Get the free Arizona state income tax 2023

Show details

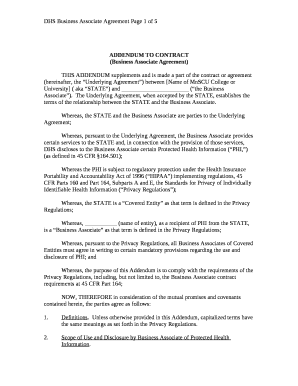

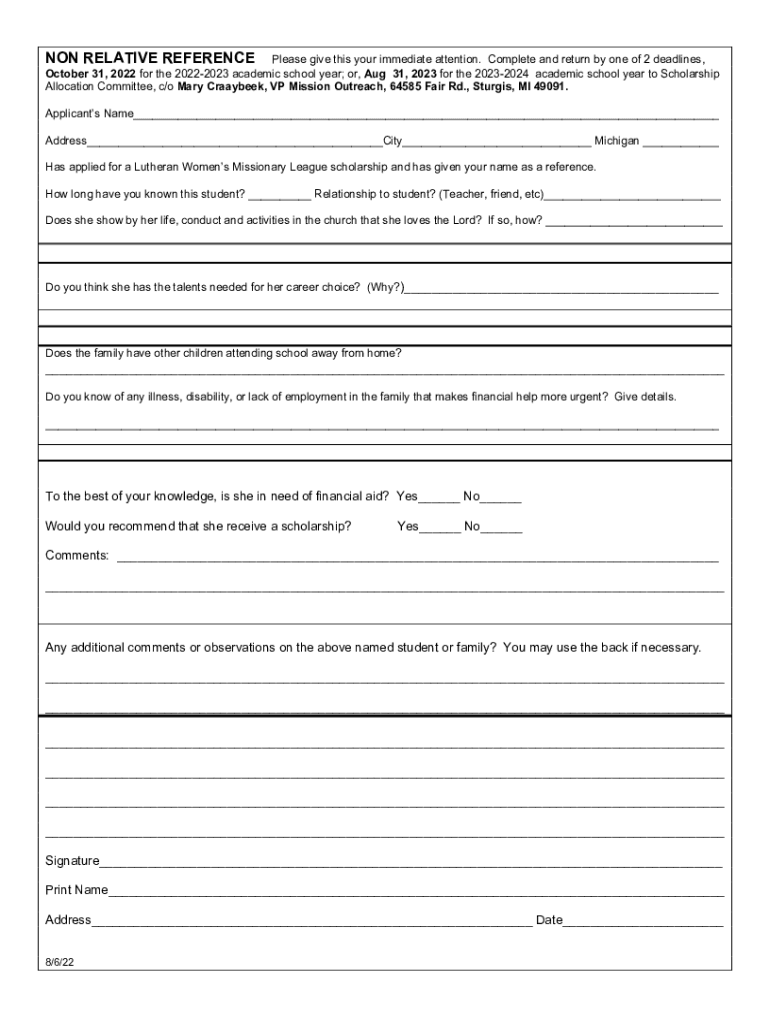

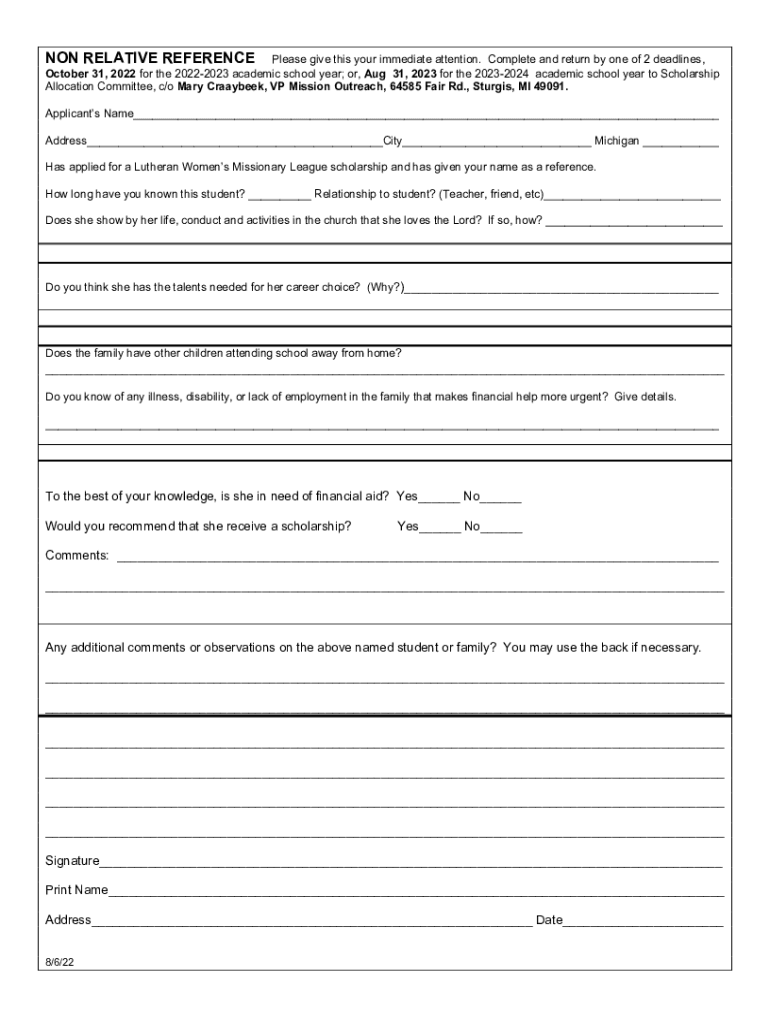

NON-RELATIVE REFERENCEPlease give this your immediate attention. Complete and return by one of 2 deadlines, October 31, 2022, for the 20222023 academic school year; or, Aug 31, 2023 for the 20232024

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign arizona state income tax

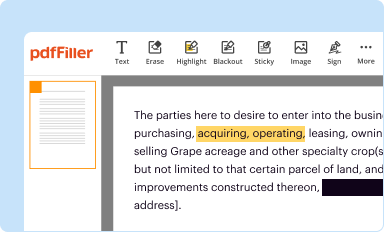

Edit your arizona state income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

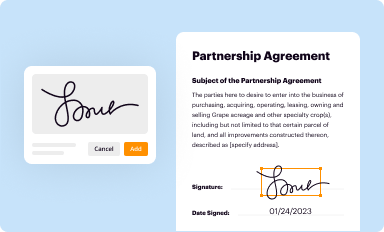

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

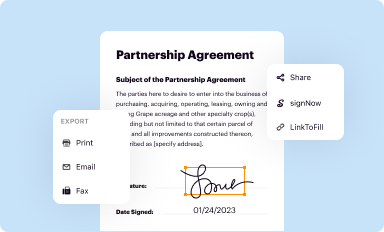

Share your form instantly

Email, fax, or share your arizona state income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit arizona state income tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit arizona state income tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out arizona state income tax

How to fill out arizona state income tax

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other income statements.

02

Obtain the Arizona state income tax form, which can be found on the Arizona Department of Revenue website.

03

Fill out the form accurately, making sure to include all sources of income and any deductions or credits you may qualify for.

04

Double-check your information for accuracy and completeness.

05

Submit the completed form either electronically or by mail before the deadline.

Who needs arizona state income tax?

01

Residents of Arizona who earn income during the tax year are required to file an Arizona state income tax return.

02

Non-residents who earn income in Arizona may also be required to file an Arizona state income tax return, depending on their specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my arizona state income tax directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your arizona state income tax and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find arizona state income tax?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific arizona state income tax and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my arizona state income tax in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your arizona state income tax and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is arizona state income tax?

Arizona state income tax is a tax imposed on individuals' and businesses' income by the state of Arizona.

Who is required to file arizona state income tax?

Individuals and businesses who earn income in Arizona are required to file Arizona state income tax.

How to fill out arizona state income tax?

To fill out Arizona state income tax, individuals and businesses can use online tax filing platforms, paper forms, or seek assistance from tax professionals.

What is the purpose of arizona state income tax?

The purpose of Arizona state income tax is to fund state government operations and services, such as education, healthcare, and infrastructure.

What information must be reported on arizona state income tax?

Information such as income earned, deductions, credits, and any other relevant financial details must be reported on Arizona state income tax.

Fill out your arizona state income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona State Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.