Labour & Service

Govt Institutions Should Not Mirror Gig Economy Trends By Misusing Temporary Employment Contracts: Supreme Court

The rise of the gig economy in the private sector has led to an increase in precarious employment arrangements, observed the Supreme Court in a recent judgment while advising the government departments from misusing the practice of engaging temporary workers.A bench comprising Justice Vikram Nath and Justice Prasanna B Varale appealed to the Government departments from adopting the detrimental practices found in the gig economy. The bench made these remarks while allowing the regularization of...

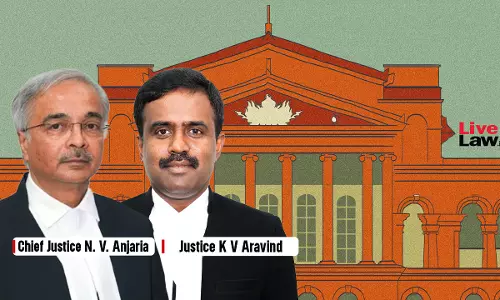

Employers Not Outsiders But Stakeholders, Must Be Heard While Fixing/Revising Minimum Wage Of Employees: Karnataka High Court

The Karnataka High Court has said that while fixing or revising the Minimum Wages to be paid to employees, employers which is a stakeholder and which will be affected in the exercise, should have their say and the stand before the notification is passed by the Government.A division bench of Chief Justice N V Anjaria and Justice K V Aravind while allowing the appeal filed by employers associations including the Karnataka Employers Association and others, challenging a single judge order...

'Resignation During Pendency Of Inquiry Or Investigation Is Generally Not Accepted', Delhi High Court

A Division Bench of the Delhi High Court comprising Justices Navin Chawla and Shalinder Kaur while dismissing the Petition of an Army Officer held that resignation during the pendency of inquiry or investigation could generally not be accepted regardless of whether the Petitioner was suspended or not. Observing that being unauthorizedly absent from duty reflect poorly on the...

Working For 240 days, Workmen Should Prove And Not Employer; Rajasthan HC Upholds Workman's Termination

A single judge bench of the Rajasthan High Court comprising of Justice Sudesh Bansal, held that an adverse inference can't be drawn against employer for non-production of record against workman's service period, it is upon the workman to prove their service period of 240 days preceding termination of service. Background Facts The workman was appointed as Watchman by...

Employee Of Aided Schools Can Directly Recover Grant In Aid From The State Government : Rajasthan High Court

A single judge bench of the Rajasthan High Court, comprising of Justice Sudesh Bansal held that the grant-in-aid can be sanctioned and paid directly by the State Government to the employees of the aided educational institutions. Background Facts The petitioner was an aided institution where respondent-Employee was appointed on a sanctioned and aided post. The Rajasthan...

Governor Has Discretion To Not Consult With Public Service Commission Under Sikkim Government Servants' (Discipline & Appeal) Rules, 1985: Sikkim High Court

Sikkim High Court: A single judge bench of Justice Bhaskar Raj Pradhan quashed a government order withdrawing retirement benefits of a dismissed government officer. It held that the procedure under Rule 11 of the Sikkim Government Servants' (Discipline & Appeal) Rules, 1985 (“Discipline & Appeal Rules”) was not followed. It explained that the government cannot modify a...

Can Only Invoke Section 33C(2), ID Act, For Computation Of Pre-Existing Benefits; Not To Decide New Issues: P&H HC

Punjab and Haryana High Court: A single judge bench consisting of Justice Jagmohan Bansal struck down the order of the Labour Court that ordered payment of overtime wages to a pump operator. The workman filed a claim under Section 33C(2) of the Industrial Disputes Act, 1947 (“ID Act”) stating that he had worked for 12 hours a day for almost a decade, but was paid only for 8 hours....

Delayed Payment Of Gratuity, Employer Liable To Pay 10% Interest As Per Central Government Notification : Jharkhand HC

A single judge bench of the Jharkhand High Court comprising of Justice Anubha Rawat Choudhary held that employers are liable to pay interest at 10% rate if they delay in payment of gratuity, as per the notification issued by the Central Government in consonance with Section 7 (3-A) of the Payment of Gratuity Act, 1972. Background Facts The respondent employee was working for the...

'Employee Is Entitled To Medical Reimbursement In Case Of Emergency Even If Hospital Isn't Empanelled Under Any Scheme', Delhi High Court

A Single Judge Bench of the Delhi High Court comprising Justice Jyoti Singh held that the Petitioner was entitled to claim medical reimbursement even if the hospital was not the one empanelled under CGHS in case the admission to such hospital was done during an emergency. The Bench held that the Petitioner could not be denied reimbursement as she was severely injured and could not...

Employee's Compensation Act, 1923; To Absolve Liability, Insurer Must Prove Negligence By Employer In Verifying Employee's Driving License: Bombay High Court

Bombay High Court: A single judge bench consisting of Justice Nitin B. Suryawanshi overturned a Labour Court order that dismissed a compensation claim under the Employee's Compensation Act, 1923. The claim was filed by the family of a truck driver who succumbed to an accident at work. The court established that the deceased was indeed employed by the Respondent. Further, it refused...

Special Allowance For Bank Employees On Deputation Cannot Be Excluded From Pay Fixation: Bombay HC

Bombay High Court: Justices Mangesh S. Patil and Prafulla S. Khubalkar ruled that employees of nationalized banks deputed to Debts Recovery Tribunals (DRTs) are entitled to include “special allowance” for the purpose of fixation. The court quashed part of a 2020 government communication that excluded the allowance from pay fixation. It held that the 2020 communication...