ZA SARS RC01 2012-2025 free printable template

Show details

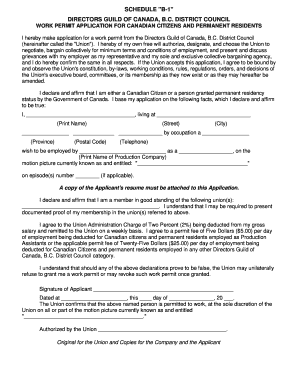

Application for a Certificate of Residence Individuals RC01 Note This document must also be completed if you require SARS to stamp any form from a foreign country to confirm residency. Form ID RC01 Version 2012. 01. 03 Page of Page 01/02 Question to be completed by natural person if the provided space is not sufficient please attach a schedule with the relevant information to the application form Are you a SA resident as defined in the Income Tax Act Y Are you an ordinarily resident N i For a...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign south visa african form

Edit your sars rc01 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rc01 form sars form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rc01 form online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rc1 form download. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sars rc01 form pdf

How to fill out ZA SARS RC01

01

Gather all necessary information regarding your income and expenses for the tax year.

02

Obtain the RC01 form from the ZA SARS website or your local SARS office.

03

Fill in your personal details accurately, including your ID number and contact information.

04

Provide details of your employment income and any additional income sources.

05

List any deductible expenses and claims related to your business or employment.

06

Double-check all entries for accuracy to avoid any discrepancies.

07

Sign and date the form to certify that the information provided is truthful.

08

Submit the completed RC01 form to ZA SARS either online or at a SARS office.

Who needs ZA SARS RC01?

01

Individuals filing their income tax returns in South Africa.

02

Self-employed persons reporting their income and expenses.

03

Taxpayers claiming deductions for expenses related to their employment.

04

Those who need to rectify or update their previous tax submissions.

Fill

rc1 form

: Try Risk Free

People Also Ask about rc01 form download

What is tax residency South Africa?

Any individual who is ordinarily resident (common law concept) in South Africa during the year of assessment or, failing which, meets all three requirements of the physical presence test, will be regarded as a resident for tax purposes.

Who provides tax residency certificate?

TRC for Indian Resident taxpayer In order to obtain such a TRC, a person would need to make an application in Form No. 10FA to the Assessing Officer. On receipt of such an application and on being satisfied in this regard, the Assessing Officer would then issue a TRC in respect of such person in Form No. 10FB.

How do I get an IRS tax certificate?

To get a complete copy of a previously filed tax return, along with all attachments (including Form W-2), submit Form 4506, Request for Copy of Tax Return. Refer to the form for instructions and for the processing fee.

How do I get a certificate of tax residence UK?

To apply for a CoR : you can use the online service. email a form (you will not need to sign in to an online account) if you're an agent applying on behalf of an individual or sole trader you can apply online.

How do I get a tax residency certificate in South Africa?

The application form must be mailed to Contact SARS by e-mail. The turnaround time is 21 days working days if the form was completed in full and no additional information is required. You may also submit at a branch, remember to make an appointment before you visit the branch.

How do I get my SARS certificate?

Once you have viewed your “My Compliance Profile”, you may request a Tax Compliance Status by: Selecting the Tax Compliance Status Request option and the type of TCS for which you would like to apply. You will have the following options: Good standing. Complete the Tax Compliance Status Request and submit it to SARS.

What is a tax residency certificate?

Form 6166 is a letter printed on U.S. Department of Treasury stationery certifying that the individuals or entities listed are residents of the United States for purposes of the income tax laws of the United States.

How long does it take to get a tax resident in South Africa?

He or she is present in South Africa for a period or periods in aggregate not exceeding 183 days in any 12-month period (not necessarily a year of assessment).

How do I get proof of SARS online?

All you need to do is log on and check your number. You can also request your notice of registration via the MobiApp if you are a registered eFiler. eFiling has been updated to allow taxpayers to request the Notice of Registration (IT150) under the 'SARS Registered Details' menu option.

What is a tax residency certificate South Africa?

To avoid double taxation, a Tax Residency Certificate in South Africa can be provided to the relevant foreign revenue authority, which Certificate will prove that you are resident in South Africa for tax purposes and that South Africa has the first and only taxing right on your worldwide income.

How do I get a tax certificate from SARS?

How to request your Tax Compliance Status via eFiling Selecting the Tax Compliance Status Request option and the type of TCS for which you would like to apply. You will have the following options: Good standing. Tender. Complete the Tax Compliance Status Request and submit it to SARS.

How long does it take to get a SARS certificate?

24-Hours is the fastest timeframe for a Tax Clearance Pin Certificate in South Africa. You can get a SARS-issued Tax Clearance Pin Certificate within 24 hours by using our Tax Clearance Pin Certificate service.

How long does SARS take to approve?

SARS will provide the taxpayer at least 21 business days to respond to the Audit Findings Letter. Conclude an audit within 90 business days from the date all required relevant material is received.

How do I get a SARS certificate letter?

