Preprint

Article

Evaluation Singapore’s Sustainability Reporting Alignment with the IFRS S1 Standards

Altmetrics

Downloads

144

Views

106

Comments

0

This version is not peer-reviewed

Submitted:

03 September 2024

Posted:

03 September 2024

You are already at the latest version

Alerts

Abstract

This study assesses the alignment of Singaporean companies’ sustainability reporting with the newly introduced International Financial Reporting Standard S1, a global framework for sustainability-related financial disclosures. Given Singapore’s role as a major financial hub, understanding the extent to which local companies comply with this standard is critical to promoting transparency and accountability in sustainability practices. The study was conducted in two phases: the first phase was to summarize the timing of different countries’ preparations for the implementation of the IFRS S1 standard, as well as their attitudes. The second phase was a content analysis of the sustainability reports of 70 listed companies. The findings show that while companies are generally proactive in reporting governance, strategy, and metrics, they fall short in risk management disclosure, which is an important requirement of IFRS S1. This gap highlights the challenges companies face in incorporating comprehensive risk management practices into sustainability reporting. This study provides a reference for improving future sustainability reporting and encourages companies to align more closely with IFRS S1 to meet investors’ growing demand for transparent and standardized sustainability disclosures.

Keywords:

Subject: Environmental and Earth Sciences - Sustainable Science and Technology

1. Introduction

Sustainable development concept was first introduced in 1987 by the Word Commission on Environment and Development (also called Brundtland Commission) and describe how it can be achieved. Based on this commission’s reporting, the sustainable development means that needs of the present without compromising the ability of future generations to meet their own goal [1]. Sustainability refers to the ability to maintain or improve certain essential processes, systems, and activities over the long term without depleting resources or causing harm to the environment [2]. Sustainability is an important ability for preserving the Earth and natural resources so that they could be available for our next generation. And for business, sustainability refers to evaluating economic expectations and environmental and social sensitivities in a balanced manner [3]. Over the past few decades, sustainable development has attracted worldwide attention, and all over the world’s main country and governments have made sustainability as one of their main agendas and are committee to achieve a more sustainable development path, and for which they have set a various goals and targets. The 17 Sustainable Developments were introduced by Union Nations (UN) in 2015, the agenda is committed to build partnerships with global reach to address social, economic, and environments issues and promote sustainable development [4]. As a universal call to action, its aims to eradicate poverty, protect environments and ensure by 2030 all people could get the opportunity to enjoy peace and prosperity. The SDGs reflect the realization that global sustainable development must harmonize economic growth, social well-being and environmental protection [5].

Environmental, social and governance (ESG) is a framework with three broad categories used to assess an organization's business practices and performance on various sustainability and ethical issues [6]. A company's social, environmental and governance practices are of great significance to its stakeholders [7], and a lot of organizations as well as public believe that focus on and reporting of ESG related information and data as a corporate social responsibility [8]. And acknowledging the importance of focusing on and reporting ESG related information as an essential way to achieve corporate social responsibility [9]. ESG disclosure can help company improving internal operational efficiency, technological innovation and long-term value creation. Corresponding, businesses play a crucial role in achieving sustainability goals, because their use of advanced technologies, global reach, and capacity to develop large-scale solutions, all of which are essential achieving sustainability efforts [10]. Additionally, the challenges encountered by businesses in pursuing sustainable development can contribute to the establishment of standards and frameworks. Currently, sustainability reporting has become an essential tool for businesses to disclose information about their ESG performance[11]. Sustainability reporting has been increasingly adopted by corporations worldwide given the demand of stakeholders for greater transparency on both environmental and social issues[12]. Sustainability reporting is an essential part of the fiscal year reporting of modern corporate, which reflecting the awareness of the need to operate sustainability and disclose the stakeholder or public with information about economic, environment, social, and governance (ESG) performance of corporate business activities[13]. Another reason for increasing development of sustainability reporting is that due to the government legal requirements and public have demand greater transparency and information on sustainability and ESG issues. Responding to those demand, according to the statistical data form KPMG’s reports approximated 79% of N100 companies worldwide in 2022 reported on sustainability and show their performance on sustainable development, and the rate up to 96% for G250 company [14]. It is obvious that more companies are willing to take responsibility to contribute to sustainable development based on the growing consumer demand for a more sustainability future, regulation requirements as well as companies have realized a that sustainable development will be aligned with long-term business success.

And active auditing of sustainability-related information contributes to its credibility and has far-reaching positive impacts on the company [15]. However, the lack of a harmonized and standardized standard poses considerable challenges and problems for those departments to report on sustainability [16]. In order to build a harmonized and standardized standard, in November 2021, the International Financial Reporting Standards (IFRS) established the International Sustainability Standards Boards (ISSB). As two main objective, ISSB committee to develop standards for a global baseline of sustainability disclosure and to enable companies to provide comprehensive sustainability information to global capital markets [17]. The ISSB launch out the IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and S2 Climate-related Disclosure in June 2023. What main focus in this paper is IFRS S1 that initiated a new regime on sustainability -related disclosure in global capital markets, aim to provide a global framework for disclosing information on governance, strategy, risk management, and metrics related to sustainability. Singapore, as a major financial hub, has companies that are active in sustainability reporting. However, the extent to which these reports align with IFRS standards remains under-researched. This paper will analyze the potential significance of IFRS S1 for Singapore and how the sustainability reporting practices of 70 listed companies in Singapore are aligned with the IFRS Sustainability Reporting Standard.

2. Literature Review

Over the past two decades, the transparency and significance of ESG reporting have notably increased, accompanied by a more extensive integration of ESG-related information into mainstream financial reporting [18]. The range of indicators that companies are required to report is progressively widening, and the depth of sustainability information demanded is also increasing [19]. Beyond monitoring performance related to climate change, the economy, and pollution, currently companies are also expected to transparently disclose their responses to biodiversity loss, as well as how they address social area problem which include OSH (Occupational safety and health), Local communities and Non-discrimination. These include not only the employee within the company also workers throughout the whole supply chain and contractors.

To chase the opportunity of wining at sustainable development, companies should change from the approach of regulatory compliance to a different vison of sustainability as an opportunity for innovation and value generation [20]. Also, in many cases there has been a shift in customer behavior towards a focus on more sustainable practices. There is a growing desire to recycle, minimize waste, make greener choices about products and reward those who are responsible [21]. By analyzing three transmission channels within a standard discounted cash flow and model, the cash-flow channel, the idiosyncratic risk channel, and the valuation channel, Gudio’s [22] team found that companies with stronger ESG characteristics tend to have a lower cost of capital, higher valuations and better financial performance, due to their lower systemic and idiosyncratic risk. After building three multi-factorial linear regressions on annual observations from 2013 to 2020, containing 750 companies, Camelia etc. [23] found a significant relationship between sustainability reporting, environmental, social and governance risk management and financial performance and market performance. Companies with better ESG risk scores and sustainability reporting practices tend to have better financial performance and higher market value. Thus, need to satisfy the demands of stakeholder and investor, also take on the corporation social responsibility, disclosure ESG information is curial for a corporation. This disclosure helps investors, consumers and regulators make informed decisions by assessing a company's sustainability and ethical practices, and disclosure of ESG information also enhances a company's reputation, reduces risk and identifies opportunities to improve sustainability practices [24]. In addition, the ESG disclosure process facilitates improved management of ESG issues within a company, leading to improved internal operational efficiency, technological innovation and long-term value creation, making it a strategic tool for companies to respond to the complexity of the modern business environment and the expectations of their stakeholders [25]. Corporations around the globe are progressively embracing sustainability reporting in response to stakeholder demands for enhanced transparency regarding environmental and social issues. Typically, a company's sustainability disclosure has become essentially as critical as traditional financial reporting. Corporation should integrate sustainability into strategic decisions based on the identification of emerging opportunities and threads in the social and environment spheres in order to keep pace with development [26]. In response to corporate demand for sustainability reporting, a range of corporate sustainability reporting tools (CSRs) such as the Global Reporting Initiative (GRI), the World Business Council for Sustainable Development (WBCSD) and the Carbon Disclosure Project (CDP) have been developed [27]. These tools can help to understand how corporations are progressing towards their sustainable development goals. CDP is a non-profit organization that operates the global disclosure system used by investors, companies, cities, states, and regions to manage their environmental impacts [28]. As one of the most popular method for corporates to disclosure Greenhouse Gas (GHG) Emissions and carbon emissions related information voluntarily to interested stakeholders [29], CDP also focus on governance actions and business strategies aimed at mitigating climate change and deforestation, and promoting water security [30]. WBCSD unites transformative organizations to form a global community that drives systemic change towards a more sustainable future [31]. In February 2010, WBCSD publicly released its 'Vision 2050: The new agenda for business' report. This report outlines nine pathway elements essential for maintaining progress towards sustainability by 2050 [32]. WBCSD focuses on expanding the boundaries of what businesses can achieve by taking action to address the climate crisis, restore nature, and tackle inequality. Among the various sustainability reporting frameworks and tools available, the structure offered by the Global Reporting Initiative (GRI) is regarded as the most widely accepted mechanism for sustainability reporting practices, due to its extensive adoption, comprehensiveness, prestige, and global visibility [33]. 1997, the GRI is an international, independent standards organization created with the aim of developing a universally applicable sustainability reporting framework. This framework emphasizes corporate social responsibility with equal consideration of environmental, social, and governance (ESG) factors. More than two-thirds of the top 100 companies across 52 countries engage in sustainability reporting using the GRI framework. Similarly, a significant portion of the world's largest 250 companies by revenue listed on the Fortune 500 have adopted the GRI framework for their sustainability reports [34]. The sustainability reporting theme of this paper's data collection matrix species uses GRI's standards as a reference.

