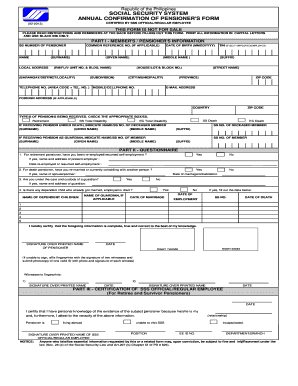

PH SSS PEN-01405 2019-2025 free printable template

Show details

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sss acop form

Edit your annual confirmation pensioner form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sss pension form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

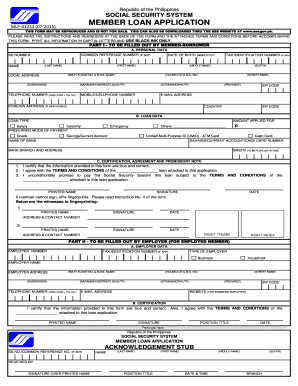

How to edit acop form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sss acop form 2024. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH SSS PEN-01405 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out acop form sss download

How to fill out PH SSS PEN-01405

01

Gather necessary information: Personal details such as full name, date of birth, and address.

02

Obtain your SSS number and make sure it is correct.

03

Fill out the form section by section, starting with your personal information.

04

Provide details about your employment history, if applicable.

05

Review all entries for accuracy.

06

Sign and date the form at the designated area.

07

Submit the completed form to the appropriate SSS office or through their online portal.

Who needs PH SSS PEN-01405?

01

Individuals who want to apply for SSS benefits.

02

Members of the Social Security System (SSS) in the Philippines.

03

Those updating their information or status with the SSS.

Fill

sss acop form download

: Try Risk Free

People Also Ask about sss renewal form

How to file acop online 2023?

Follow the instructions below to fill out Acop form online easily and quickly: Sign in to your account. Sign up with your email and password or create a free account to test the service before choosing the subscription. Upload a form. Edit Acop form. Get the Acop form accomplished.

Who needs to comply with ACOP?

Retirement pensioners living in other countries, total disability pensioners, and survivor pensioners including dependent children (minor or incapacitated) and guardians are required to comply with ACOP.

Are all SSS pensioners required to file ACOP?

All retiree (residing abroad), survivor, and total disability pensioners, as well as dependents and their guardians (minor/incapacitated children) are required to comply with the ACOP. Pensioners shall report for the ACOP once a year to ensure their continued eligibility to receive monthly SSS pensions.

Can I still get my SSS pension if I live abroad?

If you earned Social Security benefits, you can visit or live in most foreign countries and still receive payments. Look up the country on the SSA Payments Abroad Screening Tool to be sure you can receive your payments.

What are the requirements for SSS annual confirmation of pensioners?

Requirements include a duly accomplished ACOP form; one primary or two secondary identification cards; and a half-body photo that shows the beneficiary holding a current newspaper, or with television news as background wherein the news headline and date are visible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sss annual confirmation of?

SSS Annual Confirmation of Coverage is an online process to help employers confirm the accuracy of the Social Security numbers of their employees and to ensure that their employees are properly covered by Social Security. The process also helps employers to ensure that their employees are properly registered for Medicare.

Who is required to file sss annual confirmation of?

All employers who are registered with the Social Security System (SSS) are required to file their Annual Confirmation of Report of Employees and Payroll (ACREP) to the SSS every year.

How to fill out sss annual confirmation of?

1. Log in to your online account with the Social Security Administration.

2. Once logged in, select the "Annual Confirmation of Benefits" option.

3. Carefully read the information provided and answer any questions asked.

4. Review the information on the page and ensure that all the information is correct.

5. When you are satisfied with the information provided, click on the "Submit" button to complete the Annual Confirmation of Benefits.

What is the purpose of sss annual confirmation of?

The purpose of an annual confirmation of sss is to ensure that employee records are accurate and up-to-date. By confirming the accuracy of employee information such as address, banking details, and other contact information, employers can ensure that their payroll records are accurate and up-to-date. This information is also used to ensure that employees are receiving the correct pay and benefits.

What information must be reported on sss annual confirmation of?

The Social Security Administration (SSA) requires employers to report the following information on the SSA's Annual Confirmation of Reportable Earnings Form (Form W-2c):

1. Employee name

2. Social Security Number

3. Employer name

4. Employer's Tax Identification Number

5. Total wages earned in the last calendar year

6. Total tips earned in the last calendar year

7. Total Federal income tax withheld in the last calendar year

8. Social Security wages paid

9. Social Security tax withheld

10. Medicare wages paid

11. Medicare tax withheld

How do I edit ss sss pension online?

The editing procedure is simple with pdfFiller. Open your sss annual pensioner in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit how to submit sss acop online on an iOS device?

You certainly can. You can quickly edit, distribute, and sign sss pensioner on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out sss r1a form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your annual confirmation of pensioners form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is PH SSS PEN-01405?

PH SSS PEN-01405 is a specific form utilized by the Philippine Social Security System (SSS) for reporting and documenting contributions and member-related transactions.

Who is required to file PH SSS PEN-01405?

Employers, employees, and self-employed individuals in the Philippines are required to file PH SSS PEN-01405 to report contributions and other relevant details.

How to fill out PH SSS PEN-01405?

To fill out PH SSS PEN-01405, one must provide accurate information regarding the employer's details, employee data, contributions made, and any relevant transactions as specified in the form.

What is the purpose of PH SSS PEN-01405?

The purpose of PH SSS PEN-01405 is to ensure accurate reporting of social security contributions and to facilitate the proper administration of benefits and services by the SSS.

What information must be reported on PH SSS PEN-01405?

PH SSS PEN-01405 must report information such as employer and employee identification details, contribution amounts, dates of transactions, and any adjustments or corrections needed.

Fill out your PH SSS PEN-01405 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sss Acop Online Renewal 2023 is not the form you're looking for?Search for another form here.

Keywords relevant to sss annual form

Related to acop sss form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.