Brief introduction

- 1. Brief Introduction - Online Stock Market Trading Stock Exchange Stocks (Shares, equity) are traded in stock exchange. India has two big stock exchanges (Bombay Stock Exchange - BSE and National Stock Exchange - NSE) and few small exchanges like Jaipur Stock Exchange etc. Investor can trade stocks in any of the stock exchange in India. Stock Broker Investor requires a Stock Broker to buy and sell shares in stock exchanges (BSE, NSE etc.). Stock Broker are registered member of stock exchange. A stock broker can register to one or more stock exchanges. Only stock brokers can directly buy and sell shares in Stock Market. An investor must contact a stock broker to trade stocks. Broker charge commissions (brokerages) for their service. Brokerage is usually a percent of total amount of trade and varies from broker to broker. Stock Trading Traditionally stock trading is done through stock brokers, personally or through telephones. As number of people trading in stock market increase enormously in last few years, some issues like location constrains, busy phone lines, miss communication etc start growing in stock broker offices. Information technology (Stock Market Software) helps stock brokers in solving these problems with Online Stock Trading. Online Stock Market Trading is an internet based stock trading facility. Investor can trade shares through a website without any manual intervention from Stock Broker. In this case these Online Stock Trading companies are stock broker for the investor . They are registered with one or more Stock Exchanges. Mostly Online Trading Websites in India trades in BSE and NSE. There are two different type of trading environments available for online equity trading. 1. Installable software based Stock Trading Terminals These trading environment requires software to be installed on investors computer. These software are provided by the stock broker. These softwares require high speed internet connection. This kind of trading terminals are used by high volume intra day equity traders. Advantages: o Orders directly send to stock exchanges rather then stock broker. This makes order execution very fast.

- 2. o It provides almost each and every information which is required to a trader on a single screen including stock market charts, live data, alerts, stock market news etc. Disadvantages: o Location constrain - You cannot trade if you are not on the computer where you have installed trading terminal software. o It requires high speed internet connection. o These trading terminals are not easily available for low volumn share traders. 2. Web (Internet) based trading application These kind of trading environment doesn't require any additional software installation. They are like other internet websites which investor can access from around the world through normal internet connection. Below are few advantages and disadvantages of Online Stock Market Trading :- Advantages of Online Stock Trading (Website based): o Real time stock trading without calling or visiting broker's office. o Display real time market watch, historical datas, graphs etc. o Investment in IPOs, Mutual Funds and Bonds. o Check the trading history; demat account balance and bank account balance at any time. o Provide online tools like market watch, graphs and recommendations to do analysis of stocks. o Place offline orders for buying or selling stocks. o Set alert to inform you certain activity on the stock through email or sms. o Customer service through Email or Chat. o Secure transactions. Disadvantages of Online Stock Trading (Website based): o Website performance - sometime the website is too slow or not enough user friendly. o Little long learning curve especially for people who doesn't know much about computer and internet. o Brokerages are little high.

- 3. Online Stock Trading Companies in India Some of the popular stock brokers in India Financial Market are: 1. ICICI Securities Pvt Ltd. ICICIDirect (or ICICIDirect.com) is stock trading company of ICICI Bank. Along with stock trading and trading in derivatives in BSE and NSE, it also provides facility to invest in IPOs, Mutual Funds and Bonds. Trading is available in BSE and NSE. ... 2. Sharekhan Sharekhan is online stock trading company of SSKI Group, provider of India-based investment banking and corporate finance service. Sharekhan is one of the largest stock broking houses in the country. Sharekhan's equity related services include tra... 3. Indiabulls Securities Ltd Indiabulls Securities (ISL) is one of the India's capital markets companies providing securities broking and advisory services. Indiabulls Securities is promoted by Indiabulls Group, is one of the country's leading business houses with business inter... 4. 5Paisa 5paisa is Online Stock Trading Company of India Infoline Securities Private Ltd., Owner of popular business portal Indiainfoline.com. Besides high quality investment advice from an experienced research team, the site offers real time stock quotes, ma... 5. MotilalOswal Securities Ltd Incorporated in 1987, MotilalOswal Securities Ltd is a well diversified financial services firm offering a range of financial products and services such as Wealth Management, Broking & Distribution, Commodity Broking, Portfolio Management Services, ... 6. HDFC Securities Ltd HDFC Securities(HDFCsec) is Equity Trading Company of HDFC Bank. HDFC Securities provide both online trading and trading on phone. The HDFC Securities trading account has a unique 3-in-1 feature that integrates your HDFC Securities trading account wi... 7. Reliance Money Reliance Money, A Reliance Capital Limited Company, is the financial services division of Reliance Anil DhirubhaiAmbani (ADA) Group. Reliance ADA group is among top 3 business houses in India with wide range of presence across various sectors. Group... 8. IDBI Paisa Builder