However, there are still remaining obstacles of the development of sustainability. According to the results of Afanasive and Shash's [35] content analysis, there are still six major barriers that prevent companies from undertaking sustainability reporting. These are the low quality of corporate plan development in the area of sustainability; the lack of organizational and/or corporate capacity in the area of ESG; the lack of harmonized methodologies and indicators for assessing the conformity of activities with ESG principles; the lack of incentives for the business sector to introduce new accounting practices due to the lack of national policies in the area of sustainability; the lack of harmonized standards for sustainability-related corporate reporting; and the high time cost of preparing sustainability reports. Given the lack of consensus on the information to be reported and the urgent need for comparability across and within jurisdictions, there is growing momentum for the harmonization of global sustainability reporting standards, and a global need for a common language to measure and report on social conditions [36]. Market participants are increasingly demanding that companies provide high-quality, transparent and globally comparable accounting information on the risks and opportunities associated with sustainability [37]. Recognizing the importance of these issues for informed decision-making, both investors and companies are in urgent need of harmonized and efficient sustainability-related requirements and standards. IFRS S1, issued by the International Financial Reporting Standards Foundation in 2023 June, aims to establish a harmonized structure for sustainability reporting. This standard is intended to facilitate more consistent and transparent reporting practices across various industries, thereby improving the reliability of sustainability information used for decision-making. With the introduction of IFRS S1, an increasing number of companies are engaging with various stakeholders to integrate climate action and sustainability reporting into their operational frameworks. These companies are actively exploring the development of a sustainability reporting and disclosure framework that aligns with IFRS S1. This initiative reflects a broader trend towards mainstreaming environmental concerns within corporate strategies, thereby enhancing transparency and accountability in sustainability practices [38]. Essentially, IFRS S1 have garnered robust support from a diverse array of international organizations and various stakeholder groups [39].

The core contents of IFRS S1 encompass four key aspects. First, it mandates reporting on the governance processes, controls, and procedures that an entity utilizes to monitor and manage sustainability-related risks and opportunities. The second aspect, strategy, refers to the approaches employed by the entity to manage these sustainability-related risks and opportunities. Thirdly, risk management pertains to the processes an entity uses to identify, assess, prioritize, and monitor such risks and opportunities. Lastly, metrics and targets require entities to report on their performance concerning sustainability-related risks and opportunities. In contrast to previous international standards, IFRS S1 specifically emphasizes the importance of businesses reporting on sustainability-related risks and opportunities that could influence short-, medium-, or long-term cash flows, access to finance, or the cost of capital. These are collectively referred to as 'sustainability-related risks and opportunities that can reasonably be expected to affect the outlook for the business.' This focus marks a significant shift towards integrating sustainability considerations into the core financial strategy of a company. IFRS S1 delineates how entities should prepare and report their financial disclosures related to sustainable development. It specifies the content of these disclosures and the general requirements for their presentation, ensuring that the information provided is useful to users in making decisions about the allocation of resources to the entity [40]. Following the publication of IFRS S1, many international organizations and national governments have shown interest and provided positive feedback, including the International Organization of Securities Commissions (IOSCO). IOSCO's endorsement underscores the suitability of IFRS S1 for use in capital markets. It highlights the standard’s role in enabling the pricing of risks and opportunities related to sustainability, and in enhancing data collection and analysis. This endorsement is particularly significant as it is expected to resonate with growth and emerging markets, which constitute 75% of IOSCO's membership [41].

3. Materials and Methods

In this research there are two research objectives. The first is to provide a summary of the varying regulations and requirements of different stock exchanges and countries regarding the adoption of IFRS S1. Secondly, to evaluate companies’ sustainability reporting content aligned with IFRS core content in four aspects: Governance, Strategy, Risk management, Metrics and targets. To fulfill two different research objectives, there are also two different research methods. Stage 1 is Regulation review, will Review different Stock exchange and countries regulation and requirement about IFRS S1 adoption. Stage 2 is Sustainability reporting review. Review company’s sustainability reporting, collecting and analysis sustainability reporting data aligned with IFRS S1.

3.1. Regulation Review

By reviewing accounting firms' reports, the exchange requirements, and government policy in order to summary of timeline of when IFRS S1 was implemented and related policies in different countries. Because Professional accountants play a pivotal role in advancing sustainable development initiatives at the corporate level. Following the introduction of IFRS S1, numerous accounting firms have conducted analyses and offered recommendations concerning the timing and methods for implementing IFRS S1. Exchanges are a critical component of the financial system, and green finance is fundamental to future global sustainability. It is incumbent upon exchanges to establish a framework and set requirements for company sustainability reporting. And, Government established policies can provide regulations and support for company sustainability reporting at the national level. Therefore, more effective information can be obtained through these three directions.

3.2. Listed Companies Sustainability Reporting Review

Top 100 Companies based on their market capital, after selection, 70 listed companies are qualified for data review. This means that a total of 70 companies sustainability reports had been reviewed and analyzed. Figure 1 Indicated the industry distribution of the 70 selected companies. The largest number is in the real estate sector with 29. Selection of the latest sustainability report of each company published on the SGX website or on the company's website as of February 15, 2024. The criteria for selecting material topics are based on the structural guidelines of the GRI standards. As previously mentioned, the Global Reporting Initiative (GRI) is recognized globally as one of the most widely accepted frameworks for sustainability reporting. Another significant reason for its prominence is its broad applicability. Industries of any size—whether large or small, private or public—can utilize the GRI standards to report on their economic, environmental, and social impacts. This increases transparency regarding their contributions to sustainable development [42]. The GRI Standards can be divided into three main areas: universal Standards, sector standards and topic standards. The Universal Standards mandate disclosures for every organization that reports in accordance with the GRI. As the name suggests, reporting organizations are required to disclose general information about their operations and material topics. These disclosures form the foundation upon which subsequent areas or modules are built.

