predicted) an important role in treasury bill market, the call money market, the commercial bills market and the inter-corporate funds market in the allocation of short term resources, with minimum of cost and minimum of delay, further, according to the committee, a well-organized money market provided an efficient mechanism for the transmission of the monetary regulation to the rest of economy. Accordingly, the committee has recommended that RBI should take measures to develop an efficient

- 38. 38 RBI Repo rate or key short term lending rate When reference is made to the Indian interest rate this often refers to the repo rate, also called the key short term lending rate. If banks are short of funds they can borrow rupees from the Reserve Bank of India (RBI) at the repo rate, the interest rate with a 1 day maturity. If the central bank of India wants to put more money into circulation, then the RBI will lower the repo rate. The reverse repo rate is the interest rate that banks receive if they deposit money with the central bank. This reverse repo rate is always lower than the repo rate. Increases or decreases in the repo and reverse repo rate have an effect on the interest rate on banking products such as loans, mortgages and savings. RBI latest interest rate changes Change date Percentage January 25 2011 6.500 % November 02 2010 6.250 % September 16 2010 6.000 % July 27 2010 5.750 % July 02 2010 5.500 % April 20 2010 5.250 % march 19 2010 5.000 % April 21 2009 4.750 % march 05 2009 5.000 % January 05 2009 5.500 %

- 39. 39 Interest Rates based on 10 year Government Bond Yield

- 40. 40 Most recent CPI India (inflation figure) 9.303 % When we talk about the rate of inflation in India, this often refers to the rate of inflation based on the consumer price index, or CPI for short. The Indian CPI shows the change in prices of a standard package of goods and services which Indian households purchase for consumption. In order to measure inflation, an assessment is made of how much the CPI has risen in percentage terms over a give period compared to the CPI in a preceding period. If prices have fallen this is called deflation (negative inflation). CPI IN recent years Period Inflation January 2011 9.303 % January 2010 16.216 % January 2009 10.448 % January 2008 5.512 % January 2007 6.723 % January 2006 4.372 % January 2005 4.365 % January 2004 4.348 % January 2003 3.426 % January 2002 4.944 %

- 41. 41 Inflation Rate in India Money Multiplier in India

- 42. 42 Top 10 Gold Holders Inflation & Policy Rate For 2010

- 43. 43 RBI’s Inflation Benchmark Primary Article Inflation: Revision

- 44. 44 THE RESERVE BANK'S ACCOUNTS FOR 2009-10 The balance sheet of the Reserve Bank changed significantly during the course of the year, reflecting the impact of monetary and liquidity management operations undertaken by the Bank to manage the recovery in growth while containing inflation. Monetary policy measures affected through increases in the Cash Reserve Ratio (CRR) contributed to the expansion in the Bank's liabilities in the form of banks' deposits while notes in circulation continued to dominate the liability side. Foreign currency assets of the Bank continued to dominate on the asset side. As return on foreign assets tracked the near zero policy rates maintained by the central banks of the advanced economies, income on such assets declined significantly. In monetary operations, sustained period of large net absorption of liquidity through reverse repo also involved higher net interest outgo. Reflecting these, the Bank's gross income fell from `60,732 crore in 2008-09 to `32,884 crore in 2009-10. Gross expenditure of the Bank rose modestly from `8,218 crore to `8,403 crore. After meeting the needs of necessary transfer to the Contingency Reserve (CR) and the Asset Development Reserve (ADR), `18,759 crore was allocated for transferring to the Government. 1. The size of the Reserve Bank‘s balance sheet increased significantly in 2009-10 (July-June) in response to its policy actions and market operations. On the liability side, there was a high growth in notes in circulation, banks‘ deposits with the Reserve Bank due to the policy driven increases in CRR as well as deposit growth in the banking system and the Central Government‘s deposits with the Reserve Bank. The outstanding balances maintained by the Central Government under the Market Stabilization Scheme (MSS), however, declined. 2. On the asset side, there was significant increase in Bank‘s portfolio of domestic assets in the form of government securities parked by the banks with the Reserve Bank for availing funds under repo. Foreign currency assets declined largely due to valuation effect and use of a part of such assets for purchase of gold from the IMF.

