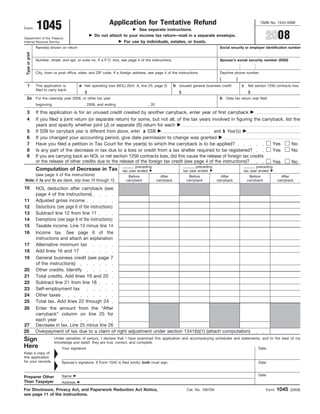

Form 1045 Application for Tentative Refund

•

1 like•638 views

This document is an application for a tentative refund filed by an individual, estate, or trust. It allows the applicant to carry back certain tax attributes, such as a net operating loss (NOL), to previous tax years in order to generate a refund of taxes previously paid. The application includes sections to report an NOL for the current year to be carried back on Schedule A, and to track any remaining NOL carryovers to future years on Schedule B. It also contains worksheets to recompute taxable income amounts for the prior years receiving the carryback, taking into account adjustments for items like the standard deduction, exemptions, and itemized deductions. Upon completion, the applicant can compute the decrease in tax for

1 of 4

Downloaded 19 times

Recommended

F1040ez[2] kn5![F1040ez[2] kn5](https://cdn.slidesharecdn.com/ss_thumbnails/f1040ez2kn5-110531142714-phpapp01-thumbnail.jpg?width=560&fit=bounds)

![F1040ez[2] kn5](https://cdn.slidesharecdn.com/ss_thumbnails/f1040ez2kn5-110531142714-phpapp01-thumbnail.jpg?width=560&fit=bounds)

![F1040ez[2] kn5](https://cdn.slidesharecdn.com/ss_thumbnails/f1040ez2kn5-110531142714-phpapp01-thumbnail.jpg?width=560&fit=bounds)

![F1040ez[2] kn5](https://cdn.slidesharecdn.com/ss_thumbnails/f1040ez2kn5-110531142714-phpapp01-thumbnail.jpg?width=560&fit=bounds)

F1040ez[2] kn5xXFunkyMonkeyXx This document is an individual income tax return form (Form 1040EZ) for the year 2010. It contains personal information for the taxpayer such as name, address, social security number. It reports $55,000 in wages on Line 1 as the only source of income. Standard deduction of $9,350 is claimed on Line 5. Taxable income of $45,650 is calculated on Line 6. No payments or credits are listed so the total tax due of $7,588 is calculated on Line 11 and owed on Line 13.

F8379 injure spouse form

F8379 injure spouse formsamgta This 3-page IRS form is used by an injured spouse to claim their share of a tax refund from a jointly filed return when the refund was applied to their spouse's past-due debts. The form walks through a series of questions to determine if the spouse qualifies as an injured spouse. If so, it has the spouse provide identifying information from the joint return and allocate refundable amounts between themselves and their spouse. By signing, the injured spouse declares under penalty of perjury that the information provided is true and complete.

it2104_409_fill_in holding Allowance Certificate

it2104_409_fill_in holding Allowance Certificatetaxman taxman This document provides instructions for completing New York State Form IT-2104, the Employee's Withholding Allowance Certificate. It explains how to determine the proper number of withholding allowances to claim based on an employee's filing status and income sources in order to avoid underwithholding. The form and instructions are used by employees to provide their employers with information to determine the appropriate amount of state and local income tax to withhold from paychecks.

1040ez

1040ezNkem17 Nkem Chukwumerije files a 2010 Form 1040EZ individual tax return. He reports $55,000 in wages as his only income. His filing status is single. He claims the standard deduction of $9,350, resulting in taxable income of $45,650. Using the tax table, his tax is calculated to be $7,600. As he had no tax withheld or credits, the amount he owes is $7,600.

1040ez

1040ez11evertzmorgan Morgan Evertz filed a 2010 Form 1040EZ individual tax return. He reported $55,000 in wages and no other income. His filing status was single and he claimed the standard deduction of $9,350, resulting in taxable income of $45,650. Using the tax table, his tax was calculated to be $7,600. As he had no payments or credits, the amount he owed was $7,600.

1040EZ

1040EZ11parsonskayla This document is an IRS Form 1040EZ for individual income tax return filing. It contains personal information such as name, address, social security number. It also contains financial information including wages, taxable interest, unemployment compensation, adjusted gross income, standard deduction, taxable income, federal tax withheld, refund amount. The form is used to file a basic tax return for single or joint filers with no dependents and simple tax situations.

1040

1040joensmichael11 1. Michael Joens filed a single tax return for 2010 reporting $40,000 in wages. He is claiming the standard deduction of $9,350 and owes $4,172.50 in federal income tax.

2. The document is Michael Joens' completed 2010 Form 1040EZ for single filers with no dependents. It reports his income, deductions, payments and credits, and the amount of tax owed.