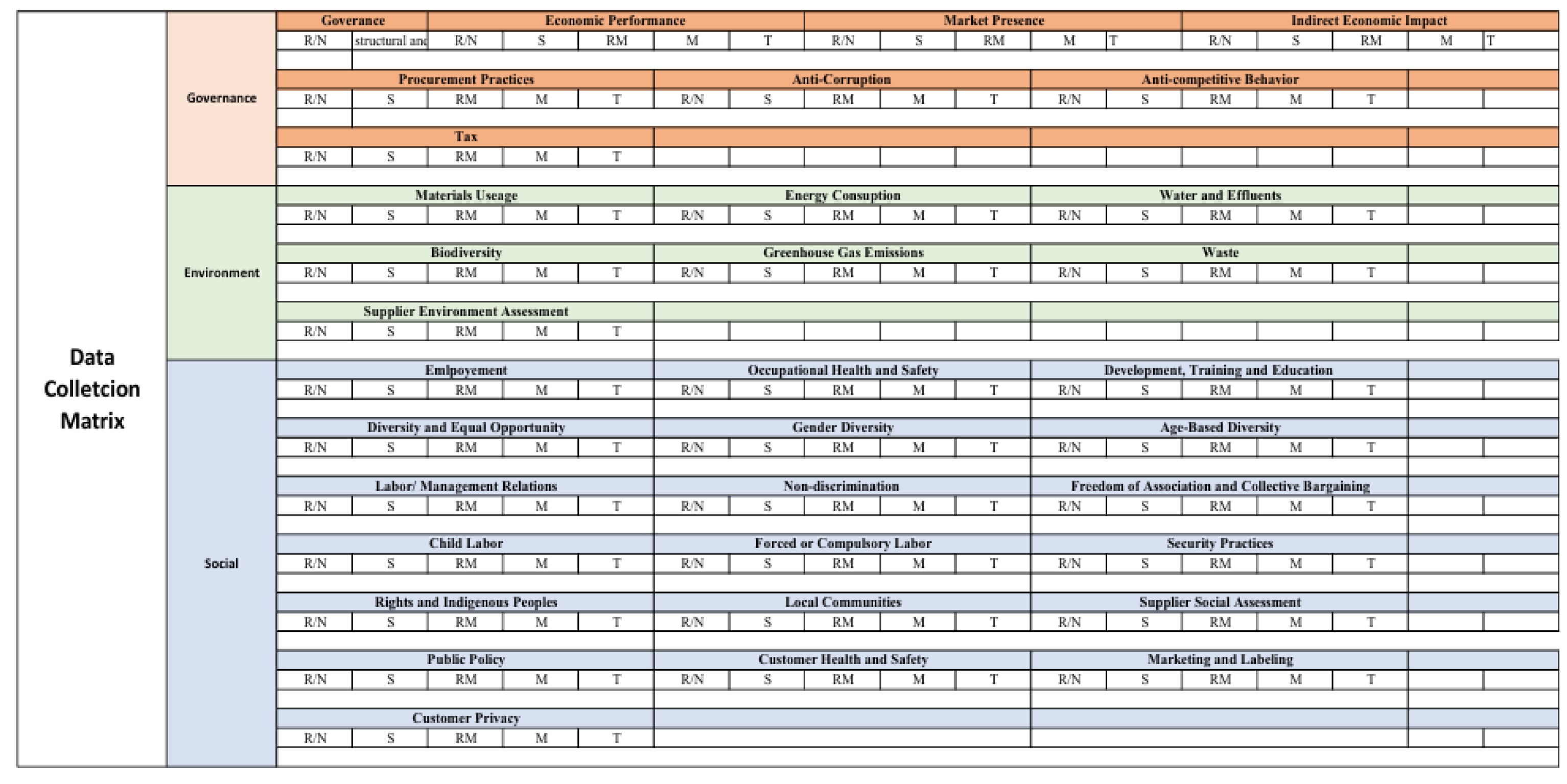

The GRI organization is developing Sector Standards, with a total of 40 standards specific to certain industries. Work has already commenced on sectors with the highest impacts. As of June 2022, the available Sector Standards include Oil and Gas, Coal, Agriculture, Aquaculture, and Fishing. The next industries to be addressed are Fishing and Mining. If a suitable Sector Standard is available, organizations are required to use the disclosures contained within that standard. Topic Standards, the last area, have maintained a structure like previous versions of the GRI standards. They provide disclosures on specific topics such as economic performance, greenhouse gas emissions, etc. When reporting, organizations must select the Topic Standards that correspond to their previously defined material topics. The selection of research topics aligns with the Topic Standards. Within these standards, GRI 20X pertains to the Economic and Governance area, encompassing seven topics. GRI 30X relates to environmental issues and includes eight subjects. Lastly, GRI 40X focuses on social aspects, covering eighteen topics. The Singapore Exchange (SGX) recommends a list of 27 core ESG metrics for issuers to use as an initial framework for sustainability reporting. These Core ESG Metrics are intended to serve as a common and standardized set of ESG metrics, which will facilitate better alignment between users and reporters of ESG information [43]. The Core ESG Metrics will be reviewed and revised periodically to align with the evolution of international reporting standards. Notably, the document separates GRI 405 Diversity and Equal Opportunity into the themes of gender diversity and age-based diversity. Then, based on the core contents of IFRS S1, each topic will be further evaluated. Governance is treated as an independent topic. The assessment involves collecting data solely on whether there is a separate sustainability structure for sustainable management detailed in the sustainability report. If the company has not established a sustainability governance structure, then it will be set as a score of 0. Strategy evaluation determines whether policies related to the topic are presented within the sustainability report. If a policy section in the report covers multiple topics, each topic included will be awarded one point. Risk management is assessed by examining the reporting on topic-related risks, including risk assessment and management measures. Actual performance data are collected and analyzed, using commonly accepted metrics for comparison to determine whether performance meets or exceeds expectations. Targets refer to specific goals or objectives set for subsequent financial years. Although similar, metrics and targets serve distinct purposes and are therefore separated during data collection. Based on the above discussion, a data collection matrix was developed, as shown in Figure 2. The matrix encompasses a total of 34 themes, divided into 8 for governance, 7 for the environment, and 19 for society. In this matrix, if a company's sustainability report addresses a specific theme, it is scored as 1. If it does not address the theme, the score is 0.

4. Results

4.1. Regulation Review

However, this standard is not mandatory to imply, thus the countries governments have the right to decide whether to impose it voluntary. On October 2023, Brazilian Securities Commission (CVM) introducing CVM’s Rule No. 193, which marking that Brazil as the first country to formally commit to the adoption of IFRS S1 and S2 [44]. This rule required that accordance to the standards set by the ISSB, the preparation and publication of financial information reports related to sustainability will be mandatory only for traded companies. This requirement will begin after January 1st, 2026 [45]. However, after January 1st, 2024, traded companies, securitization companies and investment funds can voluntarily adopt the standard framework of IFRS S1 for sustainability reporting. Stock Exchange of Hong Kong Limited is one of the first exchanges in the world to announce the alignment of its ESG disclosure requirements with the ISSB standards. In April 2023, the Exchange and Hong Kong government departments formed a co-working group to conduct a public consultation in April 2023 and announced that in August of the same year that it had begun to develop a 'comprehensive Hong Kong roadmap' of the ISSB standard implementation timetable, with the earliest possible completion of the ISSB mandate by Completion of ISSB in 2024 at the earliest [46]. Although, currently, there are no accuracy timeline plans for Mainland China that implement IFRS S1 and IFRS S2, China has always supported the ISSB and concerned about the sustainability reporting work. Durin the consultation process if the draft ISSB standards both the Ministry of Finance and China Securities Regulatory Commission actively provided feedback on the contents of the draft, focusing on the adaptability of the ISSB standards to small and medium-sized enterprises, emerging markets and developing countries [47]. And the Shanghai and Shenzhen Stock Exchanges are studying the formulation of guidelines on sustainability disclosure for traded companies, considering China's local situation and policy of development. In addition, one noteworthy thing is that the IFRS foundations opens a ISSB office in Beijing in order to lead and execute the ISSB’s strategy for emerging and developing economies, acting as a hub for stakeholder engagement in Asia [48]. Similar to China, the Sustainability Standards Board of Japan (SSBJ) works closely with the ISSB, which has indicated that it will release a draft sustainability disclosure standard based on the ISSB standards by 31 March 2024, with plans to begin adopting it in the 2025-2026 fiscal year [48]. For the Asia Pacific region, Deloitte Asia Pacific Services Limited published a report in July 2023 which summarized the responses to IFRS S1 and S2 issued by the ISSB in the Asia Pacific region. The report states that Australia would like the sustainability report to be aligned with the ISSB standard as far as possible, and that the requirements could apply to large organizations as soon as the 2024-2025 financial year, with smaller entities phasing in over the following three years [49]. . Also, in Korea and Malaysia, the adoption of ISSB-related standards is being actively discussed by their respective national financial authorities and sustainability committees, among others. In June 2021, the U.S. House of Representatives passed a landmark piece of legislation called the ESG Disclosure Simplification Act, which mandates ESG-related reporting by public companies in their filings with the U.S. Securities and Exchange Commission [50]. With the introduction of the ISSB standard, some U.S. academics have begun to call for U.S. companies to align their sustainability reporting with global practices. By analyzing a range of IFRS standards, including IFRS S1 and IFRS S2, Vira Tolkach [51] points out that the implementation of IFRS standards in the US has a number of benefits, including global consistency, demonstrating a focus on sustainability, and conveniently meeting the needs of investors in all countries for ESG information and resources. The UK’s Government also committed to introduce mandatory reporting alien with ISSB standards. Begin in the August 2023, with the Department for Business and Trade issuing guidance on the UK government’s framework to create UK sustainability disclosure standards by assessing and endorsing the ISSB’s standards [52]. And, on July 2023 HM Treasury and the Monetary Authority of Singapore issued a joint statement on the UK-Singapore Financial Dialogue, which included an agreement between the two countries to implement the ISSB standard to support the interoperability of global disclosure standards [53]. After this Financial Dialogue, Singapore Exchange Regulation suggested that from FY2025 onwards, every company should refer to both ISSB's IFRS S1 and IFRS S2 when preparing its sustainability report for each financial year [54]. While IFRS S1 and S2 could significantly enhance the disclosure of sustainability information, helping to promote globally consistent sustainability-related reporting and improve the transparency of climate-related financial data, individual regulators should also recognize the need for disclosure standards that can be developed in conjunction with the ISSB standards to suit local circumstances. At the same time, companies in all countries can take advantage of the transition period provided by the policy to familiarize themselves with the requirements of the ISSB standard and prepare themselves for future mandatory disclosure requirements.

