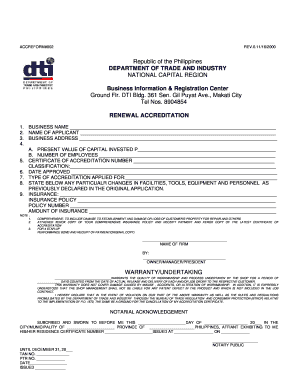

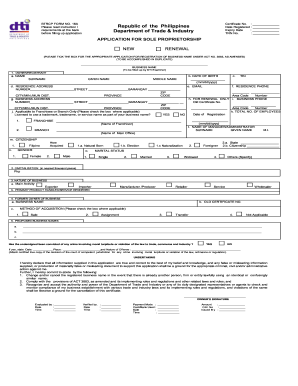

Get the free dti permit sample

Get, Create, Make and Sign dti permit sample editable form

How to edit dti application form pdf online

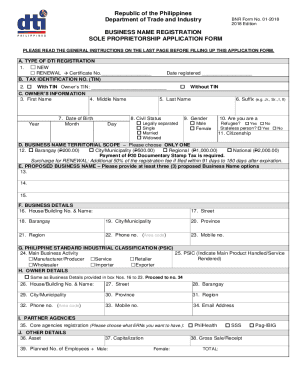

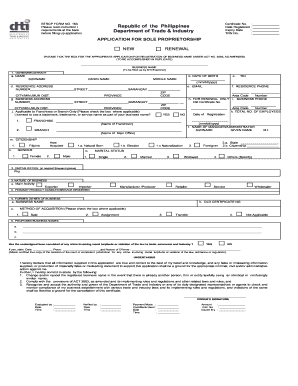

How to fill out dti business permit sample pdf form

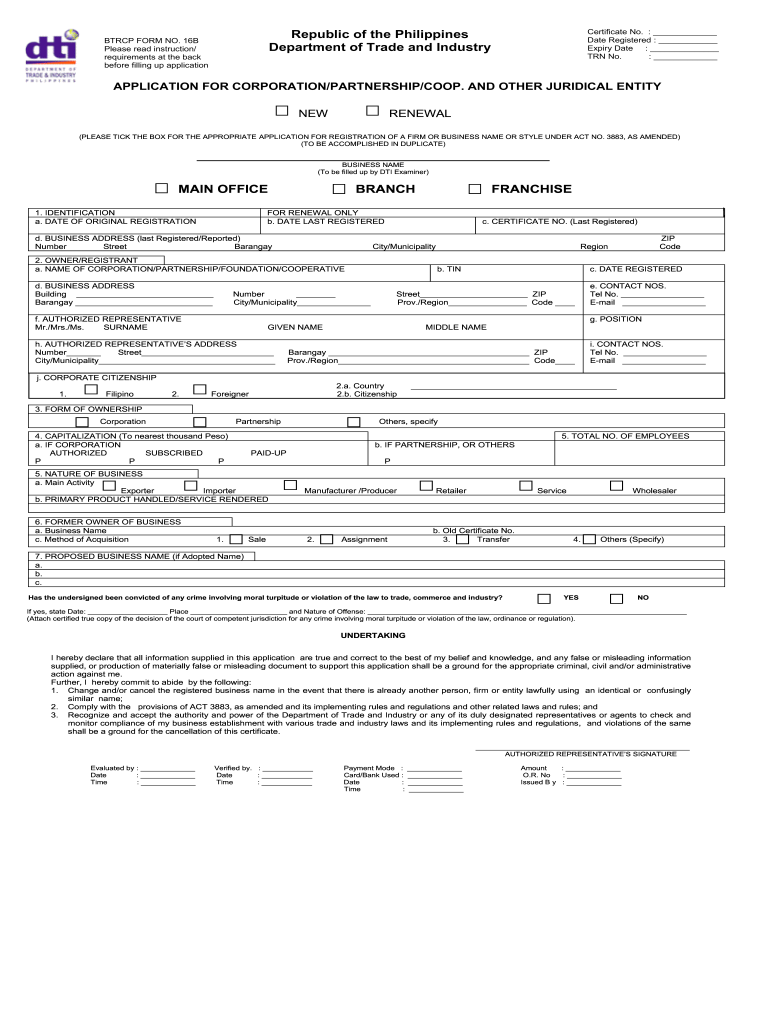

How to fill out PH DTI BTRCP 16B

Who needs PH DTI BTRCP 16B?

