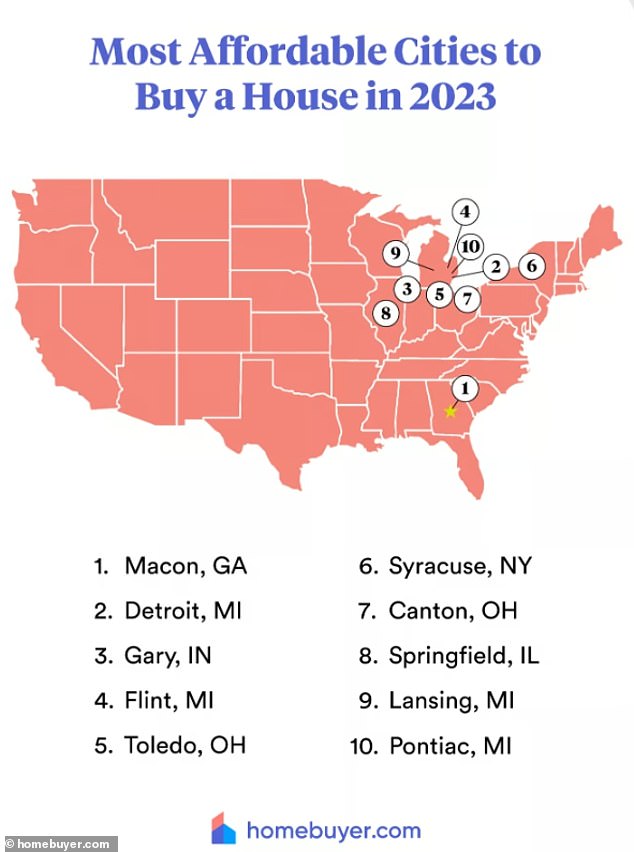

The most affordable cities in the US to buy a home: Southern city is the cheapest for your monthly mortgage with several Midwest towns helping fill out the list

- Using statistics from the U.S. Census Bureau, Homebuyer.com used an algorithm to find the most affordable cities in the country

- Macon, Georgia, takes the top spot as the most affordable city in the country, according to the findings

- Other notable mentions include Detroit, Toledo, Syracuse, and Springfield who all help make up the ten most affordable cities

Housing experts have recently highlighted the top ten most affordable cities in the US to buy a home, with one southern city taking the top spot.

Using information from the U.S. Census Bureau and Altos Research, Homebuyer.com used an algorithm to find the most affordable cities in the country.

The company analyzed mortgage payments, property taxes, transportation expenses and home insurance costs in America's 800 Census-recognized cities.

Their findings highlighted that the most affordable city to purchase a home is currently Macon, Georgia, where homeownership costs around $1,892 a month.

Other notable mentions include Detroit, Toledo, Syracuse, and Springfield who all help make up the ten most affordable cities.

Using information from the U.S. Census Bureau and Altos Research, Homebuyer.com used an algorithm to find the most affordable cities in the country

1. Macon, Georgia

With monthly mortgage payments equating to $870, insurance prices at $187 and property taxes of $94, Macon is the most affordable in the country

Known for its nickname 'The Heart of Georgia,' Macon is situated some 85 miles southeast of Atlanta.

The city has a rich history, having being founded on the Ocmulgee Old Fields, where Creek Indians lived in the 18th century.

According to the findings, the average monthly cost of homeownership equated to $1,892 with transportation costs making up the most of it with $1,021 per month.

With monthly mortgage payments equating to $870, insurance prices at $187 and property taxes of $94 the city is the most affordable in the country.

Mercer University sits in the heart of the city and is known for giving $20,000 to employees who want to purchase a home in College Hill, an area of the city.

The Macon Telegraph also reported last year that a home in the area only costs buyers roughly 14 percent of their local wage.

2. Detroit, Michigan

The Motor City sits on the Detroit River directly across from Ontario in Canada, and is known for shaping the automobile industry in America

Detroit, Michigan, was ranked as the second most affordable city for home buyers, with an average monthly cost of $1,921.

The Motor City sits on the Detroit River directly across from Ontario in Canada, and is known for shaping the automobile industry in America.

After years of decay, it has begun to experience a resurgence driven by a growing population as well as a thriving arts and cultural scene.

According to the findings, mortgage payments cost around $771 per month, with insurance equating to $185 and property taxes are $126.

The highest economic burden for homeowners would be transportation costs, which totaled $1,921.

In 2023, the city closed out 2023 with 252 homicides, which was their fewest in 57 years, a drop from 309 in 2022.

3. Gary, Indiana

Originally founded by the United States Steel Corporation in 1906 as a company town to serve its steel mills, it grew into a large industrial center

Located on Lake Michigan in northwest Indiana, the city of Gary is a 30-minute drive from downtown Chicago.

Originally founded by the United States Steel Corporation in 1906 as a company town to serve its steel mills, it grew into a large industrial center.

Nicknamed 'The Magic City', the city boasts monthly living costs of around $1,931, according to the findings.

Mortgage payments are on average $976, with insurance coming out to $229, $97 for property taxes and transportation costs equating to $956.