4.2. Sustianbaility Reporting Review Result

After conducting a content analysis on the sustainability reports of 70 listed companies, obtained result was shown on Figure 3. Figure 3 displays the overall performance of reported material topics. The top five reported topics are Development, Training and Education; Diversity and Equal Opportunity; Energy Consumption; Greenhouse Gas Emissions; and Occupational Health and Safety, along with Water and Effluents, which have the same number of reports. The top three reported governance topics are Sustainability Governance, Anti-corruption, and Economic Performance. The top three reported environmental topics are Energy Consumption, Greenhouse Gas Emissions, and Water and Effluents. The top three reported social topics are Development, Training and Education; Diversity and Equal Opportunity; and Occupational Health and Safety. The least reported topics are Security Practices, Rights of Indigenous Peoples, and Public Policy. Subsequently, based on SGX's CORE ESG metrics, four topics were selected for in-depth analysis in each category. For the Environment category, the selected topics are Greenhouse Gas Emissions, Energy Consumption, Water Consumption, and Waste Management. In the Social category, the topics chosen are Diversity and Equal Opportunity, Employment, Development & Training, and Occupational Health and Safety (OHS). For Governance, the topics selected are Sustainability Governance, Economic Performance, Anti-corruption, and Procurement Practices. Next, based on SGX's CORE ESG metrics, four topics in each category were selected for in-depth analysis. For the Environment category, the topics chosen are Greenhouse Gas Emissions, Energy Consumption, Water Consumption, and Waste Management. In the Social category, Diversity and Equal Opportunity, Employment, Development and training, and Occupational Health and Safety (OHS) were selected. For Governance, the focus is on Sustainability Governance, Economic Performance, Anti-corruption, and Procurement Practices.

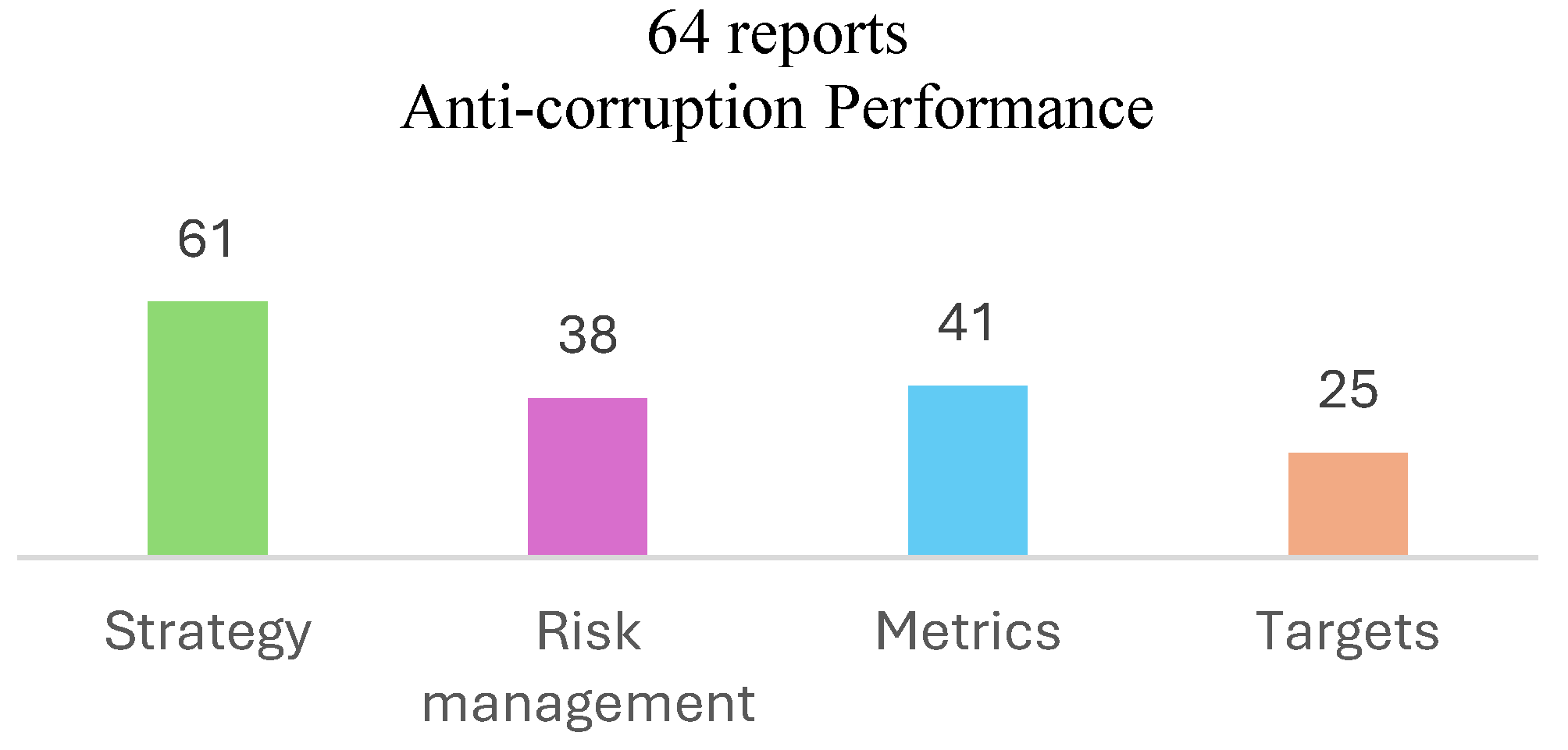

Figure 4, Figure 5, Figure 6 and Figure 7 illustrate the core governance and economic performance metrics. 60 companies reported on the Sustainability Governance topic. All companies that reported on sustainable governance also detailed their sustainability governance structures and compositions. During the data collection process, it was observed that most companies have a dedicated sustainability management committee within their management structure. Additionally, a small number of companies have direct oversight of sustainability issues provided by an executive team on the board of directors. 46 companies reported on the Economic Performance topic. 41 reported Metrics, 39 reported Strategy, 13 reported Targets, 10 reported Risk Management. Numerous companies interpret 'Economic Performance' narrowly, primarily equating it to the reporting of financial income, investment amounts, and taxes paid within the fiscal year, as detailed in their annual financial reports. As a result, they tend to report only on economic metrics and strategies within their sustainability report. However, according to GRI 201, companies are also required to disclose financial implications and other risks and opportunities related to climate change that extend beyond direct economic performance indicators. A prevalent lack of awareness of this requirement significantly contributes to the lower likelihood of companies reporting on risk management and setting targets in this area. 64 companies reported on the Anti-Corruption topic, with 61 reporting Strategy, 41 reporting Metrics, 38 reporting Risk Management, and 25 reporting Targets. Anti-corruption measures are crucial for maintaining corporate reputation and interest. Companies engaged in corrupt practices face not only legal penalties but also significant reputational damage. Furthermore, corruption within the internal management of a company can adversely affect its operations and earnings. As a result, many companies implement comprehensive anti-corruption strategies. For risk management, whistle-blowing mechanisms are commonly utilized as a primary method for managing anti-corruption risks. 17 companies reported on the Procurement Practices topic. 16 reported Strategy, 8 reported Metrics, 4 reported Risk Management, 3 reported Targets. Under GRI 204 Procurement Practices, companies are required to report the proportion of spending on local suppliers. The low reporting on this topic may be attributed to several factors. Firstly, some companies may not recognize the importance of this aspect, hindering their ability to report effectively on procurement practices. Additionally, a company might lack well-developed sustainable procurement policies, or such policies may not be fully implemented or integrated into the overall procurement strategy. Inadequate communication with suppliers regarding sustainability issues is another contributing factor. For public companies, which often operate within complex supply chains, tracking and reporting on procurement practices can be particularly challenging.

