Bhim

- 1. Prepared By - Siddhant Bhosale Veena Devadiga Eisha Kale

- 2. Introduction Three ways to transfer money-NEFT, RTGS, IMPS Major drawbacks of NEFT, RTGS, IMPS -Time consuming process -Both the Accounts should be RTGS enabled -Activation of Net Banking facility is mandatory -Limitation on number of beneficiary in day

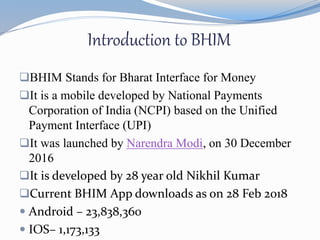

- 3. Introduction to BHIM BHIM Stands for Bharat Interface for Money It is a mobile developed by National Payments Corporation of India (NCPI) based on the Unified Payment Interface (UPI) It was launched by Narendra Modi, on 30 December 2016 It is developed by 28 year old Nikhil Kumar Current BHIM App downloads as on 28 Feb 2018 Android – 23,838,360 IOS– 1,173,133

- 4. Features of BHIM Immediate Money Transfer Allows to send / receive money to UPI Payment addresses, non UPI based accounts Allows to check balance transactions history and change pin Can be accessed on all platforms Currently supports 13 languages Only money transfer between accounts is done Transactions are done without debit Card, OTP number, CVV number or grid number

- 5. SWOT ANALYSIS STRENGTHS WEAKNESSES No Transaction charges User friendly application Very less time is required for transaction BHIM app directly links to user bank account Only Money Transfer can be done Single Bank Account can be added Doesn’t involve recharges and other payments Unattractive user interface OPPORTUNITIES THREATS Add additional banks Tie up with organizations for payment or mobile, utility bills etc Promotion through various media Cashback and referral facilities provided by competitor Facilities of bill payments ,utility bills are provided by competitors

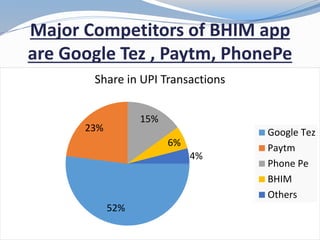

- 6. Major Competitors of BHIM app are Google Tez , Paytm, PhonePe 52% 23% 15% 6% 4% Share in UPI Transactions Google Tez Paytm Phone Pe BHIM Others

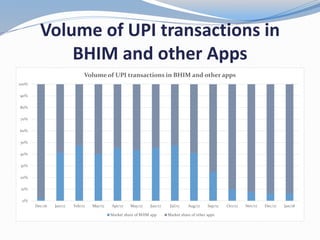

- 7. Volume of UPI transactions in BHIM and other Apps 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Dec/16 Jan/17 Feb/17 Mar/17 Apr/17 May/17 Jun/17 Jul/17 Aug/17 Sep/17 Oct/17 Nov/17 Dec/17 Jan/18 Volume of UPI transactions in BHIM and other apps Market share of BHIM app Market share of other apps

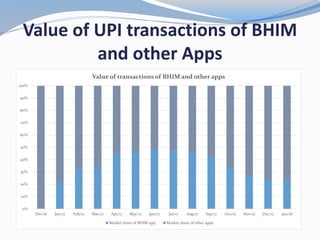

- 8. Value of UPI transactions of BHIM and other Apps 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Dec/16 Jan/17 Feb/17 Mar/17 Apr/17 May/17 Jun/17 Jul/17 Aug/17 Sep/17 Oct/17 Nov/17 Dec/17 Jan/18 Value of transactions of BHIM and other apps Market share of BHIM app Market share of other apps

- 9. Major Problems of BHIM App Declining market share from 40% to 6% For BHIM App only source of revenue is through its download from play store and i-store.

- 10. Recommendations Providing Advertisement Space. Tie up with various organizations Languages Used Auto Instruction facility for life insurance premium or loan instalments Increase in the number of gateways Promotion through “Jan hit me jari” and “Digital India campaign”