Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

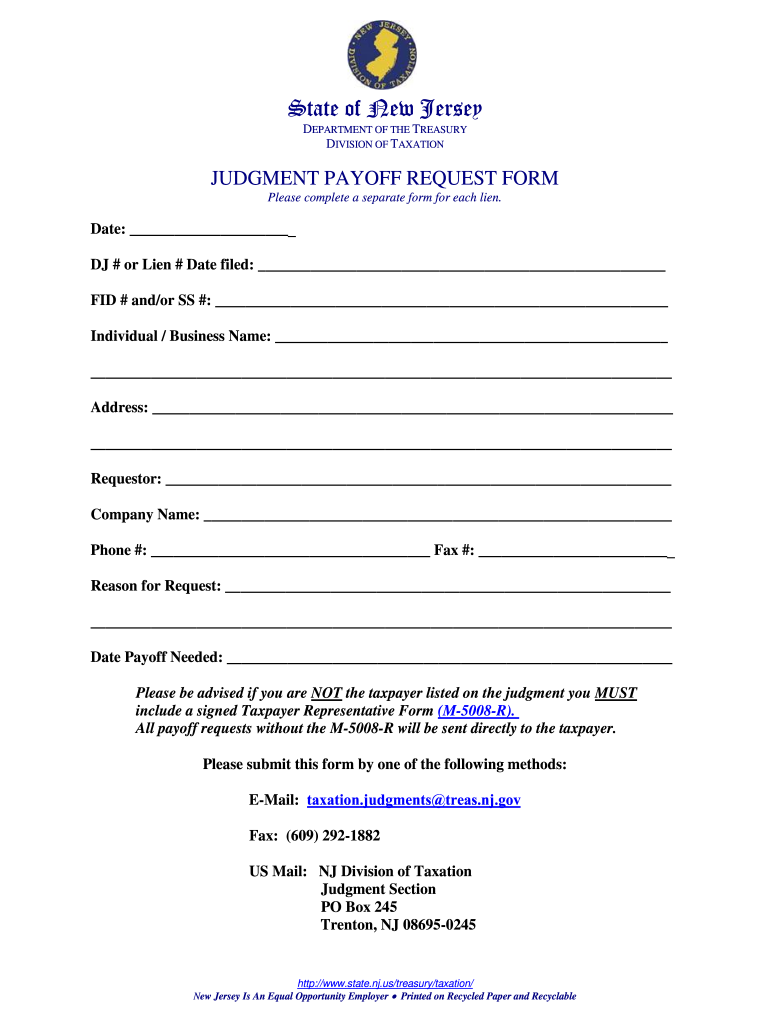

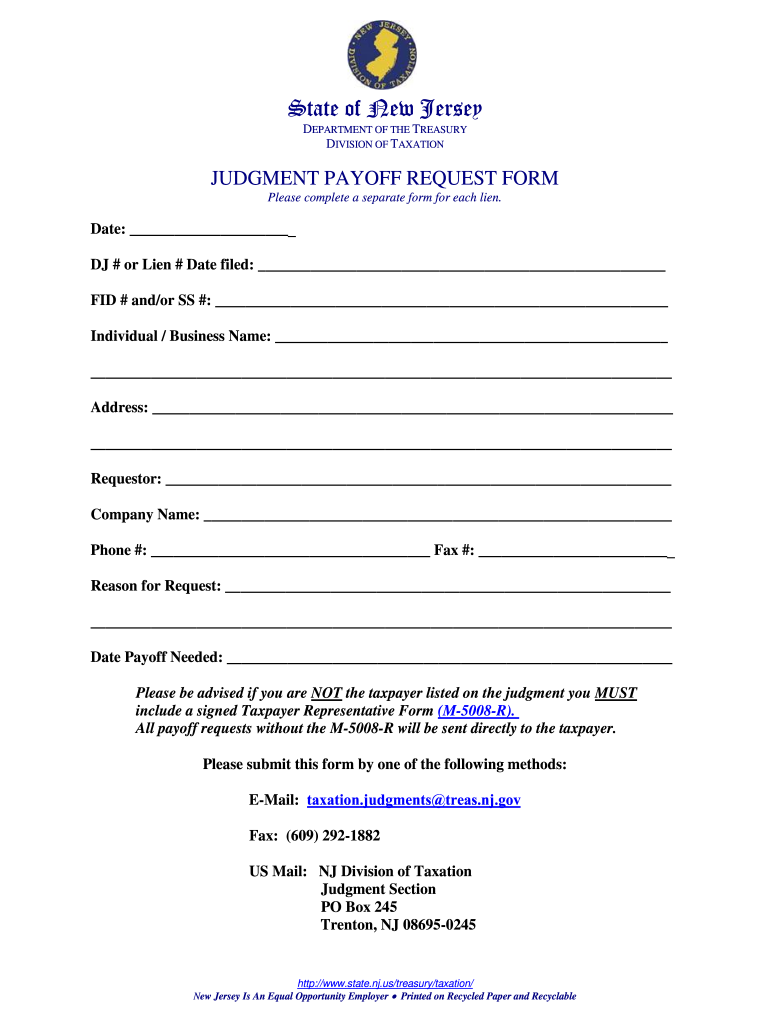

What is judgement payoff letter?

