2011 Drilling Highlights - Oklahoma Geological Survey - University ...

2011 Drilling Highlights - Oklahoma Geological Survey - University ...

2011 Drilling Highlights - Oklahoma Geological Survey - University ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

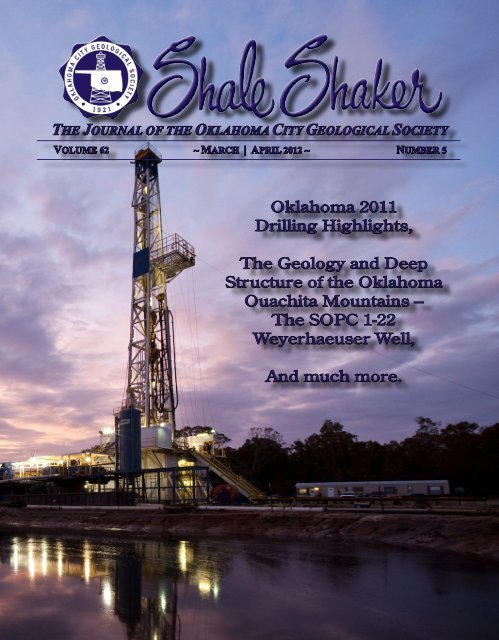

THE JOURNAL OF THE OKLAHOMA CITY GEOLOGICAL SOCIETY<br />

VOLUME 62 ~ MARCH | APRIL 2012 ~ NUMBER 5<br />

<strong>Oklahoma</strong> <strong>2011</strong><br />

<strong>Drilling</strong> <strong>Highlights</strong>,<br />

The Geology and Deep<br />

Structure of the <strong>Oklahoma</strong><br />

Ouachita Mountains –<br />

The SOPC 1-22<br />

Weyerhaeuser Well,<br />

And much more.

Volume 62 | Number 5<br />

The Journal of the <strong>Oklahoma</strong> City <strong>Geological</strong> Society<br />

Shale Shaker Staff<br />

EDITOR:<br />

Michael Root, CEO, TerraQuest Corporation<br />

[email protected]; [email protected]<br />

405-359-0773<br />

ASSOCIATE EDITOR:<br />

Neil H. Suneson, <strong>Oklahoma</strong> <strong>Geological</strong> <strong>Survey</strong><br />

[email protected]<br />

GEOLOGISTS WIVES ASSOCIATION:<br />

Stacy J. Harris, Geologist Wives<br />

PRODUCTION & DESIGN:<br />

Theresa Andrews, Art Director,<br />

Visual Concepts & Design, Inc.<br />

[email protected]<br />

405-514-5317<br />

EDITORIAL BOARD:<br />

M. Charles Gilbert, Geologist,<br />

ConocoPhillips School of Geology and Geophysics, OU<br />

[email protected]<br />

Michael W. Smith,<br />

Geologist, Weston Resources, Inc.<br />

[email protected]<br />

Raymond W. Suhm,<br />

Independent Geologist, Consultant<br />

[email protected]<br />

Kris Wells,<br />

Geologist, Mustang Fuel Corporation<br />

[email protected]<br />

OCGS Executive Committee<br />

PRESIDENT:<br />

Greg Flournoy, Schlumberger Oilfield Services<br />

VICE PRESIDENT:<br />

Mark Goss, RKI Exploration & Production<br />

SECRETARY:<br />

Jami Poor, MAP<br />

PAST PRESIDENT:<br />

Suzanne Rogers, Sandstone Energy Acquisitions Corporation,<br />

Chair of Energy Libraries Online<br />

TREASURER:<br />

Hank Trattner, Trattner & Associates<br />

LIBRARY DIRECTOR:<br />

Steve Harris, Okland Oil Company<br />

COUNCILOR:<br />

Jim Franks, Independent Consulting Geologist<br />

WEBMASTER:<br />

John McLeod, Chesapeake Energy Corporation<br />

SHALE SHAKER EDITOR:<br />

Michael Root, CEO, TerraQuest Corporation<br />

SOCIAL CHAIRMAN:<br />

Greg McMahan, SandRidge Energy, Inc.<br />

AAPG MID-CONTINENT REPRESENTATIVE:<br />

H.W. (Dub) Peace<br />

ENERGY LIBRARIES ONLINE CHAIRMAN:<br />

Suzanne Rogers, Sandstone Energy Acquisitions Corporation<br />

OCGS Offices and <strong>Geological</strong> Library:<br />

120 North Robinson, Suite 900 Center,<br />

<strong>Oklahoma</strong> City, OK 73102<br />

Phone: (405) 236-8086 | Fax: (405) 236-8085<br />

Website: www.ocgs.org<br />

Michelle Hone,<br />

Accounting Manager/Administrative Assistant<br />

Email: [email protected]<br />

Pam Yeakley, Library Manager, OCGS<br />

Email: [email protected]<br />

March ~ April 2012 | Page 337

Table of Contents<br />

The Journal of the <strong>Oklahoma</strong> City <strong>Geological</strong> Society<br />

Shale Shaker Features<br />

342 <strong>Oklahoma</strong> Is Set To Lead The Nation; Michael<br />

Root, Editor, CEO, TerraQuest Corporation,<br />

Edmond, OK<br />

360 <strong>Oklahoma</strong> Well Status; Randy Peterson, IHS<br />

395 State of the Industry; Michael Root, Editor, CEO,<br />

TerraQuest Corporation, Edmond, OK<br />

Oil and Gas Exploration<br />

362 The Geology and Deep Structure of the<br />

<strong>Oklahoma</strong> Ouachita Mountains - The SOPC 1-22<br />

Weyerhaeuser Well; Michael D. Allison, North<br />

Texas Sample Log Service; William H. Willis<br />

II, Manager, Southern Minerals, Weyerhaeuser<br />

Company; Dr. Neil Suneson, <strong>Oklahoma</strong><br />

<strong>Geological</strong> <strong>Survey</strong><br />

302 <strong>Oklahoma</strong> <strong>2011</strong> <strong>Drilling</strong> <strong>Highlights</strong>; Dan T. Boyd,<br />

<strong>Oklahoma</strong> <strong>Geological</strong> <strong>Survey</strong><br />

About the Cover<br />

Page 338 | March ~ April 2012<br />

Professional Organizations<br />

344 <strong>Oklahoma</strong> <strong>Geological</strong> Foundation Report; Thomas<br />

C. Cronin, OGF Chairman, CEO, K. Steward<br />

Exploration LLC<br />

345 OGGS <strong>2011</strong> Christmas Party; Greg McMahan,<br />

Social Chairman SandRidge Energy, Inc.<br />

352 The 2012 5th Annual Real Deal Mid-Continent<br />

Prospect Expo<br />

354 Geologist Wives Association; Stacy J. Harris,<br />

Reporter<br />

377 <strong>Oklahoma</strong> City <strong>Geological</strong> Society Library<br />

<strong>Geological</strong> Treasure Chest<br />

<strong>Oklahoma</strong> Universities<br />

Michael Root creates the covers of the Shale Shaker. The cover for this Issue utilizes an<br />

image supplied by Michelle Dodd, Coordinator of Photography for Chesapeake Energy<br />

Corporation and is one of many contained within Chesapeake’s Visual Resource Center.<br />

The cover ties nicely with this Issue’s technical subject matter: “<strong>Oklahoma</strong> <strong>2011</strong><br />

<strong>Drilling</strong> <strong>Highlights</strong>,” by Dan T. Boyd, of the <strong>Oklahoma</strong> <strong>Geological</strong> <strong>Survey</strong>; and “The<br />

Geology and Deep Structure of the <strong>Oklahoma</strong> Ouachita Mountains – The SOPC 1-22<br />

Weyerhaeuser Well,” by Michael D. Allison, North Texas Sample Log Service, William<br />

H. Willis II, Manager - Southern Minerals, Weyerhaeuser Company, and Neil H.<br />

Suneson, of the <strong>Oklahoma</strong> <strong>Geological</strong> <strong>Survey</strong>.<br />

357 Shell Colloquium Series Schedule, Fall <strong>2011</strong>;<br />

Lisa Vassmer, Special Events and Donor<br />

Relations, ConocoPhillips School of Geology and<br />

Geophysics, The <strong>University</strong> of <strong>Oklahoma</strong>

Oil and Gas Exploration<br />

By: Dan T. Boyd, <strong>Oklahoma</strong> <strong>Geological</strong> <strong>Survey</strong>, (405) 325-8898 | [email protected]<br />