- 4. Idbipaisabuilder.in is a multi purpose online stock trading website from IDBI Capital Market Services Ltd., a leading provider of financial services in India and is a 100% subsidiary of Industrial Development Bank of India (IDBI). Idbipaisabuilder... 9. Religare Religare is an emerging markets financial services group with a presence across Asia, Africa, Middle East, Europe, and the Americas. In India, Religare’s largest market, the group offers a wide array of products and services including broking, insur... 10. Geojit BNP Paribas Incorporated in 1987, Geojit BNP Paribas (Geojit) is one of the major stock brokers based in India. Geojit is based in Kochi, Kerala and has the strong presence in Gulf. Geojit BNP Paribas is cash equity and derivatives broker with extensive experie... 11. Networth Stock Broking Ltd Incorporated in 1993, Networth Stock Broking Limited (NSBL) is one of the major stock brokers in India. Networth offers premium financial services and information. NSBL is a member of the National Stock Exchange (NSE) and the Bombay Stock Exchange (B... 12. Kotak Securities Ltd Incorporated in 1994, Kotak Securities Limited, the leading stock broking house of India is 100% subsidiary of Kotak Mahindra Bank. Company offering includes stock broking through the branch and Internet, Investments in IPO, Mutual funds and Portfoli... 13. Standard Chartered Standard Chartered – STCI Capital Markets Limited (formerly UTI Securities Ltd), is a leading broking company in India, provides a wide range of financial services including Investment Banking, Institutional Equity & Derivative Broking, Fixed Income,... 14. Angel Trade Angel Group has emerged as one of the top 3 retail broking houses in India. Incorporated in 1987, it has memberships on BSE, NSE and the two leading commodity exchanges in India i.e. NCDEX & MCX. Angel is also registered as a depository participant w... 15. HSBC Invest Direct Ltd HSBC InvestDirect (India) Limited (HIL) is one of the India's leading financial services organizations providing varied range of services through its subsidiaries to Individual and Corporate customers. HIL is listed on the Bombay Stock Exchange Limit... 16. Comfort Securities Ltd

- 5. Comfort Securities is a growing financial services provider in India. Company offers a wide range of products & services covering merchant banking, equity broking, currency derivatives and depository participants to all kinds of investors, namely, re... 17. Just Trade Just Trade.in is the Online Investment & Stock Broking business from the house of Bajaj Capital - India's leading Financial Planning and Investment Advisory Company from last 46 years. The objective for Just Trade is to provide a seamless experien... 18. Zerodha Zerodha is an India based online stock trading company with a difference. It allows investors to trade at fix transaction fees of Rs 20 per trade, irrespective to number of shares or their prices. While fixed brokerage is very popular in developed na... 19. SBICAP Securities Ltd SBICAP Securities Ltd (SSL) is a 100% subsidiary of SBI Capital Markets Ltd. Services offered by SBICAP includes Institution Equity, Retail Equity, Derivatives, Broking, Depository Participant services and E-Broking. They also provide online trading ... 20. Ventura Securities Ltd Incorporate in 1994, Ventura Securities Ltd is Mumbai, India based popular stock broker. Ventura also provides wide range of investment products and services though it's over 25 branches and over 500 business partners (sub brokers) located across 300... Things to do before opening Online Share Trading Account 1. Ask for Demo: Contact the broker who provide online trading service and ask him to give you a demo of product. 2. Check if the broker trades in multiple stock exchanges. Usually most of the Online Trading Websites trade in NSE and BSE in India. 3. Check the integration of Brokerage account, Demat account and Bank account. 4. Compare brokerages with other peer companies. Standard document require to open an Online Trading Account 1. Proof of residence (Address proof) o Driving license o Voter's ID o Passport o Photo credit card

- 6. o Photo ration card o Utility Bill (Telephone, Electricity etc) o Bank Statement 2. Proof of identity o Driving license o Voter's ID o Passport o Photo ration card 3. PAN Card 4. Two photographs