3. The summary provides key information from the tax return, including Michael's income amount, filing status, claimed deduction, and total tax owed.

F1040ez

F1040ez11yauanita 1) The document is an IRS Form 1040EZ for filing an individual income tax return for the year 2010.

2) It shows an example of a single filer, Anita Yau, with $55,000 in wages as her only income.

3) After accounting for the standard deduction of $9,350, her taxable income is $45,650 and she owes $7,588 in federal income tax.

F1040ez

F1040ezmanapi This document is an IRS Form 1040EZ for individual income tax return filing for 2010. It contains information about the taxpayer such as name, address, social security number. The form shows the taxpayer's income of $40,000 in wages and requests standard deduction and exemption amounts. The taxpayer owes $6,188 in federal income tax.

F1040ez

F1040ezboise13 Catherine Park files a single tax return for 2010 reporting $40,000 in wages. She claims the standard deduction of $9,350, resulting in taxable income of $30,650. Using the tax table, her tax is calculated to be $4,175. She owes this full amount due to having no withholdings, credits, or other payments against her tax liability.

F1040ez (econ project)

F1040ez (econ project)11patelanisha 1) This document is an individual income tax return form (Form 1040EZ) for the year 2010, filed by Anisha A. Patel. It reports $40,000 in wages, the standard deduction amount, and requests no refund.

2) The form provides instructions for reporting income, deductions, payments and credits, and calculates tax owed or refund due. It includes worksheets to determine the standard deduction and making work pay credit amounts.

3) The taxpayer reports $40,000 in wages, claims the standard deduction of $9,350, and tax withheld of $6,180, resulting in no refund or tax due.

1040ez

1040ezmichellechannn 1. This document is an IRS Form 1040EZ, which is used to file a basic federal income tax return for single or married taxpayers with no dependents.

2. It requests information such as the filer's name, address, social security number, income from wages and other sources, and any tax payments made.

3. Worksheets are provided to help calculate the standard deduction amount and making work pay credit that can be claimed on the return.

F1040ez

F1040ez11patelanisha 1) This document is an individual income tax return form (Form 1040EZ) for the year 2010 that is being filled out by Anisha A. Patel.

2) Ms. Patel earned $40,000 in wages in 2010, as shown on her W-2 form. She is filing as single and claiming the standard deduction of $9,350, resulting in taxable income of $30,650.

3) Based on her taxable income, Ms. Patel owes $4,628 in federal income tax for 2010. After accounting for taxes withheld and credits, she still owes $2,614.

F1040ez

F1040ezpronitdutta This document is an individual income tax return form (Form 1040EZ) for the year 2010. It provides instructions for a single or married filing jointly taxpayer with no dependents and limited income to file their federal income taxes. The taxpayer, Pronit Dutta, earned $55,000 in wages in 2010 and is claiming the standard deduction of $9,350, resulting in taxable income of $45,650 and a tax due of $7,588.

David lee

David lee11leedavid Tyrone David Tupac Abhnikahgri Lee Shakur files a single tax return for 2010 reporting $40,000 in wages. He claims the standard deduction of $9,350, resulting in taxable income of $30,650. Using the tax table, his tax is calculated to be $4,175. As he had no tax withheld or credits, the amount he owes is $4,175.

Alex1040ez

Alex1040ezfunkymunky999 1) Hans Karl von Diebitsch-Zabalkansky files a single tax return for 2010 reporting $55,000 in wages as shown on his Form W-2.

2) His taxable income is $45,650 after subtracting the standard deduction of $9,350 for a single filer.

3) His total tax is calculated as $7,588 using the tax table in the instructions. Since he had no tax withheld or credits, he owes $7,588.

F1040ez

F1040ezdbrown337 Daniel Brown is filing a single tax return for 2010. He earned $45,000 in wages that year as shown on his W-2. His filing status is single and his standard deduction of $9,350 and taxable income of $35,650 are calculated. His total tax owed is $5,037.50 as he had no taxes withheld or credits to reduce his liability.

1040ez

1040ezmichellechannn 1) Michelle Chan filed a 2010 Form 1040EZ individual tax return. She reported $60,000 in wages and no other income or adjustments.

2) After claiming the standard deduction of $9,350, her taxable income was $50,650.

3) Using the tax table, she owed $8,850 in federal income tax. She had no payments or credits to reduce her tax liability.

F1040ez

F1040ezchristo205 1) The document is an IRS Form 1040EZ for individual income tax return filing for 2010. It provides information about the taxpayer such as name, address, social security number, income, deductions, credits, tax amount due or refund.

2) The taxpayer, Christopher Wong, is filing as single and reports $40,000 in wages as their only income.