<strong>Oklahoma</strong> <strong>2011</strong><br />

<strong>Drilling</strong> <strong>Highlights</strong><br />

This article is a summary of <strong>Oklahoma</strong><br />

drilling activity that became public in<br />

<strong>2011</strong>. Any activity or key wells that were<br />

unavailable before January 1, 2012 will<br />

appear in next year’s summary. Except<br />

where noted, all data were supplied online<br />

by Petroleum Information/Dwights<br />

LLC dba IHS Energy Group, all rights<br />

reserved. A lax State attitude towards<br />

completion and production reporting has<br />

created extraordinarily long lag times in<br />

receiving these data, making analyses of<br />

recent activity difficult. Without the Energy<br />

Information Administration (E.I.A.)<br />

and especially the information provided<br />

by the IHS Energy a report of this kind<br />

would not be possible. Editing of this article<br />

was performed by Neil Suneson and<br />

cartography by Russell Standridge, both<br />

from the <strong>Oklahoma</strong> <strong>Geological</strong> <strong>Survey</strong>.<br />

General Activity<br />

The number of working drilling rigs is a<br />

Page 378 | March ~ April 2012<br />

fundamental barometer of oil and gas activity<br />

and Baker Hughes Company tracks<br />

monthly rotary drilling rig counts for regions<br />

all over the world. After a weekly<br />

peak of 219 in September, 2008 <strong>Oklahoma</strong>’s<br />

rig count reached a low of 69<br />

working rigs in September, 2009 (Boyd,<br />

2010). Since that time numbers have been<br />

steadily climbing, with the last week of<br />

<strong>2011</strong> reaching 195 working rigs. This has<br />

brought the annual average for the year up<br />

to 180 and marks the second year of major<br />

increases in drilling activity (Figure 1).<br />

<strong>Oklahoma</strong>’s rig count is now on a par with<br />

levels seen prior to the collapse of oil and<br />

gas prices that occurred at the end of 2008.<br />

In past years as many as 3/4s of all wells<br />

drilled in <strong>Oklahoma</strong> targeted gas, which<br />

has made its price the most important factor<br />

controlling drilling. This is no longer<br />

the case. Although the price for both gas<br />

and oil fell at the end of 2008, oil has<br />

largely recovered and gas has not (Figure<br />

2). Using the standard 6 MCF per barrel<br />

conversion, on a barrel of oil equivalency<br />

(BOE), in 2003 gas and oil prices were<br />

equal. While <strong>2011</strong> oil prices have risen<br />

to near their 2008 peak, gas is now selling<br />

for less than it did in 2003. In fact, on<br />

a BOE basis oil is now over three times<br />

more valuable than gas, and this will likely<br />

continue. Oil remains between $90 and<br />

$100 per barrel, but gas has again missed<br />

the usual winter price increase that occurs<br />

during the peak-heating season and has<br />

declined steadily since June (Figure 3).<br />

The latest estimate from the <strong>Oklahoma</strong><br />

Corporation Commission (OCC) places<br />

the average <strong>2011</strong> wellhead natural gas<br />

price in <strong>Oklahoma</strong> at approximately $4.67<br />

per MCF (Soltani, 2012) (Figure 2). This is<br />

an optimistic forecast as it is based mostly<br />

on prices in the first half of the year. Although<br />

the sharp fall that occurred in the<br />

second half of the year will be eased by<br />

hedged contracts and higher Btu gas, the

Figure 1. <strong>Oklahoma</strong> annual rotary rig count from 2002 to <strong>2011</strong>. Data from Baker Hughes (2012).<br />

Figure 2. <strong>Oklahoma</strong> annual average oil and gas price on a barrel of oil equivalency (BOE) from 2003 through <strong>2011</strong>. Data from Soltani<br />

(2012).<br />

March ~ April 2012 | Page 379

Oil and Gas Exploration<br />

<strong>Oklahoma</strong> <strong>2011</strong> <strong>Drilling</strong> <strong>Highlights</strong>, cont.<br />

Figure 3. Henry Hub natural gas spot price from January 3, <strong>2011</strong> through January 17, 2012. Adapted from Williams, (2012)<br />

average for <strong>2011</strong> will undoubtedly show a<br />

significant fall from 2010. The continued<br />

decline of Henry Hub Spot prices below<br />

$3/MCF is a disturbing development (Figure<br />

3). These prices result from an oversupply<br />

that is being maintained by the active<br />

drilling of gas shales and the horizontal<br />

development of liquids-rich unconventional<br />

plays which produce high volumes<br />

of associated gas. This activity continues<br />

throughout the country and shows no sign<br />

of abating.<br />

Although oil prices are now the main<br />

driver in maintaining drilling activity in<br />

the State, <strong>Oklahoma</strong> remains strongly<br />

gas-prone with gas representing 81% of<br />

our BOE production. Given the dominance<br />

of gas in <strong>Oklahoma</strong> industry earnings,<br />

State gross-production tax income<br />

Page 380 | March ~ April 2012<br />

can never fully recover until prices reach<br />

a level where gas-targeted drilling again<br />

becomes economically viable. There are<br />

prolific shale-gas plays across the U.S.,<br />

and like the Woodford in <strong>Oklahoma</strong>, these<br />

continue to be drilled (and produced) in<br />

an already glutted market. Price predictions<br />

are impossible, but certainly until<br />

the bulk of prospective shale-gas acreage<br />

is ‘held by production,’ which will afford<br />

operators the luxury of drilling infill wells<br />

only when prices are higher, there is little<br />

chance that prices will significantly recover.<br />

Languishing gas prices, high oil prices,<br />

and the expectation that these will continue<br />

has again pushed oil-targeted drilling<br />

higher. In <strong>2011</strong> gas drilling fell another 7%<br />

with oil rising by the same amount (Boyd,<br />

<strong>2011</strong>). Technically oil now accounts for<br />

over half of all drilling in the State (Figure<br />

4). However, if horizontal gas wells that<br />

were drilled to maximize oil/condensate/<br />

NGL production are excluded, this disparity<br />

would be even more pronounced. As<br />

will be discussed, with even the oiliest<br />

plays producing mostly gas and many of<br />

the ‘gas’ plays producing substantial volumes<br />

of hydrocarbon liquids, well classification<br />

becomes problematic. However,<br />

acreage expiration issues aside, it appears<br />

there are very few wells being drilled in<br />

<strong>Oklahoma</strong> today that are not relying on<br />

liquids production for economic viability.<br />

Water-injection and disposal-well drilling<br />

represents about 9% of all <strong>2011</strong> drilling<br />

(Figure 4) - a slight increase over previous<br />

years. High-rate water-disposal wells,

which invariably target the Arbuckle<br />

Group, are a prerequisite for production<br />

in all of the State’s horizontal plays. In<br />

fact, future drilling activity can often be<br />

gauged based on the number and location<br />

of disposal-well drilling permits. Dry and<br />

junked holes accounted for an additional<br />

7% of <strong>2011</strong> drilling. Although a large percentage<br />

of the wells drilled in <strong>Oklahoma</strong><br />

were classified as ‘New Field Wildcats,’<br />

because they are targeting unconventional,<br />

blanket reservoirs, this is something of<br />

a misnomer. (The term ‘unconventional’<br />

is used here to denote reservoirs in which<br />

the permeability is too low to permit<br />

fluid separation.) The overall 93%+ success<br />

rate that the industry has enjoyed is<br />

comparable to previous years and shows<br />

that drilling throughout <strong>Oklahoma</strong> continues<br />

to be overwhelmingly developmental<br />

(Figure 4). Even for isolated horizontal<br />

wells where economic risk is probably the<br />

greatest, the chance of a non-producing<br />

dry hole is usually less than the mechanical<br />

risk associated with drilling the well.<br />

Figure 4. <strong>Oklahoma</strong> <strong>2011</strong> well completion results (for wells reported through January 1, 2012).<br />

Data from IHS Energy (2012).<br />

Figure 5. <strong>Oklahoma</strong> oil and gas production on a barrel of oil equivalency (BOE) from 2005 to <strong>2011</strong>. Early data from Soltani, 2012. Later data taken from<br />

E.I.A., 2012.<br />

March ~ April 2012 | Page 381

Oil and Gas Exploration<br />

<strong>Oklahoma</strong> <strong>2011</strong> <strong>Drilling</strong> <strong>Highlights</strong>, cont.<br />

Figure 6. <strong>Oklahoma</strong> annual well completions comparing vertical and horizontal drilling from 2002 to <strong>2011</strong>. Note the resiliency of horizontal drilling<br />

despite lower prices over the last three years. Data from IHS Energy (2012) through January 1, 2012.<br />

