disaster business loan application - Small Business Administration

disaster business loan application - Small Business Administration

disaster business loan application - Small Business Administration

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

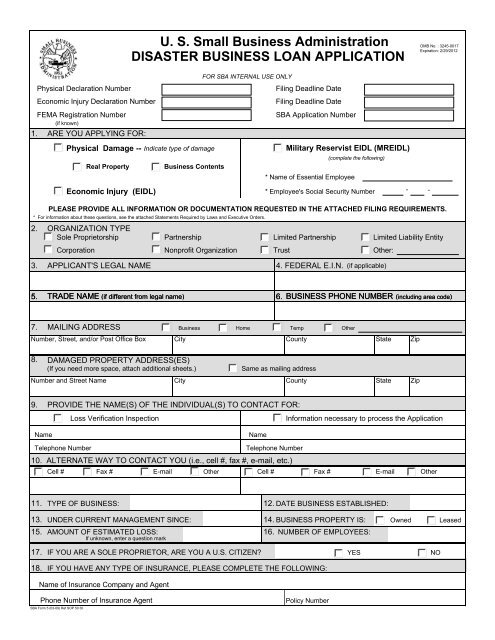

U. S. <strong>Small</strong> <strong>Business</strong> <strong>Administration</strong>DISASTER BUSINESS LOAN APPLICATIONOMB No. : 3245-0017Expiration: 2/29/2012Physical Declaration NumberEconomic Injury Declaration NumberFEMA Registration Number(if known)1. ARE YOU APPLYING FOR:Physical Damage -- Indicate type of damageReal PropertyEconomic Injury (EIDL)<strong>Business</strong> ContentsFOR SBA INTERNAL USE ONLY* For information about these questions, see the attached Statements Required by Laws and Executive Orders.Filing Deadline DateFiling Deadline DateSBA Application NumberMilitary Reservist EIDL (MREIDL)* Name of Essential Employee(complete the following)* Employee's Social Security NumberPLEASE PROVIDE ALL INFORMATION OR DOCUMENTATION REQUESTED IN THE ATTACHED FILING REQUIREMENTS.2. ORGANIZATION TYPESole Proprietorship Partnership Limited Partnership Limited Liability EntityCorporation Nonprofit Organization Trust Other:3. APPLICANT'S LEGAL NAME 4. FEDERAL E.I.N. (if applicable)- -5. TRADE NAME (if different from legal name) 6. BUSINESS PHONE NUMBER (including area code)7. MAILING ADDRESS <strong>Business</strong> Home Temp OtherNumber, Street, and/or Post Office Box City County State Zip8. DAMAGED PROPERTY ADDRESS(ES)(If you need more space, attach additional sheets.)Same as mailing addressNumber and Street Name City County State Zip9. PROVIDE THE NAME(S) OF THE INDIVIDUAL(S) TO CONTACT FOR:Loss Verification InspectionInformation necessary to process the ApplicationNameNameTelephone NumberTelephone Number10. ALTERNATE WAY TO CONTACT YOU (i.e., cell #, fax #, e-mail, etc.)Cell # Fax # E-mail OtherCell # Fax # E-mail Other11. TYPE OF BUSINESS: 12. DATE BUSINESS ESTABLISHED:13. UNDER CURRENT MANAGEMENT SINCE: 14. BUSINESS PROPERTY IS: Owned Leased15. AMOUNT OF ESTIMATED LOSS: 16. NUMBER OF EMPLOYEES:If unknown, enter a question mark17. IF YOU ARE A SOLE PROPRIETOR, ARE YOU A U.S. CITIZEN? YES NO18.IF YOU HAVE ANY TYPE OF INSURANCE, PLEASE COMPLETE THE FOLLOWING:Name of Insurance Company and AgentPhone Number of Insurance AgentSBA Form 5 (03-09) Ref SOP 50 30Policy Number

