CT 403(b) Salary Reduction Agreement 2018-2024 free printable template

Show details

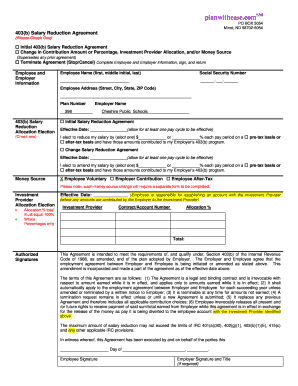

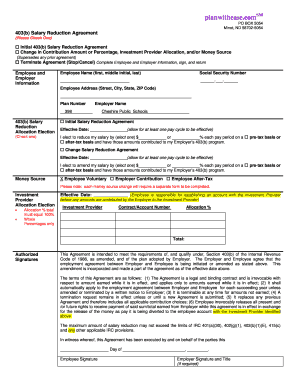

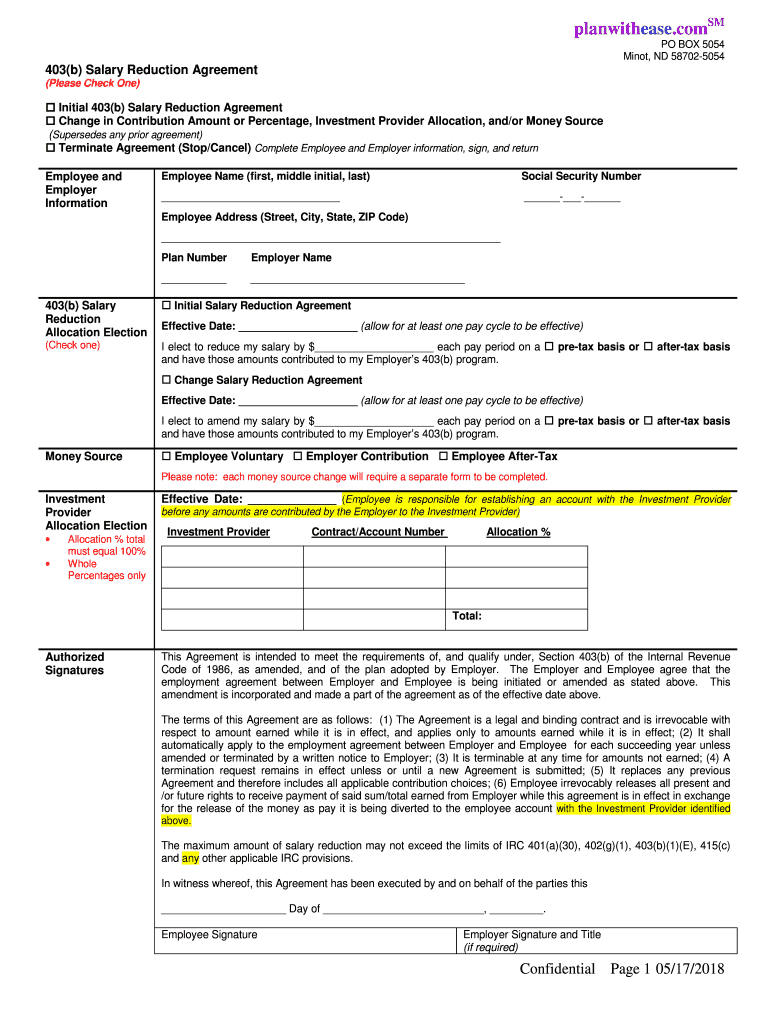

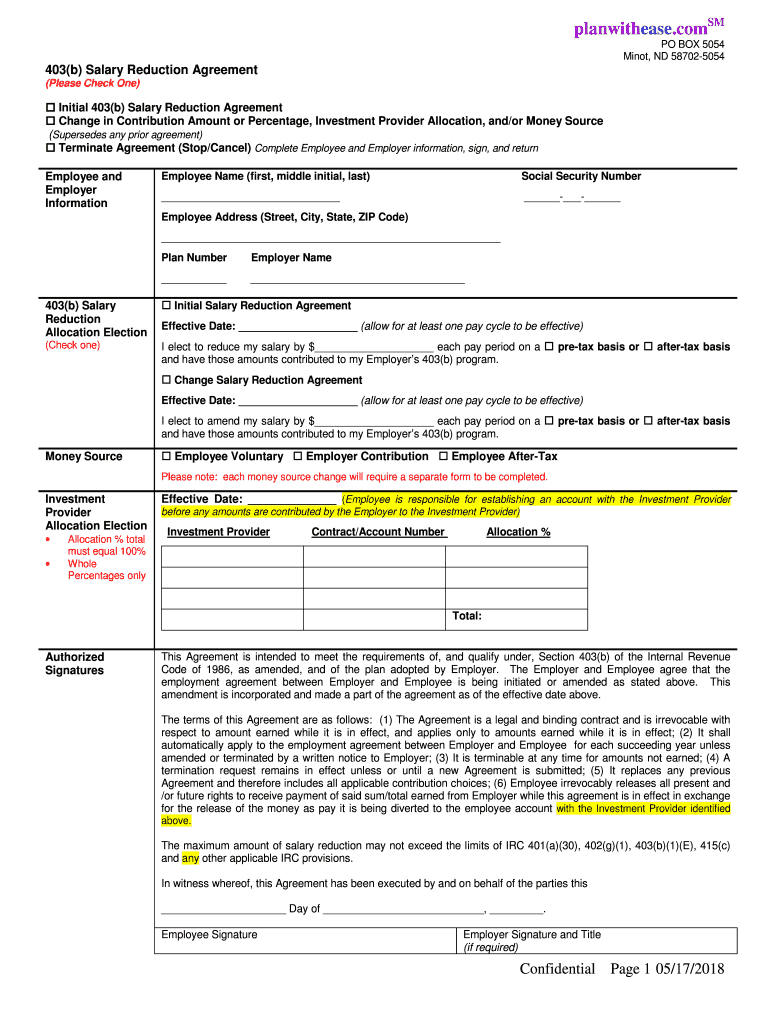

Planwithease.comm PO BOX 5054 Minot, ND 587025054403(b) Salary Reduction Agreement (Please Check One) Initial 403(b) Salary Reduction Agreement Change in Contribution Amount or Percentage, Investment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign plan with ease form

Edit your planwithease form online

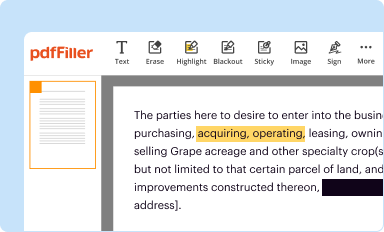

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your plan with ease salary reduction agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing plan with ease form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit plan with ease form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

How to fill out plan with ease form

01

To fill out a plan with ease salary, first gather all the necessary financial information such as income, expenses, and financial goals.

02

Create a budget by categorizing your expenses into fixed (such as rent or mortgage payments) and variable (such as groceries or entertainment expenses).

03

Prioritize your financial goals by determining what is most important to you, whether it is saving for retirement, paying off debt, or investing in a new business venture.

04

Allocate a portion of your salary towards each goal based on its importance and feasibility. This may involve making sacrifices or adjusting your spending habits.

05

Continuously track your expenses and income to ensure that you are staying on track with your plan. Use budgeting apps, spreadsheets, or simple pen and paper to monitor your financial progress.

06

