The Employees' Provident Fund Organization (EPFO) is responsible for regulation and management of provident funds in India that operates under the Government of India's Ministry of Labour and Employment.

EPFO provides a mandatory savings cum retirement scheme for employees which is known as Employees’ Provident Fund (EPF).

An eligible organisation provides a PF saving scheme by enabling the employees to contribute 12% of their basic pay per month to this savings fund.

To provide easier access to PF funds to the subscribers in time of financial emergencies, EPFO has revised the PF withdrawal rules.

The amount deposited in PF funds earns interest and the accumulated amount can be withdrawn post-retirement. But the subscriber can also make premature withdrawal which is equivalent to three months of their basic salary plus dearness allowance or 75% of the net balance in their PF or EPF account, whichever is lower. Read on to more detail about the PF withdrawal rules set by EPFO.

The EPF account consists of contributions from the employer and employee. However, the money in an EPF account cannot be withdrawn on a whim.

Here are some of the important rules about EPF withdrawal:

Employees can make a PF withdrawal claim on the EPFO member portal by following the steps mentioned below. As already mentioned, if the employee has seeded his/her Aadhaar card details with one's UAN account, they do not require the attestation of their employer to make a PF withdrawal.

Step 1: Visit the EPFO member portal.

Step 2: Choose the 'For Employees' option under the 'Our Services' tab.

Step 3: On the new webpage click on the 'Member UAN/Online Service (OCS/OTCP)' option under the 'Services' tab of the 'For Employees' page.

Step 4: This will redirect you to a new webpage. Log in to the portal using your UAN, password, and the Captcha code.

Step 5: Click on the 'KYC' option under the 'Manage' tab.

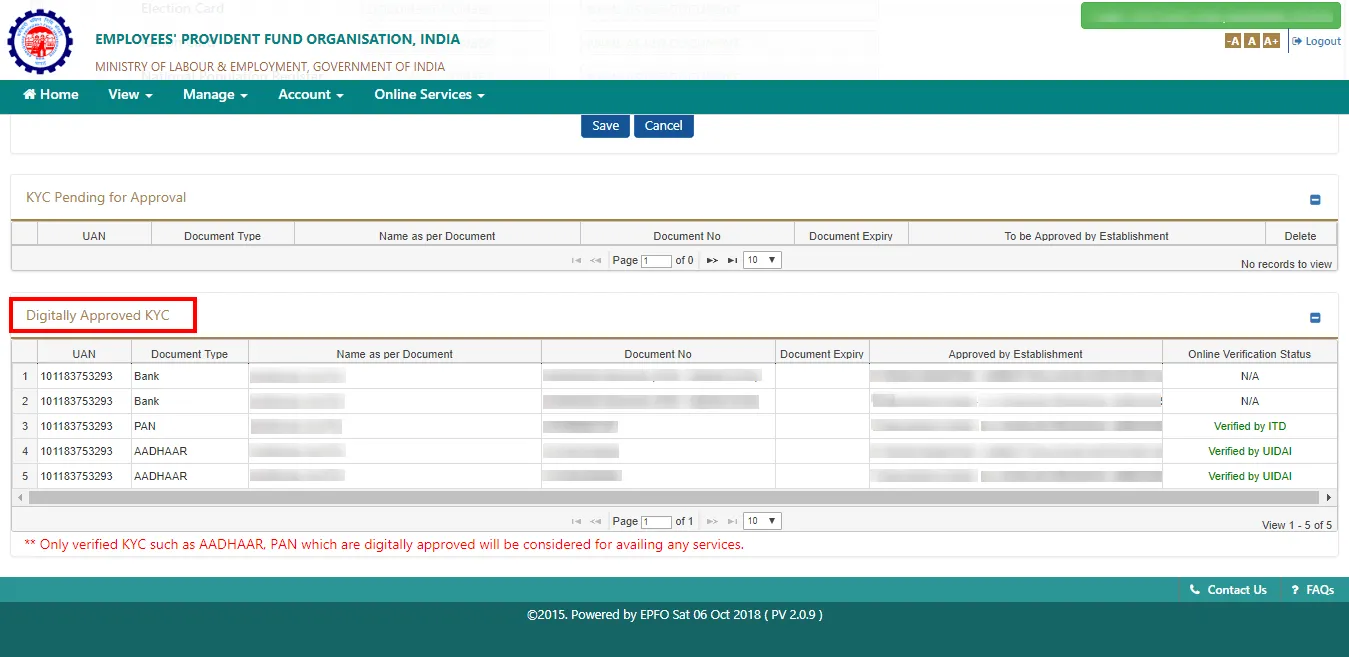

Step 6: You will be redirected to a new webpage. Scroll down to the bottom of the page to find the 'Digitally Approved KYC' section and check your KYC details. Ensure the details are correct.