3) After deducting the standard deduction of $9,350, the taxpayer's taxable income is $30,650. Based on this, the amount of tax owed is $4,175.

Tyrone tupac

Tyrone tupac11leedavid 1. Tyrone Tupac Abhnikahgri Shakur filed a single income tax return for 2010 reporting $40,000 in wages.

2. His taxable income was $30,650 after subtracting the standard deduction of $9,350.

3. His total tax owed was $4,175, which he left unpaid with the return.

F1040ez

F1040ezannielu689 This document is Annie Lu's 2010 Form 1040EZ tax return. It shows that she earned $45,000 in wages and has $9,350 in the standard deduction as a single filer. Her taxable income is $35,650 and she owes $5,088 in federal income tax.

F1040ez

F1040ezKarenKuo Karen Kuo files her 2010 federal income tax return using Form 1040EZ. She earned $40,000 working as a mathematics teacher. As a single filer with no dependents or other income, her standard deduction of $9,350 reduces her taxable income to $30,650. Using the tax table, her federal income tax owed is $4,183. As she had no tax withheld or credits to claim, the full $4,183 amount is due when she files her return.

F1040ez

F1040ezmajikseb 1. Sebastian Roberts filed a 2010 Form 1040EZ tax return as a single filer reporting $55,000 in wages.

2. His filing status was single and his standard deduction of $9,350 and taxable income of $45,650 were calculated.

3. No taxes were withheld from his wages and he did not qualify for the making work pay or earned income tax credits, resulting in $9,931 owed in taxes.

1040

104011kwakadrian 1) This document is an IRS Form 1040EZ for the 2010 tax year, which is a simplified tax return for single and joint filers with no dependents. It provides basic personal and income information to calculate tax liability or refund.

2) The taxpayer, Adrian Kwak, reports $55,000 in wages as their only income. Their standard deduction of $9,350 and taxable income of $45,650 are calculated.

3) Based on the tax table, the taxpayer's tax liability is calculated as $7,600. Since they had no tax withheld or credits, the full $7,600 is owed.

Fw9

Fw9Michael Mayes This document is an IRS Form W-9 used to request a taxpayer identification number from an individual or business. It consists of three parts:

1. Request for the name, address, and taxpayer ID number of the individual or business

2. Certification by the individual or business that the provided taxpayer ID number is correct and that they are not subject to mandatory backup withholding

3. General instructions that provide definitions of terms used in the form such as definitions of a U.S. person and foreign person, as well as special rules for partnerships.

Form 8404 Interest Charge on DISC-Related Deferred Tax Liability

Form 8404 Interest Charge on DISC-Related Deferred Tax Liability taxman taxman This document is an IRS form (Form 8404) used by shareholders of Interest Charge Domestic International Sales Corporations (IC-DISCs) to calculate and report the interest owed on DISC-related deferred tax liability. The form contains instructions for completing the form, including information on who must file, when to file, where to file, and line-by-line instructions. It also provides special rules for calculating amounts carried back or forward to other tax years.

Form 1040, Schedules A & B-Itemized Deductions & Interest and Dividend Income

Form 1040, Schedules A & B-Itemized Deductions & Interest and Dividend Income taxman taxman This document is IRS Form 1040 Schedules A and B for itemized deductions and interest/dividend income for tax year 2008. Schedule A allows taxpayers to list various deductions including medical expenses, taxes paid, home mortgage and other loan interest, gifts to charity, casualty losses, and job/other miscellaneous expenses. Schedule B requires reporting of interest and ordinary dividend income received over $1,500 and asks if the taxpayer had any foreign bank accounts or involvement with foreign trusts.

Form 1041-N U.S. Income Tax Return for Electing Alaska Native Settlement Tru...

Form 1041-N U.S. Income Tax Return for Electing Alaska Native Settlement Tru...taxman taxman This document is an IRS Form 1041-N for an Electing Alaska Native Settlement Trust. It provides general information about the trust, including the name and address of the trustee. It also includes sections to report the trust's income, deductions, tax computation, capital gains and losses, and distributions made to beneficiaries.

F1040ez

F1040ezannielu689 This document is Annie Lu's 2010 Form 1040EZ tax return. It shows that she earned $45,000 in wages and has $9,350 in the standard deduction as a single filer. Her taxable income is $35,650 and she owes $5,088 in federal income tax.

F1040ez

F1040ezannielu689 1) The document is an IRS Form 1040EZ for filing an individual income tax return for 2010. It provides lines to report wages, taxable interest, unemployment compensation, and adjusted gross income.

2) The taxpayer, Annie Lu, reports $45,000 in wages on line 1. With the standard deduction of $9,350, her taxable income is $35,650.

3) Using the tax table, Annie's tax due is $5,088. Since she had no tax withheld or credits, the full $5,088 is owed.