Regularly review and adjust your plan as your financial situation changes. Life circumstances, income fluctuations or unexpected expenses may require you to modify your budget or reprioritize your goals.

Who needs a plan with ease salary?

01

Individuals who want to take control of their finances and be more mindful of their spending can benefit from a plan with ease salary.

02

People who are looking to achieve specific financial goals, such as saving for a down payment on a home, paying off student loans, or starting a business, can use a plan with ease salary to allocate their income towards these objectives.

03

Anyone who wants to reduce financial stress and have a clearer understanding of their financial situation can benefit from a plan with ease salary. It provides a roadmap for managing money and can help individuals make more informed financial decisions.

Fill form : Try Risk Free

People Also Ask about

What is an SRA form?

The Salary Reduction Agreement (SRA) is utilized to establish, change, or cancel salary reductions withheld from your paycheck and contributed to the 403(b) Plan on your behalf. The SRA is also used to change the investment providers that receive your contributions.

Is a salary reduction Plan the same as a 401k?

A salary reduction plan helps workers save and invest for retirement through their employer via several types of retirement accounts. Money is typically deposited in a retirement account such as a 401k, 403b, or SIMPLE IRA on a pre-tax basis through recurring deferrals (a.k.a. contributions) on behalf of the employee.

What is the meaning of salary reduction?

A pay cut is a reduction in an employee's salary. Pay cuts are often made to reduce layoffs while saving the company money during a difficult economic period. A pay cut may be temporary or permanent, and may or may not come with a reduction in responsibilities.

What is the difference between a salary reduction and a salary deduction?