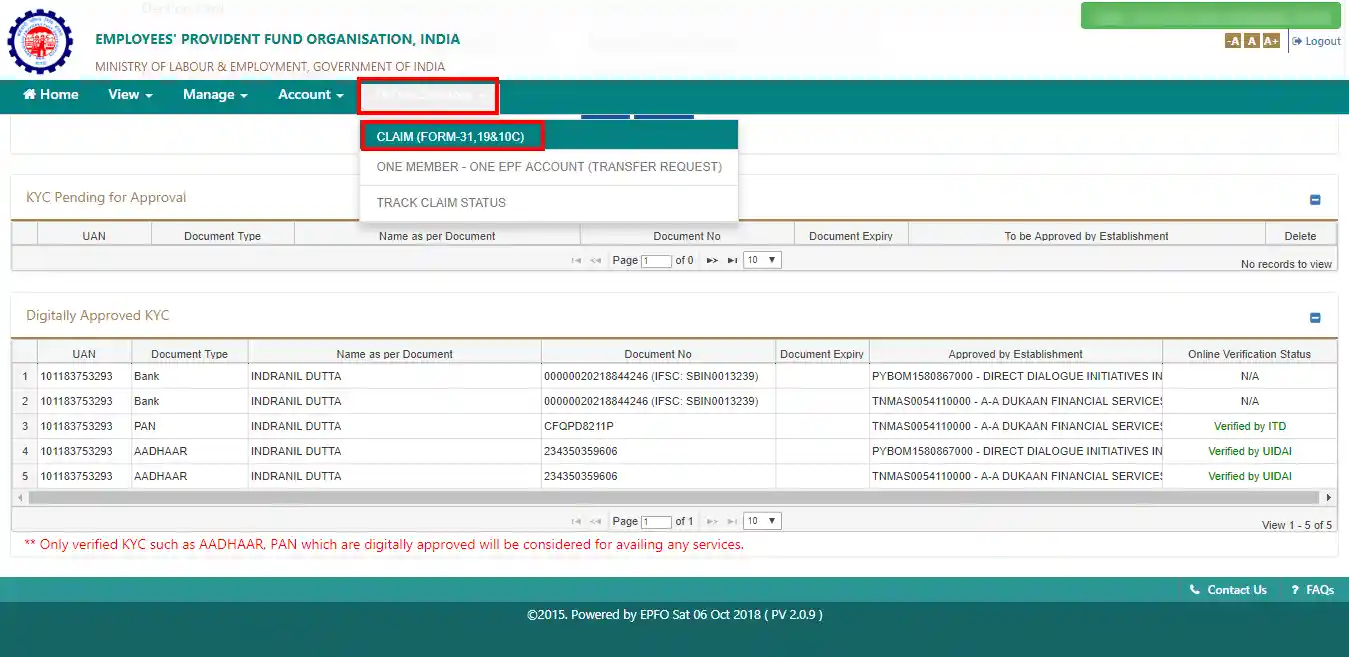

Step 7: Click on the 'Online Service' tab from the top menu to proceed with the withdrawal if all the KYC details are correct.

Step 8: Click on the 'CLAIM (FORM-31, 19 & 10C)' option from the drop-down menu.

Step 9: You will be redirected to a new webpage with an automatically generated 'ONLINE CLAIM (FORM 31, 19 & 10C)' form.

Step 10: You will be required to enter the Last 4 digits of your registered bank account number and verify the same.