19. OWNERS (If you need more space attach additional sheets.)Complete for each: 1) proprietor, or 2) limited partner who owns 20% or more interest and eachgeneral partner, or 3) stockholder or entity owning 20% or more voting stock.Name Title/Office % Owned E-mail AddressSSN/EIN* Marital Status Date of Birth* Place of Birth* Telephone Number (including area code)Mailing Address City State ZipName Title/Office % Owned E-mail AddressSSN/EIN* Marital Status Date of Birth* Place of Birth* Telephone Number (including area code )Mailing Address City State Zip* For information about these questions, see the attached Statements Required by Laws and Executive Orders.20.For the applicant <strong>business</strong> and each owner listed in item 19, please respond to the following questions, providing dates anddetails on any question answered YES (Attach an additional sheet for detailed responses.) .a. Has the <strong>business</strong> or a listed owner ever been involved in a bankruptcy or insolvency proceeding? Yes Nob. Does the <strong>business</strong> or a listed owner have any outstanding judgments, tax liens, or pending lawsuits against them? Yes Noc. Has the <strong>business</strong> or a listed owner ever been convicted of a criminal offense committed during and in connection with a riotor civil disorder or ever been engaged in the production or distribution of any product or service that has been determined tobe obscene by a court of competent jurisdiction?Yes Nod. Has the <strong>business</strong> or a listed owner ever had or guaranteed a Federal <strong>loan</strong> or a Federally guaranteed <strong>loan</strong>? Yes Noe. Is the <strong>business</strong> or a listed owner delinquent on any Federal taxes, direct or guaranteed Federal <strong>loan</strong>s (SBA, FHA, VA,student, etc.), Federal contracts, Federal grants, or any child support payments?Yes Nof. Does any owner, owner's spouse, or household member work for SBA or serve as a member of SBA's SCORE, ACE, orAdvisory Council?Yes Nog. Is the applicant or any listed owner currently suspended or debarred from contracting with the Federal government or receivingFederal grants or <strong>loan</strong>s?Yes No21. Is the applicant or any of the individuals listed in Item 19 currently, or have they ever been:22.23.a) under indictment, on parole or probation; b) charged with or arrested for any criminal offense other than a minor motor vehicle violation,including offenses which have been dismissed, discharged, or not prosecuted; or c) convicted, placed on pretrial diversion, or placed on anyform of probation, including adjudication withheld pending probation, for any criminal offense other than a minor motor vehicle violation?YesNoIf yes, NamePHYSICAL DAMAGE LOANS ONLY. If your <strong>application</strong> is approved, you may be eligible for additional funds to cover the cost ofmitigating measures (real property improvements or devices to minimize or protect against future damage from the same type of <strong>disaster</strong>event). It is not necessary for you to submit the description and cost estimates with the <strong>application</strong>. SBA must approve the mitigatingmeasures before any <strong>loan</strong> increase.By checking this box, I am interested in having SBA consider this increase.If anyone assisted you in completing this <strong>application</strong>, whether you pay a fee for this service or not, that person must print andsign their name in the space below.Name and Address of representative (please include the individual name and their company)(Signature of Individual)(Print Individual Name)(Name of Company)Phone Number (include Area Code)Street Address, City, State, ZipAGREEMENTS AND CERTIFICATIONSOn behalf of the undersigned individually and for the applicant <strong>business</strong>:Fee Charged or Agreed UponUnless the NO box is checked, I give permission for SBA to discuss any portion of this <strong>application</strong> with the representative listed above.I/We authorize my/our insurance company, bank, financial institution, or other creditors to release to SBA all records and information necessary to process this<strong>application</strong>.If my/our <strong>loan</strong> is approved, additional information may be required prior to <strong>loan</strong> closing. I/We will be advised in writing what information will be required to obtainmy/our <strong>loan</strong> funds.I/We will not exclude from participating in or deny the benefits of, or otherwise subject to discrimination under any program or activity for which I/We receive Federalfinancial assistance from SBA, any person on grounds of age, color, handicap, marital status, national origin, race, religion, or sex.I/We will report to the SBA Office of the Inspector General, Washington, DC 20416, any Federal employee who offers, in return for compensation of any kind, tohelp get this <strong>loan</strong> approved. I/We have not paid anyone connected with the Federal government for help in getting this <strong>loan</strong>.All information in and submitted with this <strong>application</strong> is true and correct to the best of my/our knowledge. All financial statements submitted with this <strong>application</strong> fullyand accurately present the financial position of the <strong>business</strong>. I/We have not omitted any disclosures in these financial statements. This certification also applies toany financial statements or other information submitted after this date. I/We understand false statements may result in the forfeiture of benefits and possibleprosecution by the U.S. Attorney General (Reference 18 U.S.C. 1001 and/or 15 U.S.C. 645).NOSIGNATURE TITLE DATESign in InkSBA Form 5 (03-09) Ref SOP 50 30

Additional Requirements for Military Reservist Economic Injury(MREIDL)Military Reservist Economic Injury (MREIDL) – A small <strong>business</strong> is eligible to apply for assistance during a periodbeginning when an essential employee receives notice of expected call-up to active duty, and ending 1 year after thedate the essential employee is discharged or released from active duty.1. Please provide:a. A copy of the essential employee’s notice of expected call-up to active duty, official call-up orders,or discharge/release from active duty status, showing (if known) the date of call-up or the date ofrelease/discharge.b. A statement from the <strong>business</strong> owner that the reservist is essential to the successful day-to-dayoperations of the <strong>business</strong> (detailing the employee’s duties and responsibilities and explaining whythese duties cannot be completed in the essential employee’s absence).c. A certification by the essential employee that he or she concurs with the statements in “b” above.d. A written explanation and financial estimate of how the call-up of the essential employee to activeduty has resulted or will result in substantial economic injury to the <strong>business</strong>. (Provide monthlysales figures beginning 3 years prior to the call-up and continuing through the most recent monthavailable. You may use SBA Form 1368 for this purpose).e. A description of the steps the <strong>business</strong> is taking to alleviate the substantial economic injury.f. A certification from the <strong>business</strong> owner that the essential employee will be offered the same or asimilar job upon return from active duty.IF SBA APPROVES YOUR LOAN, WE MAY REQUIRE ADDITIONALINFORMATION BEFORE LOAN CLOSING. WE WILL ADVISE YOU, INWRITING, OF WHAT DOCUMENTS WE NEED.Rev. 03 09