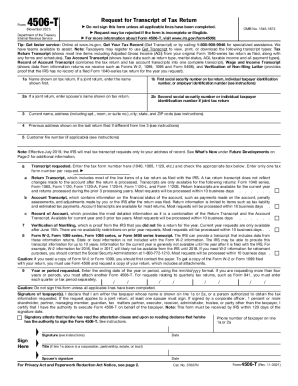

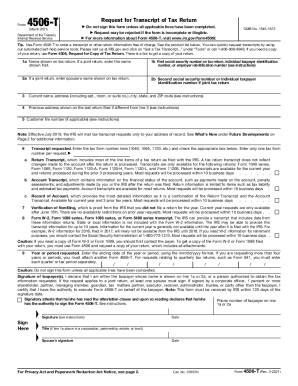

What is a 4506-T Form 2011?

4506-T Form or Request for Transcript of Tax Return allows anyone to order a transcript or a printout of the previous tax return and its versions. Once you send this request, the ordered tax return transcript is sent to you or directly to the third party. You can also order copies by filling out form 4506. You can find the printable and fillable versions of the form on the IRS website or use a PDF editing solution, like pdfFiller.

Who needs Form 4506-T 2011?

Anyone who needs a copy of their tax return should fill out IRS Form 4506-T. Such information may be helpful during the loan application process. There are various reasons for getting a tax return transcript: complete current or make changes to the previous tax return, apply for benefits or loans, etc. For instance, completing the 4506-T Form was the SBA’s requirement for getting the COVID-19 Economic Injury Disaster Loan in 2011.

How do I fill out Form 4506-T?

If you want an editable and printable version of Form 4506-T that can be easily filled out and signed online, use pdfFiller.

- Click Get Form to open 4506-T Form.

- Once opened, start filling out the document.

- Use various annotation and editing tools to add text, checkmarks, and dates.

- Click on the signature box to eSign the document.

- Date the document by selecting the Date option from the top toolbar.

- Click DONE once you’ve completed the form.

- Select from multiple delivery options: download, fax, or send the form via USPS directly from your Dashboard.

What information do I need to fill out IRS 4506-T Form?

Form 4506-T contains nine fields which each have detailed instructions. Complete the first five fields with the filer's identification information. It includes:

- Name

- Address

- Social security number

- Third party's name and address (if the information is to be mailed to the third party.)

- The remaining fields provide information about the forms requested and the filer's signature.

Before completing these fields, read the instructions carefully.

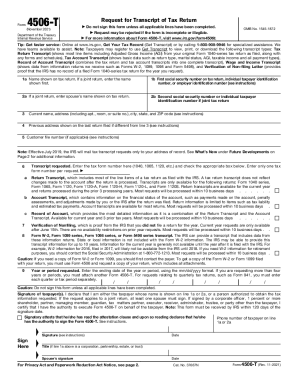

Is Form 4506-T accompanied by other forms?

As a rule, IRS form 4506-T does not require any attachments. However, if you fill out the request on behalf of the entity, you should provide an authorization document. If the taxpayer's representative signs form 4506-T, they should attach form 2848 which shows the delegation to 4506-T Form.

When is Form 4506-T due?

There is no due date for Form 4506-T. It is filled out only when necessary. However, there is a particular deadline for the form to be processed by the IRS. Thus the IRS should receive it within 120 days from the date when the taxpayer signed it. Please note it takes about ten days for IRS to process the request.

Where do I send Form 4506-T?

IRS Form 4506-T must be mailed or sent via fax to the address of the state where you reside or where your business was located when the requested return was filed. That is why you need to make sure that your form is printable or easily editable.