- 7. Kotak Securities Stock Trading / Kotak Securities Demat / Kotak Securities Brokerage Incorporated in 1994, Kotak Securities Limited, the leading stock broking house of India is 100% subsidiary of Kotak Mahindra Bank. Company offering includes stock broking through the branch and Internet, Investments in IPO, Mutual funds and Portfolio management service. It also offers portfolio management services to high net worth individuals and corporate customers. Kotak securities also distributes a range of financial products, including company fixed deposits, mutual funds, initial public offerings, secondary debt, equity, and small savings schemes. Most of the services provided by the company are available though its internet portal. In early 2009 company launched Saxo's global trading platform in India. This platform provide direct access to equities, ETF's and REITS spanning 24 stock exchanges across the USA, Europe, Asia and Australia. Kotak Securities is a corporate member of both Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). Currently, Kotak Securities is one of the largest broking houses in India with wide geographical reach. Trade In: BSE and NSE Account Types Kotak offers different account types according to users requirement: 1. AutoInvest AutoInvest is a unique Online Trading Account which provide investment planning in Gold ETFs (Exchange Traded Funds), Equities and Mutual Funds to their customers. Gold ETFs are mutual fund schemes that will invest the money collected from their investors in standard gold bullion. Kotak's advisor gives the recommendation according to investor's risk capability and investment plans. Minimum investment of Rs 5000 required for AutoInvest account. 2. Kotak Gateway Kotak Gateway account opens the gateway to a world of investing opportunities for beginners. Kotak Gateway user can trade anywhere, anytime using internet. Kotak also offers call and trade facility. Investor can also trade Currency Derivative using Kotal gateway account. Kotak Securities provide SMS alert, research report, free news and market updates to the account holders. Best feature of Kotak gateway is call and trade facility. Anybody

- 8. can activate Kotak Gateway account with any amount between Rs 20,000 to 5, 00,000. This can be in form of cash deposit or the value of the shares you buy. Brokerage will be charged based on the account type. For intraday trading brokerage is .06% both sides for less then 25 lakhs and .023% for more then 25 crores. 3. Kotak Privilege Circle Kotak Privilege Circle is the premium investment account offed by Kotak Securities. Along with Kotak Gateway account benefits Kotak provides independent market expertise and support through a dedicated relationship manager and a dedicated customer service desk which provides assistance in opening accounts, handling day- to-day problems, and more. They provides KEAT premium which is an exclusive online tool that lets you monitor what is happening in the market and view your gains and losses in real-time. One can activate Kotak Privilege Circle account with any amount more than Rs. 10,00,000 as margin, by way of cash or stock. For intraday trading brokerage is .06% both sides for less then 25 lakhs and .03% for more then 25 crores. Other then above 3 accounts, Kotak Securities also provide following accounts: 1. Kotak Freedom for Mutual Fund Investments. 2. Kotak Super Saver, a Flat Brokerage and a Low Margin account. 3. PMS (Portfolio Management Service), an account for people who need an expert to help to manage their investments. 4. NRI Account, a online trading an investment account for NRI investors. Trading Brokerage and fees Account opening fees: Trading Account Opening Charges (One Time): Rs 750 Trading Annual maintenance charges (AMC): Rs 0 Demat Account Opening Charges (One Time): - Demat Account Annual Maintenance Charges (AMC): Rs 600 per annum Trading Brokerages: Kotak Gateway (Variable Brokerage) (* All charges are on both sides) Delivery Based Trades Brokerages: 0.59% - 0.18% (For trading amount of '< 1lakh' to '> 2 crore') Intra-day Trades Brokerages: 0.06% - 0.03% (For trading amount of '< 25 lakhs' to '> 5 crore') F&O Trades Brokerages (Intraday): 0.07% - 0.023% (For trading amount of '< 2 crores' to '> 25 crores') F&O Trades Brokerages (Settlement): 0.09% - 0.032% (For trading amount of '< 2 crores' to '> 25 crores') Options Trades: Rs. 100/- per lot

- 9. Kotak Gateway (Fixed Brokerage) (* All charges are on both sides) Delivery Based Trades: 0.49% Intra-day Trades: 0.049% Futures Trades: 0.049% Options Trades: Rs. 100/- per lot or 1% on premium which ever is higher For detailed brokerage changes visit Kotak Gateway - Stock Trading Account detail page and click on the 'Charges' link. Kotak Securities charges for NSDL Depository services: Sr Account Head Rate Minimum Payable Rs.50/- per request and Rs.3/- per 1 Dematerialisation -- certificate 2 Rematerialisation Rs.10/- for 100 shares Rs. 15/- Debit Transactions - On Market 0.04% of the value of securities (Plus Rs. 27/- (Plus NSDL 3 and Off Market NSDL charges as applicable) charges as applicable) Account Maintenance Charges Rs. 50/-per month 4 -- Resident Indian Rs. 75/-per month NRI 5 Pledge Charges 0.05% of the value of securities Rs. 30/- 6 Invocation of Pledge 0.04% of the value of securities Rs. 30/- Charge for Client Master change 7 Rs.25/- intimation How to open account with Kotak Securities? There are 3 simple ways to open an account with Kotak. Call at one of the below number and ask to open an account with them. Toll Free No.: 1800-222-299, 1800-209-9191 Visit one of their nearest branches. Visit Kotak Branch Locator at: http://www.kotaksecurities.com/contactus/contactus.html. Select the city name and click on ‘Submit’ button to find the branch closest to you. Fill Online Account Application Form. http://www.kotaksecurities.com/account/openandacc/account/index.html

