Carbon credits

- 1. By: DIVINE KAUR CARBON CREDIT

- 2. Birth of Carbon Credit Concept of Carbon Credit Growth of Carbon Credit & India’s Position Concern for Chartered Accountants

- 3. The Major Concern… GLOBAL WARMING

- 4. Green house gases leading to Global Warming CO 2 Methane Nitrous Oxide Hydroflourocarbon Sulphur Hexaflouride Perflourocarbon CO 2 t-e…… one tonne of CO 2 equivalent

- 5. Birth of UNFCCC In 1992, Rio Brazil Objective… Green House Gases should be stabilized within a time frame.

- 6. The KYOTO PROTOCOL… An agreement signed in December 1997 in Kyoto, Japan

- 7. KYOTO PROTOCOL Annexure 1 Non Annexure 1 Developed Developing Under developed

- 8. The Kyoto Protocol…… Objective Reduction of Green House Gases emission by developed countries in the The First Commitment Period (2008-2012)

- 9. DID YOU KNOW???? WHY

- 10. Birth of Carbon Credit Concept of Carbon Credit Growth of Carbon Credit & India’s Position Concern for Chartered Accountants

- 11. What is Carbon Credit under the KYOTO Protocol… A credit for reducing 1 ton of CO 2 (Green House Gases) from the atmosphere

- 12. How to generate Carbon Credits??? CARBON CREDITS

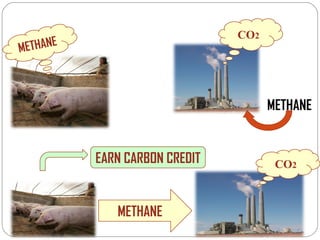

- 13. METHANE CO 2 METHANE CO 2 EARN CARBON CREDIT METHANE

- 14. USE OF CARBON CREDITS IN EMISSION REDUCTION

- 15. REDUCTION NATIONAL MEASURES ADDITIONAL MEASURES THE FLEXIBILITY MECHANISM

- 16. FLEXIBILITY MECHANISM Clean development Mechanism Joint implementation Emission trading Project based

- 17. Emission Trading Developed country A (needs CC) Developed country B Sell these carbon credits Payment for CC Earns carbon credits called Assigned Amount Units

- 18. Joint Implementation Developed country A (needs CC) Developed country B Sets a project Sell carbon credits Earns carbon credits called Emission Reduction Units

- 19. Clean Development Mechanism (CDM) Developed country (needs CC) Developing Country Sells carbon credits Sets a project Earns carbon credits called Certified Emission Reduction

- 20. Concept of VER’s VER Countries not committed to the protocol Voluntary Emission Reduction OR Verified Emission reduction

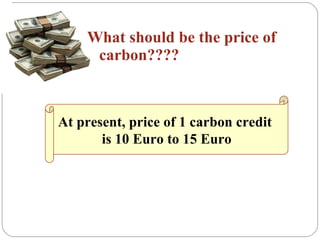

- 21. What should be the price of carbon???? At present, price of 1 carbon credit is 10 Euro to 15 Euro

- 22. Birth of Carbon Credit Growth of Carbon Credit & India’s Position Concern for Chartered Accountants Concept of Carbon Credit

- 23. Market for Carbon Trading…… Currently there are 5 Environmental Exchanges, trading in Carbon Credits POWER NEXT EUROPEAN CLIMATE EXCHANGE

- 24. India’s Stance in Carbon Credits

- 25. India along with China, lead countries in earning Carbon Credit

- 26. India pocketed Rs 1,500 crores in the year 2005 just by selling carbon credits to developed- country clients. India has generated 30 million Carbon credits & 140 million are in pipeline

- 27. Some of the Leading companies of India using & selling Carbon Credits… GUJARAT FLOUROCARBONS Ltd.

- 28. SRF… . The major beneficiary of reducing GHG gases

- 29. Birth of Carbon Credit Growth of Carbon Credit & India’s Position Concern for Chartered Accountants Concept of Carbon Credit

- 30. Concern for The Chartered Accountants ….

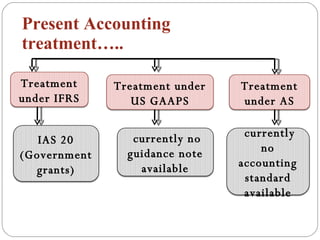

- 32. Present Accounting treatment….. Treatment under IFRS Treatment under US GAAPS Treatment under AS IAS 20 (Government grants) currently no guidance note available currently no accounting standard available

- 33. Tax Treatments Will there be any tax on Carbon Credits ?????? If there is income there will be tax…

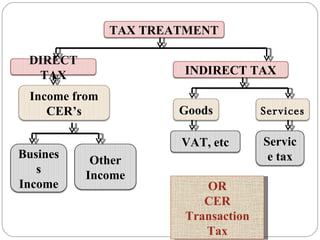

- 34. OR CER Transaction Tax TAX TREATMENT INDIRECT TAX DIRECT TAX Income from CER’s Other Income Business Income Goods Services VAT, etc Service tax

- 35. However, NO set Accounting or Tax Treatment has yet been decided

- 36. Scope for Chartered Accountants

- 37. Other opportunities….. As an auditor…. In audit of Carbon Trading As a Carbon Trading Consultant Carbon Trading Broker

- 38. Birth of Carbon Credit Growth of Carbon Credit & India’s Position Concern for Chartered Accountants Concept of Carbon Credit

- 39. What after 2012… End of Commitment Period??? NOT SUCCESSFUL THE COPENHAGEN CONFERENCE

- 40. Thank You……