MV Index and Stock Charts

Dow Jones Industrials (^DJI) Index

Simple Technical Analysis of the Volume on the Dow Jones Industrials Chart

The Dow Jones Industrial Average Index covers stocks of the 30 largest companies in the US that play a major role in their industries. These stocks are widely held by individuals and institutional investors. At the end of 1999, 28 present of the US economy (a $12 trillion-plus market value of all U.S. stocks) were invested in those 30 companies.

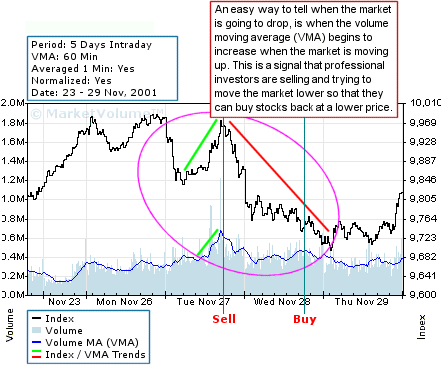

Chart 1: DJI index charts - simple analysis of volume surges.

On the DJI chart above you can see how the DJI index's price reacted to the high volume surge of November 27. This is a clear example of the relationship between the Index Price and the Volume Moving Average (VMA). The main principle of analysis of volume surges is that the price trend, as a rule, changes its direction after a large volume surge. The interpretation of a high volume surge, expressed by a Volume MA spike on the chart above, is very simple:

- The DJI price was moving up because there were more buyers and their buying pressure pushed the price up;

- On November 27 many investors decided to take a profit by selling their stocks and satisfying the buying demand of bullish traders;

- When the volume began to fall and the price began to decline, this indicated that the number of bullish traders who would have liked to continue to buy was reduced to a level at which a number of sellers became dominant. From that moment on, sellers pushed the price down.

In the table below you see the possible profit that could be achieved by trading DJI volume signals on the chart above. One of our exclusive institutional investors used this signal for the index to maximize profits by trading the DJI index derivatives:

Table 1: Return that could be achieved by following

the volume signal on the DJI chart above

| Security | Return |

| Stocks | 2% |

| Options | 25% |

The table below lists DJI index derivatives that could be used to trade signals generated by the DJI analysis. The derivatives below were developed to track the performance of the DJI index and because of that, only the DJI index indicators may provide correct analysis and generate profitable trading.

Table 2: List of the Dow Jones Industrials index derivatives.

| Securities | Issuer | Type | Symbol / Root |

| DIAMONDS | AMEX | ETF | DIA |

| Dow Jones Industrial Average "MITTS" | Merrill Lynch | ETF | MDJ |

| DJIA "TIERS" | Structured Products Corp. | ETF | ISB |

| Dow Jones Industrial Average | CBOE | Options | DJX |

| Dow Jones Industrial Average LEAPS | CBOE | Options | MUT |

| Dow Jones Industrial Average | CBOT | Futures | ZD/DJ |

| Dow Jones Industrial Average | CBOT | Options on Futures | OZD/DJC calls DJP puts |

By trading DJI index securities instead of stocks from this index basket, you gain stability and predictability that stocks do not have. Our volume-based technical analysis may help you to see the mood in the DJI market sector. The DJI index is far more logical and far more consistent in its actions than the individual stocks of the DJI index basket.