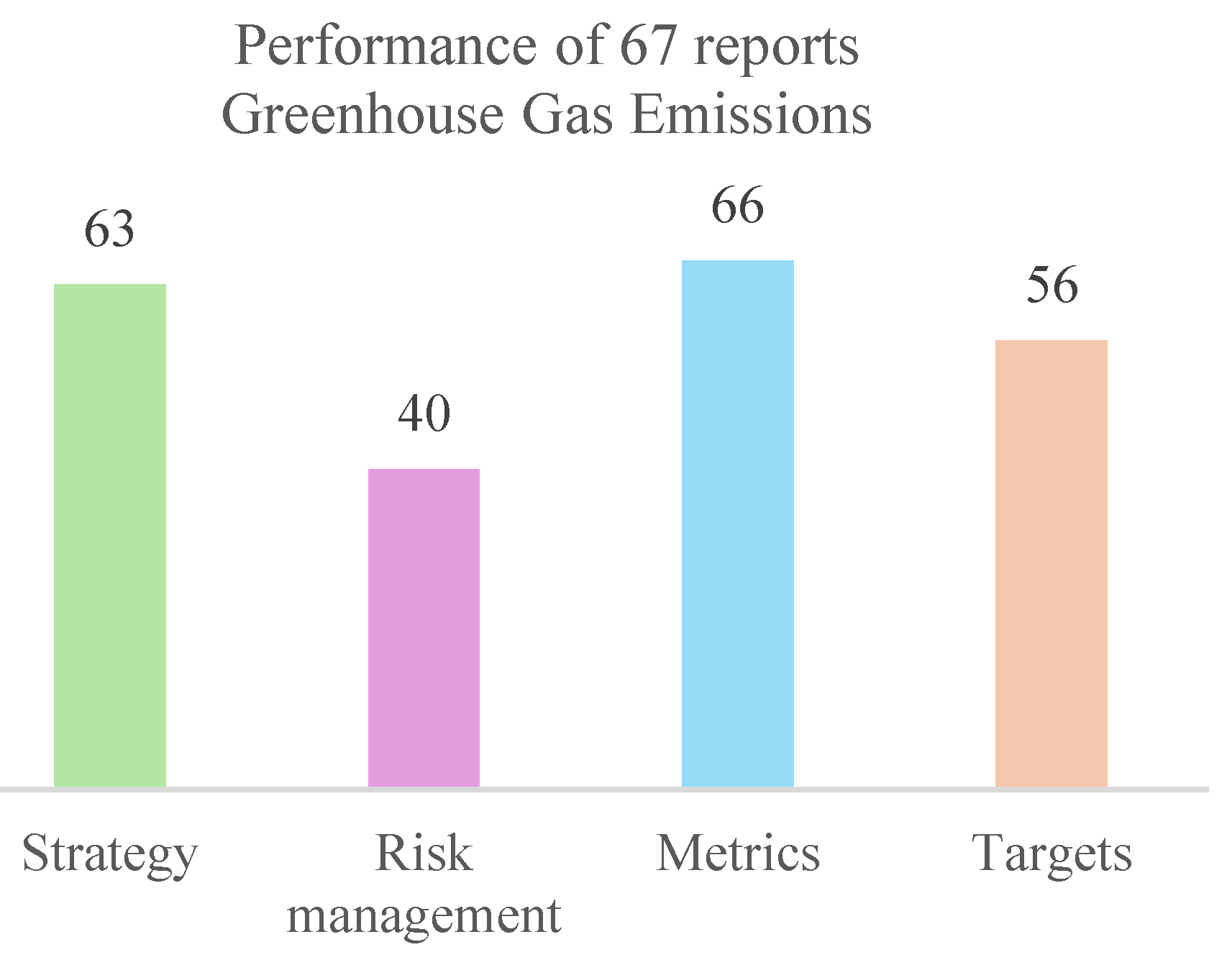

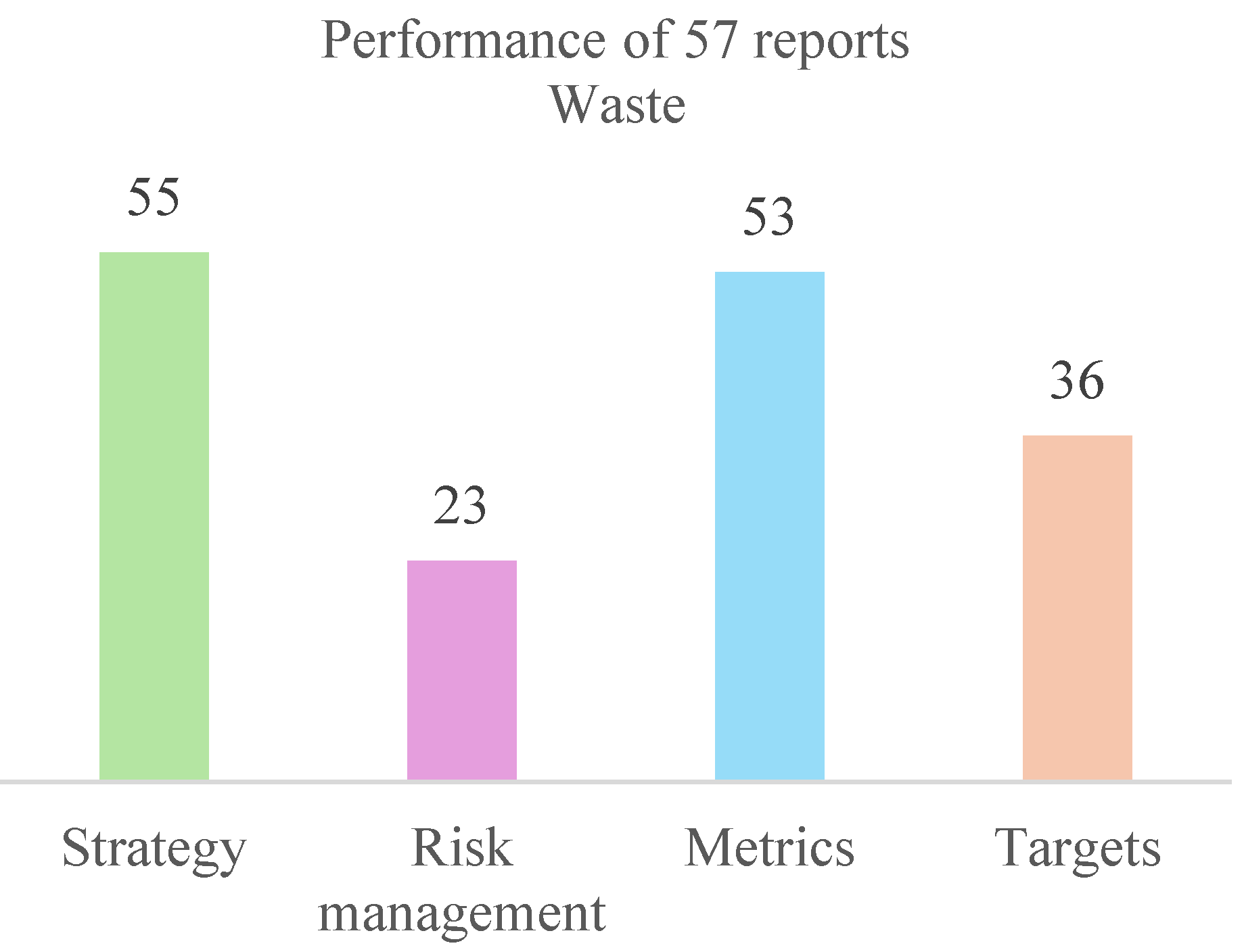

Figure 8, Figure 9, Figure 10, Figure 11 and Figure 12 show the core environment performance. 67 companies reported Greenhouse Gas Emissions. 66 companies reported Metrics, 63 reported Strategy, 56 reported Targets, 40 reported Risk Management. Climate change is an important aspect in environmental protection, and the Singapore Government has long formulated policies aimed at reducing greenhouse gas emissions. On October 2022, Singapore announced that it would raise its national climate target to achieve net-zero emissions by 2050 as part of the Long-Term Low-Emissions Development Strategy. For enterprises, they can follow relevant policies and collect metrics according to government requirements. Most companies primarily report on Scope 1 and Scope 2 emissions and often lack data on Scope 3 emissions. Scope 3 emissions refer to those not directly generated by the company or by the activities of assets owned or controlled by the company. Instead, these emissions arise from assets indirectly associated with the company, both upstream and downstream in the value chain. This trend indicates a significant gap in the attention to and management of indirect emissions, which are critical components of a comprehensive environmental impact assessment. Sixty-seven companies reported on the topic of Energy Consumption. Among these, 66 reported Metrics, 64 reported Policies, 47 reported Targets, and 32 reported Risk Management. In Singapore, energy consumption is a primary source of carbon emissions and a critical issue related to climate change. Companies committed to monitoring and reducing their energy use find that compiling and analyzing utility bills provides valuable insights into their energy consumption patterns. Moreover, many utility companies offer online tools and detailed breakdowns to assist businesses and individuals in understanding their energy use and identifying opportunities for efficiency improvements. Companies are also increasingly striving to enhance energy efficiency, thereby reducing greenhouse gas emissions concurrently. Sixty-five companies reported on Water and Effluents, with all of them reporting Metrics, 60 reporting Strategy, 41 reporting Targets, and 23 reporting Risk Management. The ubiquity of metrics reporting can be attributed to its relatively straightforward data collection method, such as using water bills, which display the amount of water used. However, while companies are actively reporting on metrics and strategies, it is evident from the data that there is less emphasis on reporting Risk Management. According to GRI 303 Water and Effluents, companies are also required to report on their interactions with water as a shared resource and the management of water discharge-related impacts. This includes being transparent about the quality and quantity of their water discharges. The objective is to minimize adverse impacts on the environment, including pollution and changes to water temperature, chemical composition, and other physical properties. Companies are expected to implement measures that treat effluents and manage discharges responsibly to prevent ecosystem degradation. 57 companies reported waste, 55 reported Strategy, 53 reported Metrics, 36 reported Targets, 23 reported Risk management. Compared to the other three themes, Waste had fewer reports. However, waste management is no less critical than any other topic. Collecting waste-related information poses challenges for companies, as it cannot be easily derived from bills or expenditures like other metrics. Establishing a comprehensive waste tracking system within a company is a complex task. Furthermore, under the requirements of GRI 306, companies are mandated to report on waste by type and disposal method, as well as on the transportation of hazardous wastes. These specific requirements have been addressed by the companies that reported on risk management.

Sixty-three companies reported on the Employment topic, with 62 reporting Metrics, 46 reporting Strategy, 9 reporting Targets, and none reporting Risk Management. According to GRI 401 Employment, companies are required to report on new employee hires and employee turnover, benefits provided to full-time employees that are not offered to temporary or part-time employees, and parental leave. Among those reporting, all companies disclosed information on new employee hires and turnover, as this data is readily collected by HR departments. However, the remaining components, particularly parental leave, are seldom reported. This lack of reporting on parental leave could be attributed to the absence of formal or equitable parental leave policies, especially in countries where such policies are not mandated by law. Sixty-eight companies reported on the Development, Training, and Education topic, with 66 reporting Strategy, 65 reporting Metrics, 49 reporting Targets, and only one reporting on Risk Management. Employee development and job skills training are crucial for increasing innovation, productivity, and flexibility among employees, thereby driving business growth and adapting to market changes. Investing in employee training also reflects a company's commitment to social responsibility, demonstrating a dedication to the welfare and career development of its employees. This investment not only benefits the company but also contributes to wider societal benefits by enhancing employee skills. The limited reporting on Risk Management suggests a lack of recognition of the potential negative impacts of inadequate training on a company’s profitability, such as skill gaps that could lead to productivity losses. Sixty-seven companies reported on the Diversity and Equal Opportunity topic, with 66 reporting Metrics, 65 reporting Strategy, 32 reporting Targets, and only two reporting on Risk Management. The objective of ensuring diversity and equal opportunity is to treat individuals as equals, afford them the dignity and respect they deserve, and celebrate their differences. The substantial reporting on strategy and metrics indicates that companies recognize the importance of providing equal opportunities and fostering a diverse and inclusive environment. This alignment with social equity reflects a crucial aspect of a company’s social responsibility. From a business perspective, a diverse and equity-focused team can enhance company performance. However, the notably low reporting on risk management related to diversity and equal opportunity suggests a possible lack of recognition or understanding of the potential risks, such as legal challenges, reputational damage, or missed opportunities for innovation and growth, associated with insufficient attention