Active Woodford Shale drilling, with<br />

279 horizontal completions registered so<br />

far in <strong>2011</strong>, combined with contributions<br />

from other high GOR horizontal plays, is<br />

projected to increase State gas production<br />

in <strong>2011</strong> by 46 BCF (7.7 MMBOE) over<br />

2010 (Figure 5). A continued concentration<br />

on oil/condensate-targeted drilling<br />

has also increased ‘oil’ production by almost<br />

2 MMBO and maintained a trend of<br />

increasing production that began in 2008.<br />

Oil production in <strong>Oklahoma</strong> declined<br />

continuously from the end of the drilling<br />

boom in 1984 until 2005. Since then higher<br />

prices have fueled increases in both vertical<br />

development and horizontal drilling<br />

that have increased production by 16%, or<br />

over 10 MMB per year.<br />

Page 382 | March ~ April 2012<br />

Reporting delays, which sometimes manifest<br />

as gross underreporting of production,<br />

have forced the use of the Energy Information<br />

Administration (EIA) data for annual<br />

State production volumes beginning<br />

in 2008 (Figure 5). The EIA develops<br />

production statistics from survey forms<br />

that are submitted by respondents on a<br />

monthly basis. These are combined with<br />

data from ‘other sources’ in order to estimate<br />

total State production. Although this<br />

is something of a black box, EIA volumes<br />

make more sense based on documented<br />

drilling and completion activity. They<br />

have online data through July, <strong>2011</strong> while<br />

the OCC as of this writing has yet to publish<br />

2010 production (E.I.A., 2012). OCC<br />

and EIA annual production numbers have<br />

diverged from near-agreement in 2007 to<br />

a difference of 3% in oil and 11% in gas<br />

in 2009. Such discrepancies make year-toyear<br />

projections impossible.<br />

Overall, the 876 wells thus far registered<br />

as having begun production in <strong>2011</strong><br />

have contributed about 23 thousand barrels<br />

(MBO) and 608 million cubic feet<br />

(MMCF) per day. This represents about<br />

12% of both State oil and State gas production,<br />

but reporting lags ensure that this<br />

percentage will be extremely conservative.<br />

The vast bulk of this new production<br />

is due to horizontal drilling. Despite the<br />

industry’s success in finding and producing<br />

oil and gas in <strong>2011</strong>, continued declines<br />

in many older wells reduces the annual

ise in overall production to about 3%.<br />

This underscores the need for continuous,<br />

high levels of drilling activity in order to<br />

maintain production levels. On a BOE<br />

basis natural gas production is four times<br />

that of oil (Figure 5), but the price differential<br />

inflates oil’s value to 43% of the total.<br />

Although this makes the industry and<br />

the State less dependent on natural gas, its<br />

price remains the key factor in the overall<br />

economic health of both.<br />

Reporting delays necessitate a revision of<br />

historic State drilling statistics each year.<br />

Since January 1, <strong>2011</strong> 987 additional completions<br />

were registered for 2010 and 163<br />

were added to 2009. In fact, in this year’s<br />

update it was necessary to add new completions<br />

to the totals registered for every<br />

year since 2002. Such delays and the fact<br />

that the proportion of reported and ‘not-<br />

yet-reported’ wells is inconsistent from<br />

year to year make annual comparisons of<br />

drilling activity difficult. As in previous<br />

years, to reduce the impact of reporting<br />

delays all completion numbers for <strong>2011</strong><br />

were increased by one third. Total completions<br />

in <strong>2011</strong> registered through January<br />

1, 2012 were slightly above those reported<br />

for 2010 at the same time last year.<br />

Although both year’s well counts will<br />

continue to rise, it appears that the number<br />

of completions that will ultimately<br />

be registered in <strong>2011</strong>, despite the higher<br />

proportion of (longer to drill) horizontal<br />

completions, will be greater than those for<br />

2010 (Figure 6).<br />

From 2002 through 2008 overall drilling<br />

activity generally increased, but this<br />

trend ended abruptly when prices fell at<br />

the end of 2008. The reduction in drilling<br />

was especially pronounced for vertical<br />

wells, which fell by half in 2009 (Figure<br />

6). The number of horizontal wells drilled<br />

also fell that year, but as a proportion of all<br />

drilling the rise in horizontal drilling was<br />

remarkably consistent until <strong>2011</strong> (Figure<br />

7). The jump in the percentage of horizontal<br />

well completions last year was as<br />

much due to less vertical activity as more<br />

horizontal. Since 2002 horizontal completions<br />

in <strong>Oklahoma</strong> have risen from 4% to<br />

41% of the total number of completions,<br />

and these now represent 62% of the total<br />

footage drilled in the State.<br />

Hundreds of companies drilled wells in<br />

<strong>2011</strong>, but Chesapeake Operating continues<br />

to be the most active operator (Figure 8).<br />

The 184 completions registered through<br />

January 1 st are comparable to those assigned<br />

to them in last year’s report, and<br />

Figure 7. <strong>Oklahoma</strong> annual horizontal drilling as a percentage of total completions from 2002 to <strong>2011</strong>. In terms of footage drilled <strong>2011</strong> horizontal wells<br />

accounted for nearly two thirds of State drilling. Data from IHS Energy (2012) through January 1, 2012.<br />

March ~ April 2012 | Page 383

Oil and Gas Exploration<br />

<strong>Oklahoma</strong> <strong>2011</strong> <strong>Drilling</strong> <strong>Highlights</strong>, cont.<br />

Figure 8. Top five operators in <strong>Oklahoma</strong> in <strong>2011</strong> based on the number of completions registered through January 1, 2012. Data from IHS Energy (2012).<br />

these represent over 8% of all drilling in<br />

the State. Chesapeake is active in almost<br />

every part of <strong>Oklahoma</strong>, but their drilling<br />

in <strong>2011</strong> was dominantly horizontal and<br />

was concentrated in the Desmoinesian<br />

Granite Wash, the Mississippian, and the<br />

Cleveland plays in the western part of the<br />

State.<br />

The remaining top operators in the State<br />

are much more focused in their drilling.<br />

Based on completion numbers the second<br />

most active operator in <strong>2011</strong> was Citation<br />

Oil and Gas who drilled or recompleted<br />

129 vertical, shallow, oil development<br />

wells and injectors in southern <strong>Oklahoma</strong>,<br />

mostly in Sho-Vel-Tum, Fitts, and Healdton<br />

Fields. SandRidge’s drilling activity<br />

was restricted exclusively to horizontal<br />

wells in the Mississippian play in Woods,<br />

Grant and Alfalfa Counties, which included<br />

37 water-disposal wells. Devon Energy<br />

was primarily focused on horizontal development<br />

of the Woodford Shale, mostly in<br />

their ‘Cana’ play located on the northeastern<br />

shelf of the Anadarko Basin. Round-<br />

Page 384 | March ~ April 2012<br />

ing out the top five operators in <strong>2011</strong>, New<br />

Dominion, another perennial member of<br />

the top-five-operators club, continues to<br />

focus exclusively on Misener/Hunton dewatering<br />

projects, most of these located in<br />

Seminole County (Figure 8).<br />

Horizontal <strong>Drilling</strong><br />

The petroleum industry in <strong>Oklahoma</strong> today<br />

is concentrating on low-permeability<br />

reservoirs that horizontal drilling and<br />

completion technology have made into<br />

attractive targets (Figure 9). This activity<br />

began in earnest about ten years ago<br />

with production from horizontal wells in<br />

the Hartshorne coal in the Arkoma Basin.<br />

<strong>Drilling</strong> here accelerated through the early<br />

part of the decade and was augmented<br />

by the Misener/Hunton dewatering play,<br />

which is located mostly in central <strong>Oklahoma</strong>.<br />

These two plays were followed in<br />

2006 by the Woodford Shale, which has<br />

seen development in the western Arkoma,<br />

Ardmore, and eastern Anadarko Basins.<br />

There is now an ever-lengthening list of<br />

other reservoirs that lend themselves to<br />

horizontal drilling and completion techniques.<br />

In addition to dozens of lesser<br />

targets, the most active include the Cleveland,<br />

Desmoinesian Granite Wash, and<br />

now the Mississippian, whose potential<br />

prospective area, which extends from<br />

northern <strong>Oklahoma</strong> through central Kansas,<br />

could become the largest of them all<br />

(IHS Energy, 2012).<br />

Horizontal drilling plays are attractive for<br />

many reasons. Because they exist in lowpermeability<br />

reservoirs in which fluid separation<br />

is not possible, the accumulations<br />

are continuous and the geological risk of a<br />

dry hole is essentially zero. Blanket reservoirs<br />

that are often quite thick also contain<br />

exceedingly large in-place gas and/or oil<br />

volumes, making the potential target large.<br />

Relatively small drainage areas, even after<br />

extensive fracture stimulation, means<br />

that many wells must be drilled in order<br />

to adequately develop such reservoirs. Although<br />

restricted drainage is not normally

Figure 9. Major <strong>Oklahoma</strong> horizontal drilling plays (> 100 completions) from 2002 to <strong>2011</strong>. Data from IHS Energy (2012) through January 1, 2012. All<br />

registered <strong>2011</strong> completion numbers increased by one third to account for reporting delays.<br />