- 10. Document required to open Kotak Securities Trading Account Individual Investors require following documents to open an account with Kotak: 1. Photograph 2. Proof of Address (Passport, Driver's License, Ration Card, Voter's Identity card, Telephone bill, and Electricity bill, Bank Passbook / Bank Statement or Rent Agreement) 3. Proof of Identity (Passport, PAN Card, Voter's Identity Card, Driver's License or MAPIN UID Card) 4. Signature Verification Advantages of Kotak Securities 1. Through its web portal company provides a single platform for investments in equities, Mutual Funds and currency derivatives. Available margin can be used for any of the three segments. 2. Saxo's global trading platform provided by the company allows direct access to equities, ETF's and REITS spanning 24 stock exchanges across the USA, Europe, Asia and Australia. 3. In late 2008 company launched an interesting ‘Smart Order’ feature to its online trading portal. While placing an order to buy or sell stocks at BSE and NSE, customer can choose this option. Once selected, this option offers customers the best available price between BSE and NSE. This option is available to all the customers of the company. 4. Kotak also provides a Call & Trade facility to its customers wherein they can place and track their orders through phone when they are away from home. 5. Kotak Securities provide daily SMS alerts, market pointers, periodical research reports, stock recommendations etc. 6. Kotak provides exclusive online tool to monitor what is happening in the market and also investor can view gains/losses in real-time. 7. Customer support chat helps customers to resolve issues faster. 8. Kotak securities have Citibank, HDFC Bank, UTI Bank and Kotak Mahindra Bank as designated banks for its trading account. Investors holding account with these banks can easily integrate the brokerage account with Kotak. Disadvantages of Kotak Securities 1. 3-in-1 account not available. Money Transfer is needed from bank to brokerage account for each transaction. 2. Slow website response time. 3. Demo of the online trading portal is not available. Useful links about Kotak Securities 1. Website: http://www.kotaksecurities.com 2. FAQs: http://www.kotaksecurities.com/faqs/equity.html 3. Phone: 30305757 (dial from mobile phone prefix your city STD code)

- 11. 4. Toll Free: 1800-222-299, 1800-209-9191 5. E-Mail:[email protected] 6. Registered Office: Kotak Securities Ltd. 1st Floor Bakhtawar, Nariman Point, Mumbai – 400021 Ph: 022-66341100

- 12. ICICIDirect Stock Trading / ICICIDirectDemat / ICICIDirect Brokerage ICICIDirect (or ICICIDirect.com) is stock trading company of ICICI Bank. Along with stock trading and trading in derivatives in BSE and NSE, it also provides facility to invest in IPOs, Mutual Funds and Bonds. Trading is available in BSE and NSE. Trade In: BSE and NSE Trading Platforms ICICIDirect offers 2 trading platforms to its customers: 1. Share Trading Account (Website Based Trading) Website based online Share Trading Account by ICICIDirect is primarily for buying and selling of stocks at BSE and NSE. The ICICIDirect website allows Cash Trading, Margin Trading, MarginPLUS Trading, Spot Trading, Buy Today Sell Tomorrow, IPO Investment, Mutual Fund Investment etc. ICICIDirect.com website is the primary Investment vehicle of ICICI Limited. 2. Trade Racer (Trading Terminal) Trade Racer is a power packed Trading platform which provides an investor with Live streaming quotes & Research Calls, integrated fund transfer system along with multiple watch list facility. Investor can also do technical analysis with the help advance charting tools. Single Order entry page for Equities and Derivatives, Technical Analysis, Integrated Fund Transfer System, Customized Interface, Intra- day and EOD Charts and Shortcut keys for faster access to markets are some of the key features of Trade Racer Terminal. Trading Brokerage and fees Trading Account Opening Charges (One Time): Rs. 975 Trading Annual maintenance charges (AMC): Rs 0 latest brokerage information on ICICIDirect website. Demat Account Opening Charges (One Time): Rs. 100 (for Agreement Stamp Paper) Demat Account Annual Maintenance Charges (AMC): Rs. 500 (Rs 0/- for 1st year with 3 in 1 Account) Other Demat Service Charges & Fees ICICI offers 2 types of brokerage plans to its customer: 1. I-Secure Plan (Flat brokerage Plan)