to diversity issues. Effective diversity and inclusion efforts can mitigate these risks by promoting a more harmonious workplace environment, enhancing the company's reputation, and broadening its market reach. Sixty-five companies reported on the Occupational Health and Safety (OHS) topic, with 63 reporting Strategy, 60 reporting Metrics, 48 addressing Risk Management, and 47 reporting Targets. The higher reporting in risk management, compared to other topics, highlights the critical nature of OHS and the direct, immediate risks associated with it. Companies recognize that workplace injuries or accidents can have severe human and business consequences, making risk management in OHS a top priority. Compared to the previous three topics discussed, Risk Management has garnered a higher number of reports. This is likely because OHS is subject to strict legal requirements and standards, making it easier for companies to develop relevant risk management systems and policies. Incidents related to OHS can result in significant financial costs due to medical expenses, legal fees, fines, and increased insurance premiums. Moreover, these risks directly impact employees' physical well-being, underscoring the importance and urgency for companies to manage this issue effectively.

Figure 12.

Performance of 63 reports Employment.

Figure 13.

Performance of 68 reports development, training and education.

Figure 14.

Performance of 67 reports diversity, and equal opportunity.

Figure 15.

Performance of 65 reports Occupational Health and Safety.

4. Discussion

Among the top five reported topics, four belong to the social category, all focusing on employee-related content. These topics encompass three key aspects of the company’s employment philosophy: employee development, occupational safety and health, and broader employment practices. The remaining two topics among the top five—energy consumption and GHG emissions—are relevant to TCFD (Task Force on Climate-related Financial Disclosures) reporting. These are among the most closely monitored issues related to achieving carbon neutrality. With Singapore aiming for net-zero emissions by 2050, many companies are actively aligning their strategies with this goal, demonstrating a strong commitment to environmental sustainability. In terms of alignment with IFRS, the topic of Strategy is the most commonly reported, followed by Metrics, Targets, and finally Risk Management. This indicates a willingness among businesses to engage in sustainable reporting and proactively develop relevant strategies. However, it is important to note that while developing policies for each sustainability-related topic is fundamental to sustainability reporting, Strategy reporting is the simplest and most basic. The high level of analysis of metrics demonstrates that companies have already established effective data tracking structures, with metrics being the most straightforward way to showcase a company's past sustainability performance. This phenomenon can be attributed to two main reasons. Firstly, it is less costly for companies to report on sustainability-related strategies and metrics, as they can easily reference government and international organization policies to create their own policies. In addition, it is simpler to establish a metrics tracking system compared to other aspects of sustainability reporting. Another reason for the varied reporting emphasis is the lack of standard requirements concerning risk management. The GRI specifies that companies should report on management practices (Strategy), performance indicators (Metrics), and targets related to sustainability[55]. However, it does not mandate a report on risk management [54]. Similarly, the SGX's Practice Note 7.6, titled 'Sustainability Reporting Guide,' requires companies to disclose policies, objectives, and performance, but it omits any mention of risk management [56]. This absence in the guidelines may lead to an underemphasis on risk management in sustainability reports. Analyzing the reasons for the lower reporting on post-risk management reveals several challenges. First, the inherent complexity of risk management must be acknowledged. Managing the risks associated with sustainability reporting involves a sophisticated assessment of various factors, including regulatory changes, market volatility, technological advancements, and natural climate risks. It is challenging for companies to establish distinct risk management frameworks for each category of ESG topics. Second, there is a lack of standardized guidelines or frameworks for assessing and reporting sustainability-related risks, which complicates the development of effective risk management strategies. Additionally, for many companies, the concept of sustainable risk management is relatively new. They may still be in the early stages of integrating environmental risks into their broader risk management strategies, which have traditionally been focused on financial, operational, and strategic risks.

Sustainable risk management is a critical component of enterprise risk management. Effective risk management not only analyzes the potential risks and opportunities associated with sustainability efforts but also facilitates more informed decision-making [57]. Companies are increasingly subjected to regulatory requirements related to sustainability and ESG disclosures. Effective risk management not only ensures compliance with these regulations but also offers a competitive advantage by identifying opportunities for innovation and enhancement of sustainability practices. This can directly and positively impact business performance, particularly through metrics like Economic Value Added (EVA) [58]. Moreover, effective risk management can reduce costs associated with risks, minimize losses from unforeseen events, and optimize resource allocation. International standards are also increasingly focusing on the management of sustainability-related risks for businesses. For instance, the 2021 updated version of GRI Standard 3: Material Topics which effective after 1st January 2023underscores the importance for companies to recognize and manage sustainability-related risks. According to GRI 3 standard, risk is defined as the combination of the severity and the likelihood of a negative impact Moreover, the standards stipulate that companies should not only include assessments of the significance of these impacts within broader enterprise risk management systems but also ensure that these systems evaluate the impacts the organization has on the economy, the environment, and people. This approach extends beyond merely assessing risks to the organization itself, emphasizing a holistic view of the organization’s external effects.