an attractive characteristic, this allows<br />

companies to book proved undeveloped<br />

reserve volumes that are two to seven<br />

times those booked for the first well in the<br />

drilling unit. The result is a ‘dream scenario’<br />

for large operators whose regional leasing<br />

programs have captured hundreds of<br />

thousands or even millions of net mineral<br />

acres. With drainage areas established,<br />

locations are permitted and wells drilled<br />

based on lease expiration. Large numbers<br />

of dedicated drilling rigs are then able to<br />

turn reserve bookings into an assemblyline<br />

process in which the primary risk is<br />

mechanical. The thousands to tens-ofthousands<br />

of development locations generated<br />

from this ‘exploratory’ drilling create<br />

proved-undeveloped reserve volumes<br />

that quickly become astronomical.<br />

However, even horizontal plays are pricesensitive.<br />

Early production declines are<br />

very steep and drilling, operational (including<br />

water disposal) and acreage costs<br />

are high. Although most horizontal plays<br />

have ‘sweet spots’ that will remain economic<br />

in almost any price environment,<br />

based on the data at hand most of the prospective<br />

areas appear to be economically<br />

marginal in all but higher-price scenarios.<br />

With the fall in natural gas prices in late<br />

2008 operators have been forced to focus<br />

on horizontal plays that are more liquidsrich,<br />

which includes oil, condensate, and<br />

natural gas liquids (NGLs). However, because<br />

the targeted reservoirs have exceedingly<br />

low permeability, even the most liq-<br />

uids-rich horizontal plays produce mostly<br />

gas (Figure 10). This preponderance of<br />

natural gas, combined with its low price,<br />

makes it appear that operators have foregone<br />

short-term economics in favor of a<br />

strategy of holding acreage by production.<br />

Development drilling on this acreage can<br />

then wait until prices rise above whatever<br />

economic threshold the operator deems<br />

necessary to justify future activity.<br />

Almost every significant productive reservoir<br />

in the State has been drilled horizontally<br />

somewhere, but some have been<br />

systematically exploited in well-defined<br />

area(s) which can be described as geologic<br />

plays. Three of these, while still producing,<br />

are largely inactive in terms of drilling.<br />

March ~ April 2012 | Page 385

Oil and Gas Exploration<br />

<strong>Oklahoma</strong> <strong>2011</strong> <strong>Drilling</strong> <strong>Highlights</strong>, cont.<br />

Figure 10. <strong>Oklahoma</strong> major horizontal play cumulative production in MMBOE. Even the most hydrocarbon liquids-rich horizontal plays produce<br />

primarily gas. Natural gas liquid (NGL) production is not taken into account. Data from IHS Energy (2012).<br />

