Get the free tiaa cref f11254 form - tiaa-cref

Show details

You may also enroll online at www. tiaa-cref.org/iras. If your Traditional IRA accumulation includes after-tax contributions they cannot be rolled over to another qualified plan. Please call us at 800 842-2252 to discuss your options for after-tax contributions. TAXTD/OTCPAYXFR F11254 7/14 Page 1 of 3 If you claim residence AND citizenship outside the U.S. you must complete Form W-8BEN in addition to this form to certify your foreign tax status. ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tiaa cref f11254 form

Edit your tiaa cref f11254 form form online

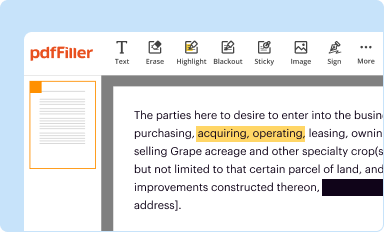

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tiaa cref f11254 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tiaa cref f11254 form online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tiaa cref f11254 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out tiaa cref f11254 form

How to fill out tiaa cref f11254 form?

01

Start by reading the instructions provided with the form. This will give you a clear understanding of the information required and how to fill it out correctly.

02

Gather all the necessary documents and information needed to complete the form. This may include personal identification, financial details, and any supporting documentation required.

03

Begin by entering your personal information such as your name, address, Social Security number, and contact information. Make sure to double-check the accuracy of this information.

04

Complete the sections related to your employment, retirement plans, and any other relevant financial information. Provide accurate and up-to-date information as requested.

05

If there are any additional sections or questions on the form, make sure to answer them thoroughly and accurately. It is important to provide all the necessary information to ensure your form is properly processed.

06

Review the completed form to ensure all the information is accurate and legible. Check for any errors or missing information that may need to be corrected.

07

Sign and date the form as required. Failure to sign the form may result in it being considered incomplete or invalid.

08

Make a photocopy of the completed form for your records before submitting it to the appropriate recipient. Keep a copy for your reference.

09

If there are any additional steps or requirements after submitting the form, follow the instructions provided or contact the appropriate party for further guidance.

Who needs tiaa cref f11254 form?

01

Individuals who are enrolled in or contributing to a retirement plan with TIAA CREF may be required to fill out the f11254 form.

02

Employers or plan administrators who need to collect specific information from participants in TIAA CREF retirement plans may request the completion of this form.

03

It is important to check with your employer or plan administrator to determine if you are required to fill out the tiaa cref f11254 form. They will provide guidance on when and how to submit the form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tiaa cref f11254 form online?

pdfFiller has made filling out and eSigning tiaa cref f11254 form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I edit tiaa cref f11254 form on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing tiaa cref f11254 form, you need to install and log in to the app.

How do I fill out the tiaa cref f11254 form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign tiaa cref f11254 form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

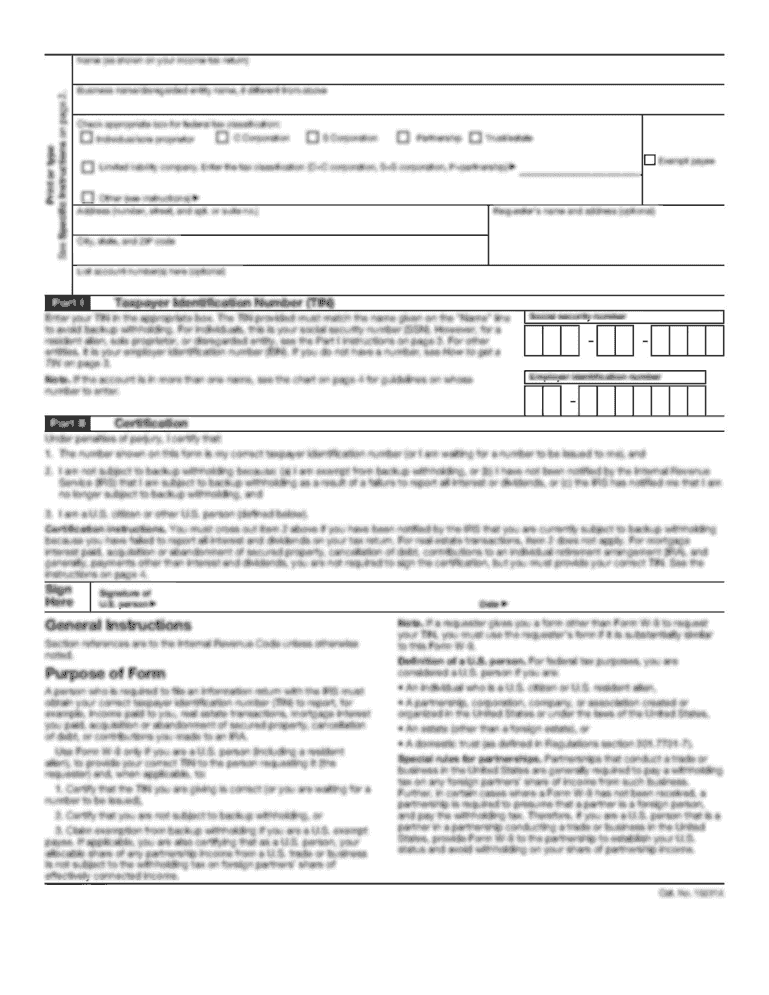

What is tiaa cref f11254 form?

The TIAA CREF F11254 form is a financial reporting form used by TIAA CREF to collect information about their clients' investment and retirement accounts.

Who is required to file tiaa cref f11254 form?

Individuals who have investment or retirement accounts with TIAA CREF are required to file the TIAA CREF F11254 form.

How to fill out tiaa cref f11254 form?

To fill out the TIAA CREF F11254 form, you need to provide your personal information, account details, and any other requested financial information. The form can be completed online or by mail.

What is the purpose of tiaa cref f11254 form?

The purpose of the TIAA CREF F11254 form is to gather financial information from TIAA CREF clients in order to assess their investment and retirement accounts.

What information must be reported on tiaa cref f11254 form?

The TIAA CREF F11254 form requires you to report your personal information (such as name, address, and social security number), account details (such as account number and balances), and any other requested financial information.

Fill out your tiaa cref f11254 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tiaa Cref f11254 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.