Stock market hemorrhages $1TRILLION as Nasdaq drops 3% on fears China is winning AI arms race

Wall Street indexes sank 3 percent on Monday morning after a Chinese artificial intelligence startup triggered fears America's top tech stocks are overvalued.

Investors dumped around $1 trillion of technology stocks in premarket trading sending the S&P 500 1.7 percent lower as markets opened at 9:30am.

The tech-heavy Nasdaq has been hit harder, tumbling more than 3 percent on Monday morning.

The panic has been driven by Chinese artificial intelligence startup DeepSeek which demonstrated a chatbot that it says rivals the top versions from OpenAI and Google but for a fraction of the cost.

Chipmaker Nvidia, which has benefitted from the AI frenzy over the last eighteen months, fell as much as 13 percent as markets opened wiping out $465 billion in market value.

The drop marks the largest rout in market history, Bloomberg reported.

Another US chipmaker Broadcom also lost around 12 percent while software giant Oracle lost 8 percent in early trading.

Microsoft slid 3.5 percent and Amazon was down 0.24 percent in the first hour of trading.

The Nasdaq tumbled almost 4 percent in premarket trading on Monday

US tech stocks took a hit before markets open on Monday morning

Google parent company Alphabet lost about 3.5 percent and Facebook parent Meta shed 2.5 percent.

DeepSeek's advances have raised doubts about whether the US will retain its lead in the global race of advancing AI technology.

The Chinese company released its free AI Assistant last week which it says uses less Nvidia chips at a fraction of the cost of current models on the market.

DeepSeek overtook its rival ChatGPT to become the most-downloaded free application available on the Apple Store in the US on Monday.

The fallout has also weighed down global indexes, with the Stoxx Europe 600 down 0.4 percent in early European trading.

Germany's DAX dropped 1.1 percent, while the CAC 40 in Paris shed 0.8 percent and Britain's FTSE 100 declined 0.3 percent.

Netherland's chip companies ASML and ASM were also hit badly off the back of DeepSeek's advances, falling 8 percent and 12 percent respectively.

Japanese chip-related stocks including Advantest and Tokyo Electron were also lower.

Traders are grappling with sinking tech stocks on Wall Street on Monday morning

'Mondays are typically quiet for stocks when markets are at all-time highs, but not today,' Bret Kenwell, eToro US Investment Analyst, told DailyMail.com.

'The AI space can and will continue to evolve, and like we're seeing today, sometimes those developments will come along quickly.

'That said, panicking rarely makes for a good investment decision.'

Monday's action is a reminder that investors need to stay grounded and disciplined with their portfolios, Kenwell added.

'While owning individual stocks and sectors is fine, having too much exposure or leverage can deal an unexpected blow seemingly out of nowhere - especially on days like today.'

Tom Stevenson, Investment Director at Fidelity International, added: 'This development underscores the rapidly shifting dynamics in AI and as the situation unfolds, investors are closely monitoring the implications of this breakthrough on the future of AI technology and the balance of power in the tech industry.'

It comes after top banker Jamie Dimon warned that the US stock market was inflated.

'Asset prices are kind of inflated, by any measure. They are in the top 10 percent or 15 percent' of historical valuations, the JPMorgan Chase CEO said at the World Economic Forum in Davos, Switzerland last week.

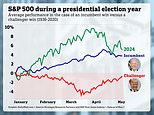

The US stock market gained over 20 percent in 2023 and in 2024 - a remarkable feat it has not achieved since the late 1990s.