Chesapeake utilized horizontal-drilling<br />

technology in the mid- to late-1990’s to<br />

pursue mostly oil in the Sycamore carbonate<br />

in southern <strong>Oklahoma</strong>. Most of these<br />

wells are located in Sho-Vel-Tum Field<br />

and the Golden Trend. Another largely inactive<br />

horizontal play was made by EOG<br />

Resources in the Panhandle in western<br />

Texas County. Here they drilled about 70<br />

horizontal gas wells between 2000 and<br />

2003 in the Council Grove, mostly in Unity<br />

SW and Guymon-Hugoton Fields. In an<br />

aggressive dewatering project that utilizes<br />

horizontal drilling, New Dominion has<br />

targeted the Arbuckle in the <strong>Oklahoma</strong><br />

City Field. Here they have drilled 55 horizontal<br />

laterals from 17 surface locations<br />

and are disposing the water into the Arbuckle<br />

on the downthrown side of the field<br />

fault (Boyd, 2010).<br />

Using an arbitrary 100-well cutoff, there<br />

are six ‘major’ horizontal plays in Okla-<br />

Page 386 | March ~ April 2012<br />

homa with all but one still active. In addition,<br />

there are others (Marmaton, Tonkawa<br />

and Cherokee) that appear destined to<br />

reach this milestone soon. <strong>Drilling</strong> statistics<br />

for the most active horizontal plays<br />

over the last ten years are shown in Figure<br />

9. [The <strong>2011</strong> totals for each of those<br />

listed have been increased by 33% in an<br />

attempt to account for the reporting delays<br />

described previously.] Although the <strong>2011</strong><br />

projections are probably still conservative,<br />

the graph should be indicative of the<br />

direction that activity in these plays is taking.<br />

Figure 11 shows the productive areas<br />

occupied by the six ‘major’ horizontal<br />

plays at the end of 2010 and the completions<br />

that were added to these and all other<br />

reservoirs in <strong>2011</strong>. In the last month reported,<br />

usually between July and September<br />

of <strong>2011</strong>, <strong>Oklahoma</strong>’s 5,030 producing<br />

horizontal wells were making 35 MBO +<br />

1,819 MMCF per day. Even this under-reported<br />

volume represents 18% of State oil<br />

production and 35% of gas. The six major<br />

horizontal plays account for over 90% of<br />

this production. (All production cited are<br />

from IHS Energy, 2012.)<br />

Hartshorne Coal<br />

Located in the Arkoma Basin, Hartshorne<br />

coalbed methane has been exploited with<br />

horizontal wells for more than a decade.<br />

Low natural gas prices and negligible liquids<br />

production have depressed drilling<br />

activity in this play since the fall in natural<br />

gas prices in 2008. Although still the largest<br />

horizontal play with 1,691 wells, with<br />

only seven registered completions in <strong>2011</strong><br />

the Hartshorne coal has disappeared as<br />

an active play. There appears to be ample<br />

room to expand this play eastward (Figure<br />

11), but only a major increase in gas prices<br />

will see this area developed. The 1595<br />

actively producing horizontal Hartshorne

coal wells have an average cumulative recovery<br />

of 249 MMCF and a current rate of<br />

60 MCF per day.<br />

Woodford Shale<br />

The next largest horizontal drilling play in<br />

the State, and the one that is still by far<br />

the most active, is the Woodford Shale. In<br />

only six years it now boasts 1,639 producing<br />

wells of which 279 have been registered<br />

thus far for <strong>2011</strong>. Although the decline<br />

in gas prices has pushed most Woodford<br />

drilling into areas with higher liquid<br />

yields, activity remains brisk (Figure 9).<br />

Of the three primary producing trends,<br />

the western Arkoma Basin accounts for<br />

nearly three quarters of all Woodford<br />

wells. Here most of the <strong>2011</strong> activity was<br />

in and around areas of established production,<br />

which has linked several isolated<br />

producing areas and appears destined to<br />

become contiguous through central Pittsburg<br />

County (Figure 11). The most active<br />

operators in the Arkoma Basin in <strong>2011</strong><br />

were Newfield Exploration, XTO Energy<br />

and Devon Energy. The 1,119 horizontal<br />

Woodford producers in this area have<br />

average cumulative production of 897<br />

MMCF and a current rate of 751 MCF<br />

per day. Oil and condensate production in<br />

most of this area is negligible.<br />

The most active <strong>2011</strong> Woodford drilling<br />

occurred in the producing area pioneered<br />

by Devon Energy in the northeastern<br />

Anadarko Basin. This productive area has<br />

continued to expand from western Canadian<br />

County into southern Blaine and<br />

northern Caddo Counties. Previously isolated<br />

pods of production in southeastern<br />

Dewey County have merged and appear<br />

poised to link with the main area. Expansion<br />

along strike to the southeast through<br />

Grady County is also taking place, but<br />

this has not yet become as active. Devon<br />

Energy was by far the most active operator<br />

in this area in <strong>2011</strong>, drilling over<br />

half of all wells. There are now 346 horizontal<br />

Woodford wells producing in the<br />

Anadarko Basin and these have average<br />

cumulative production of 662 MMCF and<br />

7 MBO. Average per well production for<br />

the last reported month across this part of<br />

the play was 960 MCF + 11 BO per day.<br />

Although only wet gas production is reported,<br />

NGL yields in this play are significant<br />

with reported Btu contents as high as<br />

1350 per MCF.<br />

A third major concentration of horizontal<br />

Woodford Shale production is located<br />

along the northern edge of the Ardmore<br />

Basin in Carter, Johnston, and Marshall<br />

Counties where there is now a trend about<br />

40 miles long. In <strong>2011</strong> this was the least<br />

active part of the play with no major extensions<br />

to the previously established producing<br />

area (Figure 11). In the Ardmore<br />

Basin the most active horizontal Woodford<br />

operator is XTO Energy. The 111 producing<br />

wells registered in this area have average<br />

cumulative production of 662 MMCF<br />

and 7 MBO. Average per well production<br />

in the last reported month was 960 MCF +<br />

11 BO per day.<br />

Misener/Hunton<br />

Dewatering has found its greatest application<br />

in the Hunton (Misener/Hunton)<br />

reservoir where over 1,322 horizontal<br />

wells have now been drilled. This play has<br />

remained consistently strong, with over<br />

100 wells drilled in each of the last seven<br />

years (Figure 9). Production through reservoir<br />

dewatering has been pursued in this<br />

reservoir interval in a number of areas.<br />

Aside from a handful of wells in the Edmond<br />

West Field area, the bulk of recent<br />

activity has again concentrated in central<br />

<strong>Oklahoma</strong> mostly in and around Seminole,<br />

Lincoln, and Okfuskee Counties.<br />

As was the case last year, New Dominion<br />

was the dominant operator in this play, accounting<br />

for more than half of all horizontal<br />

Misener/Hunton wells drilled in <strong>2011</strong>.<br />

The second most active operator was<br />

OEX-1 LLC, who has 20 wells registered<br />

thus far. Activity for both operators was<br />

mostly relegated to previously established<br />

areas of production. Because this play requires<br />

a major drop in reservoir pressure<br />

before significant hydrocarbons are produced,<br />

a process that can take years, the<br />

productivity of new wells or areas cannot<br />

be ascertained based on initial potential<br />

tests. This is why none of these has ever<br />

made the annual list of significant wells.<br />

Horizontal Hunton and Misener/Hunton<br />

wells have produced about 5 MMBO and<br />

283 BCF, generating an average recovery<br />

per completion of 10 MBO + 551 MMCF<br />

(Figure 10).<br />

Cleveland<br />

Unlike the first three horizontal plays,<br />

the remaining have significant liquids<br />

production and so have tended to benefit<br />

from the relative strength of oil prices and<br />

their continued rise (Figure 2). Horizontal<br />

Cleveland Sandstone drilling, which fell<br />

by a third in 2009, is at an all-time high<br />

with at least 90 completions projected<br />

for <strong>2011</strong>. Like last year, recent activity<br />

has seen a major expansion of the older<br />

productive areas and the addition of new<br />

areas of production.<br />

The main productive area in Ellis County,<br />

which continues into Lipscomb and Ochiltree<br />

Counties in the Texas Panhandle,<br />

has recently been extended into northern<br />

Roger Mills County. The satellite area that<br />

began in southwestern Dewey has continued<br />

to grow and has now moved well into<br />

Custer County. Based on drilling trends<br />

it appears that these two productive areas<br />

may meet in the future. An isolated pod of<br />

horizontal Cleveland production in northern<br />

Logan County also saw the addition of<br />

two wells in <strong>2011</strong> (Figure 11), but its economic<br />

viability remains in doubt. Despite<br />

the high oil volumes registered on initial<br />

tests and their general classification as oil<br />

wells, on a BOE basis horizontal Cleveland<br />

production is two-thirds natural gas<br />

(Figure 10). To date the play’s cumulative<br />

production in <strong>Oklahoma</strong> is 7.7 MMBO +<br />

92 BCF (15.4 MMBOE), giving the average<br />

well a cumulative production of 29<br />

MBO + 347 MMCF.<br />

Granite Wash<br />

There are several reservoirs called ‘Granite<br />

Wash’ that are being explored for and<br />

March ~ April 2012 | Page 387

Oil and Gas Exploration<br />

<strong>Oklahoma</strong> <strong>2011</strong> <strong>Drilling</strong> <strong>Highlights</strong>, cont.<br />

103°<br />

37°<br />

6N<br />

5<br />

3<br />

2<br />

1N<br />

4<br />

103°<br />

developed in the Anadarko Basin. These<br />

reservoirs span nearly the entire Pennsylvanian<br />

System through the lower Permian<br />

and are comprised of thick, low-permeability<br />

sediments shed from the Wichita<br />

Uplift located to the south. As such they<br />

Page 388 | March ~ April 2012<br />

1E 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 E 25 24 23 22 21 20 19 18 17 16 15 14<br />

102°<br />

101°<br />

CIMARRON TEXAS BEAVER<br />

102°<br />

EXPLANATION<br />

101°<br />

HORIZONTAL PLAY ACTIVITY<br />

<strong>2011</strong> WELL MAJOR PLAYS FORMATION<br />

0 50 Miles<br />

0 50 Kilometers<br />

vary in lithology based on the formation<br />

that was exposed on the uplift at the time<br />

of deposition. ‘Granite Wash’ reservoirs<br />

have been produced from vertical wells<br />

for decades with varying levels of success,<br />

but the advent of horizontal drilling and<br />

2<br />

Other<br />

1<br />

Miss. Lime/Chat<br />

DM Granite Wash<br />

Cleveland<br />

Misener/Hunton<br />

Hartshorne<br />

Woodford<br />

23N<br />

17<br />

16<br />

15<br />

14<br />

13<br />

12<br />

11<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1N<br />

28 W 26<br />

22<br />

21<br />

20<br />

19<br />

18<br />

36°<br />

35°<br />

100°<br />

100°<br />

ELLIS<br />

!<br />

! ! ! !<br />

!<br />

!<br />

!<br />

! !<br />

!<br />

! !<br />

! !<br />

!<br />

!<br />

! !! ! !<br />

!<br />

!<br />

!! !<br />

!<br />

!<br />

! !! !! !<br />

!<br />

!<br />

!<br />

! !<br />

!<br />

!<br />

! !<br />

!<br />

!<br />

!<br />

ROGER<br />

MILLS<br />

HARPER<br />

BECKHAM<br />

HARMON<br />

!<br />

4<br />

!<br />

GREER<br />

WOODWARD<br />

JACKSON<br />

99°<br />

DEWEY<br />

completion techniques has reduced the<br />

dry hole risk and made some enormously<br />

economic.<br />

The Desmoinesian Granite Wash horizontal<br />

play, located in the deepest part of the<br />

6<br />

!<br />

!<br />

!<br />

!<br />

5<br />

!!<br />

!!!!!!<br />

!<br />

!! ! !<br />

!<br />

!! !<br />

!<br />

! ! !<br />

!<br />

!<br />

!<br />

!<br />

!<br />

!<br />

!!<br />

!<br />

!<br />

!<br />

!!!!<br />

!<br />

!<br />

WOODS<br />

CUSTER<br />

! !<br />

!<br />

! !<br />

!<br />

! !<br />

! !<br />

!<br />

!!!!<br />

!<br />

!! !<br />

!! !! !!<br />

!!<br />

!<br />

WASHITA<br />

KIOWA<br />

HOLLIS BASIN<br />

Figure 10. <strong>Oklahoma</strong> major horizontal play cumulative production in MMBOE. Even the most hydrocarbon liquids-rich horizontal plays produce<br />

primarily gas. Natural gas liquid (NGL) production is not taken into account. Data from IHS Energy (2012).<br />

3<br />

7<br />

! 8<br />

TILLMAN<br />

99°<br />

!<br />

!<br />

!!<br />

! !<br />

!<br />

!<br />

!<br />

!<br />

!<br />

M<br />

ANAD<br />

! ! ! !<br />

! ! ! ! !!<br />

!<br />

! !<br />

!<br />

!<br />

! ! ! ! !<br />

!<br />

10<br />

!<br />

! !<br />

! !! !<br />

!!<br />

!<br />

!<br />

!<br />

WICHITA<br />

UPLIFT<br />

CO

13 12 11 10 9 8 7 6 5 4 3 2 1W 1E 2 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25E<br />