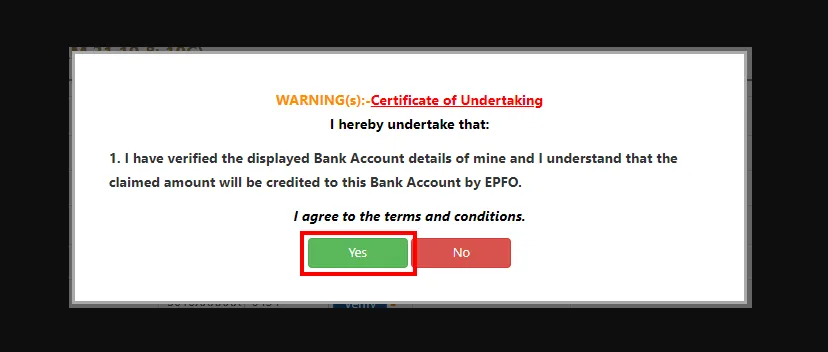

Step 11: After the verification of the bank account, a 'Certificate of Undertaking' will be generated. Click 'Yes' on the certificate pop-up to proceed.

Step 12: Click on the 'Proceed for Online Claim' option when prompted.

Step 13: For online fund withdrawal, select the 'PF ADVANCE (FORM - 31)' option from the drop-down menu provided next to the 'I want to apply for' option.

Step 14: A reason for a claim has to be selected from the drop-down options provided next to the 'Purpose for which advance is required' option. The fields provided for the address of the employee and the amount for an advance are also required to be filled in.

Step 15: Click on the checkbox at the end of the page and submit your withdrawal application.

Step 16: You might be required to upload certain scanned documents (depending on the nature of the withdrawal).

Step 17: Once the employer approves the withdrawal request, the withdrawal amount will be withdrawn from the EPF account and will be deposited to the respective bank account. Once the claim has been settled, you will receive an SMS notification on your registered mobile number.

To ensure the process of making a withdrawal is seamless, subscribers have to meet the requirements that are listed below, if they wish to carry out a withdrawal without the attestation of their employer.

If the withdrawal of your Provident Fund (PF) is delayed, then it may happen due to the exit date not being mentioned. Hence, in order to avoid this, The Employees' Provident Fund Organisation (EPFO) has come up with a facility in the Unified Portal where the employee can enter the date of exit from the previous employer by himself.

Previously, only the employer could enter the exit date, but now even employees can enter the date of exit.

You can change the exit date by logging in to the UAN portal using your Unified Account Number (UAN) and password. However, you must check whether the exit date is mentioned by clicking on 'Service History' under 'View' on the top panel.

Given below are the steps you will have to follow in order to enter the Exit Date:

Step 1: Log in to your UAN portal using your Unified Account Number and Password

Step 2: On the top panel, click on 'Manage' and click on 'Mark Exit' located under it

Step 3: From the drop-down option choose the employer

Step 4: You will be directed to a new page where you will have to enter your date of birth, date of joining, and date of exit. Mention the date of exit as the one mentioned in your resignation letter if your exit date is before the 15th day of the month

You can get tax breaks when you withdraw money from your PF account. This, however, only applies if you withdraw after providing 5 years of continuous service. It is also decided by the tax bracket in which you fall. Tax deducted at source (TDS) or tax will be imposed on your money if you withdraw your PF balance before the end of the 5-year period.

However, no tax will be levied on EPF withdrawals before 5 years in certain cases depending on the situation.They are:

If you want to register any grievance regarding the services provided by the EPFO, you can visit the EPF grievance management system online. In this system, you can file a grievance, send a reminder, check the status of your complaint or grievance, upload your grievance document, or even change your password.

Step 1: You will have to go to the EPFO Grievance Management System and click on 'Register Grievance'.

Step 2: You will then see a grievance registration form. Here, you will have to fill all the required fields accurately.

Step 3: You will need to choose your status from the drop-down option.

Step 4: Next, you will have to key in your PF number, your establishment, the address of establishment, the name of the complainant, contact details, grievance details, etc. You can then enter the captcha code and click 'Submit'.

You can register a grievance when you face issues associated with:

You can file a grievance online and then check its status on the portal itself. In case your complaint is not resolved within the stipulated period of time, you can send a reminder to them by clicking on 'Send Reminder'. Here, you will need to enter your grievance registration number and password (if you have any).

Subscribers can make three different types of PF withdrawals on the EPFO member portal. They are:

Subscribers can make the above-listed withdrawals on the EPFO member portal with the attestation of their employer if they have seeded their Aadhaar card details with their UAN.