- 45. 45 3. The Reserve Bank has continued to present its accounts covering the period July- June for the last 70 years. The financial statements of the Bank are prepared in accordance with the Reserve Bank of India Act, 1934 and the notifications issued there under and in the form prescribed by the Reserve Bank of India General Regulations, 1949. The Bank presents two balance sheets. The first one relating to the sole function of currency management is presented as the Balance Sheet of the Issue Department. The second one reflecting the impact of all other functions of the Bank is known as the Balance Sheet of the Banking Department. The key financial results of the Reserve Bank‘s operations during the year 2009-10 (July- June) are presented here. RBI’s Assets & Source of Income

- 46. 46 Research, Data and Knowledge-Sharing: How We Communicate The Reserve Bank has a rich tradition of generating sound economic research, data collection and knowledge-sharing. Our economic research focuses on study and analysis of domestic and international issues affecting the Indian economy. This is mainly done by the Department of Economic Analysis and Policy and the Department of Statistics and Information Management. This important work is designed to: Educate the public Provide reliable, data-driven information for policy and decision-making Supply accurate and timely data for academic research as well as the general public Communicating with the Public Our emphasis on communication involves a range of activities, all aimed at sharing knowledge about the financial arena. The Reserve Bank‘s web site (www.rbi.org.in) provides a full range of information about our activities, our publications, our history and our organization. The web site is updated regularly, with the most recent publications, speeches, press releases and circulars. Of note, relevant press releases and circulars are posted in 13 local languages.

- 47. 47 Customer Service: How Can We Help You? Our customer outreach policy is aimed at informing the public, so that they know what to expect, what choices they have and what rights and obligations they have in relation to banking services. Our customer service initiatives are designed to protect customers‘ rights, enhance the quality of customer service and strengthen the grievance redressal mechanism in the banking sector as a whole—and at the Reserve Bank itself. Our efforts include: Customer Service Department (CSD): Questions? Problems? Concerns? Communicate with this department ([email protected]) which was set up in 2006, based at the central office in Mumbai, to respond to system-level customer issues. Banking Codes and Standards Board of India: The Reserve Bank established this board to encourage transparency in lending and fair pricing. This will give customers more confidence in the system and encourage more usage of formal banking. (www.bcsbi.org.in) Banking Ombudsman: The Reserve Bank‘s quasi-judicial authority for resolving disputes between commercial banks, primary cooperative banks and regional rural banks and their customers. There is one Banking Ombudsman in virtually every state. (www.bankingombudsman.rbi.org.in)

- 48. 48 Build Your Future with RBI RBI provides one of the most intense training inputs and facilities at its own training establishments and outside. Incentives for self-development include scholarships to acquire higher qualifications, facility to pursue your own research, deputation to other institutions, participation in national and international level conferences and seminars and sabbatical. Benefits of working with RBI Working with RBI gives you a whole new perspective on various banking, economic and cultural dimensions. But that isn't where it ends: you also get to work with experienced, qualified people who've driven the country's economy for decades. Wider Canvas You get an opportunity to work on a wider canvas of operations, you are involved in formulation of policies having nationwide implications. You get a multi- disciplinary job content and an opportunity to contribute to nation building Team up with the Best You get to be a member of a team that shapes the financial policies. You work with the government and top level financial minds. You work with international organizations to contribute to thinking on global best practices Spearhead the Reforms You initiate and monitor reforms and changes in India's financial environment and manage an economy in transition. Your job offers the challenge of driving a nation on the move.

- 49. 49 Go Global You get an opportunity to interact with some of the brightest minds across sectors of economy and across the globe. You even negotiate treaties with multi lateral bodies or guide other emerging economies. In domestic seminars and conferences you represent your institution and internationally you represent your country. Touch the lives of millions Your everyday job can make a difference to a farmer, a small entrepreneur, an exporter, an industry, a financial entity, or even a common man. Do Research that Matters You do research that induces policy changes. You have information and data at your fingertips.

- 50. 50 Conclusion RBI is the apex banking institution in India. RBI is an autonomous body promoted by the government of India and is headquartered at Mumbai. The RBI plays a key role in the management of the treasury foreign exchange movements and is also the primary regulator for banking and non-banking financial institutions. The RBI operates a number of government mints that produce currency and coins. The RBI has been one of the most successful central banks around the world in preventing the effects of the subprime crisis to the Indian economy, particularly its banks. This adds a lot of credibility to every decision that is taken by them. Further, as a large proportion of the Indian population is impacted by inflation, it was necessary for the RBI to think about the majority and try to curb inflation by tightening its monetary stance. All the functions of RBI, monitory, non monitory, supervisory or promotional are equally significant in context of the Indian economy. Under the Banking Regulation Act, RBI has been given a wide range of powers. Under the supervision & inspection of RBI, the working of banks has greatly improved. RBI has been responsible for strong financial support to industrial & agricultural development in the country.

- 51. 51 BIBLOGRAPHY http://www.rbi.org.in http://www.scribd.com http://www.drnarendrajadhav.info/drnjadhav_web_files/Published%20papers/EPW%20BALANCE%20SHEET.pdf http://www.blurtit.com/ www.banknetindia.com www.company-profile.reportlinker.com www.allfreeessays.com http://www.authorstream.com