IFRS S1 standards detailed management requirements specifically targeting issues related to sustainability risks. As mandated by IFRS S1, risk management reporting should cover the processes and policies utilized to identify and assess risks associated with the company's sustainability initiatives. This includes detailing the methodology and outcomes used in assessing and analyzing the nature, likelihood, and potential impact of sustainability-related risks. Additionally, the standards require reporting on the prioritization of these risks and the methods of ongoing monitoring. There is also a requirement to report on the processes for identifying, assessing, prioritizing, and monitoring both risks and opportunities related to sustainable development. Finally, reports should describe the extent to which, and how, the process of managing sustainability-related risks and opportunities is integrated into and informs the entity’s overall risk management strategy.

As IFRS S1 and IFRS S2 are the most recently published sustainability reporting standards, there is little research information available on them and they are in the stage of in-depth analysis and research. As a result, the two standards have not been analyzed enough and there are not enough references with in-depth value. In addition, as the results of the analysis in STAGE 1 show, some governments are in a wait-and-see mode, expecting the emergence of best practices from mainstream countries to inform their implementation of IFRS S1. Some organizations also expect best practices to emerge so that they can follow the standard more efficiently. The data was taken from the top 100 listed companies by market capitalization, which have the ability and willingness to report on their past sustainability performance to demonstrate their contribution to the field of sustainability. In future studies, the sample size could be expanded to include more companies. Then, subsequent studies could be further segmented by different industries to explore the state of sustainability reporting within different industries. Finally, due to time constraints, the sustainability reports collected were from the financial year 2022, when IFRS S1 was not yet available, so there is a lack of relevance to IFRS S1. Further research can be carried out based on the latest sustainability report for FY2024.

5. Conclusions

As one of the world's key financial hubs, Singapore plays a crucial role in advancing global sustainability. An analysis of sustainability reports from 70 leading companies among the top 100 listed in Singapore reveals that the most frequently reported ESG topic is development, training, and education. This finding highlights a predominant focus on employee-related topics within the social category, including employment, occupational health and safety (OSH), and diversity and equality in the workplace. Environmental topics such as 'Energy Consumption' and 'Greenhouse Gas Emissions' also rank highly, underscoring the efforts by many companies to address climate change. These trends demonstrate a robust engagement by companies in enhancing their sustainability disclosures, driven by a commitment to meet the increasing demands of investors and stakeholders for greater transparency and accountability in sustainability. In alignment with IFRS S1, the engagement with core elements such as governance, strategy, metrics, and goals is commendable. However, risk management—a critical and fundamental aspect of sustainability—shows limited reporting, which may reflect the challenges companies face with the newly released IFRS S1 standard. This research aids in understanding the gaps in current reporting practices and provides a reference framework that can significantly assist companies in enhancing their sustainability efforts to meet the IFRS S1 standards. It offers companies a reference for developing subsequent sustainability reporting frameworks that adhere to the requirements of the IFRS S1 standard. Additionally, this framework facilitates experimentation with best practices, enabling companies to optimize their sustainability strategies effectively.

References

- Burton, I., Report on reports: Our common future: The world commission on environment and development. Environment: Science and Policy for Sustainable Development, 1987. 29(5): p. 25-29.

- Waseem, N. and S. Kota. Sustainability definitions—An analysis. in Research into Design for Communities, Volume 2: Proceedings of ICoRD 2017. 2017. Springer.

- Kolk, A., The social responsibility of international business: From ethics and the environment to CSR and sustainable development. Journal of World Business, 2016. 51(1): p. 23-34. [CrossRef]

- Halkos, G. and E.-C. Gkampoura, Where do we stand on the 17 Sustainable Development Goals? An overview on progress. Economic Analysis and Policy, 2021. 70: p. 94-122. [CrossRef]

- Colglazier, W., Sustainable development agenda: 2030. Science, 2015. 349(6252): p. 1048-1050.

- Huang, D.Z., Environmental, social and governance (ESG) activity and firm performance: A review and consolidation. Accounting & finance, 2021. 61(1): p. 335-360. [CrossRef]

- Eccles, R.G., L.-E. Lee, and J.C. Stroehle, The social origins of ESG: An analysis of Innovest and KLD. Organization & Environment, 2020. 33(4): p. 575-596.

- Karwowski, M. and M. Raulinajtys-Grzybek, The application of corporate social responsibility (CSR) actions for mitigation of environmental, social, corporate governance (ESG) and reputational risk in integrated reports. Corporate Social Responsibility and Environmental Management, 2021. 28(4): p. 1270-1284. [CrossRef]

- Gillan, S.L., A. Koch, and L.T. Starks, Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance, 2021. 66: p. 101889. [CrossRef]

- Ordonez-Ponce, E., A. Clarke, and A. MacDonald, Business contributions to the sustainable development goals through community sustainability partnerships. Sustainability Accounting, Management and Policy Journal, 2021. 12(6): p. 1239-1267. [CrossRef]

- Buallay, A., Sustainability reporting and firm’s performance: Comparative study between manufacturing and banking sectors. International Journal of Productivity and Performance Management, 2020. 69(3): p. 431-445.

- Buallay, A., Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Management of Environmental Quality: An International Journal, 2019. 30(1): p. 98-115. [CrossRef]

- Sisaye, S., The influence of non-governmental organizations (NGOs) on the development of voluntary sustainability accounting reporting rules. Journal of Business and Socio-economic Development, 2021. 1(1): p. 5-23. [CrossRef]

- King, A., The Time Has Come: The KPMG Survey of Sustainability Reporting. KPMG International Limited, diakses tanggal, 2022. 1.

- Almashhadani, M. and H.A. Almashhadani, The Impact of Sustainability Reporting on Promoting Firm performance. International Journal of Business and Management Invention, 2023. 12(4): p. 101-111.

- Boiral, O., I. Heras-Saizarbitoria, and M.-C. Brotherton, Assessing and improving the quality of sustainability reports: The auditors’ perspective. Journal of Business Ethics, 2019. 155: p. 703-721. [CrossRef]

- Standards, I.F.R. International Sustainability Standards Board. 2024 [cited 2024 23 Feb]; Available from: https://www.ifrs.org/groups/international-sustainability-standards-board/.

- Jebe, R., The convergence of financial and ESG materiality: Taking sustainability mainstream. American Business Law Journal, 2019. 56(3): p. 645-702. [CrossRef]

- International, K. Get ready for the next wave of ESG reporting. 2023 [cited 2024 23 Feb]; Available from: https://kpmg.com/xx/en/home/insights/2023/01/get-ready-for-the-next-wave-of-esg-reporting.html.

- Calabrese, A., et al., Materiality analysis in sustainability reporting: A tool for directing corporate sustainability towards emerging economic, environmental and social opportunities. Technological and Economic Development of Economy, 2019. 25(5): p. 1016-1038. [CrossRef]

- White, K., R. Habib, and D.J. Hardisty, How to SHIFT consumer behaviors to be more sustainable: A literature review and guiding framework. Journal of marketing, 2019. 83(3): p. 22-49. [CrossRef]

- Giese, G., et al., Foundations of ESG investing: How ESG affects equity valuation, risk, and performance. The Journal of Portfolio Management, 2019. 45(5): p. 69-83.