Video instructions and help with filling out and completing dti permit sample

Instructions and Help about dti permit editable

One of the biggest mistakes I see new entrepreneurs make is not setting up a solid foundation for success between themselves and their partners or cofounders when they start building their business in the form of a shareholders' or partnership agreement. Now, just in case you're new to my blog, I am not a lawyer, so I cannot give you legal advice. But I have seen many an entrepreneur stuck with ulcers and migraines because they didn't have an agreement in place from the beginning and then the relationship with his or her cofounders fell apart. In order to make sure that the new business is on sound footing and that you won't be in hot water when the going gets tough you absolutely have to have a few items spelled out in a formal legal document before jumping in. When it's just you and your cofounders high on startup euphoria and loving life and loving each other, it seems like nothing could ever go wrong, but I guarantee there will be disagreements and the road will get a bit rockier down the line, so having a document that clearly spells everything out will save you from a potential nightmare. In your agreement make sure that you clearly spell out the following: First, you need to identify who contributed what — This includes everything from office space to computers or equipment to actual cash. If anyone chipped in, you should identify who it was and what they added. Next, you need to say who owns what — Not all companies are split up exactly in line with the monetary contributions each person made. You need to be clear in your document about who owns how much of the company Along those same lines, you need to say when they own that much. It's in everyone's best interest to set up a vesting schedule for anyone whose contributions that earn him or her equity are non-monetary. If you don't, you run the risk of someone signing on as a key contributor but then walking away with his or chunk of equity and not actually adding any value. If you create a vesting schedule and someone turns out to be a total slacker, you're not stuck handing over part of your company anyway. Be clear about what they have to do to vest, when they vest, and what would give you grounds to kick them out without allowing them to vest. You also need to identify who controls what — and this is on a few different levels... The first bit of this relates to voting rights and classes of stock. Just because I own 50% of the stock of a company does not mean I necessarily have a 50% say in what that company can do. There are numerous ways of structuring ownership and control so that they are not necessarily directly in line. Look at examples like Zuckerberg's control of Facebook. The next bit relates to decision-making outside the most major company decisions, and you need to decide who is allowed to make what type of calls for the company — i.e. who can sign contracts, who can take on debt, who can spend money, etc. It's normal to set limits on what certain team members can do or...

People Also Ask about dti permit sample pdf

How to register a business in the Philippines?

How is DTI calculated for an LLC?

What is a DTI form?

What does a DTI do?

How do I get my DTI?

What does your DTI need to be for a loan?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

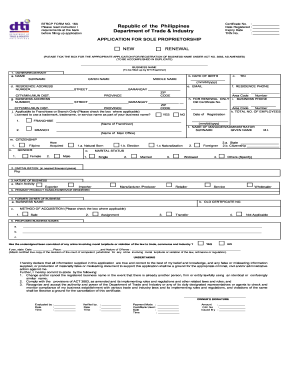

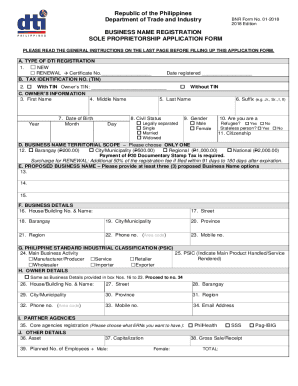

What is dti permit?

Who is required to file dti permit?

What is the purpose of dti permit?

What information must be reported on dti permit?

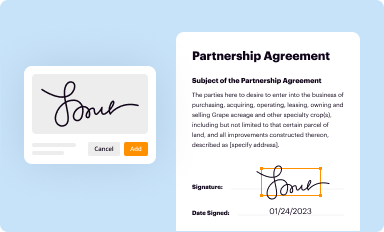

How can I send business dti permit sample blank for eSignature?