- 13. This plan offers Flat Brokerage (in %) irrespective of turnover value. This plan is suitable for traders / investors looking at secured and fixed brokerage. 2. I-Saver Plan (Variable brokerage plan) This plan offers brokerage based on the trading volume i.e. high brokerage for low volume and low brokerage for high volume trades. This plan suitable for traders / investors who trade in high volumes and can benefit from low brokerage. ICICIDirect Brokerage in Cash I - Saver Plan I - Secure Plan Total Eligible Effective Effective Total Eligible Turnover (Per Brokerage Brokerage on Brokerage Brokerage on Turnover (Per calendar (%) Intraday (%) Intraday calendar Quarter) Quarter) Squareoff Squareoff Above Rs. 5 Irrespective of 0.25 0.125% 0.55 0.275% Crores turnover Rs.2 Crores to 5 0.30 0.150% Crores Rs.1 Crores to 2 0.35 0.175% Crores Rs.50 Lakhs to 1 0.45 0.225% Crores Rs.25 Lakhs to 50 0.55 0.275% Lakhs Rs.10 Lakhs to 25 0.70 0.350% Lakhs Less than Rs.10 0.75 0.375% Lakhs ICICIDirect Brokerage in Future & Future Plus I - Saver Plan / I - Secure Plan

- 14. For Equity/Currency Futures Equity Future and Future Plus Currency Futures Total Eligible Brokerage Brokerage on Second leg of Brokerage on Second leg of Turnover per month (%) Intraday square off (per lot) Intraday square off (per lot) Above Rs. 20 Crores 0.030 Rs.15/- Rs.10/- Rs.10 Crores to 20 0.035 Rs.15/- Rs.10/- Crores Rs.5 Crores to 10 0.040 Rs.15/- Rs.10/- Crores Less than Rs.5 0.050 Rs.15/- Rs.10/- Crores ICICI Brokerage in Margin & Margin Plus I - Saver Plan / I - Secure Plan Total Eligible Turnover per month Brokerage (%) Above Rs. 20 Crores 0.030 Rs.10 Crores to 20 Crores 0.035 Rs.5 Crores to 10 Crores 0.040 Less than Rs.5 Crores 0.050 ICICI Direct Brokerage in Options I - Saver Plan / I - Secure Plan Brokerage in Options Total Flat brokerage per Brokerage on Second leg of Intraday Eligible Lots per month contract lot (Rs.) square off (per lot) Above 600 65/- Rs.15/- 301-600 70/- Rs.15/-

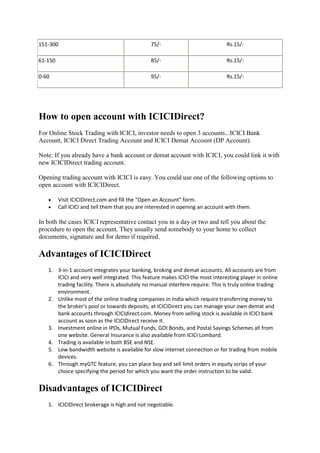

- 15. 151-300 75/- Rs.15/- 61-150 85/- Rs.15/- 0-60 95/- Rs.15/- How to open account with ICICIDirect? For Online Stock Trading with ICICI, investor needs to open 3 accounts...ICICI Bank Account, ICICI Direct Trading Account and ICICI Demat Account (DP Account). Note: If you already have a bank account or demat account with ICICI, you could link it with new ICICIDirect trading account. Opening trading account with ICICI is easy. You could use one of the following options to open account with ICICIDirect. Visit ICICIDirect.com and fill the "Open an Account" form. Call ICICI and tell them that you are interested in opening an account with them. In both the cases ICICI representative contact you in a day or two and tell you about the procedure to open the account. They usually send somebody to your home to collect documents, signature and for demo if required. Advantages of ICICIDirect 1. 3-in-1 account integrates your banking, broking and demat accounts. All accounts are from ICICI and very well integrated. This feature makes ICICI the most interesting player in online trading facility. There is absolutely no manual interfere require. This is truly online trading environment. 2. Unlike most of the online trading companies in India which require transferring money to the broker's pool or towards deposits, at ICICIDirect you can manage your own demat and bank accounts through ICICIdirect.com. Money from selling stock is available in ICICI bank account as soon as the ICICIDirect receive it. 3. Investment online in IPOs, Mutual Funds, GOI Bonds, and Postal Savings Schemes all from one website. General Insurance is also available from ICICI Lombard. 4. Trading is available in both BSE and NSE. 5. Low bandwidth website is available for slow internet connection or for trading from mobile devices. 6. Through myGTC feature, you can place buy and sell limit orders in equity scrips of your choice specifying the period for which you want the order instruction to be valid. Disadvantages of ICICIDirect 1. ICICIDirect brokerage is high and not negotiable.

