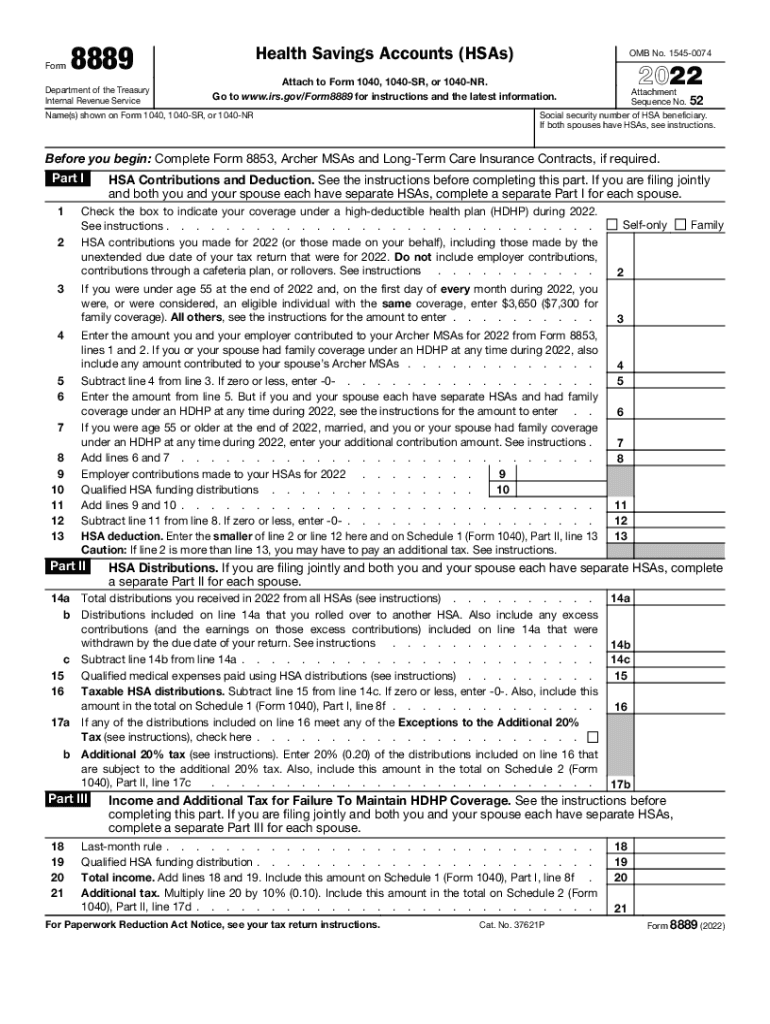

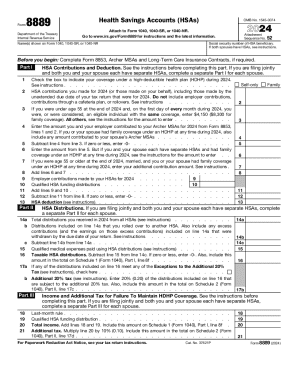

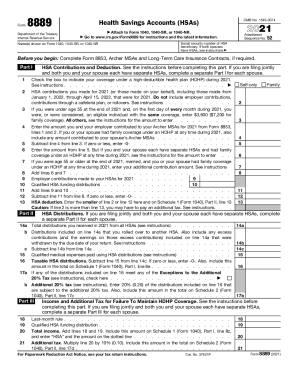

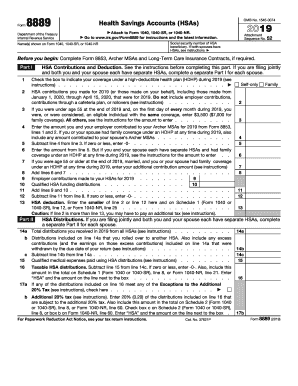

What is Form 8889 2022?

IRS form 8889 is used to report:

- Health Saving Accounts (HSA) distributions (money the account owner takes out of their account),

- HSA contributions (money the account owner or their employer deposits to the account),

- HSA deductions.

The form also covers the account holder’s eligibility. Include the deduction you calculate in this form on your tax return.

Who should file Tax Form 8889 2022?

File 8889 Form if you have a Health Saving Account and contributed to your HSA; received distributions from your HSA; altered your eligibility for HSA during the year, or were designated as an HSA beneficiary.

What information do you need to file Form 8889?

IRS form 8889 consists of three sections.

In Part I, provide the information on the total amount of contributions deposited to your HSA and distributions you qualify for and calculate your deduction (if applicable).

Part II reports total distributions from one or multiple Health Saving Accounts and provides the total amount of qualified medical expenses. Confirm what expenses are eligible before continuing to fill out the form. For more information, review Form 8889 instructions.

In Part III, state any changes you made to your health care plan or your HSA eligibility for 2022.

How do you fill out Form 8889 in 2023?

Services like pdfFiller, allow you to fill out Form 8889 online quickly. Here’s how to proceed:

- Click the Get Form button to open the form in pdfFiller.

- Review the form and enter your information.

- View the Form 8889 instructions as you fill out the form.

- Use annotation and editing tools to complete the document.

- Click DONE when you’ve finished the form.

- Save the form to your computer or select to combine your 8889 form with the 1040 form using our editor.

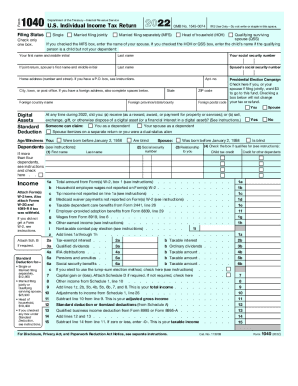

Is Tax Form 8889 accompanied by other forms?

When filing your tax return, submit IRS Form 8889 with Form 1040 (or related 1040 forms).

When is Form 8889 due?

The deadline for submitting the form would be April 18, 2023, unless you applied for an extension.

Where do I send Tax Form 8889?

Send Form 8889 along with the 1040 Form to your state’s IRS mailing address.