Subscribers to the Employees' Provident Fund Organization (EPFO) plan no longer need their employer's permission to make partial or entire withdrawals, thanks to EPFO changes. All the subscriber has to do is make sure their UAN is seeded with their Aadhaar card information. In addition, the EPFO has released the Composite Claims Form, which can be used to request a partial or complete withdrawal. Subscribers can complete the entire withdrawal process online, either through the EPFO member portal or the UAN site.

The PF Withdrawal Claim Forms that must be submitted to withdraw the provident fund or pension fund differ according to the age of the employee, the cause for the claim, and whether or not the employee is still employed. Withdrawals were previously made using Form 19, Form 31, and Form 10C. However, the above-mentioned forms have lately been replaced by a composite claim form. The forms that required the employee's UAN have been replaced by a composite claim form that requires the employee's Aadhaar data.

As mentioned earlier, the PF claim form that needs to be submitted varies based on certain criteria.

1. When an employee is still under service

2. When an employee switches the job

3. When an employee leaves an establishment due to a physical disability

4. When an employee is deceased while in service

5. When an employee is deceased

The situations under which you can go ahead and withdraw money from your EPF while you are still working

IYou can withdraw money from your EPF account to meet the financial requirements of a medical treatment, provided it meets the following conditions:

You can actually withdraw the money in EPF at any given time during the period of your service. It is not needed that you to have completed a specific number of years in the organisation to claim that money. You can always draw the money for treatment purposes, even if you have completed one or two years in your present organisation.

You must also remember that the maximum amount that can be availed by you is your six months' salary. This amount may not be very big, but it will offer you some help that you might need in a crisis situation. Not only can this advantage be taken anytime, but also, it can be enjoyed as many times as you want. Thus, your PF will save you for sure.

Certain documents must be provided by you along with Form 31

Money from your EPF can be withdrawn for an occasion like marriage in case you have already completed seven years of your service life. You can use up to 50 % of the amount that is there in your EPF account, and you can enjoy this advantage for a maximum of three times. So, let us consider that you have around INR 5 lacs in your EPF account. However, you must not calculate the entire amount when you wish to withdraw it for your marriage purposes. Just your own contribution towards EPF along with the interest accumulated on it is supposed to be calculated by you. Applicable cases are as follows.

You can withdraw some money from the EPF when you are planning to purchase a house or construct a house. However, you must understand a few rules first.

If the property that you intend to purchase is in question, then it should first become free from all related disputes. The property must be a registered one and proof of registration must also be provided.

If you have taken a home loan and wish to prepay it, then you may withdraw some amount from your EPF. But to avail this benefit you must have completed ten years of your service. However, you can only avail this advantage once in your entire lifetime. Also, you can either use the EPF for purchasing a house or property or for repayment of your present home loan. You cannot avail money for both of them.

The property for which you are making the payment must be in your name, your spouse's name or jointly held by both of you. Many people have joint home loans with their siblings or parents. In such cases, you will not be able to avail this particular benefit. An amount equivalent to 36 times your monthly salary can be availed from the EPF for the repayment of the existing home loan.

Some money from your EPF can be withdrawn for educational purposes. This advantage can be availed only for post matriculation educational expenditures. This means, if you admit your daughter or son to any university or college then you will be able to draw money from the EPF account. You must complete seven years of your service before you can avail this benefit.

After several years of staying in a house, you might think that it needs some repairs. Some alterations can also be an option that will make things convenient for you. But this is a costly affair and could very well burn a hole in your pocket. You can avail some money from the EPF for this purpose. But first you need to know some rules.

Employees can make withdrawals based on the below-listed circumstances. Listed below are the withdrawal purpose, the minimum service requirement to be eligible to make the withdrawal, the PF withdrawal limit and the relations for whom the employee can make the withdrawal.