3<br />

29N<br />

28<br />

!!!!<br />

! !<br />

! ! !<br />

!<br />

! ! !!! ! !!<br />

! ! ! !!!<br />

! !<br />

! !<br />

!<br />

!<br />

!<br />

! ! ! !!<br />

!<br />

!<br />

!<br />

!<br />

!<br />

!<br />

!<br />

!<br />

!<br />

! ! ! !! 11 ! ! !<br />

!<br />

AJOR<br />

ALFALFA<br />

!<br />

BLAINE<br />

CADDO<br />

MANCHE<br />

!!!!<br />

COTTON<br />

98° 97° 96°95°<br />

GRANT<br />

GARFIELD<br />

KINGFISHER<br />

34°<br />

!<br />

!! !<br />

! !<br />

ARKO BASIN<br />

& SHELF<br />

!<br />

! !<br />

!<br />

! !<br />

!!!! ! !<br />

! !! ! ! !<br />

! !<br />

!<br />

! ! ! !<br />

! !!! !<br />

!!! ! ! ! !<br />

!<br />

!!<br />

! ! ! !<br />

!<br />

! ! !<br />

! !<br />

!<br />

!<br />

!<br />

!<br />

!<br />

! !<br />

!!!<br />

!<br />

!<br />

!<br />

! ! ! !<br />

! !<br />

!<br />

!<br />

! !<br />

!<br />

!<br />

! ! !<br />

! ! ! ! ! !<br />

! ! ! ! !<br />

!<br />

! !<br />

!<br />

!<br />

!<br />

!<br />

!<br />

CANADIAN<br />

!<br />

!<br />

GRADY<br />

STEPHENS<br />

JEFFERSON<br />

98°<br />

! !!!<br />

! ! !!<br />

!<br />

!!<br />

!<br />

! !<br />

!<br />

!<br />

!<br />

!<br />

9!<br />

! !<br />

McCLAIN<br />

!<br />

12<br />

!!<br />

LOGAN<br />

!<br />

OKLAHOMA<br />

ARDMORE<br />

BASIN<br />

!<br />

!<br />

!<br />

! !!<br />

!<br />

KAY<br />

NOBLE<br />

PAYNE<br />

!<br />

!<br />

CLEVELAND<br />

GARVIN<br />

CARTER<br />

LOVE<br />

!<br />

!<br />

!<br />

!<br />

!!<br />

!<br />

13 !<br />

PAWNEE<br />

!<br />

!<br />

!<br />

! !<br />

!!<br />

LINCOLN<br />

!<br />

POTTAWATOMIE<br />

MURRAY<br />

! !<br />

! !<br />

!! !<br />

!! !<br />

!<br />

Anadarko Basin, is by far the most important<br />

of the ‘Granite Wash’ reservoirs<br />

to date. Starting in north-central Washita<br />

County, completion numbers grew by<br />

a third in the last year. Chesapeake was<br />

again the dominant operator in this play,<br />

14<br />

! !<br />

!<br />

!<br />

!<br />

!<br />

!<br />

!! !<br />

MARSHALL<br />

SEMINOLE<br />

!<br />

OSAGE<br />

PONTOTOC<br />

JOHNSTON<br />

!<br />

!<br />

CREEK<br />

OKFUSKEE<br />

!<br />

!!<br />

! !<br />

ARBUCKLE<br />

UPLIFT<br />

!<br />

!!<br />

!<br />

!<br />

!!<br />

!<br />

!!!!<br />

CHEROKEE<br />

PLATFORM<br />

!<br />

!<br />

COAL<br />

HUGHES<br />

!!!!<br />

! !<br />

!<br />

!<br />

!<br />

!<br />

!<br />

! !<br />

BRYAN<br />

TULSA<br />

! ! !<br />

!<br />

!<br />

OKMULGEE<br />

!<br />

!! !<br />

!! !<br />

!<br />

!!!! ! !!<br />

!<br />

!<br />

!!!<br />

!<br />

!<br />

!<br />

!<br />

WASHINGTON<br />

!<br />

!<br />

!<br />

ATOKA<br />

NOWATA CRAIG<br />

ROGERS<br />

PUSHMATAHA<br />

CHOCTAW<br />

MAYES<br />

OTTAWA<br />

WAGONER CHEROKEE<br />

ADAIR<br />

PITTSBURG<br />

MUSKOGEE<br />

McINTOSH<br />

LATIMER<br />

HASKELL<br />

97° 96° 95°<br />

! !<br />

! ! !<br />

!<br />

! ! !<br />

! !! !<br />

!<br />

! ! !!<br />

!<br />

! !<br />

!<br />

!<br />

accounting for nearly two thirds of the<br />

<strong>2011</strong> completions registered thus far. In<br />

addition to development within the main<br />

producing area, recent drilling has expanded<br />

this core area another township<br />

west into Roger Mills County (Figure 11).<br />

15<br />

ARKOMA<br />

BASIN<br />

OUACHITA<br />

MOUNTAINS<br />

UPLIFT<br />

DELAWARE<br />

OZARK<br />

UPLIFT<br />

27<br />

26<br />

25<br />

24<br />

23<br />

22<br />

21<br />

SEQUOYAH<br />

37°<br />

20<br />

19<br />

18<br />

LE FLORE<br />

17<br />

McCURTAIN<br />

36°<br />

16<br />

15<br />

14<br />

13<br />

12<br />

11<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1N<br />

1S<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

35°<br />

34°<br />

10S<br />

Activity was also brisk along the Texas<br />

border, but efforts to connect these two<br />

areas with economic production appear to<br />

have failed so far.<br />

Vertical wells have produced Desmoine-<br />

March ~ April 2012 | Page 389

Oil and Gas Exploration<br />

<strong>Oklahoma</strong> <strong>2011</strong> <strong>Drilling</strong> <strong>Highlights</strong>, cont.<br />

