Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

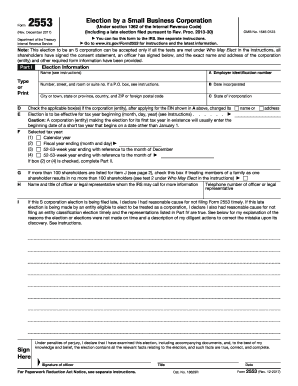

What is form 2553?

Form 2553 is an Internal Revenue Service (IRS) tax form used by certain small business corporations and eligible Limited Liability Companies (LLCs) to elect their tax treatment. The form is called "Election by a Small Business Corporation" and is used to elect S corporation status for tax purposes. By filing Form 2553, eligible entities can elect to be treated as an S corporation, which can provide certain tax advantages.

Who is required to file form 2553?

Form 2553 is required to be filed by certain eligible small business corporations or entities to elect to be treated as an S corporation for tax purposes. According to the IRS guidelines, the following conditions must be met for entities to file Form 2553:

1. The entity must be a domestic corporation.

2. The entity must be eligible to be treated as an S corporation, such as by having only allowable shareholders (individuals, certain trusts, and estates) and a maximum of 100 shareholders.

3. All shareholders must consent to the election.

4. The entity must have a tax year that ends on December 31st.

If these conditions are met, the entity is required to file Form 2553 with the Internal Revenue Service (IRS) to make the election to be treated as an S corporation.

How to fill out form 2553?

Filling out Form 2553, also known as the Election by a Small Business Corporation, is a process that allows a qualifying corporation to be treated as an S corporation for tax purposes. Here is a step-by-step guide on how to fill out Form 2553:

1. Obtain the form: The most recent version of Form 2553 can be found on the official website of the Internal Revenue Service (IRS). Download and print the form for manual filling, or use an online software that offers electronic form filling options.

2. Provide general information: Provide the name of the corporation, mailing address, employer identification number (EIN), and date of incorporation.

3. Select the tax year: Indicate the tax year for which you are filing Form 2553.

4. Choose the eligibility criteria: Check the box that reflects the eligibility criteria for filing Form 2553. Generally, an eligible corporation must be a domestic corporation, have only allowable shareholders (individuals, estates, certain trusts), have no more than 100 shareholders, and have only one class of stock.

5. Specify the election: State the effective date of the S corporation election, which can be either the first day of the tax year the election is made or a later date, not exceeding two months and 15 days after the start of the tax year the election is being made.

6. Determine the shareholder information: Provide the name, address, and social security number or EIN for each shareholder. Additionally, specify the percentage of ownership for each shareholder.

7. Get shareholder consent: Every shareholder listed must sign and date the form to indicate their agreement with the election to be treated as an S corporation.

8. Authorize the corporation: An authorized officer of the corporation, such as the president or vice president, must sign and date the form to certify that the information provided is accurate.

9. Submit the form: Once the form is completed, make a copy for your records and mail the original to the appropriate address provided in the form's instructions. Alternatively, if you are using an online software, follow the instructions provided to submit the form electronically.

Remember to review the form carefully before submission to ensure accuracy. It is recommended to consult with a tax professional or attorney for further guidance, as individual circumstances may vary.

What is the purpose of form 2553?

Form 2553 is used by eligible small business corporations (S corporations) to elect to be treated as a pass-through entity for tax purposes. The purpose of filing Form 2553 is to obtain S corporation status, which allows the business to pass its income, deductions, and credits through to its shareholders. This means the business itself is not subject to federal income tax, and the shareholders report and pay taxes on their share of the S corporation's income on their individual tax returns. The form must be filed with the Internal Revenue Service (IRS) within a specific timeframe after the incorporation or beginning of the tax year the election is to take effect.

What information must be reported on form 2553?

Form 2553 is used to apply for S corporation status with the Internal Revenue Service (IRS). The form requires the following information to be reported:

1. Eligibility: The form starts with a brief eligibility checklist to ensure the organization meets the necessary requirements to qualify as an S corporation.

2. Identification: Basic information about the corporation such as the name, address, Employer Identification Number (EIN), and the date of incorporation.

3. Election Information: This section requires you to indicate the effective date of the S corporation election. By default, S corporation status is effective for the tax year requested, but you can also specify a different effective date as long as it is within 75 days of filing the form.

4. Shareholder Information: Details about the corporation's shareholders, including their names, addresses, Social Security Numbers (SSN), the number of shares each holds, and the percentage of ownership. There is space to list up to 75 shareholders on the form, but if the corporation has more shareholders, an additional sheet can be attached.

5. Consent Statement: Every shareholder must provide their consent to elect S corporation status by signing and dating this section. The form contains a statement that all shareholders have signed or provides an explanation if that is not the case.

6. Authorized Officer: The form must be signed and dated by an authorized officer of the corporation, such as the president, vice president, or any other person authorized to sign. Their name, title, phone number, and email address should also be provided.

7. Effective Date: Finally, the authorized officer should indicate the date of the resolution or other action that authorized the filing of the S corporation election.

It's important to note that the instructions accompanying Form 2553 provide additional guidance and requirements that must be followed while completing the form. Consulting a tax professional or referring to the IRS guidelines is recommended to ensure the accuracy of the information reported on the form.

How do I execute election by a small online?

pdfFiller has made it easy to fill out and sign election by a small. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit election by a small online?

The editing procedure is simple with pdfFiller. Open your election by a small in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit election by a small on an iOS device?

Create, modify, and share election by a small using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.