PF withdrawal reason | Minimum service | PF Withdrawal Limit | Relations |

House Construction or purchase of plot | 5 years | 24 times the monthly salary for purchasing/36 times the monthly salary for purchase and construction, or the cost of the property or the total of employee and employer's shares with the interest amount, whichever is less | The PF account holder and spouse or joint |

Home Loan Repayment | 3 years | 90% of PF the balance | The PF account holder and spouse or joint |

House renovation or alteration | 5 years from the completion of the construction of a house | 12 times the monthly salary | The PF account holder and spouse or joint |

Marriage | 7 years | 50% of the employee's contribution with interest | The PF account holder, siblings, and children |

Medical treatment | Not required | Employee's share with interest or 6 times the monthly salary, whichever is lower | The PF account holder, parents, spouse, or children |

Contributions from employees as well as employers add to the EPF. However, unlike what is commonly thought to be, the entire portion of contribution from an employer doesn't go exclusively towards the EPF. The division of funds is mentioned as follows -

As per the latest changes made to the EPF rules, the following should be borne in mind -

Complete Withdrawal

EPF can be withdrawn under these cases:

Partial Withdrawal

Partial withdrawal from the EPF account can be made under a few circumstances.

House Construction or purchase of plot | 5 years | 24 times the monthly salary for purchasing/36 times the monthly salary for purchase and construction, or the cost of the property or the total of employee and employer's shares with the interest amount, whichever is less | The PF account holder and spouse or joint |

Home Loan Repayment | 3 years | 90% of PF the balance | The PF account holder and spouse or joint |

House renovation or alteration | 5 years from the completion of the construction of a house | 12 times the monthly salary | The PF account holder and spouse or joint |

Marriage | 7 years | 50% of the employee's contribution with interest | The PF account holder, siblings, and children |

Medical treatment | Not required | Employee's share with interest or 6 times the monthly salary, whichever is lower | The PF account holder, parents, spouse, or children |

Step 1: First, download the Composite Claim Form (Aadhaar)/Composite Claim Form (Non-Aadhaar)

Step 2: Now, use the Composite Claim Form (Aadhaar) if you have entered your bank account details and Aadhaar number on the UAN portal

Step 3: Fill in and then submit the form to the jurisdictional EPFO office without the signature of the employer.

Step 4: You can then use the Composite Claim Form (Non-Aadhaar) if the Aadhaar number has not been entered on the UAN portal.

Step 5: Now, fill in and then submit the form with the employer's attestation to the EPFO office.

Step 1: Go to the UAN portal.

Step 2: Log into the portal with the UAN and password and enter the captcha.

Step 3: Select 'Manage' tab and click on 'KYC' to see if the KYC details like Aadhaar, PAN, and the bank details have been verified or not.

Step 4: After the KYC have been verified, visit the 'Online Services' tab and then choose the 'Claim (Form-31, 19 & 10C)'.

Step 5: You will then see member details, and KYC details and here, enter your bank account number and select 'Verify'.

Step 6: Choose 'Yes' to sign the certificate

Step 7: Select 'Proceed for Online Claim'.

Step 8: In the claim form, choose the claim you require- full EPF settlement, EPF part withdrawal (loan/advance) or pension withdrawal.

Step 9: Choose 'PF Advance (Form 31)'

Step 10: Click on the certificate and submit the application.

Provident Fund Withdrawal via New Form

Step 1: Update your Aadhaar number via the UAN portal

Step 2: Get your Aadhaar authenticated and link it to your UAN

Step 3: Fill in the withdrawal form at the EPF member portal

Step 4: Submit the form and you will receive the withdrawn amount

Provident Fund Withdrawal via Old Form

Step 1: You have to first contact the HR team of the previous employer to get the Form 19 for EPF withdrawal.

Step 2: The form can be downloaded from the EPFO's website

Step 3: Fill in details like employment details, PF account number, IFSC code, and bank account details.

Step 4: You will have to submit the canceled cheque leaf

Step 5: Submit the form to your employer

Step:6: The employer will attest the form

The following documents are required for PF withdrawal:

The fundamental condition for a member to withdraw EPF for house loan repayment is that he or she has worked for three years in a row. Furthermore, the maximum amount that can be taken out for this purpose is 90% of the EPF corpus.

You can withdraw your entire PF corpus only after you retire. You will be allowed to retire only after you are 55 years old. If you retire before you attain this age, you will not be permitted to receive your entire corpus. However, you are entitled to obtain 90% of your EPF corpus 1 year before you retire. You need to note that your age cannot be lower than 54.