sian Granite Wash since the mid-1980s,<br />

but horizontal production only began in<br />

April 2007 (Figure 9). Through August of<br />

last year the wells in this play registered<br />

an average recovery of 727 MMCF and 55<br />

MBC, with most of these on line for less<br />

than two years. Having the highest average<br />

liquids production for any horizontal<br />

play in the State, it is notable for spectacular<br />

rates on initial potential tests and wells<br />

with payouts often measured in months.<br />

Although its high condensate yield makes<br />

this horizontal play particularly attractive,<br />

like the Cleveland, on a BOE basis it is<br />

still about two-thirds gas (Figure 10).<br />

Although the Desmoinesian Granite Wash<br />

is the only horizontal wash play with a<br />

significant production history, there are<br />

several others that appear destined to expand.<br />

Naming conventions make these<br />

difficult to distinguish from non-wash<br />

reservoirs, and some may overlap with<br />

reservoirs to the north. However, wells<br />

located in Beckham, Washita, Caddo, and<br />

southern Roger Mills and Custer Counties<br />

likely have a southern source and so could<br />

be called ‘wash’ reservoirs. In addition to<br />

those identified as Desmoinesian (Series)<br />

and Granite Wash (which is assumed to<br />

also be Desmoinesian Granite Wash), this<br />

area includes reservoirs identified by operators<br />

as Atoka, Skinner, Cherokee, Missouri,<br />

Pennsylvanian Missourian, Hoxbar,<br />

Marchand, and Hogshooter. Reservoirs<br />

using the same names produce in horizontal<br />

wells in northern Roger Mills and Ellis<br />

Counties, and although their productive<br />

characteristics are similar, these are probably<br />

sourced from the north and/or east<br />

and so are not true ‘wash’ reservoirs.<br />

Mississippian (Lime / Chat)<br />

A much more scattered horizontal play,<br />

but the one that has experienced the greatest<br />

drilling surge in the last year, is targeting<br />

what is identified as the Mississippian<br />

Lime and Chat. These are different<br />

reservoirs, but are combined here due to<br />

inconsistent naming. The Chat produces<br />

horizontally mostly in Osage and Kay<br />

Counties and this part of the play appeared<br />

Page 390 | March ~ April 2012<br />

to be relatively quiet in <strong>2011</strong>. It is a thin,<br />

siliceous zone of variable reservoir quality<br />

that intermittently develops on top of<br />

the Mississippian Lime. Like the Mississippian<br />

Lime beneath, it has produced for<br />

decades from vertical wells. It can now<br />

be identified seismically, and horizontal<br />

wells drilled on seismic anomalies have<br />

allowed operators to maximize exposure<br />

to the Chat. Because it has natural permeability<br />

wells are usually untreated.<br />

The Mississippian Lime is a regional carbonate<br />

found across most of the State. It<br />

has produced from vertical wells for decades,<br />

albeit usually marginally. Horizontal<br />

wells have the potential to make this<br />

reservoir economic over a much wider<br />

area. Although it can develop porosity and<br />

permeability, reservoir quality tends to be<br />

poor. It is often fractured, and horizontal<br />

drilling affords the opportunity to enhance<br />

natural fractures with multi-stage acid<br />

fracture stimulations. The Mississippian<br />

Lime is thick and oil-prone across much<br />

of the northern half of the State, giving<br />

this formation regional prospectivity. Given<br />

its wide extent, the play has the potential<br />

to become the largest and perhaps the<br />

most productive horizontal drilling play in<br />

<strong>Oklahoma</strong> (Figure 11).<br />

A total of 157 horizontal Mississippian<br />

wells have so far been registered for <strong>2011</strong>,<br />

bringing the total number of completions<br />

to 285. Recent wells were mostly clustered<br />

around the main area of production<br />

located in Woods and Alfalfa Counties and<br />

this activity has moved across the border<br />

into Kansas. The core area is dominated<br />

by Chesapeake and SandRidge, each of<br />

whom have leaseholds exceeding one million<br />

net acres. The core productive area<br />

is expanding to the east and south with<br />

isolated activity as far east as Payne and<br />

Pawnee Counties. Although 241 wells are<br />

now on production, the vast majority have<br />

been online for less than a year. Average<br />

cumulative per well recoveries now stand<br />

at 13 MBO + 113 MMCF with production<br />

in the last reported month at 25 BO +<br />

306 MCF per day. Although it is the oiliest<br />

of the horizontal plays, on a BOE basis<br />

Mississippian production is still 60% gas<br />

(Figure 10).<br />

The <strong>Oklahoma</strong> oil and gas industry has<br />

applied horizontal-drilling technology to<br />

dozens of other reservoirs across the State<br />

and will continue to test the limits of where<br />

this can be applied. There are sweet spots,<br />

but a large proportion of the horizontal<br />

wells drilled thus far appear to be marginal<br />

to clearly sub-economic. However, low<br />

productivity can be as much due to the<br />

manner in which the wells are drilled and<br />

completed as any inherent geological factors.<br />

The learning curve from first (often<br />

marginal) production to more consistent,<br />

economic development is a process measured<br />

in years. There are a number of reservoirs<br />

that were not discussed that, based<br />

on initial potentials, are showing promise.<br />

Wells tapping these reservoirs, which are<br />

classified as ‘Others’ in Figure 9 and are<br />

shown as black pluses in Figure 11, may<br />

develop into larger horizontal-drilling<br />

plays in the future.<br />

Significant Wells in <strong>2011</strong><br />

The following is a list of what are believed<br />

to be among the most significant<br />

wells registered for <strong>Oklahoma</strong> in <strong>2011</strong>.<br />

Although all were registered in the past<br />

year, due to reporting delays, some have<br />

earlier completion dates. The wells listed<br />

were identified from a weekly review of<br />

the IHS Energy EnergyNews on Demand<br />

Midcontinent activity reports released<br />

online throughout the year. An initial list<br />

of 152 candidates compiled from this<br />

publication was distilled to a final total<br />

of 15. Such a list is subjective and may<br />

miss wells that could eventually become<br />

noteworthy. Due to confidentiality issues,<br />

wells that may be notable for technical<br />

reasons will probably be missed. For instance,<br />

those that confirm some new type<br />

of trapping style or proved the benefit of a<br />

new drilling or completion technique will<br />

be difficult to identify until information is<br />

disseminated years from now.<br />

Horizontal wells have occupied a progres-

sively larger share of the significant well<br />

listings each year. In 2010, and now <strong>2011</strong>,<br />

they comprise all of the ‘all-star’ wells in<br />

this report. Those listed here have either<br />

significantly expanded what appears to<br />

be economic production in an established<br />

horizontal play or in some way constrained<br />

its ultimate extent. To keep this<br />

listing to a manageable size, in some cases<br />

related nearby wells were added to the<br />

discussion. Wells with production histories<br />

are given precedence over those with<br />

only impressive initial potential tests and,<br />

where available, the volumes reported are<br />

given. Please refer to Figure 11 for orientation<br />

during the following discussion.<br />

1) Sec. 13-3N-21ECM (Beaver County):<br />

In one of the State’s most active horizontal<br />

drilling plays QEP Energy extended Marmaton<br />

production two miles to the northwest<br />

with the completion of their Bobbitt<br />

Trust #3-13H well. As well as expanding<br />

the productive area, this well has also established<br />

a new highest initial potential<br />

with a daily rate of 1,063 BO per day. No<br />

gas, water, or stimulation was recorded for<br />

this well, which was completed in a 4,508’<br />

lateral located at a true vertical depth<br />

(TVD) of 6,000’.<br />

2) Sec. 6-1N-20ECM (Beaver County):<br />

In a related development, Unit Petroleum<br />

made a horizontal Marmaton completion<br />

in the State of <strong>Oklahoma</strong> #1-H that is 15<br />

miles west of the main play. This well is<br />

located on the southern limit of a small<br />

pod of vertical Marmaton wells assigned<br />

to the Camrick District that were drilled<br />

in 1970 and 1971. Since that time the five<br />

wells in Section 6 have produced about<br />

172 MBO. This new horizontal well had<br />

an initial potential on pump of 284 BO<br />

(38 O API) + 93 MCF + 1,740 BW per day<br />

from a 2,218’ lateral at a TVD of 5,890’.<br />

It was fracture stimulated with 650,000<br />

pounds of sand.<br />

3) Sec. 4-14N-24W (Roger Mills County):<br />

Classified for now as part of the same<br />

horizontal Marmaton play located to the<br />

north, operators drilled about two dozen<br />

wells in southern Ellis County and have<br />

now pushed production into central Roger<br />

Mills County. Although here it may have<br />

a southern provenance, making it a Marmaton<br />

‘wash’, it is still simply identified<br />

as Marmaton. The Cordillera Energy Galileo<br />

#2-4HA had an initial potential of 367<br />

BO + 5.36 MMCF per day with no water<br />

reported. The well has a 2,200’ lateral located<br />

at a TVD of 11,150’. Cordillera has<br />

reported that the NGL yield from the gas<br />

at this well is about 93 barrels per MMCF,<br />

giving it nearly 500 barrels of NGL production<br />

initially. This is comparable to<br />

the yield reported for Marmaton wells in<br />

Ellis County. The number of horizontal<br />

Marmaton wells nearly tripled in <strong>2011</strong><br />

with Unit Petroleum and EOG Resources<br />

operating most of them. With a total of 86<br />

completions registered thus far this play<br />

will undoubtedly become one of the ‘major’<br />

horizontal plays in next year’s report.<br />

4) Sec. 23-26N-24W (Harper County): In<br />

another horizontal play that will probably<br />

reach the 100-well hurdle and become<br />

‘major’ in the next year or two, Cherokee<br />

completions also more than tripled<br />

in <strong>2011</strong>. The 45 completions in <strong>2011</strong> are<br />

mostly scattered in three areas in southern<br />

Roger Mills, southern Ellis, and western<br />

Harper Counties. Apache completed their<br />

Zoldoske #4-23H for 525 BO (45 O API)<br />

+ 681 MCF + 117 BW per day. This well,<br />

which is the southernmost in the Harper<br />

County trend, shows that this play is far<br />

from defined. The well was completed in a<br />

4,482’ lateral at a TVD of 6,750’ and acidfraced<br />

in ten stages with about 1.2 million<br />

pounds of sand. In six months this well<br />

produced about 31 MBO + 77 MMCF<br />

with a rate in the last complete month of<br />

117 BO + 3.0 MMCF per day.<br />

5) Sec. 17-11N-21W (Beckham County):<br />

In a major westward extension of liquidsrich<br />

Desmoinesian Granite Wash production,<br />

Apache drilled a pair of excellent<br />

wells from the same surface location. Both<br />

completed in June <strong>2011</strong>, the Smith 1-16H<br />

and 1-17H are virtual twins with initial<br />

potentials of 1,115 BC + 12,634 MCF +<br />

596 BW and 1,095 BC + 12,582 MCF +<br />

554 BW per day. Both wells have a TVD<br />

of about 13,000’ and 4,000’ laterals that<br />

were fracture stimulated with 3.1 to 3.3<br />

million pounds of sand. The heart of the<br />

play remains in Washita County, but these<br />

wells are the first to establish high liquids<br />

production in Beckham County, which until<br />

now has been dominantly gas. The two<br />

wells have produced 564 and 574 MMCF<br />

in less than two months with a combined<br />

recovery of 34 MBC. In the last complete<br />

month each well was producing about 11.6<br />

MMCF per day with a combined daily<br />

rate of 1,082 BC. Although Desmoinesian<br />

Granite Wash production extends westward<br />

into the Texas Panhandle, the eastern<br />

limit of this play seems to be anchored in<br />

the center of township 11N-16W. It is not<br />

known if this limit is geological or lease<br />

related, but high condensate-yield wells<br />

have been drilled by Chesapeake right up<br />

to this limit.<br />

6) Sec. 14-11N-23W (Roger Mills County):<br />

Along the trend of the Desmoinesian,<br />

Hogshooter and other horizontal ‘Granite<br />

Wash’ plays operators have been drilling<br />

wells targeting what they are calling<br />

Missouri Granite Wash or Cottage Grove<br />

sand. The most notable of these wells was<br />

drilled by Crawley Petroleum. The Moore<br />

#5-14H had an initial potential of 1,485<br />

BO + 5,717 MCF + 710 BW per day in a<br />

reservoir identified as the Cottage Grove<br />

sand. This well has a 5,260’ lateral at a<br />

TVD of 11,322’ that was fraced using<br />

about 2.4 million pounds of sand.<br />

7) Sec. 11-16N-20W (Dewey County):<br />

Horizontal Tonkawa completions, which<br />

doubled in <strong>2011</strong>, have historically been<br />

situated in Roger Mills and southern Ellis<br />

Counties. <strong>2011</strong> saw a major westward<br />

development of the play into southwestern<br />

Dewey County. Chesapeake drilled what<br />

appears to be the best of the nine wells<br />

in this area with their Lauder #1-11H.<br />

Completed in a 4,260’ lateral at a TVD of<br />

8,240’ the well had an initial potential on<br />

gas lift of 510 BO (46 O API) + 420 MCF +<br />

1,260 BW per day after a fracture stimulation<br />

that used 4.2 million pounds of sand.<br />

In four months of production this well,<br />

apparently choked back, has cumulative<br />

March ~ April 2012 | Page 391

Oil and Gas Exploration<br />

<strong>Oklahoma</strong> <strong>2011</strong> <strong>Drilling</strong> <strong>Highlights</strong>, cont.<br />