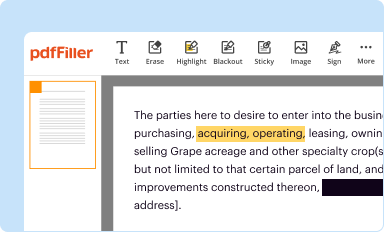

How do I edit dti business permit sample online?

How can I fill out philippines dti application form download on an iOS device?

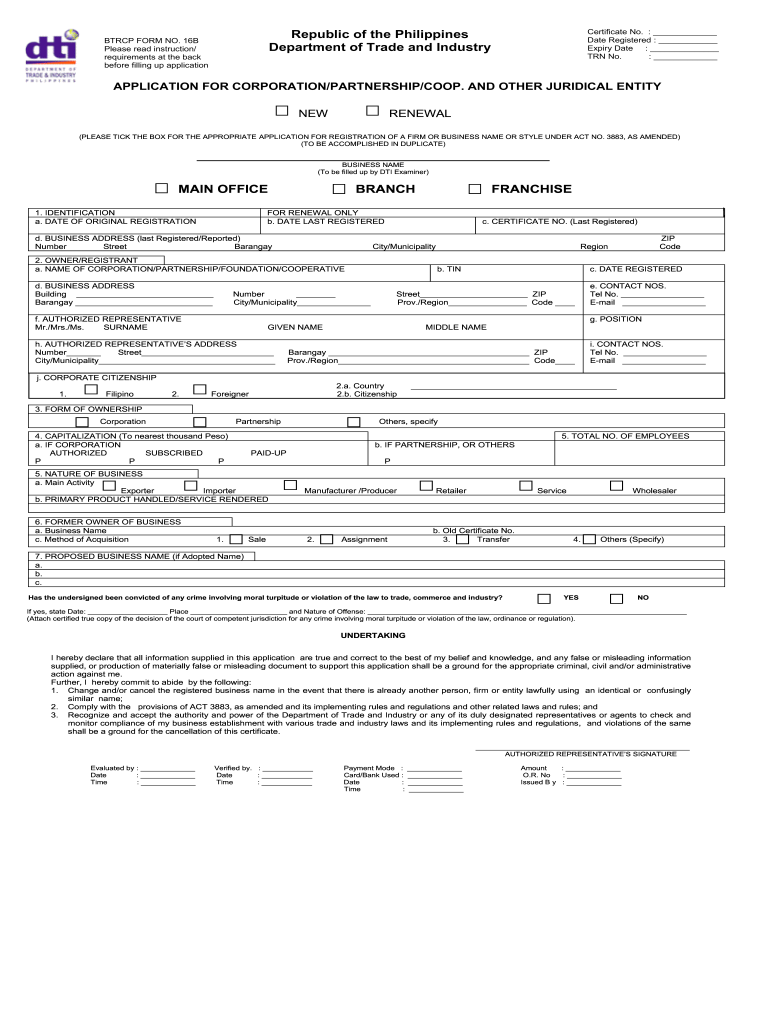

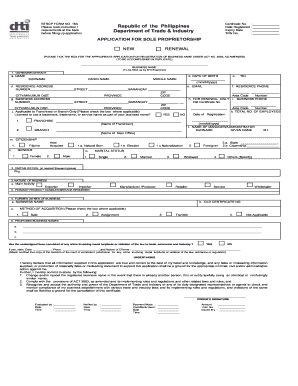

What is PH DTI BTRCP 16B?

Who is required to file PH DTI BTRCP 16B?

How to fill out PH DTI BTRCP 16B?

What is the purpose of PH DTI BTRCP 16B?

What information must be reported on PH DTI BTRCP 16B?

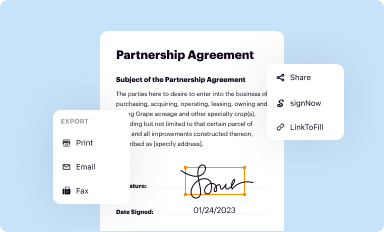

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.