Salary Reductions vs. A reduction may occur when a business is instituting cost-cutting measures, when an employee reduces their working hours, or when an employee changes roles. A salary deduction is a set amount that is deducted from an employee's monthly salary.

What is a salary reduction?

Salary Reductions are an agreement between employee and employer to reduce Employee's salary and direct the amount reduced to the investment account that the employee has established on a pre-tax basis.

Do I have to accept a salary reduction?

Workers must be paid their agreed salaries for the work that they have already performed. This means that employers are required to notify their workers when they intend to reduce their pay, and the employees must either agree to the reductions or quit their jobs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of plan with ease salary?

Plan with ease salary is a tool that helps companies streamline their payroll processes. It enables the employer to easily calculate employee salaries, review payroll data, and manage payroll taxes and deductions. It also helps employers to design comprehensive benefit plans for their employees, and track employee performance.

When is the deadline to file plan with ease salary in 2023?

The deadline for filing Plan with Ease salary is April 15, 2023.

What information must be reported on plan with ease salary?

When reporting the salary information on a Plan with Ease, the following details must be included:

1. Employee Name: The full name of the employee for whom the salary is being reported.

2. Salary Amount: The specific dollar amount paid to the employee for a given period (e.g., monthly, annually).

3. Salary Frequency: The frequency at which the employee is paid, such as weekly, bi-weekly, or monthly.

4. Pay Period: The specific time period covered by the salary payment, such as the dates from which the salary is calculated.

5. Deductions: Any deductions or withholdings from the employee's salary, such as taxes, insurance premiums, retirement contributions, or other authorized deductions.

6. Gross Salary: The total salary amount before any deductions or withholdings are applied.

7. Net Salary: The remaining amount after deducting all necessary taxes and other deductions from the gross salary.

8. YTD (Year-to-Date) Earnings: The total salary earned by the employee from the beginning of the current calendar year until the current pay period.

9. Employer Contributions: If any additional contributions or benefits are provided by the employer, such as retirement matching funds or healthcare contributions, those should be separately reported.

10. Supplemental Compensation: Any additional compensation or bonuses paid to the employee on top of their regular salary, should be specified separately.

It's important to note that specific reporting requirements may vary depending on the laws and regulations of the country, state, or company policies.

What is plan with ease salary?

A salary plan with ease typically refers to a compensation structure designed to make it easier for employees to understand and manage their earnings. It may include several components such as a base salary, bonuses, commissions, or other incentives. The goal of such a plan is to provide clarity and transparency to employees about how their salary is determined and to ensure a fair and competitive pay structure within the organization.

Who is required to file plan with ease salary?

It is not clear what "ease salary" refers to. However, if you are referring to filing tax returns or a financial plan, it is typically required for individuals and businesses with a certain income level or financial complexity. The specific requirements vary by country and jurisdiction. It is recommended to consult a tax professional or financial advisor for more accurate information based on your specific situation.

How to fill out plan with ease salary?

To fill out a plan with ease salary, follow these steps:

1. Start by calculating your total monthly salary. This includes all sources of income, such as your employment salary, side hustle income, investment returns, or any other sources.

2. Make a list of all your fixed monthly expenses. These are expenses that remain constant every month, such as rent/mortgage payment, utility bills, insurance premiums, loan repayments, etc.

3. Deduct your fixed monthly expenses from your total monthly salary. This will give you the remaining amount, which is your discretionary income.

4. Identify your financial goals and prioritize them. These could include saving for emergencies, paying off debt, saving for retirement, or any other specific goals you may have.

5. Allocate a portion of your discretionary income towards each of your financial goals. Determine how much you can comfortably save or contribute towards each goal every month.

6. Review your discretionary spending and categorize them as variable expenses. These expenses may include groceries, dining out, entertainment, shopping, etc.

7. Set a realistic and reasonable budget for your variable expenses. Consider your lifestyle and prioritize areas where you can cut down unnecessary spending without sacrificing your quality of life.

8. Stick to your budget and track your expenses regularly. This will help you stay on track and make adjustments wherever necessary.

9. Revisit your financial plan periodically to reassess your goals, evaluate progress, and make any necessary adjustments to your budget.

10. Consider automating your savings and bill payments to ensure consistency in saving and avoiding any late-payment fees.

Remember, creating a plan with ease salary requires discipline and consistency. It's important to regularly review your plan and make adjustments as needed to ensure your financial goals are being met.

How can I send plan with ease form for eSignature?

Once your plan with ease form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit plan with ease form in Chrome?

Install the pdfFiller Google Chrome Extension to edit plan with ease form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the plan with ease form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your plan with ease form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your plan with ease form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Plan With Ease Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.