production of only 76 MMCF with an average<br />

rate of about 700 MCF per day with<br />

no liquids production noted.<br />

8) Sec. 33-14N-18W (Custer County):<br />

There are now over 300 horizontal Cleveland<br />

completions with 65 registered thus<br />

far for <strong>2011</strong>. Most of the activity took<br />

place within established producing areas,<br />

but the most significant extension seems<br />

to be in central Custer County where<br />

Chesapeake now has four months of production<br />

history on a <strong>2011</strong> discovery. The<br />

SGD #1-33H was completed in April from<br />

a 4,483’ lateral at a TVD of 10,591’ with<br />

2.2 million pounds of sand. After an initial<br />

flowing potential of 547 barrels of 46 O<br />

API oil + 1,153 MCF + 1,102 BW per day<br />

it has produced 23 MBO + 60 MMCF. In<br />

the last reported month it was still producing<br />

at a rate of 124 BO + 300 MCF per<br />

day. Several additional wells have since<br />

been permitted in the area.<br />

9) Sec. 11-3N-5W (Grady County): What<br />

began as the Woodford Shale ‘Cana’ play<br />

in western Canadian County is spreading<br />

over an ever-widening swath of the eastern<br />

shelf of the Anadarko Basin. The core<br />

area, which now comprises the better part<br />

of a dozen townships in Canadian, Blaine<br />

and Caddo Counties, appears to have been<br />

extended to the extreme southern corner<br />

of the basin some 60 miles to the southeast.<br />

The Continental Resources Lambakis<br />

#1-11H had an initial potential from<br />

the Woodford of 5.4 MMCF + 160 BC per<br />

day with no water reported. The well was<br />

produced after a ten-stage fracture stimulation<br />

from a 4,200’ lateral at a TVD of<br />

15,128’. Continental has indicated that the<br />

gas from the Lambakis has a Btu content<br />

of 1,350 (~ 170 barrels NGL per MMCF)<br />

and is commanding a price of $6.25/MCF.<br />

In three and a half months of production<br />

the Lambakis made about 12 MBO + 319<br />

MMCF with a rate in the last complete<br />

month of about 100 BC + 4.2 MMCF per<br />

day.<br />

10) Sec. 32-18N-15W (Dewey County):<br />

The ‘Cana’ Woodford Shale play has also<br />

moved well into Dewey County with Dev-<br />

Page 392 | March ~ April 2012<br />

on drilling the two most northerly wells<br />

so far. Their Rauh #1-32H had an initial<br />

potential of 147 BO + 3,253 MCF + 908<br />

BW per day. The Btu content of the gas<br />

was not reported, but the NGL production<br />

will probably be at least double what is<br />

reported as the initial ‘oil’ rate. This well<br />

was completed from a 4,292’ lateral at a<br />

TVD of 11,677’ and a fracture treatment<br />

using 2.2 million pounds of sand. The<br />

best well in this extension of the play is<br />

the Continental Resources #1-2H Brown<br />

which was drilled about three miles southwest<br />

in Section 2-17N-16W. After an initial<br />

potential of 3,772 MCFPD this well<br />

produced 1.5 BCF in two years and was<br />

making about 1 MMCFPD in the last reported<br />

month (September, <strong>2011</strong>).<br />

11) Sec. 34-26N-13W (Woods County):<br />

Eagle Energy recorded the highest initial<br />

potential of any horizontal Mississippian<br />

well with the completion of their Longhurst<br />

#3H-34. This well flowed 2,225<br />

barrels of 32 O API oil with 4,767 MCF +<br />

2,789 BW per day. Completed in a 3,615’<br />

lateral at a TVD of 5,806’, it was acidfraced<br />

with 12,500 barrels of fluid and<br />

160,000 pounds of sand. This well is less<br />

than a mile west of another Eagle Energy<br />

well in section 35. Completed in 2010,<br />

the Mary Beth #1-H was completed in a<br />

2,307’ lateral (TVD – 5,807’) pumping<br />

at a rate of 50 BO + 318 MCF + 3,212<br />

BW per day. Oriented north-south like the<br />

Longhurst, the Mary Beth is shown as a<br />

Chat well completed with a 24,500 barrel<br />

‘acid-frac’ in which no proppant was reported.<br />

There are many examples of wildly<br />

different initial potentials in adjacent<br />

wells in the Mississippian, as well as other<br />

horizontal plays, but this is the largest<br />

seen thus far. The underlying cause is not<br />

known, and neither well has any recorded<br />

production, but this certainly highlights a<br />

pitfall in blanket reserve assignments to<br />

regional plays.<br />

12) Sec. 3-23N-4W (Garfield County):<br />

Establishing the highest horizontal Mississippian<br />

initial potential in the county,<br />

Plymouth Exploration completed their Sebranek<br />

#1-3H flowing at 1,031 BO (44 O<br />

API) + 1,327 MCF + 3,799 BW per day.<br />

This well was completed in a 3,302’ lateral<br />

at a TVD of 5,774’ with a nine-stage,<br />

750,000 pound acid-fracture stimulation.<br />

The Sebranek seems to confirm at least a<br />

step in a bridge that may eventually link<br />

the western and eastern Mississippian play<br />

areas. However, it is a direct offset to a<br />

2010 well, the Wicklund #1-34H Massie,<br />

that had an initial potential on pump of 90<br />

BOPD. This well produced only 6 MBO<br />

+ 12 MMCF in 17 months, with a rate in<br />

the last month of 6 BOPD. It is not known<br />

whether the drilling/completion technique<br />

or some geologic factor is responsible for<br />

this discrepancy.<br />

13) Sec. 22-23N-4E (Pawnee County):<br />

Territory Resources pushed horizontal<br />

Mississippian production nine miles<br />

northeast of Pablo Energy’s initial discovery<br />

(Ripley #1H-31) in this westernmost<br />

part of the play (Boyd, <strong>2011</strong>). Their Beast<br />

#1-27H had an initial potential on pump<br />

of 585 barrels of 40 O API oil with 1,000<br />

MCF + 2,300 BW per day. In this area the<br />

TVD of the 3,689’ lateral was only 3,674’,<br />

which was stimulated with an acid frac<br />

treatment using 122,000 pounds of sand.<br />

The Beast produced 137 BOPD in its first<br />

month, but in its last month was down to<br />

44 BOPD. Cumulative production in four<br />

months is about 8 MBO with no reported<br />

gas. The Ripley well (Sec. 31-22N-4E),<br />

which began Mississippian horizontal activity<br />

in this part of the State, in 20 months<br />

has produced about 54 MBO with a last<br />

reported rate of 24 BOPD. It too has no<br />

reported gas production.<br />

14) Sec. 21-18N-3E (Payne County): A<br />

horizontal Woodford Shale well that is off<br />

the beaten track was drilled by Calyx Energy<br />

with their State WFD #16-1H. With<br />

a TVD of only 4,379’ the 3,700’ lateral<br />

was acid-fraced with 685,000 pounds of<br />

sand and had an initial potential on pump<br />

of 310 BO (36 O API) + 150 MCF + 1,500<br />

BW per day. A true Woodford oil well, this<br />

well does not yet have any reported production.<br />

15) Sec. 16-7N-17E (Pittsburg County):

Petroquest Energy pushed the main productive<br />

area of the horizontal Woodford<br />

Shale in the Arkoma Basin eastward with<br />

the drilling of several wells in <strong>2011</strong>. The<br />

best of these, their Tonya #1-20H, came<br />

References Cited<br />

Baker Hughes, 2012, <strong>2011</strong> Average Rotary <strong>Drilling</strong> Rig Count,<br />

Accessed at: http://gis.bakerhughesdirect.com/Reports/StandardReport.aspx<br />

Boyd, D. T., 2010, <strong>Oklahoma</strong> 2009 <strong>Drilling</strong> <strong>Highlights</strong>, Shale<br />

Shaker, Vol. 60, No. 5 pp. 199-209.<br />

Boyd, D. T., <strong>2011</strong>, <strong>Oklahoma</strong> 2010 <strong>Drilling</strong> <strong>Highlights</strong>, Shale<br />

Shaker, Vol. 61, No. 5 pp. 293-306.<br />

E.I.A. (Energy Information Administration), 2012, Annual<br />

<strong>Oklahoma</strong> Production of Crude Oil and natural Gas: Accessed<br />

January, 2012 http://www.eia.gov/dnav/pet/hist/LeafHandler.<br />

ashx?n=pet&s=mcrfpok1&f=a http://www.eia.gov/dnav/ng/ng_<br />

prod_sum_dcu_sok_a.htm<br />

Chet<br />

Dan T.<br />

Wallace<br />

Boyd<br />

on for 6,293 MCF + 1,259 BW per day.<br />

The well was completed with a fracture<br />

stimulation using 2.6 million pounds of<br />

sand on a 4,993’ lateral located at a TVD<br />

of 8,653’. Although there is not yet any<br />

Biographical Sketch<br />

recorded production for these wells, they<br />

appear to be as good as any in the play and<br />

show that there is still ample room to expand<br />

horizontal Woodford Shale production<br />

in this part of the State.<br />

IHS Energy, 2012, Well Data supplied online by Petroleum<br />

Information/Dwights LLC dba IHS Energy Group, January 1,<br />

2012, all rights reserved. http://energy.ihs.com/<br />

Northcutt, R. A.; and Campbell, J. A., 1995, Geologic provinces<br />