You can request a notice of registration through the following channels: eFiling: Once logged in to eFiling click on the “Notice of registration” icon on the 'Home' page to obtain your IT150. SMS: Request the issuing of the IT150 (Tax reference number) by sending an SMS to SARS on 47277.

How do I get a tax residency certificate in Canada?

Mail or fax your written request, or the form given to you by the foreign government for this purpose, to the Sudbury Tax Centre to get a certificate of residency. You may be able to ask for the certificate over the phone in some cases: for individuals or trusts, call 1-800-959-8281.

How do I get a SARS certificate?

Request a Notice of Registration (IT150) SMS: Request the issuing of the IT150 (Tax reference number) by sending an SMS to SARS on 47277. You can also request your notice of registration via the MobiApp if you are a registered eFiler. Send us a query. Please ensure your details match our records.

How do I get a SARS tax residence certificate?

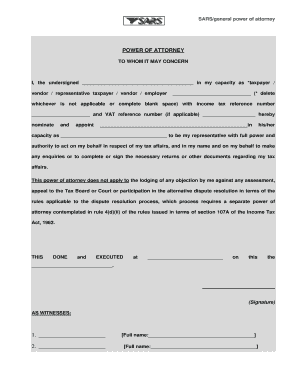

The confirmation of tax residency can be obtained in two ways: i) A resident application form issued by a foreign country where services are rendered or income derived; or ii) A SA resident may request SARS to issue a certificate of residence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file rc01 form?

RC01 forms are required to be filed by employers in the United Kingdom with HM Revenue and Customs (HMRC). This form is used to provide information about the employer's payroll information and is typically filed each month.

What is the purpose of rc01 form?

The RC01 form is used to register a business with HM Revenue & Customs (HMRC). It provides HMRC with the details of the business, such as its name, address, contact information, and the type of business it is. By providing this information, HMRC can then register the business for tax purposes and provide it with a Unique Taxpayer Reference (UTR).

What information must be reported on rc01 form?

The RC01 form is used to report information related to a business's registered charity status. This includes information about the charity's governing body, activities, finances, and fundraising activities. Specifically, the RC01 requires information about the charity's name and contact information, registration number, type of charity, purpose, activities, income sources, expenditure, and balance sheet.

What is rc01 form?

I am sorry, but I couldn't find any specific information about an "rc01 form." It is possible that the term is specific to a particular context or organization. If you could provide more details or context, it would be helpful in providing a more accurate answer.

How to fill out rc01 form?

To fill out an RC01 form, please follow these steps:

1. Obtain the RC01 form: This form can be downloaded from the official website of the relevant government authority or organization. Make sure you have the latest version of the form.

2. Read the instructions: Carefully read the instructions provided on the form or any accompanying guidelines to understand the purpose and requirements of the RC01 form.

3. Gather required information: Collect all the necessary information and documents needed to complete the form. This may include personal details, contact information, financial information, or any other specific information requested.

4. Complete the form: Start by entering your personal information in the designated spaces. This usually includes your name, address, date of birth, and social security number.

5. Fill in additional details: Provide any additional information required, such as employment details, income information, or specific checkboxes to indicate certain preferences or choices.

6. Include supporting documents (if applicable): Attach any supporting documents or proof required to support the information provided on the form. These may include identification documents, proof of income, or any other relevant documents requested.

7. Review and verify: Once you have completed the form, carefully review all the information you provided to ensure accuracy and completeness. Make any necessary corrections or additions.

8. Sign and date: Sign the form and add the date on the specified signature line. If applicable, ensure that any other required parties also sign and date the form.

9. Copy and retain: Make a copy of the completed form for your records before submitting it. Keep the copy in a safe place for future reference if needed.

10. Submit the form: Follow the instructions provided on the form for submission. This may require mailing it to a specific address or submitting it electronically through an online portal, if available.

Note: The specific steps may vary depending on the jurisdiction or organization for which the RC01 form is intended. It is essential to carefully review the instructions provided to ensure you accurately complete the form as required.

Where do I find sars forms download pdf download?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific sars certificate of residence and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute tax residency certificate south africa online?

pdfFiller makes it easy to finish and sign visa african online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete south african apply on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your south residency african, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is ZA SARS RC01?

ZA SARS RC01 is a form used in South Africa for the registration of a new company or close corporation with the South African Revenue Service (SARS).

Who is required to file ZA SARS RC01?

Any individual or entity that wishes to register a new company or close corporation in South Africa must file the ZA SARS RC01 form.

How to fill out ZA SARS RC01?

To fill out ZA SARS RC01, one must provide details such as the company name, registration number, contact information, and tax-related information as required by SARS.

What is the purpose of ZA SARS RC01?

The purpose of ZA SARS RC01 is to ensure that new businesses are registered for tax purposes and to comply with South African tax laws.

What information must be reported on ZA SARS RC01?

The information required on ZA SARS RC01 includes the business's name, registration details, shareholder or member information, and relevant tax information.

Fill out your ZA SARS RC01 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

South Africa Certificate Residence is not the form you're looking for?Search for another form here.

Keywords relevant to south african year

Related to rc01 sars

If you believe that this page should be taken down, please follow our DMCA take down process

here

.