- Oprean-Stan, C., et al., Impact of sustainability reporting and inadequate management of ESG factors on corporate performance and sustainable growth. Sustainability, 2020. 12(20): p. 8536. [CrossRef]

- Khan, M.A., ESG disclosure and firm performance: A bibliometric and meta analysis. Research in International Business and Finance, 2022. 61: p. 101668. [CrossRef]

- Tsang, A., T. Frost, and H. Cao, Environmental, social, and governance (ESG) disclosure: A literature review. The British Accounting Review, 2023. 55(1): p. 101149. [CrossRef]

- Calabrese, A., et al., Integrating sustainability into strategic decision-making: A fuzzy AHP method for the selection of relevant sustainability issues. Technological Forecasting and Social Change, 2019. 139: p. 155-168. [CrossRef]

- Siew, R.Y., A review of corporate sustainability reporting tools (SRTs). Journal of environmental management, 2015. 164: p. 180-195. [CrossRef]

- Matisoff, D.C., D.S. Noonan, and J.J. O'Brien, Convergence in environmental reporting: Assessing the carbon disclosure project. Business Strategy and the Environment, 2013. 22(5): p. 285-305. [CrossRef]

- Ott, C., F. Schiemann, and T. Günther, Disentangling the determinants of the response and the publication decisions: The case of the Carbon Disclosure Project. Journal of Accounting and Public Policy, 2017. 36(1): p. 14-33. [CrossRef]

- Depoers, F., T. Jeanjean, and T. Jérôme, Voluntary disclosure of greenhouse gas emissions: Contrasting the carbon disclosure project and corporate reports. Journal of Business Ethics, 2016. 134: p. 445-461. [CrossRef]

- Nelson, J. and D. Grayson, World business council for sustainable development (WBCSD), in Corporate responsibility coalitions. 2017, Routledge. p. 300-317.

- Wilkinson, A. and D. Mangalagiu, Learning with futures to realise progress towards sustainability: The WBCSD Vision 2050 Initiative. Futures, 2012. 44(4): p. 372-384. [CrossRef]

- Orazalin, N. and M. Mahmood, Determinants of GRI-based sustainability reporting: evidence from an emerging economy. Journal of Accounting in Emerging Economies, 2020. 10(1): p. 140-164. [CrossRef]

- Abeysekera, I., A framework for sustainability reporting. Sustainability Accounting, Management and Policy Journal, 2022. 13(6): p. 1386-1409. [CrossRef]

- Afanasiev, M. and N. Shash, New Information in Financial Disclosures Related to Sustainable Development in the Concept of ESG (Version IFRS). Studies on Russian Economic Development, 2023. 34(5): p. 696-703. [CrossRef]

- Hasmath, S.W.D.M.E.I.D.B.R., The future of sustainability reporting standards. 2021, EY: Oxford.

- GBADEBO, A.D., REVIEW OF THE GLOBAL-IFRS ACCOUNTING AND THE RECENT SUSTAINABILITY-DISCLOSURE STANDARDS. International Journal of Social and Educational Innovation (IJSEIro), 2023: p. 186-200.

- Park, S.K., Sustainable finance in global capital markets, in Research Handbook on Global Capital Markets Law. 2023, Edward Elgar Publishing. p. 236-250.

- Zaid, M.A. and A. Issa, A roadmap for triggering the convergence of global ESG disclosure standards: lessons from the IFRS foundation and stakeholder engagement. Corporate Governance: The International Journal of Business in Society, 2023. 23(7): p. 1648-1669. [CrossRef]

- Lyons, S., General Requirements for Disclosure of Sustainability-Related Financial Information: Response to ISSB Public Exposure Draft. ISSB Public Exposure Draft: IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information, 2022.

- Zdolšek, D. and S.T. Beloglavec. " The 2023's new and the fresh": the International Sustainability Disclosure Standards. in International Scientific Conference on Economy, Management and Information Technologies. 2023.

- Christofi, A., P. Christofi, and S. Sisaye, Corporate sustainability: historical development and reporting practices. Management Research Review, 2012. 35(2): p. 157-172. [CrossRef]

- Exchange, S. Starting with a Common Set of Core ESG Metrics. 2023; Available from: https://api2.sgx.com/sites/default/files/2023-05/SGX%20Core%20ESG%20Metrics_for%20website%20%28updated%20Apr2023%29.pdf.

- Santos, L.G.B.B.L.P. Brazil Sets Global Precedent: First Nation to Embrace ISSB Sustainability Financial Reports. Eye on ESG: Tracking the Transition to Sustainable Business and Finance 2023 [cited 2024 25 Feb]; Available from: https://www.eyeonesg.com/2023/10/brazil-sets-global-precedent-first-nation-to-embrace-issb-sustainability-financial-reports/#more-3780.

- Gadinis, S., Dissonance in Climate Disclosure: the SEC, EU, California, and ISSB Regimes. EU, California, and ISSB Regimes (May 14, 2024), 2024.

- (HKEX), H.K.E.a.C.L. Exchange Publishes Consultation Paper on Enhancement of Climate Disclosure under its ESG Framework. 2023 [cited 2024 23 Feb]; Available from: https://www.hkex.com.hk/news/regulatory-announcements/2023/230414news?sc_lang=en.

- Lee, G.A.P.J.T.W.N.S.R.K.E.Z.J.C.Y. Asia Regulators’ Responses to the ISSB Disclosure Standards. Eye on ESG: Tracking the Transition to Sustainable Business and Finance 2023; Available from: https://www.eyeonesg.com/2023/08/asia-regulators-responses-to-the-issb-disclosure-standards/.

- IFRS. IFRS Foundation opens ISSB office in Beijing. 2023 [cited 2024 23 Feb]; Available from: https://www.ifrs.org/news-and-events/news/2023/06/ifrs-foundation-opens-issb-office-in-beijing/.

- Limited, D.A.P.S., Asia Pacific's Response to the International Sustainability Standards Board (ISSB)'s Finalised IFRS S1 and IFRS S2 Standards, B.H.C. Kuen, Editor. 2023. p. 20.

- Mariani, S.M., Environmental, Social, and Governance (ESG) Matters: Can the SEC Mandate Disclosure? Should the SEC Mandate Disclosure? Notre Dame JL Ethics & Pub. Pol'y, 2023. 37: p. 369.

- Tolkach, V., The importance of international financial reporting standards (IFRS) and the new sustainability reporting standards, IFRS S1 and IFRS S2, in sustainable business development in the US. Věda a perspektivy, 2023(7 (26)). [CrossRef]

- Saadah, S.L.H., UK commits to new ISSB sustainability disclosure standards for capital markets – are you prepared?, in Financier Worldwide Magazine. 2023.

- UK and Singapore Enhance Cooperation in Sustainable Finance and FinTech, M.A.o. Singapore, Editor. 2023: Singapore.

- Groupp, S. SGX RegCo details how sustainability reports should incorporate ISSB Standards. 2024 [cited 2024 6 Mar]; Available from: https://www.sgxgroup.com/media-centre/20240307-sgx-regco-details-how-sustainability-reports-should-incorporate-issb.

- Pizzi, S., S. Principale, and E. De Nuccio, Material sustainability information and reporting standards. Exploring the differences between GRI and SASB. Meditari Accountancy Research, 2023. 31(6): p. 1654-1674. [CrossRef]

- Group, S., Practice Note 7.6 Sustainability Reporting Guide, in Practice Notes. 2016: Singapore.

- Anderson, D.R., The critical importance of sustainability risk management. Risk Management, 2006. 53(4): p. 66-72.

- Shad, M.K., et al., Integrating sustainability reporting into enterprise risk management and its relationship with business performance: A conceptual framework. Journal of Cleaner production, 2019. 208: p. 415-425. [CrossRef]

Figure 1.

This is a ring chart showing the industry distribution of 70 selected listed companies.

Figure 2.

This is the data collection matrix. Data collection based on the topics disclosed in the company’s sustainability report.

Figure 2.

This is the data collection matrix. Data collection based on the topics disclosed in the company’s sustainability report.

Figure 3.

This bar chart displays the overall performance of GRI required reported material topics.

Figure 4.

Sustainability Governance Performance.

Figure 5.

Economic performance.

Figure 6.

Anti-corruption Performance.

Figure 7.

Procurement Practices.

Figure 8.

Performance of 67 reports Greenhouse Gas Emissions.

Figure 9.

Performance of 67 reports Energy Consumption.

Figure 10.

Performance of 65 reports Water and Effluents.

Figure 11.

Performance of 57 reports waste.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Copyright: This open access article is published under a Creative Commons CC BY 4.0 license, which permit the free download, distribution, and reuse, provided that the author and preprint are cited in any reuse.

Sustainability & Risk Disclosure: An Exploratory Study on Sustainability Reports

Elisa Truant

et al.

,

2017

Current State of Sustainability Reporting: A Case of Public Universities in Western Kenya

Patrick B. Ojera

et al.

,

2020

The Impact Of Sustainability Reporting On Financial Performance: Evidence From Turkish FBT And TCL Sectors

Serhii Lehenchuk

et al.

,

2023

MDPI Initiatives

Important Links

© 2024 MDPI (Basel, Switzerland) unless otherwise stated