- 16. 2. With ICICIdirect.com e-Invest account(3-IN-1 concept), the Demat Account has to be opened with ICICI Bank Ltd as the Depository Participant (DP) and the Bank Account has to be opened with ICICI Bank Ltd. as the Banker. Useful links about ICICIDirect 1. Website: http://www.ICICIDirect.com 2. Product Demo: Trade Racer Terminal and Demo of trading through ICICIDirect Website. 3. Trading FAQs

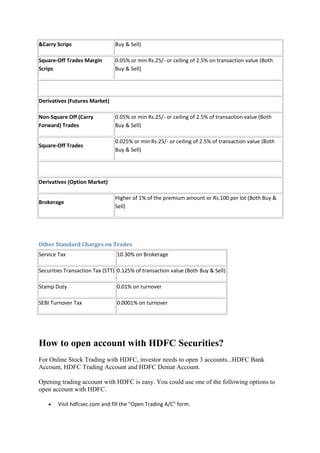

- 17. HDFC Securities Stock Trading / HDFC Securities Demat / HDFC Securities Brokerage HDFC Securities(HDFCsec) is Equity Trading Company of HDFC Bank. HDFC Securities provide both online trading and trading on phone. The HDFC Securities trading account has a unique 3-in-1 feature that integrates your HDFC Securities trading account with your existing HDFC bank savings account and existing Demat account. Funds / shares are seamlessly moved from the linked Demat/Bank account to execute the transactions. HDFCsec provides Cash-n-Carry on both NSE and BSE, Day trading on both NSE and BSE, Trade on Futures & Options on the NSE and Online IPO Investment. Features on HDFC Securities Online trading 1. Seamless Transactions - By integrating your accounts, we ensure minimal waste of time during movement of your funds and shares. 2. Speed - Orders are placed electronically, so proceeds are available instantly. 3. No manipulation - To prevent any mismanagement, we will send you an email confirmation, the minute your order is executed. 4. Safety and Security - HDFC Securities offer the highest level of security such as 128- bit encryption technology. 5. Dedicated and Separate contact numbers - for trading over the phone as well as for customer care. Trade In: BSE and NSE Trading Brokerage and fees Rs. 799/- (Including trading account, bank account and DP account with HDFC) Please note: For HDFC Bank savings account minimum balance (Average Quarterly Balance) of Rs. 10,000 (Metro / Urban) or Rs. 5000 (Semi-Urban / Rural) is required. If you already have Saving account or DP account with HDFC, you could link them with trading account. Brokerage for Delivery Based Trades Equity Segment Resident Indians - 0.50% or min Rs.25/- or ceiling of 2.5% on transaction value (Both Buy & Sell) Delivery Based Trades For NRI's - 0.75% or min Rs. 100 or ceiling of 2.5% on transaction value (Both Buy & Sell) Square-Off Trades Cash 0.10% or min Rs.25/- or ceiling of 2.5% on transaction value (Both

- 18. &Carry Scrips Buy & Sell) Square-Off Trades Margin 0.05% or min Rs.25/- or ceiling of 2.5% on transaction value (Both Scrips Buy & Sell) Derivatives (Futures Market) Non-Square Off (Carry 0.05% or min Rs.25/- or ceiling of 2.5% of transaction value (Both Forward) Trades Buy & Sell) 0.025% or min Rs.25/- or ceiling of 2.5% of transaction value (Both Square-Off Trades Buy & Sell) Derivatives (Option Market) Higher of 1% of the premium amount or Rs.100 per lot (Both Buy & Brokerage Sell) Other Standard Charges on Trades Service Tax 10.30% on Brokerage Securities Transaction Tax (STT) 0.125% of transaction value (Both Buy & Sell) Stamp Duty 0.01% on turnover SEBI Turnover Tax 0.0001% on turnover How to open account with HDFC Securities? For Online Stock Trading with HDFC, investor needs to open 3 accounts...HDFC Bank Account, HDFC Trading Account and HDFC Demat Account. Opening trading account with HDFC is easy. You could use one of the following options to open account with HDFC. Visit hdfcsec.com and fill the "Open Trading A/C" form.