A judgment payoff letter is a legal document that confirms the amount of money required to satisfy or pay off an outstanding judgment. This letter is typically sent by the creditor (the party to whom the judgment is owed) to the debtor (the party who owes the judgment) and outlines the full amount due, including any interest or additional fees that may have accrued since the judgment was initially rendered. Once the debtor receives and pays the amount stated in the judgment payoff letter, the creditor will consider the debt fully satisfied, and the judgment will be marked as paid in full.

Who is required to file judgement payoff letter?

The party required to file a judgment payoff letter may vary depending on the jurisdiction and specific circumstances of the case. In general, it is typically the responsibility of the party who obtained the judgment, also known as the judgment creditor, to file the judgment payoff letter. This letter provides confirmation that the judgment has been fully satisfied, including any outstanding debts or liabilities owed by the judgment debtor. However, it is advisable to consult with an attorney or legal professional familiar with local laws and procedures to ensure compliance with specific requirements.

What is the purpose of judgement payoff letter?

The purpose of a judgment payoff letter is to provide confirmation that a judgment has been satisfied or settled. It is typically issued by the party who obtained the judgment (the creditor) to the party against whom the judgment was made (the debtor). The letter states that the debt has either been paid in full or settled for an agreed-upon amount, and it releases the debtor from any further liability related to the judgment. The judgment payoff letter is crucial to ensure that the debtor's credit report and public records are updated to reflect the satisfaction of the judgment, which can be important for future credit and financial transactions.

What is the penalty for the late filing of judgement payoff letter?

The penalty for late filing of a judgment payoff letter may vary depending on the jurisdiction and the specific circumstances of the case. In some cases, there may be specific provisions or penalties outlined in the court rules or local laws regarding the late filing of such a document.

Typically, the penalties for late filing can include fines, sanctions imposed by the court, or negative consequences for the party responsible for the delay. These consequences might include a delay in the resolution of the case, potential dismissal of the case, or adverse rulings by the court.

It is essential to consult with a legal professional familiar with the laws and rules of the jurisdiction in question for accurate and appropriate information regarding the penalties for late filing of a judgment payoff letter in a specific case.

What information must be reported on judgement payoff letter?

A judgement payoff letter typically includes the following information:

1. Case details: The letter should include information about the court case, such as the case number, court name, and the parties involved.

2. Judgement details: It should outline the details of the judgement, including the amount owed, the interest rate, and any additional fees or costs associated with the judgement.

3. Payment terms: The letter should specify the terms of payment, such as the total amount due, the due date, and any acceptable payment methods.

4. Contact information: The letter should provide contact information for the creditor or their authorized representative, including their name, address, phone number, and email address. This allows the debtor to easily get in touch if they have any questions or concerns.

5. Confirmation of payment: The letter should state that once the payment is received, the creditor will provide a written confirmation of payment and release of the judgement lien.

6. Deadline for response: If there is a specific deadline for payment or response, it should be clearly stated in the letter.

7. Instructions for payment: The letter should provide instructions on how to make the payment, including the payment address, any forms that need to be included, and whether the payment should be made by check, money order, or electronic payment.

Note: The specific information required in a judgement payoff letter may vary depending on the jurisdiction and the particular circumstances of the case. It is always recommended to consult with an attorney or legal professional for guidance on the specific requirements in your jurisdiction.

How to fill out judgement payoff letter?

When filling out a judgment payoff letter, you will typically follow a specific structure and include necessary information. Here is a step-by-step guide on how to fill out a judgment payoff letter:

1. Begin with the heading: At the top of the letter, include your name and contact information (address, phone number, email).

2. Add the date: Below your contact information, include the date when you are writing the letter.

3. Include the recipient's information: Below the date, mention the name, address, and contact information of the recipient. This is typically the judgment creditor (the person or entity that is owed money).

4. Start with a salutation: Address the recipient formally using "Dear [Recipient's Name]."

5. State the purpose of the letter: Begin the letter's body by explicitly stating that the purpose is to provide the judgment payoff amount. For example, you can write, "I am writing to inquire about the total amount required to satisfy the judgment owed on [case or judgment number]."

6. Specify the judgment details: Include relevant information about the judgment, such as the case or judgment number, the court where the judgment was issued, and the date of the judgment.

7. Request a payoff statement: Ask the judgment creditor to provide you with an official payoff statement that includes all outstanding balances, including principal, interest, and any applicable fees. You can write, "Please provide an itemized payoff statement indicating the total amount due, including any accrued interest or fees."

8. Provide your contact information: Reiterate your contact details and request the recipient to communicate the payoff instructions or statement using your preferred method (email, phone, or mail). For example, you can write, "Please send the payoff statement to my email address provided above or contact me through the phone number provided."

9. Express willingness for prompt payment: Assure the recipient that you are willing and prepared to make a prompt payment upon receiving the payoff statement. You can write, "Upon receiving the requested payoff statement, I will make immediate arrangements to settle the judgment in full."

10. Thank the recipient: Conclude the letter by thanking the recipient for their assistance, cooperation, and prompt attention to your request. For example, you can write, "Thank you for your attention to this matter, and I greatly appreciate your assistance in facilitating the resolution of this judgment."

11. End the letter with a closing and sign-off: Use an appropriate closing, such as "Sincerely" or "Best regards," followed by your full name and signature.

Once completed, review the letter for accuracy, proofread it, and make copies for your records before sending it to the judgment creditor.

How can I send judgment payoff form for eSignature?

When you're ready to share your judgment payoff form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for the judgment payoff form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your judgment payoff form.

How can I fill out judgment payoff form on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your judgment payoff form. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.