DAM Capital Share Price Live Updates: DAM Capital Advisors shares list at 39% premium over issue price. Shares jump over 12% post listing. Check other details

DAM Capital Advisors Share Price Live (27 Dec 2024): DAM Capital Advisors' shares made their debut on D-St at a premium of 38.87%. The stock opened at Rs 393 on the NSE and Rs 392.90 on the BSE, reflecting a 38.83% rise from the issue price of Rs 283.

Despite the offer being entirely an OFS, DAM Capital Advisors saw an overwhelming response from investors, with the issue being oversubscribed by 81.88 times by the close. Analysts attribute the strong demand to the company's reasonable valuations, which offered attractive listing gains for new investors.

DAM Capital Advisors Share Price Live Updates: DAM Capital shares up over 7% in late afternoon trade

DAM Capital Advisors Share Price Live Updates: DAM Capital shares up over 9% in afternoon trade

Despite being entirely an OFS, DAM Capital Advisors listing was in line with our expectation. The heathy listing gain is on the back of reasonable valuations. Considering market sentiments and all other parameters, we recommend conservative allotted investors to book profits above our expectations. While long term investors considering taking risk on the post listing trend on the company can HOLD IT FOR LONG TERM despite knowing short term volatility & risk in the markets. For non-allotted investors, we advise to accumulate if we get dips post listing due to profit booking attempts. Dam Capital has demonstrated a strong market leadership, holding a 12.1% share in IPOs and QIPs in Fiscal 2024, With a strategic approach to emerging investment themes, we believe DAM Capital is well-positioned to capitalize on India’s vibrant equity markets

- Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd

DAM Capital Advisors Share Price Live Updates: DAM Capital shares jump over 12% post listing

DAM Capital Advisors Share Price Live Updates: DAM Capital Advisors shares list at 39% premium over issue price

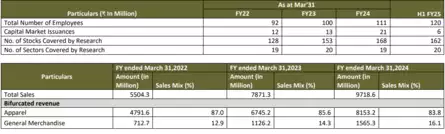

DAM Capital Advisors Share Price Live Updates: Key operational Metrics

Investment Recommendation and Rationale by AJCONGLOBAL

following reasons: -

1. DAM Capital is the fastest growing merchant bank in India by revenue CAGR from Fiscals 2022 to 2024 with the highest profit margin in Fiscal 2024.

2. DAM Capital boasts strong ties with institutional investors, financial sponsors, corporations, and family offices. The company attributes its

success to experienced team members and regular client involvement, resulting in repeat business from satisfied clients.

3. The firm advised on 20 deals, including M&A, PE, and structured finance, and executed block trades.

4. The company plans to form a strategic agreement with a major merchant bank to improve cross-border transaction capabilities and worldwide reach.

DAM Capital Advisors Share Price Live Updates: Valuation & outlook by Anand Rathi

is asking a PE of 22.8x times for FY 2025 which is fully priced. Therefore we believe that the company is well-placed to leverage the growing capital

market opportunities in India. As part of its growth strategy, the company plans to enter additional fee-based businesses to capitalize on emerging

market trends. Additionally, a strategic partnership with a global merchant bank will strengthen its ability to handle cross-border transactions and broaden its international presence. Hence considering all parameters, we recommend the issue can be consider as “SUBSCRIBE for LONG TERM”.

DAM Capital Advisors Share Price Live Updates: Valuation and View by Arihant Capital

into complementary fee-based businesses. This will help them to tap into the growing markets. Further, strategic tie-up with a global merchant bank will

enhance their cross-border transaction capabilities and expand their global reach. At the upper band price of INR 283, the issue is valued at 10.15x P/Bv based on

Q2FY25 net worth. We recommend “Subscribe for long term” to the issue.

