Tina Daniels is director of agency measurement and analytics at Google. She leads teams that work with agencies and brands to evaluate media performance. Here Tina shares advice on how video advertisers can make the most of their media spend in a dynamic market.

The coronavirus pandemic has forced brands to pause and consider how to navigate disruption and, eventually, plan for recovery. While general advice has been to continue investing in marketing, nearly every advertiser is redefining priorities and reassessing budgets.

In this high-stakes environment, marketers are under pressure to stretch their media dollars further, making efficient spending more important than ever. Efficiency requires reaching the right people with the right message at the right time. For video buyers, it also requires reaching people the right number of times.

Over time, the GRP has become a mechanism that masks ad waste.

But efficiency has become increasingly challenging on linear TV. The problem has to do with ad frequency and audience reach, which are the building blocks of TV’s long-standing currency: the gross rating point (GRP). For years, advertisers have been conditioned to offset diminishing reach by paying more for increased frequencies. And over time, the GRP has become a mechanism that masks ad waste.

Video buyers who rely on GRP goals alone to achieve campaign objectives may not be getting the most out of their investment at this critical time. Here’s an in-depth look at why this is the case, along with steps that can be taken to plan more efficiently and reduce waste.

Declining viewership skews delivery and drives up frequency

Consistent declines in broadcast and cable TV viewership mean that ads must run at higher frequencies to meet traditional GRP goals. But what does “higher frequencies” mean in practice? A recent Google-commissioned custom Nielsen Total Ad Ratings (TAR) study provides an explanation.

