Understanding the interest cover ratio

- 1. Understanding the interest cover ratio from businessbankingcoach.com in association with

- 2. The interest cover ratio. What is that exactly?

- 3. This ratio measures the business’ ability to generate sufficient profit to meet its contractual interest payments.

- 4. The higher the number, the better able the business is to meet its interest obligations. A minimum ratio of 3 and, in tough economic times closer to 5, is often suggested. A higher ratio allows for a greater margin of safety for both the business and lenders of interest-bearing debt.

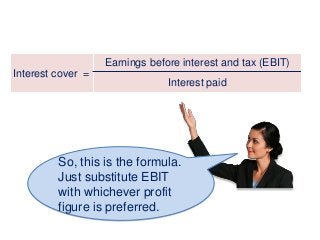

- 5. Which profit figure to use in the calculation is open to debate. Some analysts use net profit before taxation while some would argue that taxation has to be paid first and so the profit after tax figure should be used.

- 6. In both cases the profit figure would be adjusted by adding back any amount of interest paid that had already been deducted.

- 7. It’s very common for some analysts to use operating profit or EBIT (earnings before interest and tax) and it’s possible to take that one step further and exclude depreciation and amortisation from the expenses to arrive at a “cash” profit figure known as EBITDA.

- 8. Interest cover = Earnings before interest and tax (EBIT) Interest paid So, this is the formula. Just substitute EBIT with whichever profit figure is preferred.

- 9. The big problem with the ratio is that it’s looking back at the financial year (or whatever period is covered by the income statement) So it has limited usefulness

- 10. When we are considering a lending opportunity for a client we are looking to the future because that's where we get repaid from.

- 11. So, remembering that one of the drivers of the interest cover ratio is the interest rate (because it has a direct impact on the amount of interest the client will actually pay) it's sensible to think about what the interest rate could be for the client in the future.

- 12. Consider where the economy is in the interest rate cycle. The rate charged to the client is based on an underlying fluctuating rate such as a repo rate set by a central bank, rates that are set by the markets such as LIBOR, JIBAR or similar.

- 13. An increase or decrease in that fluctuating rate (which is usually driven by economic fundamentals and not an individual business’ risk profile) is going to affect the interest that a client has to pay in the future and so will affect the ratio in the future.

- 14. Where the client is using a facility under which the amount of the debt can vary depending on the client’s day-to-day funding needs (such as an overdraft facility), the second driver of interest paid by a client is the usage of that facility over the time period covered by the income statement.

- 15. If usage has been low, the amount of interest paid will have been low - nothing to do with the actual overdraft limit.

- 16. Now, if things turn difficult for the client and cash flow suffers, overdraft usage might increase and the amount of interest paid will increase, leading to a deterioration in the interest cover ratio.

- 17. How to get around this?

- 18. Firstly; re-calculate the interest cover ratio using the existing profit figure but adjust the interest paid figure by working a new interest amount based on an interest rate maybe 1%-2% higher than it is now and......

- 19. …secondly; calculate the amount of interest that would be payable if the total amount of the overdraft facility was utilised by the business. Then re-calculate the interest cover ratio.

- 20. If the re-calculated interest cover ratio still looks good after making those adjustments, then you should be okay at least for the next year, assuming that profit doesn’t fall.

- 21. We do hope that you enjoyed this presentation. For more commercial and business banking content, please visit our website at www.businessbankingcoach.com where you can subscribe to our blog, listen to our podcasts or view and download our other Slideshare presentations. If you have any questions about this presentation or any of our other content, please send us an email at [email protected]