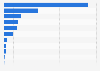

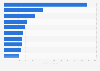

According to the 2024 European Hotel Investors Intentions Survey conducted by CBRE Research, vacant properties are most favored by hotel investors in Europe, as 36% of respondents chose this as their investment priority. This is followed by independent hotels at 28%.

As the world’s favorite destination, Europe has consistently captured more than half of global international travel and remains one of the most attractive targets for hospitality industry investors. CBRE, one of the largest commercial real estate services and investment firms, explained in their report that the investment climate in the travel accommodation sector is now defined by increased labor constraints and geopolitical uncertainties. In pursuit of what CBRE calls value-add strategies, many investors are eyeing repositioning opportunities in unaffiliated hotels through renovations and upgrades, rebranding, or shifting the focus to a different demographic or type of traveler.

Predictably, “vacant possession” structures came as the top choice, but independent hotels weren’t far behind. Investors expressed less than one-fourth of the acquisition appetite for hotels “affiliated with a globally recognized brand family” as opposed to appetite for independent properties.

An interesting distinction exists when it comes to the perception of hard and soft brands. Investors expressed a clear preference for the latter. Notably, in Europe, only 6% seek affiliation with a hard global brand, in stark contrast to the US, where a majority (55%) expressed this preference. Given the strong recovery and optimistic growth forecasts for the industry, investors convey confidence in pursuing hotel assets. 90% of those surveyed by CBRE expect to maintain or increase hotel investments in 2024.

This is an excerpt from The Titans of Travel: How Small Businesses Shape Europe’s Accommodation Industry in 50 Charts click here to download the eBook for free.