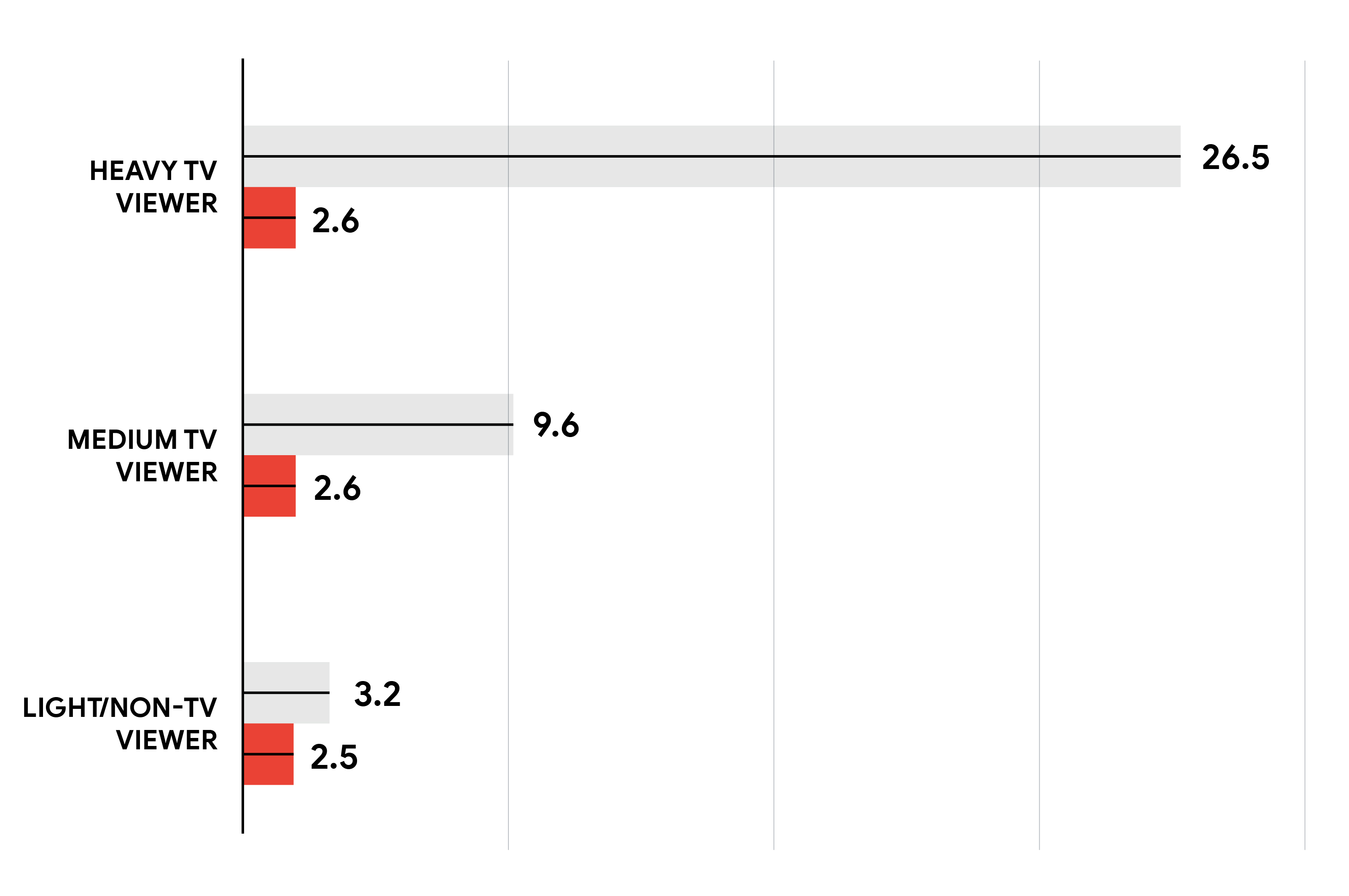

The study looked at 22 video campaigns that ran on YouTube and linear TV. To gauge ad frequency on both platforms, viewers were split into three evenly sized groups — heavy, medium, and light TV viewers — based on their total viewing time on live and on-demand TV.

On average on TV, heavy TV viewers saw an ad 26.5 times over the course of the campaign study. Medium TV viewers saw an ad 9.6 times, and light TV viewers saw it 3.2 times. In that same campaign period, ad frequency was far lower and more consistent across segments on YouTube. Both heavy and medium TV viewers saw an ad 2.6 times on average; light (and non) TV viewers, on average, saw an ad 2.5 times.1

Average campaign frequency

-

TV

-

YouTube

A timely follow-up question to ask, of course, is whether the recent stay-at-home-driven spike in live TV viewership has improved frequency distribution across viewing segments. The data suggests otherwise.

For the four-week period between March 16 and April 12, for example, the vast majority of increased watch time (85%) came from heavy and medium TV viewers. And notably, 68% of that increase came from the 50+ population.2 So despite temporary surges in viewing, according to eMarketer, linear TV continues to trend toward being a less-efficient place to achieve video goals.

High frequency weakens reach quality

As linear TV’s audience shrinks and consolidates, high frequencies pose a second problem. They degrade the overall quality of reach by further saturating some segments at the cost of others. So even during a time when more people are at home, you aren't necessarily getting your money’s worth.