DAM Capital Advisors Share Price Live Updates: Financials

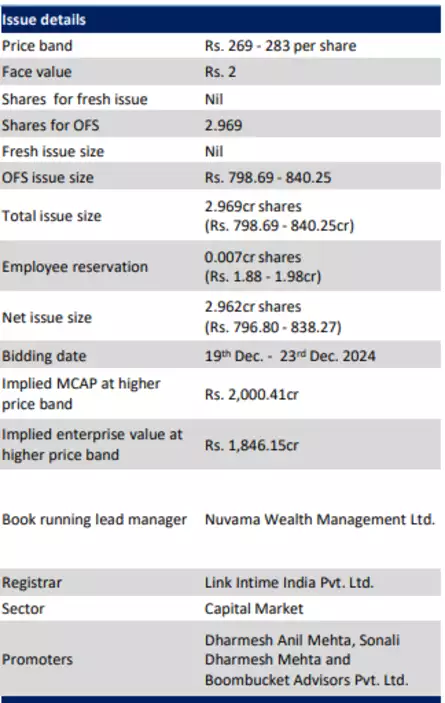

DAM Capital Advisors Share Price Live Updates: Issue Details

DAM Capital Advisors Share Price Live Updates: About the issue

- This offer represents 42% of the post-issue paid-up equity shares of the company. Total IPO size is Rs. 798.69 - 840.25cr.

- The issue is through book building process with a price band of Rs. 269 - 283 per share.

- Lot size comprises of 53 equity shares and in-multiple of 53 shares thereafter.

- 0.007cr shares are reserved for eligible employees.

- The issue will open on 19th Dec. 2024 and close on 23rd Dec. 2024.

- This public issue is fully OFS, thus the company will not receive any proceeds from this public issue

- The promoter & promoter group (P&PG) entities are participating in the OFS and offloading 0.31cr equity shares. Individual public

- shareholders are also participating and offloading 2.65cr shares. Post-IPO, the P&PG and public shareholders will have 41.50% and

- 58.50% stake in the company, respectively.

- 50% of the net issue is reserved for qualified institutional buyers, while 15% and 35% of the net issue is reserved for non-institutional

- bidders and retail investors, respectively.

DAM Capital Advisors Share Price Live Updates: Peer comparison and valuation

peers. The Indian capital market has experienced strong growth in FY24 compared to FY23, with the number of issues rising from 234 in

FY23 to 316 in FY24. This has also positively reflected in the company’s top and bottom line. Looking ahead, the favorable outlook for

capital markets, increased investor participation, and India’s status as one of the fastest-growing economies are expected to benefit the

company in long run. However, the high valuation being demanded raises concerns. Thus, we recommend an “Subscribe for Long Term”

rating for this issue

DAM Capital Advisors Share Price Live Updates: Risk and concerns

- General slowdown in the global economic activities

- Past losses in the stock broking segment and any further reduction in brokerage fees could significantly impact the business

- Ineffective management of risk systems can negatively impact the

- business

- Facing challenges in attracting and retaining clients, investors, and employees, as well as executing transactions on time

- Operate in a highly regulated environment

- Competition

DAM Capital Advisors Share Price Live Updates: Pre and post-issue shareholding pattern

DAM Capital Advisors Share Price Live Updates: Key competitive strengths

- Fastest-growing merchant bank in India

- Proven execution with in-depth understanding of sectors and products

- Institutional equities platform with comprehensive research and

- execution capabilities

- Extensive coverage of corporates, financial sponsors and institutional

- investors, with repeat business

- Experienced management and professionals, backed by a majority

- independent board

- Strong track record of revenue growth and profitability

DAM Capital Advisors Share Price Live Updates: Salient features of the IPO

- DAM Capital Advisors Ltd. (DAM Capital), is a merchant bank which provide a wide range of financial solutions in different areas, is coming upwith an IPO to raise around Rs. 798.69 - 840.25cr, which opens on 19th Dec. and closes on 23rd Dec. 2024. The price band is Rs. 269 - 283 pershare.

- This public issue is fully OFS, thus the company will not receive any proceeds from this public issue

- The promoter & promoter group (P&PG) entities are participating in the OFS and offloading 0.31cr equity shares. Individual public shareholders are also participating and offloading 2.65cr shares. Post-IPO, the P&PG and public shareholders will have 41.50% and 58.50% stake in the company, respectively.