- 19. Call HDFC and tell them that you are interested in opening an account with them. In both the cases HDFC representative contact you in a day or two and tell you about the procedure to open the account. They usually send somebody to your home to collect documents, signature and for demo if required. Document Required to open account with HDFCsec Any Indian resident/non resident individual NRI (except for the US NRIs) or an Indian Corporate can register with HDFCsec. Following documents are required to open accouunt with HDFCsec. 1. One passport size photograph. 2. Copy of PAN card. 3. Identity proof - copy of passport or PAN card or voter ID or driving license or ration card. 4. Address proof - copy of driving license or passport or ration card or voter card or telephone bill or electricity bill or bank statement. Useful links about HDFC Securities 1. HDFC Website: HDFCSec.com 2. Corporate Office: Trade World, C Wing, First Floor, Kamala Mills Compound, SenapatiBapatMarg, Lower Parel, Mumbai 400 013 3. Customer Service E-mail: [email protected] 4. Customer Service Phone (India): 39019400 Please prefix your local area code (0 + local area code + 39019400) eg : From Delhi 011 39019400 5. Customer Service Phone (for NRI's): +91 22 28346685 6. Fax: 91-22-2834-6690

- 20. Indiabulls Securities Stock Trading / Indiabulls Securities Demat / Indiabulls Securities Brokerage Indiabulls Securities (ISL) is one of the India's capital markets companies providing securities broking and advisory services. Indiabulls Securities is promoted by Indiabulls Group, is one of the country's leading business houses with business interests in Power, Financial Services, Real Estate and Infrastructure. Indiabulls Securities also provides depository services, equity research services and IPO distribution to its clients. Company also offers commodities trading through a separate company. These services are provided both through on-line and off-line distribution channels. Indiabulls Securities has been assigned the highest rating BQ-1 by CRISIL. Trade In: BSE and NSE Trading Platforms Power Indiabulls (PIB): Power Indiabulls (PIB) is the integrated online trading platform with great speed to invest in Equity, F&O and Commodities. Power Indiabulls main features includes real-time stock prices, Live trading reports, Multiple Market watch, Intraday charting, Technical analysis, Price alerts, News Room for seasoned investors and traders. Power Indiabulls (PIB) is a dedicated desktop (PC based) application, developed specially for active traders. It also provides various kinds of trading reports according to the internet trading users needs. Main features Power Indiabullsterminal are: 1. Live Streaming Quotes and News 2. User can create multiple market watch 3. Instant Trade Confirmation 4. User can set customizable alerts on various scrip-based parameters 5. Value added tools like Financial Calculator, Intraday Charting, Technical Analysis etc. 6. Real time updated reports 7. Multiple Order Books Click here to find more detail about Power Indiabulls trading platform Trading Brokerage and fees Trading Account Opening Charges (One Time): Rs. 750 Trading Annual maintenance charges (AMC): - Demat Account Opening Charges (One Time): - Demat Account Annual Maintenance Charges (AMC): Rs. 500

- 21. How to open account with Indiabulls Securities? For online trading with Indiabulls Securities, investor has to open an account. Following are the ways to open an account with Indiabulls Securities: Call them at 0124 – 4572444 and ask that you want to open an account with them. Click here and fill a form, Representative from Indiabulls Securities will contact you. Contact Indiabulls Securities by sending email at [email protected] Visit one of their nearest branch and ask to open an account with them List of documents required to open an acount 1. Proof of Identity – Copy of PAN Card 2. Proof of Address – Copy of any one of the following (Self Attested) o Passport o Ration card o Voter’s ID o Driving license o Electricity bill (not more than 2 months old) o Landline Telephone Bill (not more than 2 months old) o Bank Pass Book 3. Bank Proof – Copy of Bank Pass Book or Personalized Cheque leaf (For Existing Bank Account Holders Only) 4. 3 Photographs Advantages of Indiabulls Securities 1. Brokerage is less compare to other online trading companies. 2. Provide trading terminal 'Power Indiabulls', which is very fast in terms of speed and execution. 3. Indiabulls Securities also provides Mobile Power Indiabulls (MPIB) trading platform. This application allows the client to view live streaming quotes, trade in equities as well as derivatives segment, view trading reports and account details on their Mobile. Useful links about Indiabulls Securities 1. Website: http://www.indiabulls.com/securities/default.aspx 2. Faq's: http://www.indiabulls.com/securities/customercare/openanaccount.htm 3. Low bandwidth website: https://trade.indiabulls.com/tradelite 4. Corporate Office: 448 – 451, UdyogVihar, Phase V, Gurgaon – 122001 5. Email: [email protected] 6. Phone: 0124-4572444