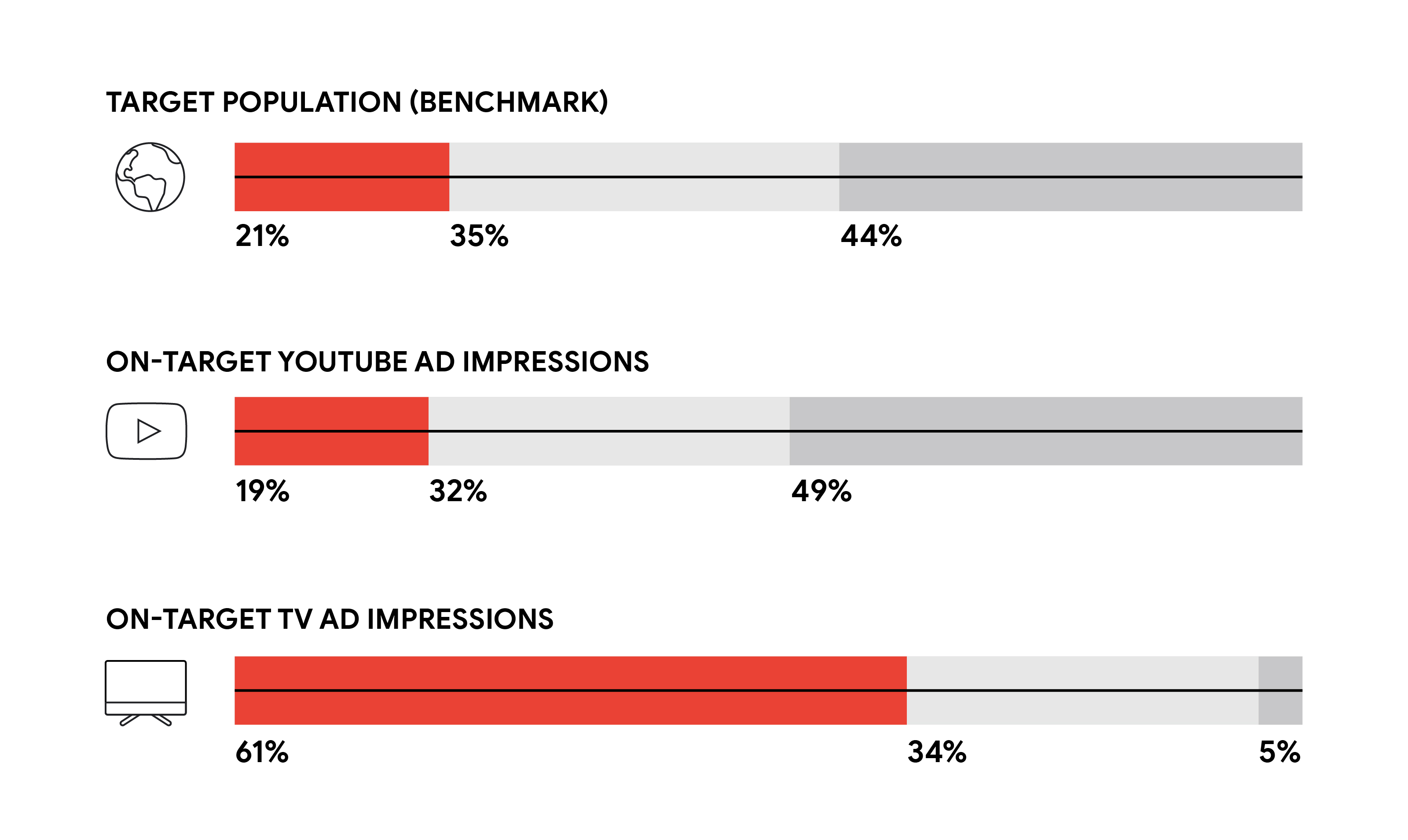

The same custom Nielsen TAR study showed that 61% of the TV ad impressions were served to heavy TV viewers, who made up just 20% of the target audience. Meanwhile, just 5% of TV ad impressions were served to light TV viewers, even though they represented 44% of the target population.3

Percentage of TV and YouTube impressions vs target population

-

Heavy TV viewers

-

Medium TV viewers

-

Light/Non-TV viewers

Delivery on YouTube was more evenly distributed across all TV viewer segments and closely aligned with the target population. And this study underscored a general shift in viewership and consequence of cord cutting: 80% of the light/non-TV viewers who were served an ad on YouTube saw the ad on YouTube only. This incremental opportunity — reaching viewers on YouTube alone — existed for the other viewer segments too. Twenty-five percent of medium TV viewers and 37% of heavy TV viewers who were served an ad on YouTube were not reached by linear TV.4

How video buyers can reduce ad waste today

If you are concerned that your campaigns are not efficiently reaching the audiences you care about, here are three things to do:

- Plan TV and digital together: As audiences consume more digital, plan across channels using new tools. Reach Planner is a good example. It leverages Nielsen TV Data to help advertisers see how different distributions of spend on TV and YouTube can affect reach.

- Experiment to find the right mix of TV and YouTube: Evolving from a TV-first mentality is challenging and won’t happen overnight. But incorporating digital channels is necessary to reach audiences where they are watching. Experimenting with shifting spend to digital video in a low-risk scenario is a great place to start. See what you learn and adjust your mix accordingly. Google’s own marketing team has seen success with this approach.

- Use cross-platform measurement: In addition to planning tools that help determine optimal media mix, there are also new ways to accurately measure across channels. Nielsen TAR studies give advertisers the ability to directly measure TV reach against digital video reach to better identify inefficiencies in their buys.