If you remove your EPF funds before 5 years, you would be subject to a 10% TDS deduction (if you show your PAN at the time of withdrawal; if you fail to do so, then TDS to be deducted will be at 30 percent ). If you withdraw your EPF after five years of continuous service, however, it is tax-free.

EPF can only be withdrawn in specified circumstances, such as medical illness, the EPF account holder's or his children's wedding, property purchase and/or construction, or retirement.

As per the latest EPFO regulations, individuals who are terminated from their job will be allowed to make a withdrawal of 75% of their accumulated corpus. This can be done 1 month after they are terminated. Earlier, one was not permitted to make a withdrawal post 1 month. If the individual remains unemployed for a tenure of 2 months, then he or she will be allowed to withdraw the other 25% and settle the PF amount completely.

Yes, you can withdraw your PF in parts for emergency situations, which can be medical requirements, house construction, educational needs, etc. The limit for partial withdrawal will depend on your reason. To be eligible for a partial withdrawal, you will need to meet a particular minimum service limit.

The primary reason is that EPFO is a long-term investment programme. It helps members in building a retirement corpus. Hence, it does not allow anybody to withdraw their EPF balance while they are working with an organisation or establishment.

Yes, one can claim their EPF amount without having to go through the EPFO Portal. To do so offline, one will be required to get a Composite Claim Form, fill it in completely and submit the same.

It is absolutely essential for individuals looking to make a partial withdrawal from their EPF account to provide their PAN details. Failure to do so may attract TDS at the rate of 30% or more. However, if PAN is provided, the rate of TDS applicable shall be 10%.

Only when it is withdrawn after an employment tenure of 5 years, EPF will be exempt from tax. That is not the case if the withdrawal is made before one completes a service period of 5 years. In the latter case, the amount being withdrawn will be taxed. The purpose that Form 15G/H serves is that it saves one from having TDS deducted from their EPF withdrawal amount.

If you have provided 5 years of continuous service with an establishment and with your PF account, then you can enjoy a tax exemption on your EPF withdrawal. However, if you withdraw before you give 5 years of uninterrupted service, you will then be required to pay taxes on the withdrawn amount.

No, you do not need to get consent from your employer in order to withdraw your EPF amount. You can go ahead with the withdrawal process directly from the EPFO. However, your Aadhaar and UAN need to be linked, and should be authorised by your employer compulsorily. Once the Aadhaar and UAN have been authenticated accurately, the EPFO member will receive the funds directly from the EPFO.

If you are employed currently and your current organisation has opened a new PF account for you that is linked to your previous organisation's UAN, you won't be eligible to withdraw your PF balance accrued with your previous employer. In this case, it is recommended that you transfer your previous employer's EPF balance to the new account. This can be done easily with the help of the EPF Member e-Sewa Portal. Log in to the portal, go to the tab labelled 'Online Services' and click. Next you will see a drop-down menu from which you must locate and click on the option labelled "One Member-One EPF Account (Transfer Request)". Please also note that if you remain unemployed for a period of over two months, you will be eligible to claim your entire EPF balance after filling up and submitting Form 19.

To avoid tax deductions, a PAN is essential when withdrawing or settling EPF funds. Tax deducted at source (TDS) might be as high as 30% if you fail to submit your PAN.

If you don't want to use the internet platform, you can fill out the EPF withdrawal form on paper. If you want to use the online option, go to the EPF member portal and log in with your UAN and password.

You do not need to seek verification from your employer if you apply for EPF withdrawal online. You must also have your PAN and Aadhaar connected to your UAN account in order to claim withdrawals online.

The Employees' Provident Funds Organisation (EPFO) has raised the threshold for auto claims processing under Paragraph 68J to Rs. 1 lakh from the previous Rs. 50,000, as outlined in a circular issued on 16 April 2024. This enhancement, effective from 10 April 2024, allows EPF subscribers to seek advances for medical expenses, both for themselves and their dependents, under Paragraph 68-J of the EPF Scheme. Such advances can be requested in specific situations, such as extended hospitalisation, major surgeries, or medical conditions like TB, leprosy, and cancer, among others, without the need for additional documents like proforma or medical certificates. Furthermore, physically impaired members can apply for advances under Paragraph 68-N to procure equipment to alleviate their hardship.

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2025 BankBazaar.com.