In 2019, the city launched the Dollar House Program to bring people to the city following a period of social decline.

CNBC reported that homeowners were selected through a lottery system and had to meet a few key requirements.

4. Flint, Michigan

The city grew into an automobile powerhouse, having been responsible for their Buick and Chevrolet divisions

Situated along the Flint River just 66 miles northwest of Detroit, Flint is the largest city in Genesee County.

The Vehicle City has a rich history and a strong sense of community, having been the home of General Motors which was founded their in 1908.

The city grew into an automobile powerhouse, having been responsible for their Buick and Chevrolet divisions.

Since the 1960s, the city has faced economic downturn after GM downsized the work force.

In recent times, new businesses and developments have started popping up around the city in a hope to revitalize the area.

Mortgage payments currently average out to $738 per month, with insurance coming to $209, $102 for property taxes and around $1,213 for transportation costs according to the findings.

Flint has met water quality standards since 2016. The city was also recently named in the top 150 Best Cities to Live by U. S. News.

5. Toledo, Ohio

Located in the northwest corner of Ohio, Toledo sits on the shores of Lake Erie, nestled between Cleveland, Detroit, and Fort Wayne, Indiana

Located in the northwest corner of Ohio, Toledo sits on the shores of Lake Erie, nestled between Cleveland, Detroit and Fort Wayne, Indiana

Affordable homes and ample housing supply land The Glass City on various 'Best Of…' lists, including best cities for first-time buyers and best cities to buy investment properties.

Mortgage payments currently average out to $932 per month, with insurance coming to $147, $161 for property taxes and around $1,023 for transportation costs according to the findings.

The Glass City has been subject to major revitalization efforts in recent times, and is known for its burgeoning entertainment district in Downtown Toledo.

6. Syracuse, New York

Syracuse offers hiking, kayaking, as well as easy getaways to Saratoga Springs and the Finger Lakes

Situated in Onondaga County in upstate New York, Syracuse has become a popular destination for home buyers looking for an affordable place to live with plenty of outdoor and commercial activity.

Syracuse offers hiking, kayaking, as well as easy getaways to Saratoga Springs and the Finger Lakes.

According to the findings, mortgage payments are roughly $1,002 per month, with insurance coming to $114, $246 for property taxes and around $1,063 for transportation costs.

Demand for homes is so high in Syracuse, but housing inventory is really low meaning buying a home is incredibly hard.

7. Canton, Ohio

The city was one a heavy manufacturing center due to its numerous railroad lines but its status started to decline during the late 20th century

Canton lies approximately 60 miles south of Cleveland, and 20 miles south of Akron on the edge of Ohio's Amish Country.

The city was once a heavy manufacturing center due to its numerous railroad lines but its status started to decline during the late 20th century.

Since the mid-2010s, the area has started experiencing a large urban renaissance and a growing arts district located in the downtown area.

The city is also home to beautiful parks and walking trails along the Tuscarawas River.

According to the findings, mortgage payments equate to $1,063 per month, with insurance coming to $159, $147 for property taxes and around $1,097 for transportation costs.

8. Springfield, Illinois

The city boasts above-average public schools, a diverse population and is consistently ranked as one of the best places to buy a home in the country

Springfield, Illinois's capital, was famously the home of President Abraham Lincoln prior to his move to the White House.

The city boasts above-average public schools, a diverse population and is consistently ranked as one of the best places to buy a home in the country.

The majority of residents work for the state in the city, as well local schools and the health care system.

Mortgage payments currently average out to $1,104 per month, with insurance coming to $184, $199 for property taxes and around $1,064 for transportation costs, according to the findings.

9. Lansing, Michigan

The findings argue that Lansing in a top choice for first-time buyers who want an affordable home in a progressive city with plenty of amenities

Lansing, the capital of Michigan, has a population of 112,644 residents, according tp the 2020 census.

The recent findings show that Lansing in a top choice for first-time buyers who want an affordable home in a progressive city with plenty of amenities.

It features an economy driven by technology and manufacturing firms and a vibrant art scene including the Wharton Center at Michigan State University.

Within a two-hour car drive, residents can explore Detroit, Grand Rapids and Ann Arbor.

Currently, monthly costs for a mortgage total $1,156, while insurance is about $184 and a further $217 in property taxes and $1,028 in transportation costs.

10. Pontiac, Michigan

In the city's heyday, it was the home to the primary automobile assembly plant for the production of the Pontiac car, a brand that was named after the city

Located in Oakland County, Pontiac is best known for its former General Motors automobile manufacturing plants of the 20th century.

In the city's heyday, it was the home to the primary automobile assembly plant for the production of the Pontiac car, a brand that was named after the city.

The city is now in the midst of an economic renaissance, pushed on by a recent boom in jobs and housing to the area.

A newly elected team of city officials is also rolling out improved facilities for the city.

Currently, monthly costs for a mortgage total $1,165, with average insurance costing $219 and a further $158 in property taxes and $1,071 in transportation costs.

Just a short 30-minute commute from Detroit, it routinely scores high for diversity and nightlife.