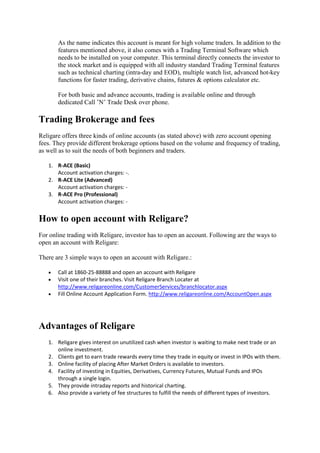

- 22. Religare Stock Trading / ReligareDemat / Religare Brokerage Religare is an emerging markets financial services group with a presence across Asia, Africa, Middle East, Europe, and the Americas. In India, Religare’s largest market, the group offers a wide array of products and services including broking, insurance, asset management, lending solutions, investment banking and wealth management. With 10,000-plus employees across multiple geographies, Religare serves over a million clients, including corporate and institutions, high net worth families and individuals, and retail investors. Religare Securities Ltd. (RSL), a wholly owned subsidiary of Religare Enterprises Limited (REL), an emerging markets financial services group is a market leading securities firm in India. The company offers equity & currency broking services to more than 7,50,000 clients using both, offline and online platforms and also offers depository participant services. RSL is a member of the NSE, BSE, MCXSX, USE and a depository participant with NSDL and CDSL. RSL employs more than 4800 employees and has a wide distribution reach that spans across more than 1500 locations in India. Online platform provides customers the opportunity to trade in Equities, Commodities, Currency Futures, apply for IPOs and invest in Mutual Funds. People who wonder where Religare word came from, it's a Latin word meaning 'to bind together'. Account Types Religare allows customer to choose from a wide range of financial services through its sophisticated and customized trading platform called R-ACE (Religare Advanced Client Engine). Given below are 3 types of R-ACE accounts available to investors. 1. R-ACE (Basic) R-ACE (Religare Advanced Client Engine) is a basic online trading account provided by Religare. Investors can trade and access their account information both online as well as over the phone. This account comes with a browser-based online trading platform with no requirement of an additional software installation. 2. R-ACE Lite (Advanced) R-ACE Lite is the advanced trading platform, which provides all the features as provided by R-ACE (Basic) account. Additionally it also provides real-time streaming stock quotes and alerts. This account comes with a browser-based online trading platform with no requirement of an additional software installation. 3. R-ACE Pro (Professional)

- 23. As the name indicates this account is meant for high volume traders. In addition to the features mentioned above, it also comes with a Trading Terminal Software which needs to be installed on your computer. This terminal directly connects the investor to the stock market and is equipped with all industry standard Trading Terminal features such as technical charting (intra-day and EOD), multiple watch list, advanced hot-key functions for faster trading, derivative chains, futures & options calculator etc. For both basic and advance accounts, trading is available online and through dedicated Call ’N’ Trade Desk over phone. Trading Brokerage and fees Religare offers three kinds of online accounts (as stated above) with zero account opening fees. They provide different brokerage options based on the volume and frequency of trading, as well as to suit the needs of both beginners and traders. 1. R-ACE (Basic) Account activation charges: -. 2. R-ACE Lite (Advanced) Account activation charges: - 3. R-ACE Pro (Professional) Account activation charges: - How to open account with Religare? For online trading with Religare, investor has to open an account. Following are the ways to open an account with Religare: There are 3 simple ways to open an account with Religare.: Call at 1860-25-88888 and open an account with Religare Visit one of their branches. Visit Religare Branch Locater at http://www.religareonline.com/CustomerServices/branchlocator.aspx Fill Online Account Application Form. http://www.religareonline.com/AccountOpen.aspx Advantages of Religare 1. Religare gives interest on unutilized cash when investor is waiting to make next trade or an online investment. 2. Clients get to earn trade rewards every time they trade in equity or invest in IPOs with them. 3. Online facility of placing After Market Orders is available to investors. 4. Facility of investing in Equities, Derivatives, Currency Futures, Mutual Funds and IPOs through a single login. 5. They provide intraday reports and historical charting. 6. Also provide a variety of fee structures to fulfill the needs of different types of investors.

- 24. Useful links about Religare 1. Website: www.religare.in / www.religareonline.com 2. Email: [email protected] 3. FAQs: http://www.religareonline.com/CustomerServices/knowledgecenter.aspx 4. Phone for servicing Domestic clients: : 1860-25-88888 5. Phone for servicing NRI clients:: Call-N-Trade: 0120-67980000 Customer Care: 0120-3397535/3397287 6. For Local Customer Care:http://www.religareonline.com/CustomerServices/customerservice.aspx ALL THESE ABOVE MENTIONED INFORMATION IS TAKEN FROM http://www.chittorgarh.com/ Regards N.P RAB RAKHA